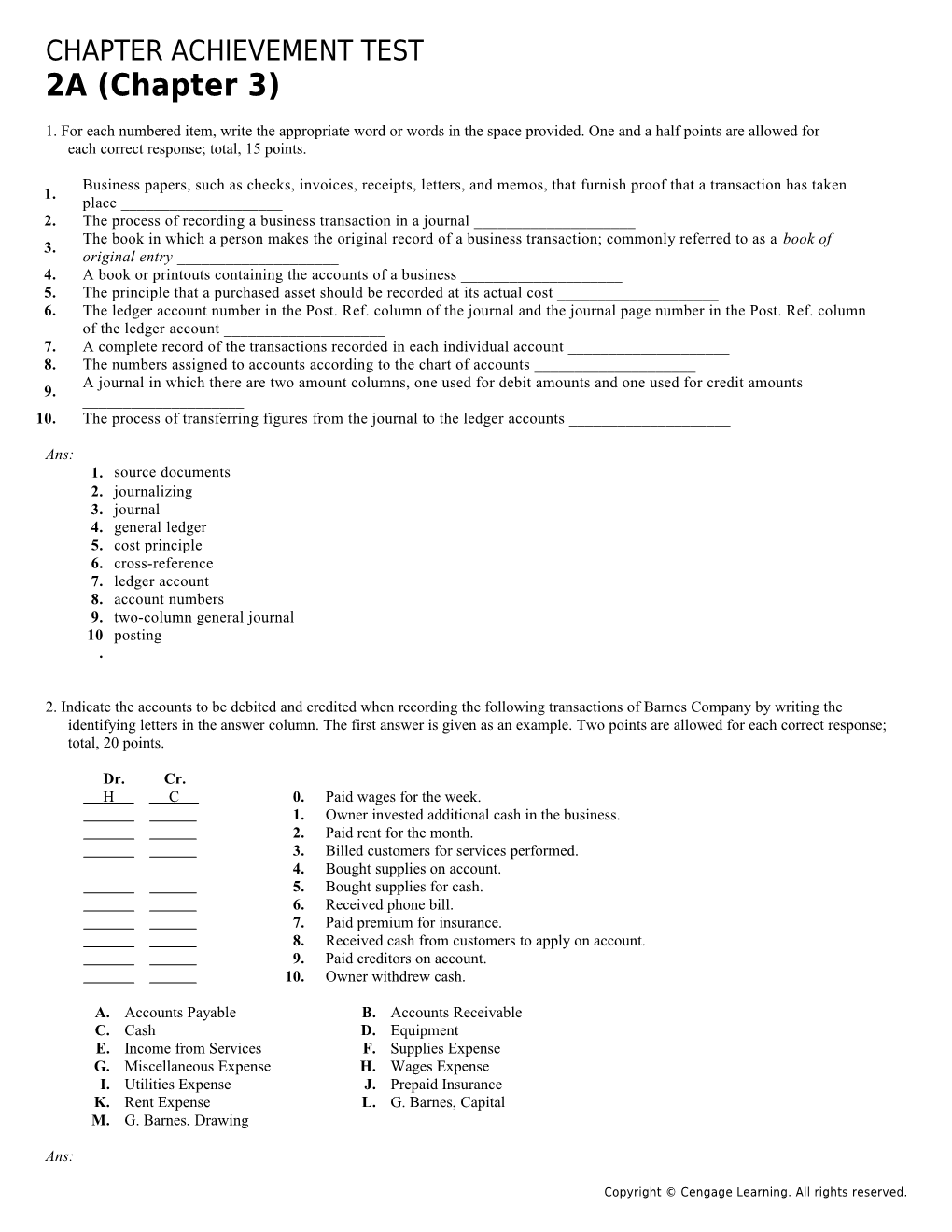

CHAPTER ACHIEVEMENT TEST 2A (Chapter 3)

1. For each numbered item, write the appropriate word or words in the space provided. One and a half points are allowed for each correct response; total, 15 points.

Business papers, such as checks, invoices, receipts, letters, and memos, that furnish proof that a transaction has taken 1. place ______2. The process of recording a business transaction in a journal ______The book in which a person makes the original record of a business transaction; commonly referred to as a book of 3. original entry ______4. A book or printouts containing the accounts of a business ______5. The principle that a purchased asset should be recorded at its actual cost ______6. The ledger account number in the Post. Ref. column of the journal and the journal page number in the Post. Ref. column of the ledger account ______7. A complete record of the transactions recorded in each individual account ______8. The numbers assigned to accounts according to the chart of accounts ______A journal in which there are two amount columns, one used for debit amounts and one used for credit amounts 9. ______10. The process of transferring figures from the journal to the ledger accounts ______

Ans: 1. source documents 2. journalizing 3. journal 4. general ledger 5. cost principle 6. cross-reference 7. ledger account 8. account numbers 9. two-column general journal 10 posting .

2. Indicate the accounts to be debited and credited when recording the following transactions of Barnes Company by writing the identifying letters in the answer column. The first answer is given as an example. Two points are allowed for each correct response; total, 20 points.

Dr. Cr. H C 0. Paid wages for the week. 1. Owner invested additional cash in the business. 2. Paid rent for the month. 3. Billed customers for services performed. 4. Bought supplies on account. 5. Bought supplies for cash. 6. Received phone bill. 7. Paid premium for insurance. 8. Received cash from customers to apply on account. 9. Paid creditors on account. 10. Owner withdrew cash.

