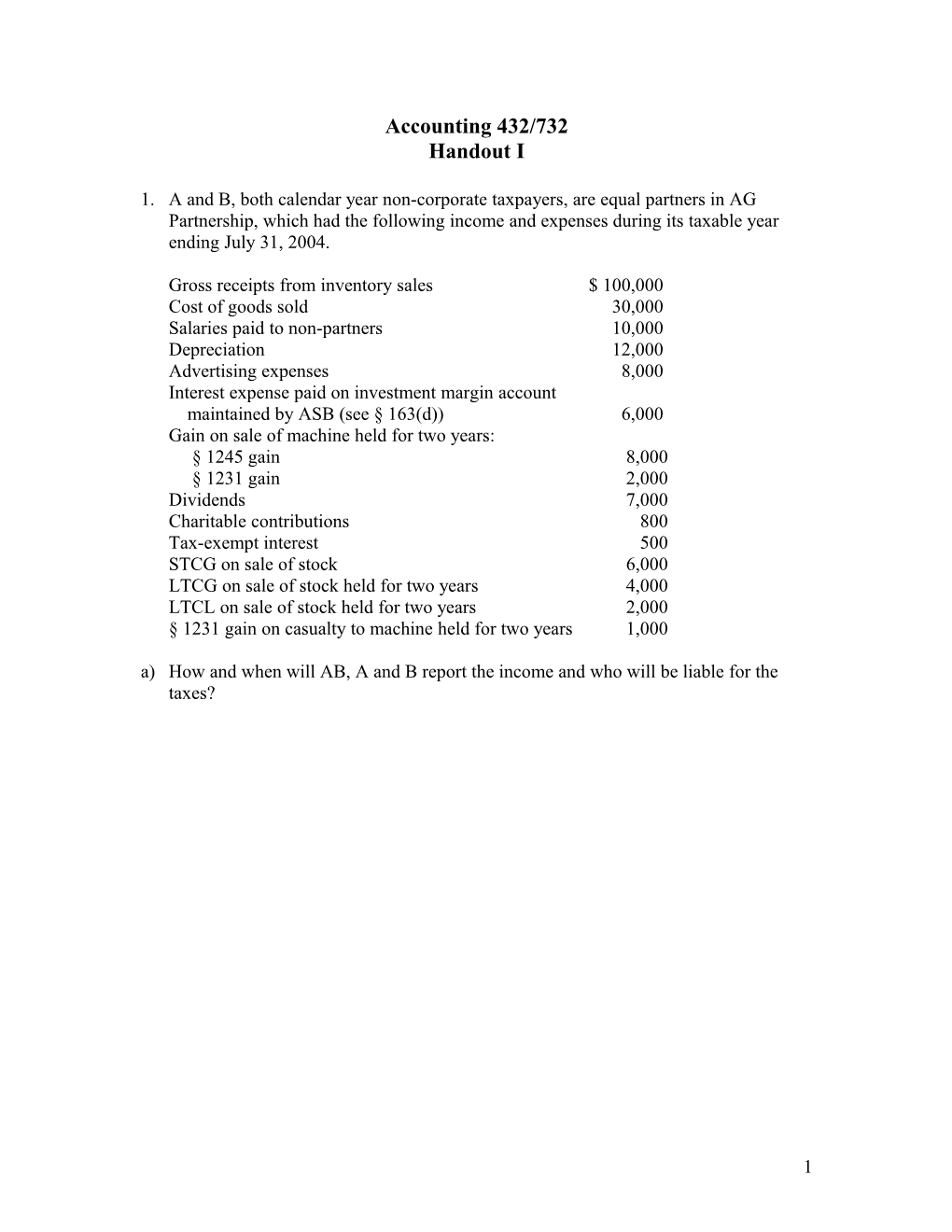

Accounting 432/732 Handout I

1. A and B, both calendar year non-corporate taxpayers, are equal partners in AG Partnership, which had the following income and expenses during its taxable year ending July 31, 2004.

