GREG ABBOT T GOVERNOR

TEXAS ENTERPRISE ZONE PROGRAM Eligibility and Requirements

Program Objective The Texas Enterprise Zone program is an economic development tool for local communities to partner with the State of Texas to encourage job creation and capital investment in economically distressed areas of the state.

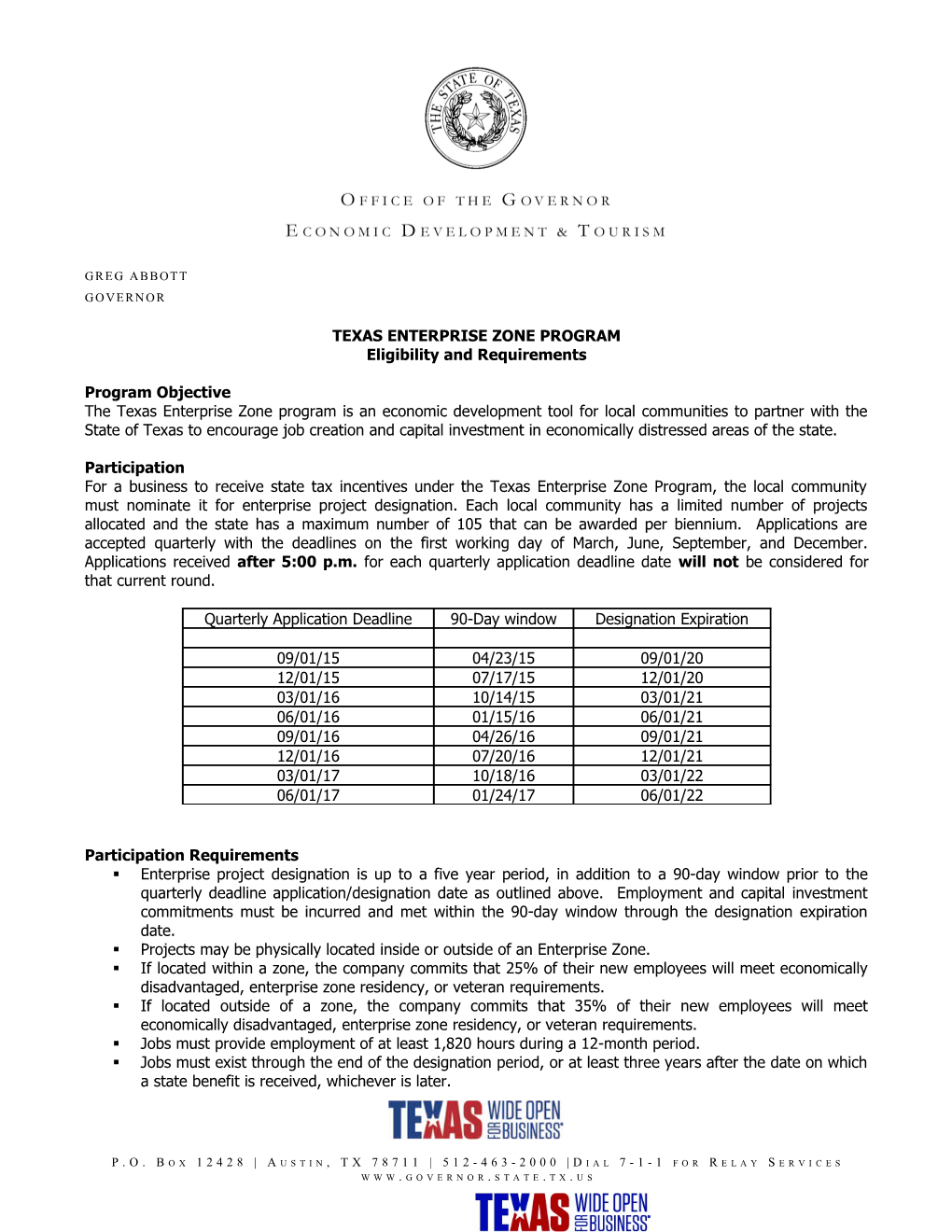

Participation For a business to receive state tax incentives under the Texas Enterprise Zone Program, the local community must nominate it for enterprise project designation. Each local community has a limited number of projects allocated and the state has a maximum number of 105 that can be awarded per biennium. Applications are accepted quarterly with the deadlines on the first working day of March, June, September, and December. Applications received after 5:00 p.m. for each quarterly application deadline date will not be considered for that current round.

