September 27, 2011

Snap-On Incorporated (SNA-NYSE)

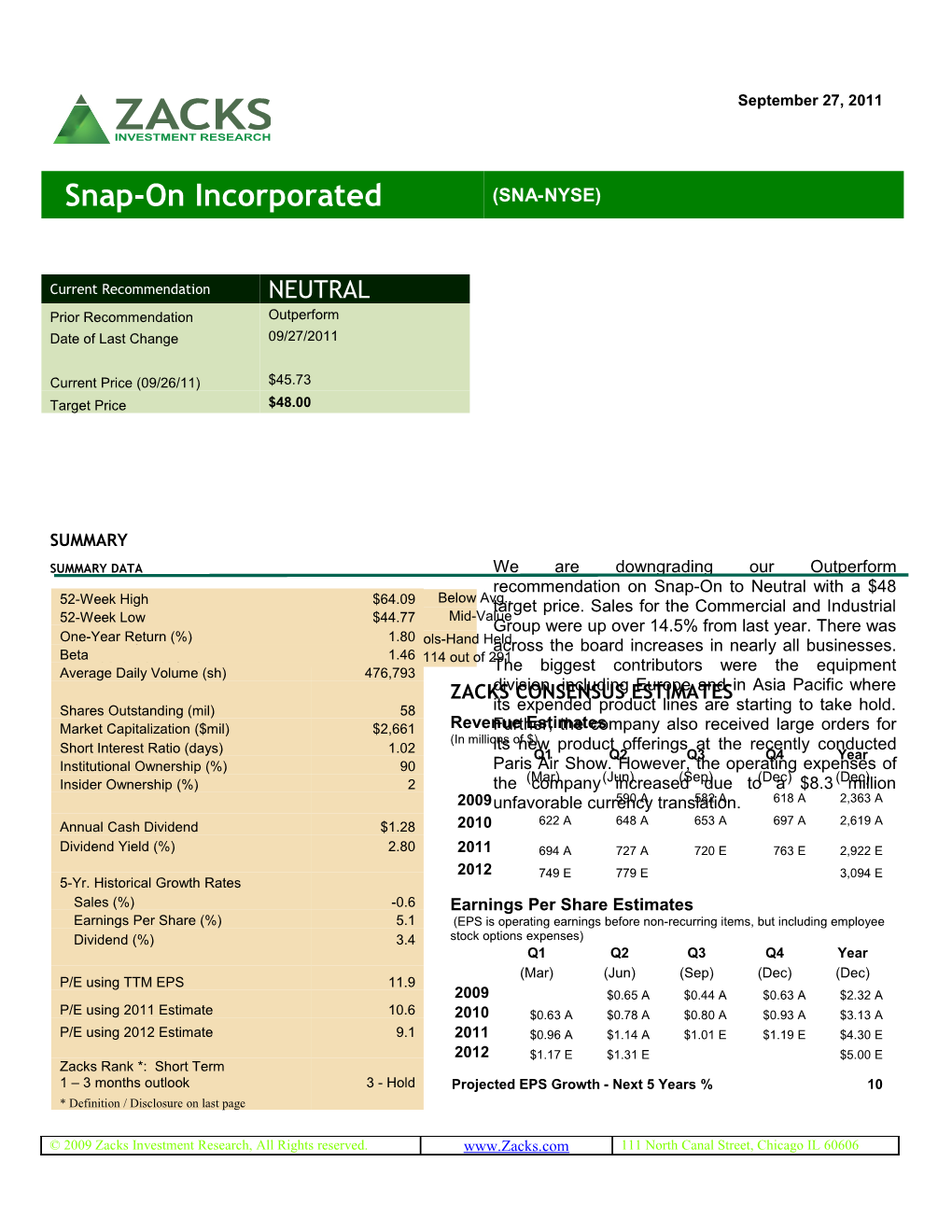

Current Recommendation NEUTRAL Prior Recommendation Outperform Date of Last Change 09/27/2011

