NPH Due Diligence

MARKET DATA

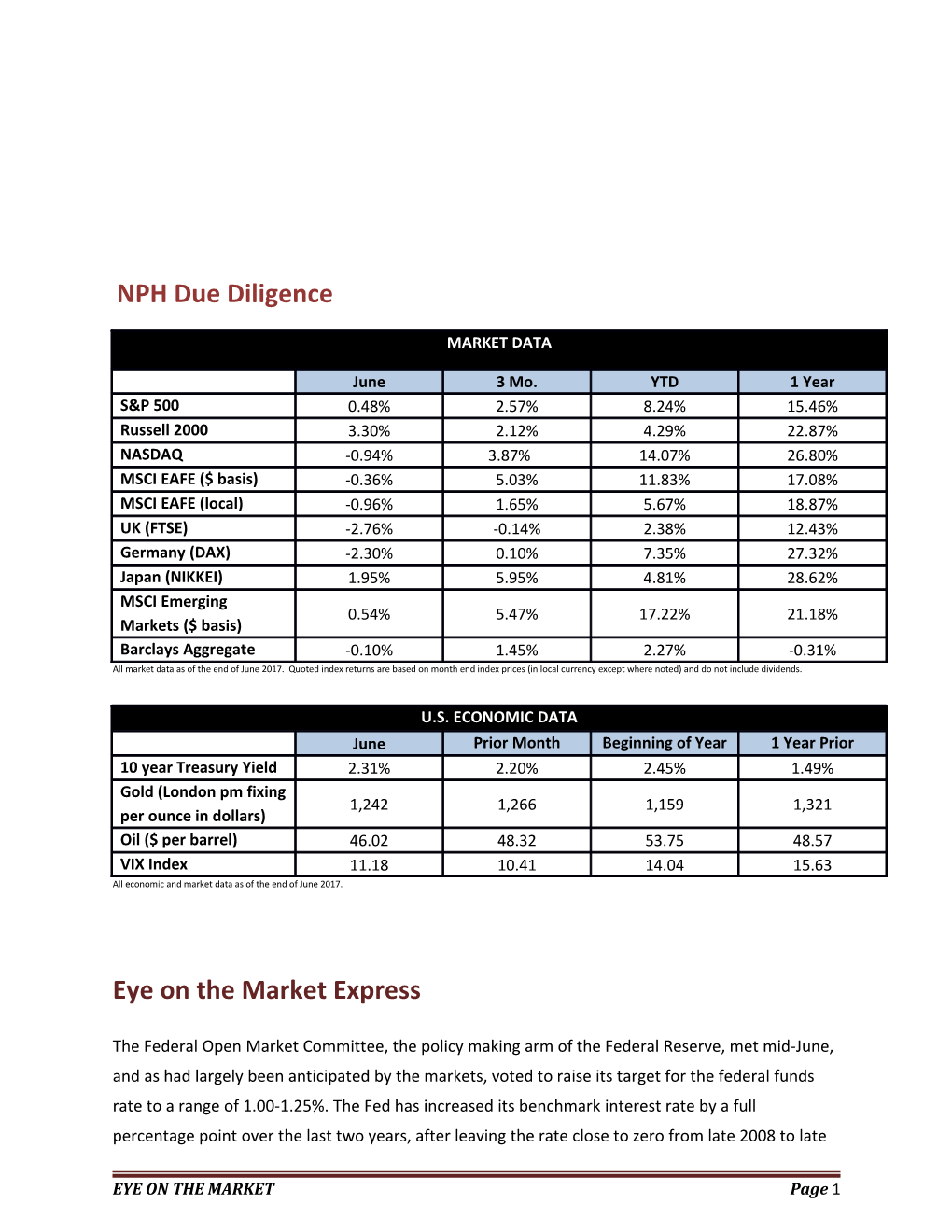

June 3 Mo. YTD 1 Year S&P 500 0.48% 2.57% 8.24% 15.46% Russell 2000 3.30% 2.12% 4.29% 22.87% NASDAQ -0.94% 3.87% 14.07% 26.80% MSCI EAFE ($ basis) -0.36% 5.03% 11.83% 17.08% MSCI EAFE (local) -0.96% 1.65% 5.67% 18.87% UK (FTSE) -2.76% -0.14% 2.38% 12.43% Germany (DAX) -2.30% 0.10% 7.35% 27.32% Japan (NIKKEI) 1.95% 5.95% 4.81% 28.62% MSCI Emerging 0.54% 5.47% 17.22% 21.18% Markets ($ basis) Barclays Aggregate -0.10% 1.45% 2.27% -0.31% All market data as of the end of June 2017. Quoted index returns are based on month end index prices (in local currency except where noted) and do not include dividends.