Quarterly Application Deadline 90-Day window Designation Expiration

09/01/15 04/23/15 09/01/20 12/01/15 07/17/15 12/01/20 03/01/16 10/14/15 03/01/21 06/01/16 01/15/16 06/01/21 09/01/16 04/26/16 09/01/21 12/01/16 07/20/16 12/01/21 03/01/17 10/18/16 03/01/22 06/01/17 01/24/17 06/01/22

Participation Requirements . Enterprise project designation is up to a five year period, in addition to a 90-day window prior to the quarterly deadline application/designation date as outlined above. Employment and capital investment commitments must be incurred and met within the 90-day window through the designation expiration date. . Projects may be physically located inside or outside of an Enterprise Zone. . If located within a zone, the company commits that 25% of their new employees will meet economically disadvantaged, enterprise zone residency, or veteran requirements. . If located outside of a zone, the company commits that 35% of their new employees will meet economically disadvantaged, enterprise zone residency, or veteran requirements. . Jobs must provide employment of at least 1,820 hours during a 12-month period. . Jobs must exist through the end of the designation period, or at least three years after the date on which a state benefit is received, whichever is later.

P . O . B O X 1 2 4 2 8 | A U S T I N , T X 7 8 7 1 1 | 5 1 2 - 4 6 3 - 2 0 0 0 | D I A L 7 - 1 - 1 F O R R E L A Y S E R V I C E S W W W . G O V E R N O R . S T A T E . T X . U S Benefits to participation Designated projects are eligible to apply for state sales and use tax refund on taxable items. The level and amount of refund is related to the capital investment and jobs created and/or retained at the qualified business site.

Maximum Maximum potential Maximum refund per job Level of Capital Investment number of jobs refund allocated allocated Half Enterprise Project $40,000 to $399,999 10 $25,000 $2,500 $400,000 to $999,999 25 $62,500 $2,500 $1,000,000 to $4,999,999 125 $312,500 $2,500 $5,000,000 or more 250 $625,000 $2,500 Enterprise Project $5,000,000 or more 500 $1,250,000 $2,500 Double Jumbo Project $150,000,000 to $249,999,999 500 $2,500,000 $5,000 Triple Jumbo Project $250,000,000 or more 500 $3,750,000 $7,500

Double and Triple Jumbo Projects may not have retained jobs for benefit. A triple jumbo enterprise project must create at least 500 jobs.

Capital investment is money paid to purchase capital assets or fixed assets including but not limited to land, buildings, labor used to construct or renovate a capital asset, furniture, manufacturing machinery, computers and software, or other machinery and equipment. Property that is leased under a capitalized lease is considered a qualified capital investment but property that is leased under an operating lease is not considered a qualified capital investment.

NOTE: if using a contractor to construct the facility, a “separated contract” (a contract in which the agreed contract price is divided into separately states prices for materials and labor) must be executed. If a “lump sum” contract is executed, a claim for refund of taxes invoiced to, and paid by a third party, will not qualify for a refund under this Program. Please call the Comptroller of Public Accounts’ Office at 1-800-531-5441 ext. 51083 if you have any questions regarding this issue.

Local communities may offer benefits to participants under the enterprise zone program as well. These may include tax abatement, tax increment financing, one-stop permitting and others.

Enterprise Zone An enterprise zone is a census tract block group that has 20% or more poverty rate based upon the most recent decennial census federal poverty level information, a distressed county, a federally designated zone or renewal community.

Fee There is a non-refundable application fee for consideration of an enterprise project designation. Enterprise projects will be assessed 3% on the amount of any refund benefit received under the state enterprise zone program.

Contact Information For additional information on the Texas Enterprise Zone Program call (512) 936-0101.