Name: ______

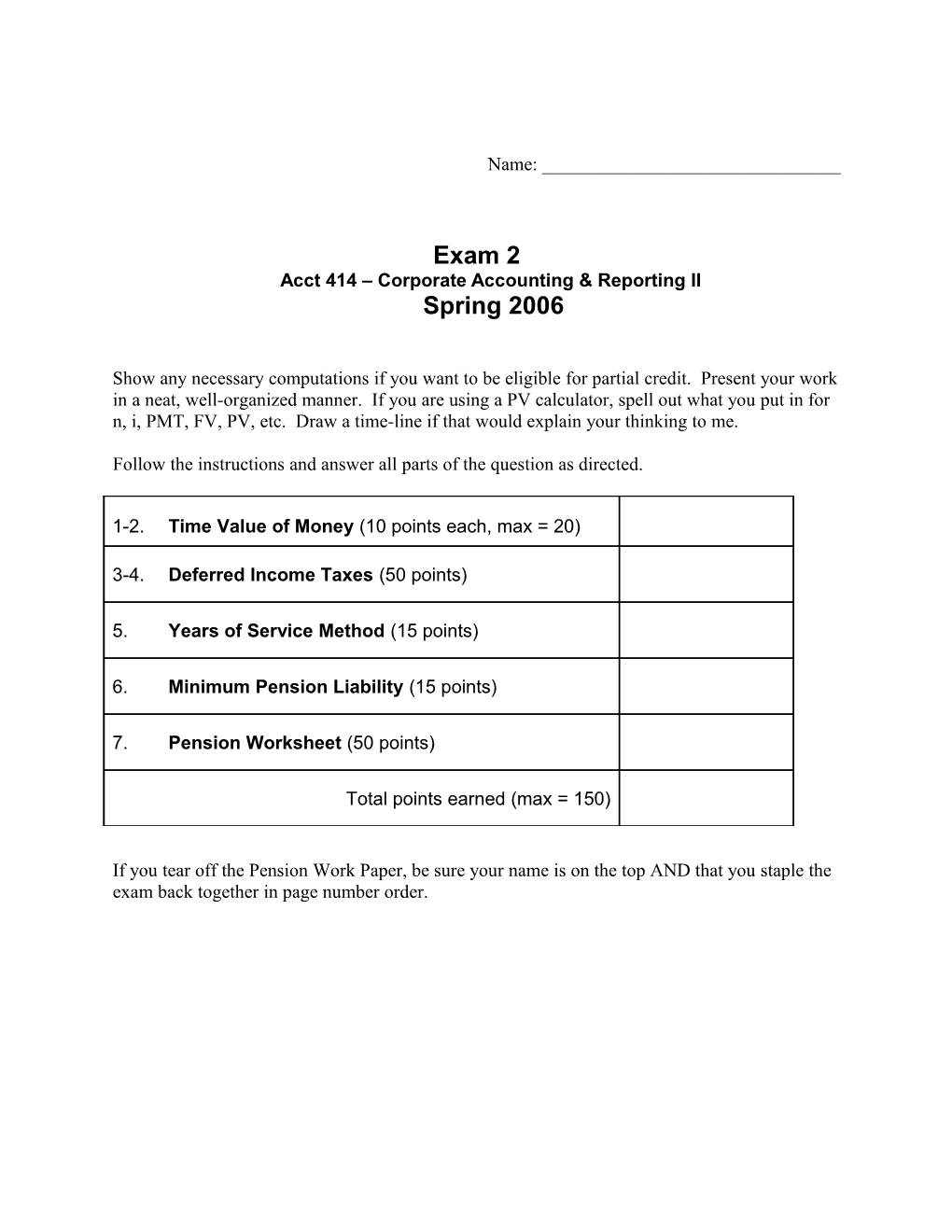

Exam 2 Acct 414 – Corporate Accounting & Reporting II Spring 2006

Show any necessary computations if you want to be eligible for partial credit. Present your work in a neat, well-organized manner. If you are using a PV calculator, spell out what you put in for n, i, PMT, FV, PV, etc. Draw a time-line if that would explain your thinking to me.

Follow the instructions and answer all parts of the question as directed.

1-2. Time Value of Money (10 points each, max = 20)

3-4. Deferred Income Taxes (50 points)

5. Years of Service Method (15 points)

6. Minimum Pension Liability (15 points)

7. Pension Worksheet (50 points)

Total points earned (max = 150)

If you tear off the Pension Work Paper, be sure your name is on the top AND that you staple the exam back together in page number order. Exam 2 – Acct 414 – Spring 2006 Page 2

Time Value of Money – problems 1 through 2 (10 points each = 20 points total)

1. Boise’s Best Inc. is establishing a pension plan for its sole employee. She will receive credit for 10 years of prior service and is expected to work 20 years until retirement. After retirement, she should collect pension payments for another 20 years. Her current salary is $80,000 with estimated future pay increases to average 5% per year. What will be the initial amount of projected benefit obligation (i.e., prior service cost) at the inception of the plan if the benefit formula is final year’s annual salary times years of service times 1.5%? You may assume ordinary annuities and end-of-year annual payments upon retirement and a 10% per annum discount rate.

