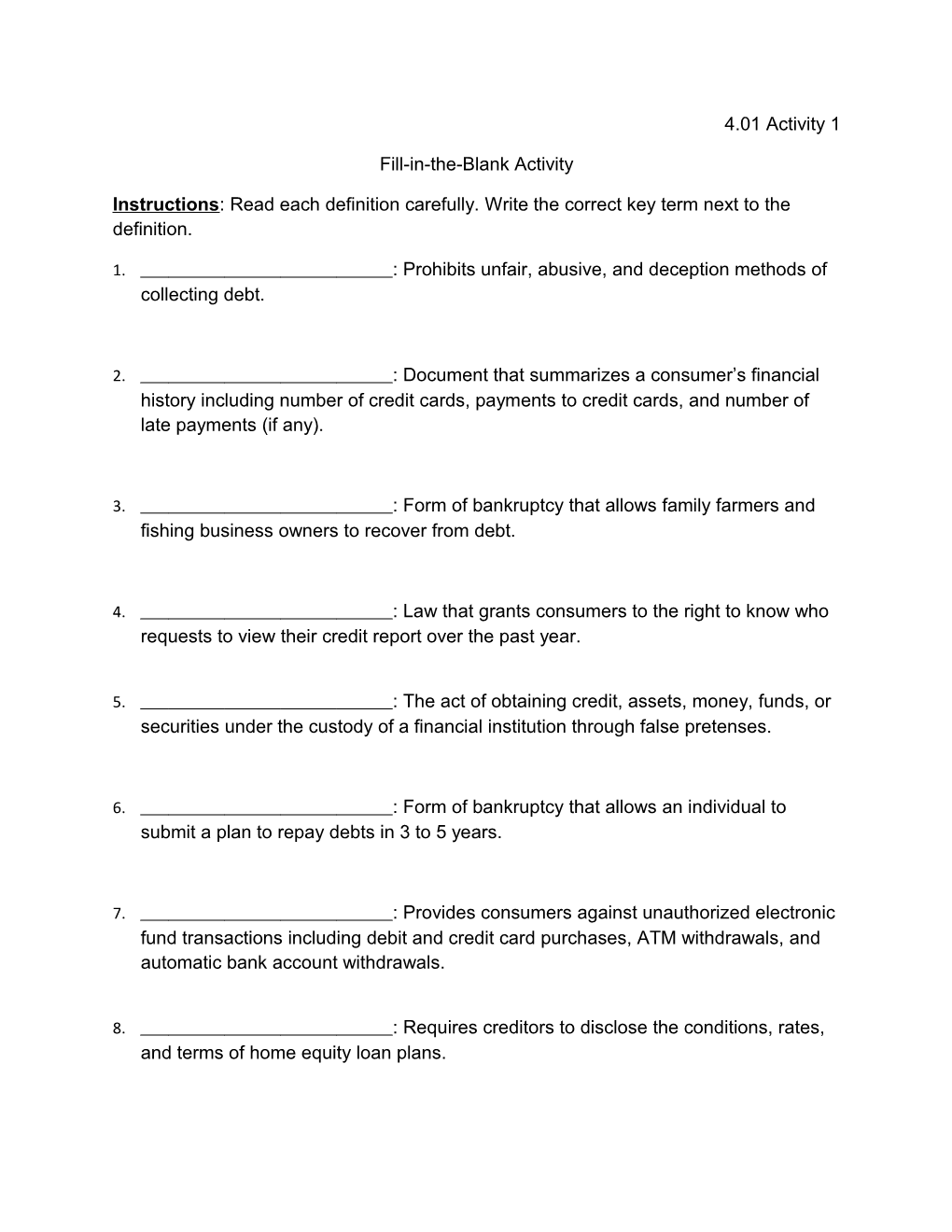

4.01 Activity 1

Fill-in-the-Blank Activity

Instructions: Read each definition carefully. Write the correct key term next to the definition.

1. : Prohibits unfair, abusive, and deception methods of collecting debt.

2. : Document that summarizes a consumer’s financial history including number of credit cards, payments to credit cards, and number of late payments (if any).

3. : Form of bankruptcy that allows family farmers and fishing business owners to recover from debt.

4. : Law that grants consumers to the right to know who requests to view their credit report over the past year.

5. : The act of obtaining credit, assets, money, funds, or securities under the custody of a financial institution through false pretenses.

6. : Form of bankruptcy that allows an individual to submit a plan to repay debts in 3 to 5 years.

7. : Provides consumers against unauthorized electronic fund transactions including debit and credit card purchases, ATM withdrawals, and automatic bank account withdrawals.

8. : Requires creditors to disclose the conditions, rates, and terms of home equity loan plans. 9. : Form of bankruptcy that allows businesses to create a plan to “reorganize” and pay off their debts over time.

10. : Provides consumers with a means to dispute a billing error on open-ended credit accounts (credit and charge cards).

11. : The current market value of a home minus the remaining mortgage balance.

4.01 Activity 1

12. : Amendments to the Truth-in-Lending law that include requirements for cosigners who applicants under 21 years of age.

13. : Law that states that a consumer’s credit application can only be judged on the basis on financial responsibility not the applicant’s gender, race, marital status, age, national origin, or receipt of public assistance.

14. : Created to maintain the public’s confidence in banks and encourage stable banking practices.

15. : Protects consumers’ right to attain, use, and maintain credit by monitoring and enforcing credit laws.

16. : Increased the government’s ability to combat bank fraud.

