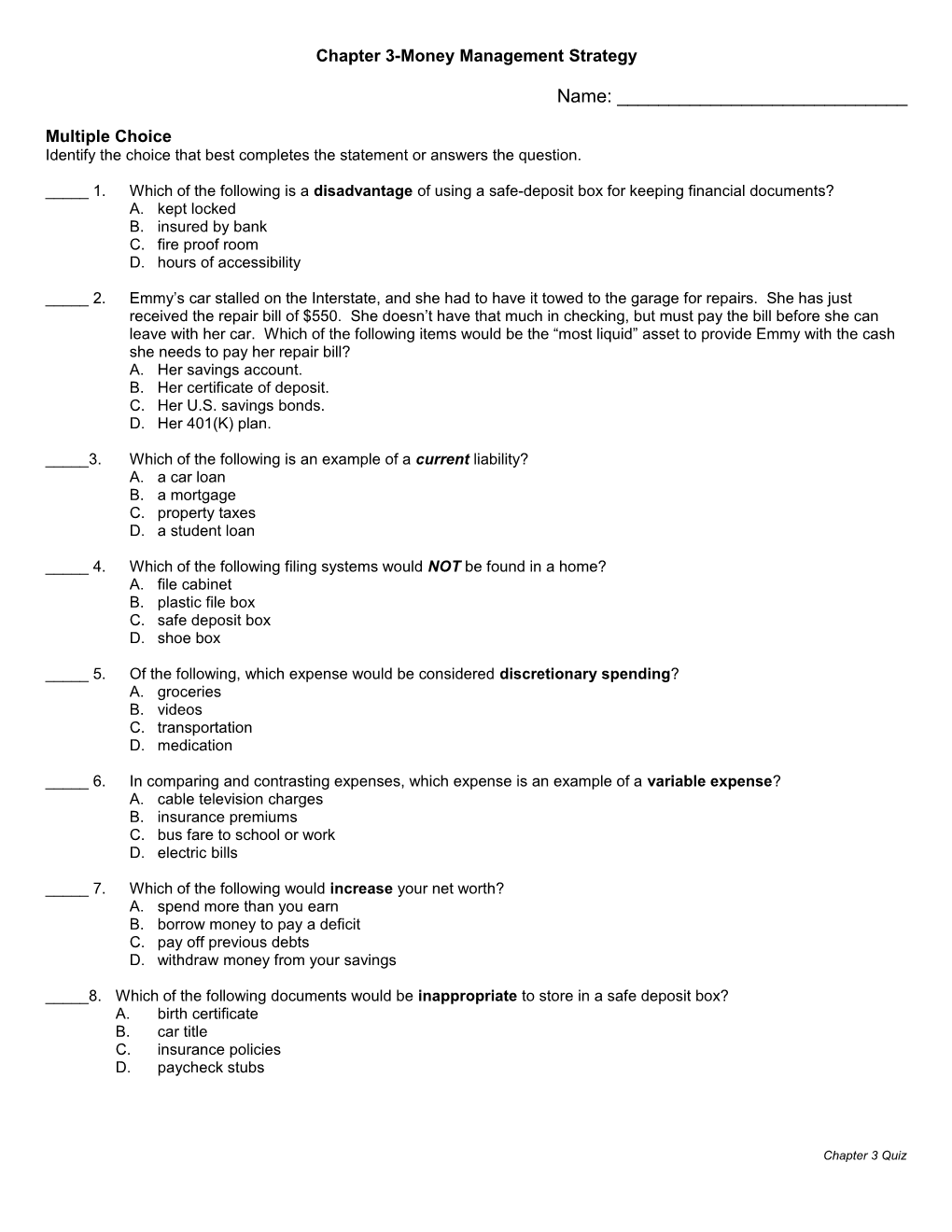

Chapter 3-Money Management Strategy

Name: ______

Multiple Choice Identify the choice that best completes the statement or answers the question.

_____ 1. Which of the following is a disadvantage of using a safe-deposit box for keeping financial documents? A. kept locked B. insured by bank C. fire proof room D. hours of accessibility

_____ 2. Emmy’s car stalled on the Interstate, and she had to have it towed to the garage for repairs. She has just received the repair bill of $550. She doesn’t have that much in checking, but must pay the bill before she can leave with her car. Which of the following items would be the “most liquid” asset to provide Emmy with the cash she needs to pay her repair bill? A. Her savings account. B. Her certificate of deposit. C. Her U.S. savings bonds. D. Her 401(K) plan.

_____3. Which of the following is an example of a current liability? A. a car loan B. a mortgage C. property taxes D. a student loan

_____ 4. Which of the following filing systems would NOT be found in a home? A. file cabinet B. plastic file box C. safe deposit box D. shoe box

_____ 5. Of the following, which expense would be considered discretionary spending? A. groceries B. videos C. transportation D. medication

_____ 6. In comparing and contrasting expenses, which expense is an example of a variable expense? A. cable television charges B. insurance premiums C. bus fare to school or work D. electric bills

_____ 7. Which of the following would increase your net worth? A. spend more than you earn B. borrow money to pay a deficit C. pay off previous debts D. withdraw money from your savings

_____8. Which of the following documents would be inappropriate to store in a safe deposit box? A. birth certificate B. car title C. insurance policies D. paycheck stubs

Chapter 3 Quiz _____ 9. Which of the following is NOT a characteristic of a good budget? A. inaccessibility B. practicality C. flexibility D. written

_____10. What is the financial state that occurs when your liabilities are greater than your assets? A. insolvency B. cash flow C. surplus D. net worth

_____11. What does it mean to “pay yourself first”? A. conscious effort to spend less each day B. setting aside a fixed amount for savings before paying bills C. deduction taken automatically out of your paycheck D. increasing savings to establish a sound financial future

_____12. In comparing and contrasting expenses, which of the following is an example of a fixed expense? A. rent B. recreation C gas D. medical costs

_____13. Which of the following is NOT a purpose of a budget? A. learn to live within your income B. learn to spend money uncontrollably C. learn money management skills D. learn to spend money wisely

_____14. Larry has assets of $5,450 and liabilities of $2,365. What is his net worth? A. $1,085 B. $2,085 C. $3,085 D. $4,085

_____15. Which of the following items should NOT be stored in a home file? A. birth certificate B. tax records C. pay stubs D. bank statements

_____16. Which of the following is NOT a benefit of organizing your personal documents? A. plan and measure financial progress B. make ineffective decisions about spending money C. handle routine money matters D. determine how much money you have now and in the future

_____17. What is the definition of money management? A. financial state that occurs if liabilities are greater than assets B. a simple to set up system in your home C. any items of value that are owned D. planning to get the most from your money

_____18. To become a member of an Internet DVD library, Maritza had to put down a $100 deposit using her credit card, in return she received a membership agreement. If she choose to discontinue this membership, the library will refund the deposit only if she has returned all of her DVDs, paid the annual membership fee, and presents her membership agreement. What would be safest place for Maritza to store her membership agreement? A. a shoe box B. safe deposit box C. dresser drawer

Chapter 3 Quiz D. glove box in car

Chapter 3 Quiz