U.S. ECONOMIC DATA June Prior Month Beginning of Year 1 Year Prior 10 year Treasury Yield 2.31% 2.20% 2.45% 1.49% Gold (London pm fixing 1,242 1,266 1,159 1,321 per ounce in dollars) Oil ($ per barrel) 46.02 48.32 53.75 48.57 VIX Index 11.18 10.41 14.04 15.63 All economic and market data as of the end of June 2017.

Eye on the Market Express

The Federal Open Market Committee, the policy making arm of the Federal Reserve, met mid-June, and as had largely been anticipated by the markets, voted to raise its target for the federal funds rate to a range of 1.00-1.25%. The Fed has increased its benchmark interest rate by a full percentage point over the last two years, after leaving the rate close to zero from late 2008 to late

EYE ON THE MARKET Page 1 2015. In addition to lifting its target for short-term interest rates, the committee announced its plans to reduce its balance sheet, starting later this year. In the years following the financial crisis, the Fed supported the economy by purchasing treasury bonds and mortgage backed securities, which increased its bond holdings from less than $900 billion to approximately $4.5 trillion. The Fed plans to initially allow $10 billion of bonds to mature without reinvesting the proceeds each month for three months. It will then raise the pace by $10 billion every three months, until reaching $50 billion a month. The mixture of bonds rolling off will be 60% Treasury securities and 40% mortgage backed securities. In the press conference following the Fed’s announcement, Chairperson Janet Yellen asserted “our decision reflects the progress the economy has made and is expected to make.” While the Fed’s messaging was generally upbeat, inflation has consistently remained below the central bank’s target of 2%, and the committee cut its inflation expectations for this year from 1.9% to 1.6%. Regarding this change, Yellen stated “We continue to feel that with a strong labor market and a labor market that’s continuing to strengthen, the conditions are in place for inflation to move up.” As at their last meeting in March, the Fed still predicts one additional rate hike this year, and three hikes next year.

Economic data released in June showed little change in recent trends. Consumers continue to espouse their confidence to surveyors as the Conference Board’s consumer confidence index unexpectedly rose to 118.9 and while the University of Michigan consumer sentiment index declined for the month, it is still at a robust reading of 95.1. The decline in consumer sentiment was driven by lower consumer expectations about future economic conditions. However, optimistic attitudes have not translated into actual spending. Consumer spending edged up only 0.1% in May, and retail sales declined 0.3% over the same period. The decline in retail sales was broad-based, but sales at auto dealers account for about a fifth of all retail sales, giving the 0.2% decline in that category a relatively large impact on the overall number. Lately auto sales have cooled after a series of strong annual gains that put them at record highs. The disappointing consumption data was despite personal income rising 0.4% in May, and the savings rate rose to its highest level since last September at 5.5%. The labor market still appears to be healthy, and while non-farm payroll additions of 138,000 for May were below expectations, the unemployment rate fell to a 16-year low at 4.3%. The decline in the unemployment rate was primarily due to a fall in the labor force participation rate to 62.7%. After rising for decades, the labor force participation rate plateaued around 2000 and has since declined to levels last seen in the 1970s. Weekly unemployment claims were also subdued throughout June. Theoretically low levels of unemployment should push wages up, but wage growth missed expectations, rising 2.5% on an annual basis1. In the housing market the imbalance between low supply and strong demand continues to drive up prices, which as measured by the S&P CoreLogic Case-Shiller 20-City Composite rose 5.5% year-over-year through

1 Personal income, which was referenced earlier and showed stronger growth, is a broader measure of income than wages since it includes other forms of income in addition to wages such as investment or rental income. EYE ON THE MARKET Page 2 April. Existing home sales, which make up 90% of the market, rose unexpectedly in May to their third highest monthly level in a decade at a 5.62-million-unit annual rate, but inventory is down 8.4% from a year ago. Despite strong demand, pending home sales declined in May for the third month in a row, as prospective buyers have been squeezed by tight inventory and higher prices. The problem is most acute at the lower end of the market, where demand is highest. According to Trulia, a real estate website, the number of starter and trade-up homes currently on the market is down 15.6% and 13% respectively compared to a year ago. First quarter GDP growth was revised up to a 1.4% growth rate from 1.2% when economists had expected the reading to remain unchanged. The upward revision reflected stronger consumer spending and exports than previously estimated. However, these gains were modestly offset by worse business investment. Forecasts are for stronger growth moving forward, with the Atlanta Federal Reserve currently forecasting 2.9% growth in the second quarter due to higher consumer spending.

