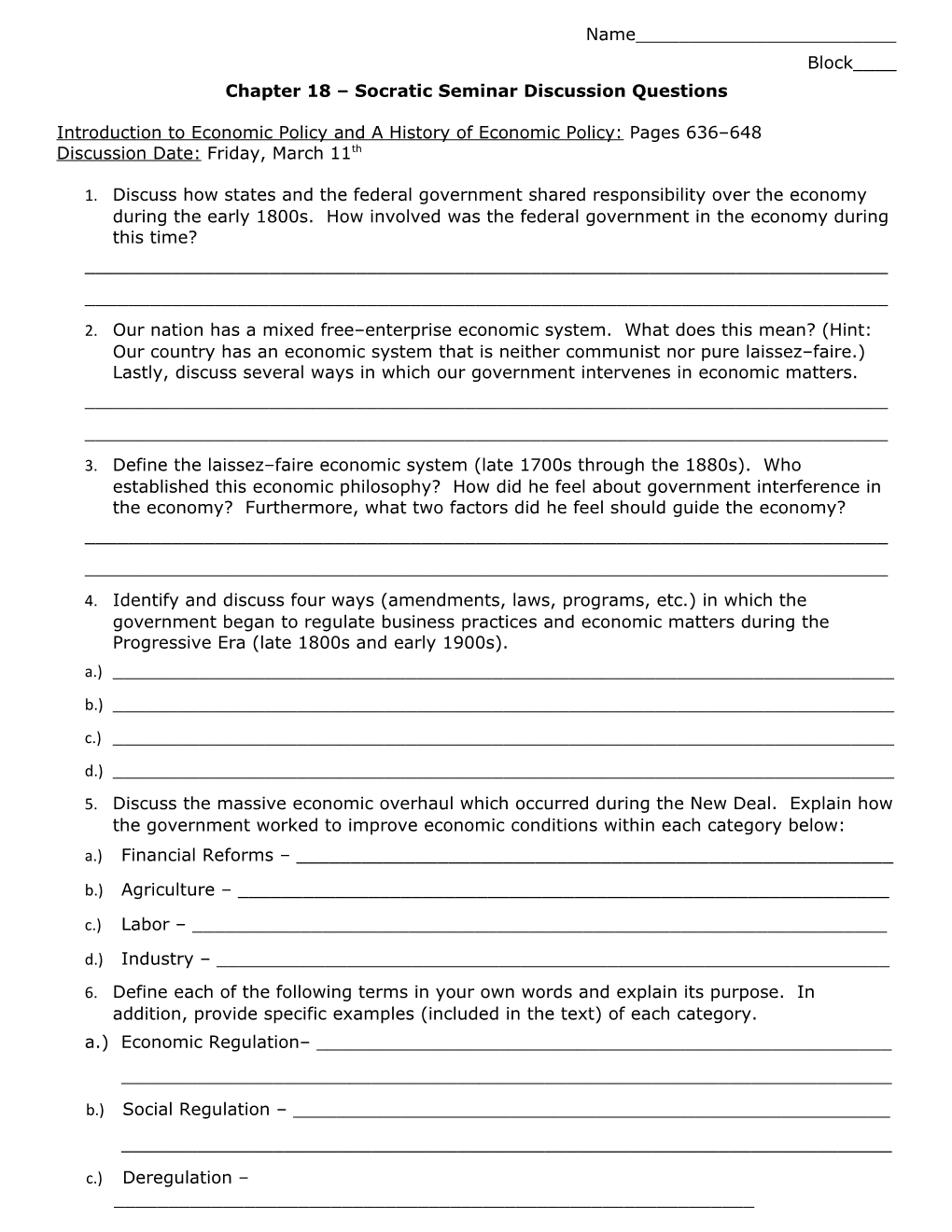

Name______Block____ Chapter 18 – Socratic Seminar Discussion Questions

Introduction to Economic Policy and A History of Economic Policy: Pages 636–648 Discussion Date: Friday, March 11th

1. Discuss how states and the federal government shared responsibility over the economy during the early 1800s. How involved was the federal government in the economy during this time? ______2. Our nation has a mixed free–enterprise economic system. What does this mean? (Hint: Our country has an economic system that is neither communist nor pure laissez–faire.) Lastly, discuss several ways in which our government intervenes in economic matters. ______3. Define the laissez–faire economic system (late 1700s through the 1880s). Who established this economic philosophy? How did he feel about government interference in the economy? Furthermore, what two factors did he feel should guide the economy? ______4. Identify and discuss four ways (amendments, laws, programs, etc.) in which the government began to regulate business practices and economic matters during the Progressive Era (late 1800s and early 1900s). a.) ______b.) ______c.) ______d.) ______5. Discuss the massive economic overhaul which occurred during the New Deal. Explain how the government worked to improve economic conditions within each category below: a.) Financial Reforms – ______

b.) Agriculture – ______

c.) Labor – ______

d.) Industry – ______6. Define each of the following terms in your own words and explain its purpose. In addition, provide specific examples (included in the text) of each category. a.) Economic Regulation– ______

b.) Social Regulation – ______

c.) Deregulation – ______

Chapter 18 – Socratic Seminar Discussion Questions

Stabilizing the Economy: Monetary Policy vs. Fiscal Policy: Pages 648–655 Discussion Date: Tuesday, March 15th

1. Define monetary policy and identify the two economic factors which are controlled as part this policy. Which government body is tasked with managing U.S. monetary policy? ______2. What is the purpose of the Federal Reserve System? Which group heads this agency? How are these members selected, how many members are there, and how long are their terms? ______3. Describe the influence of the Federal Reserve in controlling the activities of member banks. Explain how adjusting reserve requirements and discount rates can influence the borrowing/lending power of member banks. ______4. Define fiscal policy and identify the two economic factors which can be adjusted as part of this policy. Which government body is responsible for adjusting these two factors? ______5. Using your handout, define each types of tax and include one example for each category: a.) Proportional taxes – ______

b.) Progressive taxes – ______

c.) Regressive taxes – ______6. Explain the views of John Maynard Keynes on economic policy. Consistent with Keynes’ economic philosophy, what was the government’s role in trying to remedy the problems caused by the Great Depression? Furthermore, what affect would Keynesian economics have on government spending and unemployment? (Keynesian Economics: Pages 648, 652 and 653) ______Chapter 18 – Socratic Seminar Discussion Questions Globalization, the Budget Process, and Federal Expenditures: Pages 655–668 Discussion Date: Thursday, March 17th 1. Define globalization and identify international factors influencing the U.S. economy. Furthermore, what is the goal of the U.S. government when it exercises the economic philosophy of protectionism? ______2. What is GDP stand for, how is it calculated, and what is it designed to measure? Which country has the largest GDP in the world? ______3. Analyze the two pie charts page 659: a.) Discuss major sources of federal revenue – ______

b.) Discuss major expenditures in the federal budget – ______

c.) Make observations about the federal budget chart which Mr. Fike will display on the screen: ______4. Analyze the roles of Congress and the president in the budget process. What is a fiscal year and when does it start and end? ______5. Define each of the following and discuss the role which each plays in the budget process: a.) OMB – ______b.) CBO – ______6. Discuss the current budget debt which the U.S. is experiencing. Define a budget deficit and a budget surplus. In terms of fiscal policy (taxing and spending), what two things must occur in order to reduce the national debt? ______7. What was the purpose of the Gramm–Rudman–Hollings Act of 1985? Discuss other ways which the U.S. government has attempted to reduce the federal deficit. ______8. Explain the subprime mortgage crisis of the 2000s and discuss the negative ways in which it impacted the U.S. economy. ______