Current Price (09/26/11) $45.73 Target Price $48.00

SUMMARY

SUMMARY DATA We are downgrading our Outperform recommendation on Snap-On to Neutral with a $48 52-WeekRisk HighLevel * $64.09 Below Avg.,target price. Sales for the Commercial and Industrial Type of Stock Mid-Value 52-Week Low $44.77 Group were up over 14.5% from last year. There was One-Year Return (%) 1.80 Industry Tools-Hand Heldacross the board increases in nearly all businesses. Beta Zacks Industry Rank * 1.46 114 out of 291 Average Daily Volume (sh) 476,793 The biggest contributors were the equipment ZACKSdivision, CONSENSUS including ESTIMATESEurope and in Asia Pacific where Shares Outstanding (mil) 58 its expended product lines are starting to take hold. Market Capitalization ($mil) $2,661 RevenueFurther, Estimates the company also received large orders for (In millionsits ofnew $) product offerings at the recently conducted Short Interest Ratio (days) 1.02 Q1 Q2 Q3 Q4 Year Institutional Ownership (%) 90 Paris Air Show. However, the operating expenses of (Mar) (Jun) (Sep) (Dec) (Dec) Insider Ownership (%) 2 the company increased due to a $8.3 million 2009unfavorable currency590 A translation.582 A 618 A 2,363 A Annual Cash Dividend $1.28 2010 622 A 648 A 653 A 697 A 2,619 A Dividend Yield (%) 2.80 2011 694 A 727 A 720 E 763 E 2,922 E 2012 749 E 779 E 3,094 E 5-Yr. Historical Growth Rates Sales (%) -0.6 Earnings Per Share Estimates Earnings Per Share (%) 5.1 (EPS is operating earnings before non-recurring items, but including employee Dividend (%) 3.4 stock options expenses) Q1 Q2 Q3 Q4 Year (Mar) (Jun) (Sep) (Dec) (Dec) P/E using TTM EPS 11.9 2009 $0.65 A $0.44 A $0.63 A $2.32 A P/E using 2011 Estimate 10.6 2010 $0.63 A $0.78 A $0.80 A $0.93 A $3.13 A P/E using 2012 Estimate 9.1 2011 $0.96 A $1.14 A $1.01 E $1.19 E $4.30 E 2012 $1.17 E $1.31 E $5.00 E Zacks Rank *: Short Term 1 – 3 months outlook 3 - Hold Projected EPS Growth - Next 5 Years % 10 * Definition / Disclosure on last page

© 2009 Zacks Investment Research, All Rights reserved. www.Zacks.com 111 North Canal Street, Chicago IL 60606 OVERVIEW REASONS TO BUY Headquartered in Kenosha, Wisconsin, Snap-on Incorporated is a global provider of professional tools, Over the past few years, management has been equipment, and related solutions for technicians, focused on delivering a more predictable and vehicle service centers, original equipment consistent financial performance. To this end, manufacturers (OEMs), and other industrial users. management implemented the ‘Driven to Deliver’ Products include a broad range of professional hand strategy in 2001, which resulted in an increased and power tools; tool storage; vehicle diagnostics and focus on customer relationships and business service equipment; business management systems; processes. In addition, Snap-On has invested in equipment repair services; and other tool and new products and increased brand awareness. In equipment solutions. In FY2010, Snap-on generated early 2005, management introduced the Rapid total revenue of over $2.62 billion. The company Continuous Improvement (RCI) process, which is divides its operations in four segments: Snap-on Tools designed to improve organizational effectiveness Group, Commercial & Industrial Group, Repair and lower costs, including working capital Systems & Information Group, and Financial Services requirements. As a result, asset utilization has segment. Snap-on markets its products and brands improved by rationalizing production through plant through multiple distribution sales channels in closures, and working capital has been used more approximately 130 countries. effectively.

Part of the Rapid Continuous Improvement process Snap-on Tools Group (33.3% of total net sales is the transformation of Snap-On’s global in 4QFY10): The segment consists of the manufacturing and supply chain into a market- business operations serving the worldwide demand-based, lower-cost replenishment system. franchise van channel. Through a structured approach of supply chain and franchise improvement initiatives, order-fill rates are Commercial & Industrial Group (35.0%): This improving and profitability is increasing across most segment comprises business operations operating segments. The company continues to providing tools and equipment products and invest in its planned growth investments, including equipment repair services to a broad range of further expansion of manufacturing capacity in industrial and commercial customers worldwide China and Eastern Europe. through direct, distributor and other non- franchise distribution channels. Snap-on is expanding its presence in the critical industries such as aerospace and natural Repair Systems & Information Group (28.9%): resources. In the recently, conducted Air Show at The segment consists of the business Paris, the company received large orders for its operations providing diagnostics equipment, high-tech Automated Tool Control Unit and newly vehicle service information, business increased range of torque products primarily management systems, electronic parts targeting the aerospace industry. catalogs, and other solutions for vehicle service to customers in the worldwide vehicle service and repair marketplace. REASONS TO SELL Financial Services (2.7%): This segment comprises the business operations of Snap-on Operating expenses of $243.4 million during the Credit LLC, a consolidated, 50%-owned joint second quarter increased $18.6 million compared venture between Snap-on and The CIT to the prior year levels, primarily due to $8.3 million Group, Inc., and Snap-on’s wholly owned of unfavorable foreign currency effects and higher finance subsidiaries in those international volume related in other expenses, including a $4.2 markets where it has franchise operations. million of anticipated higher pension expense.