Gross receipts from inventory sales $ 100,000 Cost of goods sold 30,000 Salaries paid to non-partners 10,000 Depreciation 12,000 Advertising expenses 8,000 Interest expense paid on investment margin account maintained by ASB (see § 163(d)) 6,000 Gain on sale of machine held for two years: § 1245 gain 8,000 § 1231 gain 2,000 Dividends 7,000 Charitable contributions 800 Tax-exempt interest 500 STCG on sale of stock 6,000 LTCG on sale of stock held for two years 4,000 LTCL on sale of stock held for two years 2,000 § 1231 gain on casualty to machine held for two years 1,000 a) How and when will AB, A and B report the income and who will be liable for the taxes?

1 b) Assume this is the first year of partnership operations. A’s basis in his partnership interest is $ 70,000 and B’s basis in her partnership interest is $ 40,000. What will be the tax consequences (under § 705) of AB’s first year of operations to A and B?

c) What will be each partner’s basis at the end of the year given the results from (b) and a distribution of $ 20,000 in cash to each partner on July 31, 2004?

2 d) Would it matter if the § 1231 gain on the sale of machinery would have been ordinary income if A had sold it individually?

2) C and D are partners who share income and losses equally. C has an outside basis of $ 5,000 in his partnership interest and D has an outside basis of $ 15,000 in her partnership interest. a) During the current year the partnership has gross income of $ 40,000 and expenses of $ 60,000. What are the tax results under § 704 (d) and Reg. 1.704-1(d) (4) to C & D?

b) What are the results to C and D in the succeeding year when the partnership had $ 20,000 of net profits?

3 c) How might C have alleviated his problem in his first year?

d) Under Example 3 of Reg. 1.704-1(d) (4) what is the result in part (a) above if the net $ 20,000 loss consists of $ 15,000 ordinary loss and $ 5,000 long term capital loss?

4 e) What is the result to S, C’s son, in (a) above, if C gives his interest in the partnership to S on the first day of the year in which the partnership has profits of $ 20,000? (See § 1015 (a) and § 1223(2))

3) The ABC equal limited partnership (in which A is a general partner and B and C are limited partners purchased an apartment building for $ 540,000, paying $ 90,000 cash (contributed equally by partners to the partnership) and financing the balance with a $ 450,000 non-recourse loan secured by the building. Assume that A, B and C are unrelated and that the partnership holds no other assets. To what extent are each of the partners at risk if the loan is: a) From a commercial bank in which none of the parties owns an interest? (see § 465(b) (6)(B) & § 465(b)(6)(C))

5 b) From the seller of the apartment complex? (See 465(b)(6)(B)ii, § 465(b)(6)(C), 465(b)(6)(D)(i)& (ii) and § 49(a)(1))

c) From B’s brother who makes the loan at regular commercial rates of interest?

d) Personally guaranteed equally by A, B and C. (See Arbramson 86 T.C. 360 (1986); Gefen 87 T .C. 1471 (1986))

6 4) A,B, & D each contribute $ 25,000 to the ABCD partnership which then acquires a $ 1,000,000 building, paying $ 100,000 cash and borrowing $ 900,000 on a non- recourse basis. a) Assuming the parties are equal general partners, what is each partner’s outside basis?

b) What is the result if the partnership is a limited partnership, A is the sole general partner and all the partners share profits and losses equally?

7 c) What is the result in (b) above if the partnership were personally liable? (See Reg. 1.752-2(a).)

8 5) A and B each contribute $ 30,000 cash to the ABC partnership and C contributes land held for more than one year, worth $ 60,000 and subject to a non-recourse mortgage of $ 30,000. A, B and C are all general partners with a one-third interest in the profits and losses of ABC a) What are the tax consequences to A,B, C and ABC if the land has a basis to C of 4 40,000?

b) Same as (a) above, except the mortgage is recourse debt of C that the partnership assumes?

9 c) Same as (a), above, except that the land has a basis to C of $ 10,000?

10