Domestic equities were mixed in June with the benchmark S&P 500 index edging up 0.48% for the month, bringing its return to 8.24% for the first half of the year, excluding dividends. Small cap stocks, as measured by the Russell 2000 index, outperformed and rose by 3.30% for the month, although they still lag for the year with a 4.29% rise. Conversely, tech stocks, as measured by the NASDAQ composite index, lagged this month, losing 0.94%, but they are still the best performer year-to-date, rising 14.07%. In June, sectors that are generally sensitive to changes in interest rates had the most extreme movements as the 10-year Treasury note moved from 2.20% to 2.31%. Financials, which typically profit off higher interest rates, posted the largest monthly gains, rising 6.43% and telecom service and utilities, both debt heavy sectors, had the largest losses, declining 2.92% and 2.70% respectively. Looking at how sectors have performed for the first half of 2017, information technology leads with a 17.48% gain as the sector has benefited from improved business confidence and anticipated corporate technology upgrades. Conversely, energy has been the worst performing sector because despite OPEC production cuts, increased production in the U.S. appears to be limiting price gains.

International stocks were modestly negative in June with the MSCI EAFE index losing 0.96% on a local currency basis. When translated into U.S. dollars the index declined 0.36% as the dollar declined in value against a trade weighted basket of currencies over the course of the month. For the year, the index is up 5.67% on a local currency basis and 11.83% when translated into dollars. In Europe, British, French and German indexes posted losses in June as the two-year formal process of Britain exiting the European Union commenced. Britain’s economy defied expert expectations and initially posted some of the highest GDP growth rates of developed economies following the vote for Brexit. However, since then the weak pound has triggered higher inflation and worn on growth. Conversely, economic data for other European countries has recently turned more positive with unemployment and budget deficits improving across the Eurozone. In Japan, stocks, as measured by

EYE ON THE MARKET Page 3 the Nikkei 225, rose 1.95% for June and are up 4.81% for the year. Japan’s economy has barely grown over the last several decades, but it has recently shown modest signs of improvement with GDP expanding at a 1.0% annualized rate in the first quarter of 2017 and the government upgrading its assessment of the economy in its most recent monthly report for the first time since December of last year, saying the economy is on a path of “moderate recovery.” Outside of developed markets, emerging market stocks, as measured by the MSCI Emerging Markets index, inched up 0.54% for the month, bringing their annual return to a 17.22% gain. In China, the world’s largest developing economy, data indicates growth continues at a robust rate, with the economy expanding by 6.9% in the first quarter and manufacturing data that indicated the sector was expanding again after a period of contraction.

Fixed income returns were negative in May as shorter- and medium-term interest rates moved up, while longer-term Treasuries edged slightly down. The benchmark Bloomberg Barclays Aggregate Bond index declined -0.10%. The best performing fixed income sectors were those with longer duration and credit exposure with the Bloomberg Barclays Long Term U.S. Treasury index and the Bloomberg Barclays U.S. Corporate High Yield index gaining 0.40% and 0.14% respectively. The worst performing sectors all had unique causes for lagging the benchmark. Mortgage backed bonds declined on expectations of demand from the Fed discussed earlier. U.S. inflation linked bonds, such as TIPS, lost value as inflation lagged expectations, and European government bond yields widened as inflation expectations for the Eurozone increased. Finally, municipals bonds suffered from Illinois’ possible credit downgrade to junk status.

Commodity returns for the month were once again mostly negative with the benchmark Reuters/Jefferies CRB index declining for the sixth month in a row, losing 2.78% in June and 9.21% for 2017 so far. Wheat was the best performing commodity for June with its spot prices rising 22.54% due to drought affecting the U.S. spring wheat crop. Cotton was the worst performing commodity of the month, with the spot price declining 10.90% as production in India increased. Oil prices also moved lower as West Texas Intermediate Crude spot prices declined from $48.32 to $46.02 a barrel.

Company Name Here

Address, City, State & Zip Code

Office Phone Number

EYE ON THE MARKET Page 4 Company Website

IMPORTANT DISCLOSURES:

[INSERT DBA NAME HERE] is separate from, and unrelated to, SII Investments, Inc., and all other named companies.

