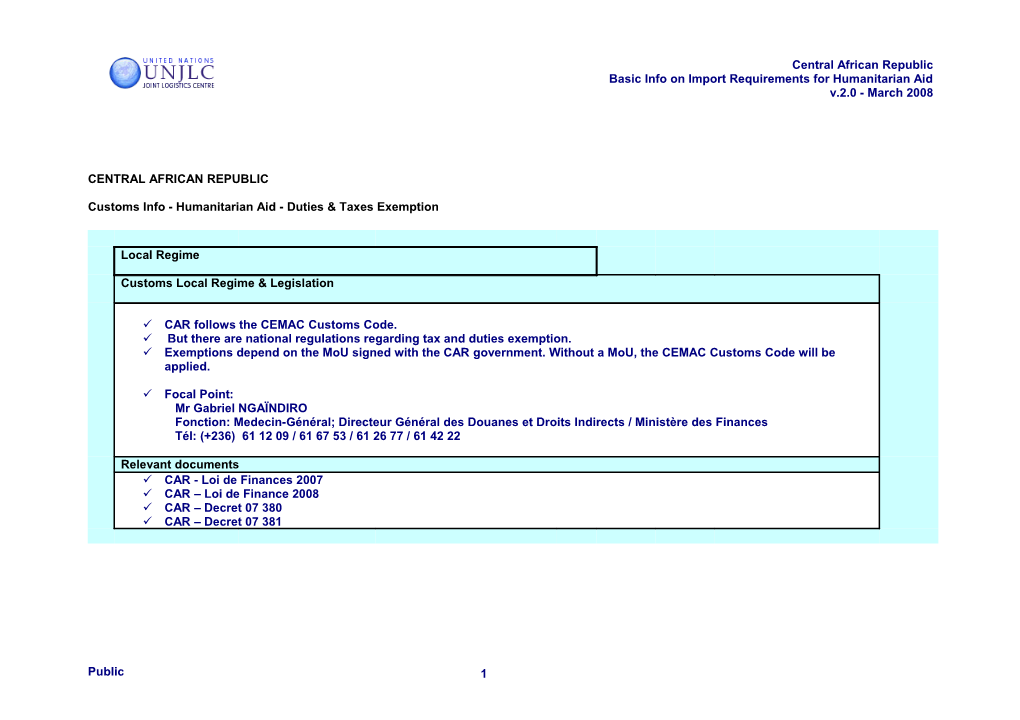

Central African Republic Basic Info on Import Requirements for Humanitarian Aid v.2.0 - March 2008

CENTRAL AFRICAN REPUBLIC

Customs Info - Humanitarian Aid - Duties & Taxes Exemption

Local Regime

Customs Local Regime & Legislation

CAR follows the CEMAC Customs Code. But there are national regulations regarding tax and duties exemption. Exemptions depend on the MoU signed with the CAR government. Without a MoU, the CEMAC Customs Code will be applied.

Focal Point: Mr Gabriel NGAÏNDIRO Fonction: Medecin-Général; Directeur Général des Douanes et Droits Indirects / Ministère des Finances Tél: (+236) 61 12 09 / 61 67 53 / 61 26 77 / 61 42 22

Relevant documents CAR - Loi de Finances 2007 CAR – Loi de Finance 2008 CAR – Decret 07 380 CAR – Decret 07 381

Public 1

Central African Republic Basic Info on Import Requirements for Humanitarian Aid v.2.0 - March 2008

Organizations Duties & Taxes Exemption Regime

United Nations Agencies

United Nations agencies have to sign a Memorandum of Understanding with the Government of the CAR through the Ministry of Foreign Affairs (and then follow subsequent negotiations with the Ministry with authority of the sector of the programme (education, health, etc).

Ministry of Foreign Affairs, Regional Integration and French Speaking countries Focal Point person : Mr. Mathieu Batolo, Director of Immunities and Privileges Telephone Number : (+236) 21 61 12 43 Mobile Number : (+236) 75 05 62 31

NGOs

International NGOs have to sign a MoU with the Ministry of Planning, the Ministry of Finances and with the relevant implementing Ministries. There is a standard template (available at Ministry of Planning). This MoU holds the customs duties exemption. But NGOs still have to pay about 10% (Various CEMAC taxes).

Ministry of Planning Focal Point person : Mr. Jean-Louis Pouninginza, Chef de service des ONGs Mobile Number : (+236) 75.70.64.84

Public 2

Central African Republic Basic Info on Import Requirements for Humanitarian Aid v.2.0 - March 2008

Duties & Taxes Exemption

Application Procedure - Generalities

The procedure to be followed is:

1. The UN agency or NGO should submit the hereunder listed administrative paperwork when applying for the exemption (to MoFa for UN and to MoF for NGOs with a copy for Ministry of Planning):

a. Demande d’admission en franchise (Letter of request for exemption of duties & taxes request) b. Facture non commerciale (Proforma Invoice: international currency, value in euros or dollars) c. Facture originale d’achat (Original Invoice) d. Or Attestation de don (Donation Certificate) e. Note de détails – manque à gagner (loss of earnings, to be drawn up by a freight/customs clearance agent) f. NIF (Tax Identification Number to get from tax office –compulsory)

Then :

UN Agencies 2. The MoFa validates the pack of documents and forwards them to the Customs Office. 3. Receive of Customs authorization and clearance

NGOs 2. The MoF forwards the pack of documents to the Customs Office. 3. Receive of Customs authorization and clearance 4. A new decree, still to be applied, changes the procedure: an inter-ministerial board will be set up to validate the exemption. They have 30 days to give their authorization to the Customs Office which will give the clearance.

To get the clearance, in addition to the documents listed above, NGOs and UN agencies has to submit :

Public 3

Central African Republic Basic Info on Import Requirements for Humanitarian Aid v.2.0 - March 2008

1. Packing List 2. Transport Doc = BSC (bordereau de Suivi de Chargement ) if by boat, LTA if by plane…

Public 4

Central African Republic Basic Info on Import Requirements for Humanitarian Aid v.2.0 - March 2008

Duties & Taxes Exemption

Application Procedure - Indexed paperwork required Packing Invoice Type Airway bill / Certificate of Other required documents: List Number of Invoices transport Donation document no - pro-forma invoice no YES Demande de franchise - original invoice NIF (4 copies) Loss of Earnings

Comments

Same paperwork requirements and procedure apply to all commodities (NFI, medicines, etc)

For vehicles, the procedure to get the number plates and vehicles registered is done after release and clearance. With the Ministry of Foreign Affairs for UN Agencies (CD plates). For NGOs (TA plates), once the exemption is authorized, the Customs Office provides a D18 form, which allows Ministry of Transport to give TA numbers. (cost = around 50 000 CFA)

Customs Clearance Packing Invoice Type Airway bill / Certificate of Exemption Certificate List Number of Invoices transport Donation document YES - pro-forma YES (original) YES YES - original 4 copies

Public 5