A. Accounts Payable B. Accounts Receivable C. Cash D. Equipment E. Income from Services F. Supplies Expense G. Miscellaneous Expense H. Wages Expense I. Utilities Expense J. Prepaid Insurance K. Rent Expense L. G. Barnes, Capital M. G. Barnes, Drawing

Ans:

Copyright © Cengage Learning. All rights reserved. 2 Chapter Achievement Test: 2A 1. C; L 2. K; C 3. B; E 4. F; A 5. F; C 6. I; A 7. J; C 8. C; B 9. A; C 10. M; C

3. For each of the following accounts, determine the classification and normal balance. Write the identifying letter and either Dr. or Cr. in the answer column. The first answer is given as an example. One point is allowed for each correct response; total, 20 points. Normal Classification Balance E Dr. 0. Wages Expense 1. Income from Services 2. Accounts Receivable 3. Prepaid Insurance A Assets 4. Supplies Expense L Liabilities 5. Accounts Payable OE Owner’s Equity 6. Rent Expense R Revenue 7. B. Franks, Drawing E Expense 8. Professional Fees 9. Equipment 10. B. Franks, Capital

Ans: 1. R; Cr. 2. A; Dr. 3. A; Dr. 4. E; Dr. 5. L; Cr. 6. E; Dr. 7. OE; Dr. 8. R; Cr. 9. A; Dr. 10. OE; Cr.

4. 1. Journalize the following transactions for Samuelson Company in the general journal (page 25). One point is allowed for each account, amount, and explanation; total, 25 points.

July 5 Paid on account to Dobson Company, Ck. No. 445, $350. 15 Received a bill for advertising from Town Crier, invoice no. 561, $220. 18 T. Samuelson, the owner, withdrew $600 for personal use, Ck. No. 446. 25 Paid Town Crier on account, Ck. No. 447, $220. 31 Billed customers for the month for services rendered, $980.

2. Post the entries. One point is allowed for each posting plus balance; total, 10 points. 3. Prepare a trial balance dated July 31. One point is allowed for each line; total, 10 points.

GENERAL JOURNAL Page POST. DATE DESCRIPTION REF. DEBIT CREDIT

Copyright © Cengage Learning. All rights reserved. Chapter Achievement Test: 2A 3

GENERAL LEDGER ACCOUNT Cash ACCOUNT NO. 110 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 4,800.00

ACCOUNT Accounts Receivable ACCOUNT NO. 112 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 950.00

ACCOUNT Accounts Payable ACCOUNT NO. 221 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 760.00

ACCOUNT T. Samuelson, Capital ACCOUNT NO. 310 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 3,620.00

ACCOUNT T. Samuelson, Drawing ACCOUNT NO. 312 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 1,900.00

ACCOUNT Income from Services ACCOUNT NO. 410 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 3,840.00

ACCOUNT Advertising Expense ACCOUNT NO. 510 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

Copyright © Cengage Learning. All rights reserved. 4 Chapter Achievement Test: 2A 20-- July 1 Balance √ 570.00

Account Name Debit Credit

Ans:

GENERAL JOURNAL Page 25 POST. DATE DESCRIPTION REF. DEBIT CREDIT 20-- July 5 Accounts Payable 221 350.00 Cash 110 350.00 Paid Dobson Company on account, Ck. No. 445.

15 Advertising Expense 510 220.00 Accounts Payable 221 220.00 Town Crier, invoice no. 561.

18 T. Samuelson, Drawing 312 600.00 Cash 110 600.00 Withdrawal for personal use Ck. No. 446.

25 Accounts Payable 221 220.00 Cash 110 220.00 Paid Town Crier on account, Ck. No. 447.

31 Accounts Receivable 112 980.00 Income from Services 410 980.00 Billed customers for month.

Copyright © Cengage Learning. All rights reserved. Chapter Achievement Test: 2A 5

GENERAL LEDGER ACCOUNT Cash ACCOUNT NO. 110 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 4,800.00 5 J25 350.00 4,450.00 18 J25 600.00 3,850.00 25 J25 220.00 3,630.00

ACCOUNT Accounts Receivable ACCOUNT NO. 112 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 950.00 31 J25 980.00 1,930.00

ACCOUNT Accounts Payable ACCOUNT NO. 221 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 760.00 5 J25 350.00 410.00 15 J25 220.00 630.00 25 J25 220.00 410.00

ACCOUNT T. Samuelson, Capital ACCOUNT NO. 310 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 3,620.00

ACCOUNT T. Samuelson, Drawing ACCOUNT NO. 312 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 1,900.00 18 J25 600.00 2,500.00

ACCOUNT Income from Services ACCOUNT NO. 410 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT 20-- July 1 Balance √ 3,840.00 31 J25 980.00 4,820.00

ACCOUNT Advertising Expense ACCOUNT NO. 510 POST BALANCE DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT Copyright © Cengage Learning. All rights reserved. 6 Chapter Achievement Test: 2A 20-- July 1 Balance √ 570.00 15 J25 220.00 790.00

Samuelson Company Trial Balance July 31, 20-- Account Name Debit Credit Cash 3,630.00 Accounts Receivable 1,930.00 Accounts Payable 410.00 T. Samuelson, Capital 3,620.00 T. Samuelson, Drawing 2,500.00 Income from Services 4,820.00 Advertising Expense 790.00 ______8,850.00 8,850.00

Copyright © Cengage Learning. All rights reserved.