The Market Update has been prepared by National Planning Holdings, Inc. (NPH), for use by its affiliated broker-dealers which includes SII Investments, Inc. This Update is for informational purposes only – any mention of any security, index, or corporation is not meant as a solicitation to buy or sell any security, or any investment related to any corporation mentioned in this Update. Securities offered through SII Investments, Inc., Member FINRA/SIPC.

Opinions, Forecasts and Statistical Information. All expressions of opinions and forecasts expressed in this Market Update are based on assumptions we feel are reasonable. However, these opinions and forecasts may or may not actually come to pass. This information is subject to change at any time, based on market or other conditions and should not be construed as a recommendation. Undue reliance should not be placed on forward-looking statements because, by their nature, they are subject to known and unknown risks and uncertainties. Past performance does not guarantee future results. NPH, its affiliates, officers, directors or their employees may in the normal course of business, have a position in any securities mentioned in this report. This Update also contains statistical information related to the performance of certain indices which are presented for illustrative purposes only as factors that may have an impact on today’s economic environments. Keep in mind individuals cannot invest directly in any index, and index performance does not include transaction cost or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Risks of Investing. Both stock and bond investing are subject to risks, including the possibility you may lose money and include credit, interest rate and inflation risk. Stock or bond market investing may not be suitable for all investors. Certain investments including international investments, global or emerging markets, securities of small to middle sized companies, companies with low quality industry ratings, commodities, foreign currencies are subject to a higher degree of risk than more conservative investments and thus may only be suitable for the more speculative investor. International investments are subject to special risks, such as political unrest, economic instability, and currency fluctuations.

Securities products are Not FDIC/NCUA Insured; are Not Guaranteed By Any Bank or Credit Union, and May Lose Value. SII Investments, Inc. is not affiliated with any bank or credit union.

Affiliate Disclosure. Please note that NPH and SII Investments, Inc. are affiliates of Jackson National Life Insurance Company.

INDEX DESCRIPTION

10 Year Treasury The closing yield on 10-year Treasury notes calculated on a daily basis. Data sourced from the Federal Reserve.

Barclays Capital Aggregate Bond A broad based index used to represent performance of Index investment grade bonds traded in the United States. The index includes Treasury securities, government related and corporate securities, mortgage-backed securities and asset-backed securities.

Barclays Municipal Bond Index An unmanaged index considered representative of the tax- exempt bond market.

Conference Board Consumer An indicator used to measure consumer confidence in the Confidence economy produced by the Conference Board on a monthly basis based upon a survey of 5,000 households.

DAX (Germany) A total return index of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange.

Dow Jones Industrial Average An unmanaged index of 30 widely held securities.

EYE ON THE MARKET Page 5 Federal Funds Rate Targeted interest rate at which depository institutions lend to each other overnight. The rate is targeted by the Federal Open Market Committee (FOMC).

FTSE (UK) A capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange.

FTSE NAREIT All REITs Index Market capitalization weighted index that includes all tax- qualified REITs listed on the New York Stock Exchange.

GDP A measure of broad economic output in the United States produced by the US Bureau of Economic Analysis on a quarterly basis with revisions made monthly.

Gold Value of gold based upon the afternoon fix (15:00 GMT) in London each afternoon.

ISM A measure of manufacturing activity reported by the Institute of Supply Management each month. A reading over 50 signifies growth in manufacturing during the month.

MSCI EAFE A widely accepted benchmark of foreign stocks. It comprises 21 MSCI country indices, representing the developed markets outside North America: Europe, Australasia and the Far East.

MSCI Emerging Markets A widely accepted benchmark of emerging markets stocks. It is a float-adjusted market capitalization index designed to measure equity market performance in the global emerging markets.

NASDAQ An unmanaged index of all stocks traded on the NASDAQ over- the-counter market.

Nikkei (Japan) An unmanaged price-weighted index of 225 widely held stocks listed in Japan.

Oil Closing value of light, sweet crude oil futures in the near month.

Retail Sales A measure of retail sales compiled monthly by the US Department of Commerce

Russell 2000 An unmanaged index of small cap securities.

S & P 500 An unmanaged index of 500 widely held stocks.

Shanghai Composite Index of all listed (A and B share class) stocks traded on the Shanghai Stock Exchange.

Thomson-Reuters Jefferies CRB A widely accepted benchmark of commodity prices. The index is Index designed to provide a representation of long-only broadly diversified investment in commodities.

Unemployment A measure of unemployment compiled monthly by the US Bureau

EYE ON THE MARKET Page 6 of Labor Statistics.

VIX Index Measure of market expectations of near-term volatility based on S&P 500 stock option prices.

EYE ON THE MARKET Page 7