17. : Requires creditors to provide consumers with the terms and cost of credit. 18. : Sets the maximum amount of interest that can be charged for a loan.

19. : Requires the debtor to liquidate (sale) nonexempt property to repay creditors.

20. : Grants consumers’ personal financial records a reasonable amount of privacy from federal government searches.

4.01 Activity 2

Credit Laws Review Activity

Instructions: Read each question carefully. Answer the questions in complete sentence form.

1. How does the Federal Fair Debt collection Practices Act protect debtors?

2. How does the Federal Equal Credit Opportunity Act protect a debtor that is married and female?

3. If you are married with joint accounts, how do you have the right to report credit information? 4. What are 4 ways to file bankruptcy?

5. What bankruptcy chapter requires liquidation of assets?

6. What bankruptcy chapter is used to reorganize debt?

7. How many days do creditors have to mail bills before the due date? 4.01 Activity 3

PROTECTION OF DEBTORS

Instructions: Mark each statement TRUE or FALSE. If the statement is false, change the underlined word or phrase to make the statement true.

QUESTION TRUE/FALSE CORRECT WORD 1. A creditor may not refuse, on the basis of sex or marital status, to grant a separate account to a credit worthy applicant. ______

2. The interest rate is the total added cost when one pays in installments for goods or services. ______

3. The creditor should not have any communication with the debtor at work. ______

4. Chapter 12 bankruptcy plan is for family farm owners only. ______

5. Under Chapter 7 bankruptcy assets such as bank accounts, stocks, and bonds are all exempt property. ______

6. The Federal Credit Opportunity Act makes it lawful for any creditor to discriminate against an applicant because of sex or marital status. ______

7. Under the laws of challenging unconscionable contracts, the judge may refuse to enforce the contract. ______

8. Chapter 13 bankruptcy law requires the debtor to have $500,000 in unsecured debt. ______

9. Chapter 11 Reorganization is for corporations, partnerships, or sole proprietorship to continue in business. ______

10. Creditors must mail bills at least 15 days before the due date. ______4.01 Activity 4 CREDIT PROJECT

This project will help give you a deeper understanding of credit cards and credit in general. Go to http://www.bankrate.com/finance/credit-cards/chapter-1-match-card- and-lifestyle.aspx and go through each chapter – answering the following questions as you go. Be sure to answer the questions completely – giving detailed explanations for each question. If you are unsure, please be sure to ask!

Introduction: You are to write a one paragraph explanation of what you know and understand about credit before you begin your research. What do you think of credit in general – is it good or bad? How do you think you use credit? What are some of the types of credit that you have available to you? What are your plans for credit in your future specifically? (10 Points)

Chapter 1: Match Card and Lifestyle (2 points per question, 10 Points total)

What are your options for credit cards (i.e., how do you find your ideal credit card)?

What are some questions you need to ask before you sign up for a credit card?

How is the balance on a card calculated?

What kinds of information do you need to know in the “fine print” of a credit card?

What are some scams that you need to be aware of?

Chapter 2: Credit Reports and Scores (2 points per question, 6 Points total)

What is a credit score?

What kinds of information is used to determine your credit score?

How do you check your credit score?

Chapter 3: Costs and Fees (2 points per question, 12 Points total)

How are finance charges calculated?

What are some of the fees that you might be charged for a credit card?

What are some tips to avoid late fees?

What are the reasons rates may go up?

What are some of the ways you can avoid going over your credit limit? When can a credit card company raise your rate?

Chapter 4: Managing Your Cards (2 points per question, 14 Points total)

What are some of the fees and charges that will show up on your monthly statement?

What are your options for lowering your interest rate?

What are some of the concerns with balance transfers?

4.01 Activity 4

What are some reasons for canceling a card? What are the steps?

What happens when you pay either the minimum or less than the minimum on your credit card statement?

What do you do if your card is lost or stolen?

What happens if you do not pay your bill?

Chapter 5: Using credit Wisely (2 points per question, 10 Points total)

What are some concerns about making purchases on the internet?

What are your options for disputing charges on your card?

What are some of the “perks” of using credit cards?

How can you use a credit card to help raise your credit (or establish good credit)?

What are options for the due date of your credit card bill?

Chapter 6: Special-need Card Users (2 points per question, 8 Points Total)

What are some of the things you should be aware of when you get your first credit card?

What are some of the concerns for college students and credit?

In what circumstances can a credit card be useful for students?

What happens if you have bad credit?

Conclusion Once you have completed your research, complete a one-paragraph summary of what you learned. Were the things you thought you knew about credit accurate? What did you learn that you did not know already? What do you think of credit now – is it good or bad? (10 Points)

Other Points Earned:

Grammar and Spelling (10 Points)

Detailed explanations given with examples showing knowledge of material (10 points)

4.01 Activity 5

Bankruptcy Project

Some of you have been here at this school for up to 4 years; some maybe longer. This school as just filed for Chapter 11 Bankruptcy protection and you were brought in by the bankruptcy trustee to evaluate the school.

Your assignment is as follows:

1. You are to come up with at least 25 problems in this school or about this school. You are not allowed to name anyone in particular. You can make reference to subjects taught, but under no circumstances will any school employee’s name be used. 2. In a PowerPoint or presentation medium of your choice, you are to list each problem on a slide and what you feel would be possible solution to fix that problem. This assignment does involve some thinking on your part. Be creative. I, as the bankruptcy trustee, will pull some of the best ideas together and present a presentation to the school administration for their review. 3. This assignment will be due by end of class tomorrow. So please take your time as it will be worth TWO test grades.