2. Using the facts provided above for Boise’s Best pension plan, what is the service cost that will be incurred in the first year after the plan is adopted? Exam 2 – Acct 414 – Spring 2006 Page 3

3. Income Tax Expense & Deferred Income Taxes (40 points) The records for Flint Co. show this data for 2005: Gross profit on installment sales recognized at point of sale per GAAP was $300,000. Gross profit from collections of installment receivables was $220,000 for tax purposes. Life insurance on officers was $3,800. Machinery was acquired in January for $300,000. Straight-line depreciation over a ten-year life (no salvage value) is used. For tax purposes, MACRS depreciation is used and Flint may deduct 14% for 2004. Interest received on tax exempt Iowa State bonds was $9,000. The estimated warranty expense related to 2005 sales was $19,600. Repair costs under warranties during 2005 were $13,600. The remainder will be incurred in 2006. Pretax financial income is $450,000. The tax rate is 30%. You may assume that there is no balance forward in net deferred taxes.

Instructions (a) Prepare a schedule starting with pretax financial income to compute taxable income. (b) Prepare the journal entry to record income taxes for 2004. (c) Indicate account titles and section of balance sheet where deferred taxes will be reported (with amounts). Exam 2 – Acct 414 – Spring 2006 Page 4

This page left blank intentionally for extra room for answer to problem 3 Exam 2 – Acct 414 – Spring 2006 Page 5

4. Recognition of deferred tax asset. (10 points) (a) Briefly describe a deferred tax asset. (If you can’t think of a definition, at least provide an example) (b) When should a deferred tax asset be reduced by a valuation allowance? Exam 2 – Acct 414 – Spring 2006 Page 6

4. Amortization of prior service cost using years-of-service method. (15 points)

On January 1, 2003, Lawson Incorporated amended its pension plan which caused an increase of $4,800,000 in its projected benefit obligation. The company has 400 employees who are expected to receive benefits under the company's defined benefit pension plan. The personnel department provided the following information regarding expected employee retirements:

Number of Expected Retirements Employees On December 31 _ 40 2003 120 2004 60 2005 160 2006 20 2007 400

The company plans to use the years-of-service method in calculating the amortization of unrecognized prior service cost as a component of pension expense.

Instructions Prepare a schedule which shows the amount of annual prior service cost amortization that the company will recognize as a component of pension expense for 2003 and 2004 (to save time, you do not need to produce the complete amortization schedule). Exam 2 – Acct 414 – Spring 2006 Page 7

5. Pension (Minimum Liability) (5 points per year for 15 points total)

Information about the Tami’s Tambourines Inc. pension plan is provided in the table below. Prepare any necessary journal entries for 2005, 2006 and 2007 to record a minimum liability related to pensions. You may assume that the company was not required to record a minimum liability adjustment at the end of 2005.

Projected Prior Unrecognize Accumulated (Accrued)/Prepaid Plan Benefit Service d Benefit Pension Cost Assets Obligation Costs (gains)/losses Oblation

12/31/2006 17,000 (968,000) 885,000 185,000 (85,000) 920,000 12/31/2007 (18,000) (1,025,000) 975,000 155,000 (123,000) 998,000 12/30/2008 45,000 (1,184,000) 1,025,000 125,000 79,000 1,111,500 Exam 2 – Acct 414 – Spring 2006 Page 8

6. Pension Work Paper (50 points)

The Panlatch Corporation initiated a noncontributory defined benefit pension plan on January 1, 1980 and applied the provisions of FASB Statement 87 as of January 1, 1987. Tree uses the straight-line method, based on average remaining service period of employees, to amortize prior service costs.

2005 BALANCES AS OF JANUARY 1, 2005 Projected Benefit Obligation $1,300,000 Plan Assets at market $895,000 Prepaid/(accrued) pension cost $190,000 Additional Liability (there will also be a related intangible asset and/or deferred pension cost account in accumulated other comprehensive income) 0 Unrecognized transition cost (gain) 0 Unrecognized Prior Service Cost $220,000 Amortization amount $31,000 per year Unrecognized (gains)/losses $375,000

OTHER INFORMATION: Service cost for year $155,000 Discount rate for year 6.00% Expected rate of return on plan assets 7.00% Actual return on plan assets: gain/(loss) $53,000 Pension plan contribution $200,000 Retirement benefits paid during year $59,000 Accumulated Benefit Obligation, Dec. 31, 2002 $1,085,000 Average remaining service years related to active employees 12 Increase/(decrease) in PBO during year due to revised actuarial assumptions $14,000

REQUIRED: a. Compute net periodic pension expense for 2005. (Be sure to show all of the components of pension expense.) Prepare the journal entry needed to record pension expense and funding of pension plan. b. Compute the balance in unrecognized gains and losses, projected benefit obligation, and plan assets, and prior service costs at 1/1/06.