Equity Research SNA | Page 2 Some of the company’s segments have substantial Financial Services operating earnings of $35.5 million interrelationships with the automotive in the second quarter which includes an $18.0 million industry. However, there is weakness in the United arbitration settlement gain from the settlement of a States’ automotive industry currently, which could previously disclosed dispute with CIT Group Inc. result in the failure of certain automobile Excluding the arbitration settlement gain, operating manufacturers, suppliers and dealers. It could also earnings increased to $17.5 million in the second result in a reduction in the number of automobile quarter of 2011 compared to $1.7 million last year, dealerships through consolidations. Such driven by continued growth of the on-book finance occurrences could substantially affect sales and portfolio. underlying margins for Snap-on. Balance Sheet and Cash Flow

RECENT NEWS Cash and cash equivalents year to date declined to $418.2 million compared to $572.2 million in January 2011. Net cash provided by operating activities also reduced to $14.2 million from $65.9 million in the prior Snap-On Beats Estimates year period.

Snap-On Incorporated reported revenues of $726.7 Year to date, the company had long term debt of million for the second quarter of 2011, up 12.2%, from $955.5 million with a debt to capitalization ratio of 2010 levels. Excluding $30.0 million of favorable 37.6%. foreign currency translation, organic revenues increased 7.2%.

Net earnings of $66.9 million or $1.14 per diluted share increased from $45.3 million, or $0.78 per diluted VALUATION share, a year ago. This was above $1.06 cents as per the Zacks Consensus Estimate. Snap-On’s current trailing 12-month earnings multiple Gross profit was $342.2 million and margin improved to is 11.9X, compared to the 12.3X average for the peer 47.1% of revenues, compared to 46.9% a year ago. group and 15.5X for the S&P 500. Over the last five Operating expenses of $243.4 million in the quarter years, Snap-On’s shares have traded in a range of increased $18.6 million from 2010 levels, largely due to 5.8X to 24.7X trailing 12-month earnings. Our long-tern higher volume related and other expenses including: Neutral recommendation on the stock indicates that it $6.3 million of increased stock-based compensation. would move in line with the broader U.S. equity market in the next six to twelve months. Our $48.00 target Segment Details price or 11.2X 2011 EPS reflects this view. P/E P/E 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low Commercial and Industrial Group revenues of $279.7 F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) million for the secondSNAP-ON quarter INC (SNA) improved 8.1% from10.6Key Indicators9.1 10.0 10.2 11.9 24.7 5.8 2010 levels. Excluding currency translation, organic sales increased 1.9%.Industry Average 11.7 10.5 10.0 9.0 12.3 89.6 4.6 S&P 500 11.8 10.8 10.7 11.2 15.5 27.7 13.8

Revenues in Snap-onMAKITA Tools CORP GroupADR (MKTAY) increased 13.0% 13.4 11.7 19.1 5.7 year-over-year, largelySHOPSMITH due to INC continued (SSMH) higher sales in the United States.TORO On anCO organic(TTC) basis, sales were up13.8 12.2 11.3 13.8 24.7 7.6 10.0%. QEP COMPANY INC (QEPC) 6.5 81.7 2.8 TTM is trailing 12 months; F1 is 2011 and F2 is 2012, CF is operating cash flow Repair Systems & Information Group sales of $234.5 million increased 13.9% year-over-year.P/B Excluding Last P/B P/B ROE D/E Div Yield EV/EBITDA currency translation, organic sales increasedQtr. 5-Yr 9.7%, High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) reflecting higher SNAP-ON sales to INC repair (SNA) shop1.8 owners 2.9 and 1.1 15.2 0.6 2.4 7.8 managers. Industry Average 1.8 1.8 1.8 18.5 0.3 1.1 -0.9 S&P 500 3.3 5.2 2.9 27.1 2.1 Equity Research SNA | Page 3 Equity Research SNA | Page 4 Earnings Surprise and Estimate Revision History

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Snap- On Inc (SNA) at StockResearchWiki.com:

http://www.stockresearchwiki.com/tiki- index.php?page=SNA/Ticker

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of SNA. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1032 companies covered: Outperform - 14.7%, Neutral - 78.1%, Underperform – 6.0%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s

Equity Research SNA | Page 5 industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Equity Research SNA | Page 6