Note: Completing a worksheet will be an acceptable answer for (a) the components of pension expense and (b) the ending balances as long as the answers are easy to find, read, and understand. You do NOT need to compute any minimum liability that might be required. You do not need to use the work paper as long as you write out the required answers where I can find them.

Journal entry: Exam 2 – Acct 414 – Spring 2006 Page 9

Name: ______

Pension Worksheet 1 2 3 4 5 6 7 8 Accounts on Employer's Books Memorandum Amounts Prepaid/ Pension (Accrued) Projected Benefit Unrecognized Prior Serivce Transition Panlatch Corporation Expense Cash Pension Cost Obligation Plan Assets (gain)/loss Cost (Gain)/loss BALANCE FORWARD Service Cost Interest Cost Expected return on plan assets Corridor Amount Excess AMORTIZATIONS: Unrecognized gain/loss Prior Service Cost Transition Amount Contributions to Pension Plan Retirement Benefits Paid by Plan Actual Return on Plan Assets Actuarial Adjustments to PBO Amounts for journal entry: BALANCES AT YEAR END Computation of Minimum Liability Other Accumulated benefit obligation at Additional Comprehensive year end Accounts on Books - Minimum Liability Requirement Intangible Asset Pension Liability Income Plan Assets at end of year Minimum liability needed Balances forward Accrued/Prepaid Pension Cost at year end Correct amounts need EOY Minimum liability to record (if any) Amounts for adjusting journal entry Exam 2 – Acct 414 – Spring 2006 SOLUTION Page 1

SOLUTIONS

Problem 1 - prior service cost Current salary $ (80,000) =PV Step 1 Salary increases 5% =i Years until 65 20 =n Future salary $ 212,264 at retirement Benefit formula 1.5% per year of service Benefit per yr $ 3,183.96 Life expectancy 20 years after retirement Credited for PS 10 years credited for prior service Benefit for PSC $ 31,839.57 PSC yrs * amt for each year Step 2 PMT = $ (31,839.57) benefit related to prior service N = 20 life expectancy after retirement FV = $0.00 INT RATE = 10% discount rate PV = $ 271,068.23 Needed at retirement for PSC PMT = 0 Step 3 N = 20 years until retirement INT RATE = 10% discount rate FV = $ (271,068.23) Needed at retirement for PSC PV = $ 40,291.71 needed at plan amendment

Problem 2 - service cost Current salary $ (80,000) =PV Step 1 Salary increases 5% =i Years until retirement 20 =n Future salary $ 212,264 at retirement Benefit formula 1.5% per year of service Benefit per yr $ 3,183.96 Life expectancy 20 years after retirement Service cost for 1 year Benefit for working one year $ 3,183.96 Step 2 PMT = $ (3,183.96) benefit related to current year N = 20 life expectancy after retirement FV = $0.00 INT RATE = 10% discount rate PV = $ 27,106.82 Needed at retirement for 1 year PMT = 0 Step 3 N = 19 years until retirement INT RATE = 10% discount rate FV = $ (27,106.82) Needed at retirement for 1 year PV = $ 4,431.35 Service cost for year

SOLUTION 4. (a) A deferred tax asset is the deferred tax consequences attributable to deductible temporary differences and operating loss carryforwards. Examples of deductible temporary differences include warranty expenses recognized on the income statement that will be paid in a future year and rent revenue received (and taxed) in advance of recognition on the income statement. (b) A deferred tax asset should be reduced by a valuation allowance if, based on all available evidence, it is more likely than not that some portion or all of the deferred tax asset will not be realized. More likely than not means a level of likelihood that is at least slightly more than 50%. Exam 2 – Acct 414 – Spring 2006 SOLUTION Page 1

Solution 3 (a) Pretax financial income $450,000 Permanent differences Life insurance 3,800 Tax-exempt interest (9,000) Book TI 444,800 Temporary differences Installment sales ($300,000 – $220,000) (80,000) Extra depreciation ($42,000 – $30,000) (12,000) Warranties ($19,600 – $13,600) 6,000 Total temporary differences (86,000) Taxable income $358,800

(b) Income Tax Expense [$107,640 + 25,800] ...... 133,440 Deferred Taxes (net) (30% × $86,000) ...... 25,800 Income Tax Payable (30% × $358,800) ...... 107,640

(c) Take each temporary difference and multiply by the tax rate (30%). Combine current items and combine noncurrent items. If the net is a debit, classify as asset. If the net is a credit, classify as a liability. Installment sales (80,000) * 30% = (24,000) Warranties 6,000 * 30% = 1,800 (22,200) current liability Depreciation ( 3,600) noncurrent liability Check: should = (86,000) * 30% (25,800) net deferred tax

Balance Sheet: Deferred tax liability (current) $22,200 [related to warranties & installment sales] Deferred tax liability (noncurrent) $ 3,600 [related to depreciation]

Solution 5 – note that the first schedule is “sideways” as compared to the one we did in class. Computation of Service-Years Year Total 2003 40 120 60 160 20 400 2004 120 60 160 20 360 2005 60 160 20 240 2006 160 20 180 2007 20 20 40 240 180 640 100 1,200

Cost Per Service Year: $4,800,000 ÷ 1,200 = $4,000.

Lawson Incorporated Computation of Annual Prior Service Cost Amortization

Total Cost Per Annual Year Service-Years Service-Year Amortization 2003 400 $4,000 $1,600,000 or 400/1200 * $4.8 million 2004 360 4,000 1,440,000 or 360/1200 * $4.8 million 2005 240 4,000 960,000 2006 180 4,000 720,000 2007 20 4,000 80,000 1,200 $4,800,000 Exam 2 – Acct 414 – Spring 2006 SOLUTION Page 1

SOLUTION #6 Accumulated Max Plan Benefit intangible= Assets Oblation PSC Min liab Addl Liab OCI 12/31/2005 920,000 885,000 185,000 35,000 52,000 0 712/31/2006 998,000 975,000 155,000 23,000 5,000 0 12/31/2007 1,111,500 1,025,000 125,000 86,500 131,500 6,500

12/31/2006 Intangible asset 52,000 Addl pension liability 52,000

12/31/2007 Intangible asset 0 47,000 Addl pension liability 47,000 0

12/30/2008 Intangible asset 120,000 Addl pension liability 126,500 AOCI - deferred pension cost 6,500

225,500 225,500

Intangible Asset Addl Liability 12/31/2006 52,000 12/31/2006 0 52,000 12/31/2007 0 47,000 12/31/2007 47,000 0 5,000 5,000 12/30/2008 120,000 0 12/30/2008 0 126,500 125,000 131,500

PROBLEM #7 JOURNAL ENTRY:

Periodic Postretirement Benefit Cost 221,767 Cash 200,000 Prepaid/accrued pension cost 21,767 Exam 2 – Acct 414 – Spring 2006 SOLUTION Page 1

Problem 7 - solution PENSION WORKSHEETS: JOURNAL ENTRY M E M O A M O U N T S PENSION CASH PREPAID/ PBO PLAN PRIOR UNRECOG TRANSITION EXPENSE (ACCRUED) ASSETS SERVICE (GAINS) AMOUNT 2005 PENSION COST LOSSES

BALANCE FORWARD 01/01/05 190,000 -1,300,000 895,000 220,000 375,000 0

SERVICE COST 155,000 -155,000 INTEREST COST 6.00% 78,000 -78,000 EXPECTED RETURN 7.00% -62,650 62,650 AMORTIZATIONS: TRANSITION 0 0 PRIOR SERVICE 31,000 -31,000 UNRECOGNIZED GAINS/LOSSES 20,417 -20,417 130,000 CORRIDOR AMT 245,000 EXCESS 12 YEARS AMORTIZED

CONTRIBUTION TO PENSION PLAN -200,000 200,000 RETIREMENT BENEFITS PAID 59,000 -59,000 ACTUAL RETURN ON PLAN ASSETS 53,000 -53,000 ADJUSTMENTS TO PBO -14,000 14,000

JOURNAL ENTRY 221,767 -200,000 -21,767

BALANCES AT 01/01/06 OK 168,233 -1,488,000 1,089,000 189,000 378,233 0

ABO 1,085,000 Max Int Asset Max Int Asset PLAN ASSETS 1,089,000 at end of yr = at beg of yr = MIN LIAB NEEDED - 189,000 220,000 ON BOOKS 168,233 INTANGIBLE ASSET ACCTS Intangible Addl Liability Contra OE MIN LIAB REQUIRED - Asset BAL FWD AMTS 0 0 0 AS OF 01/01/05 ADDL LIABLITY NOT REQUIRED CORRECT AMTS END OF YR 0 0 0 AS OF 01/01/06

JOURNAL ENTRY NEEDED: 0 0 0