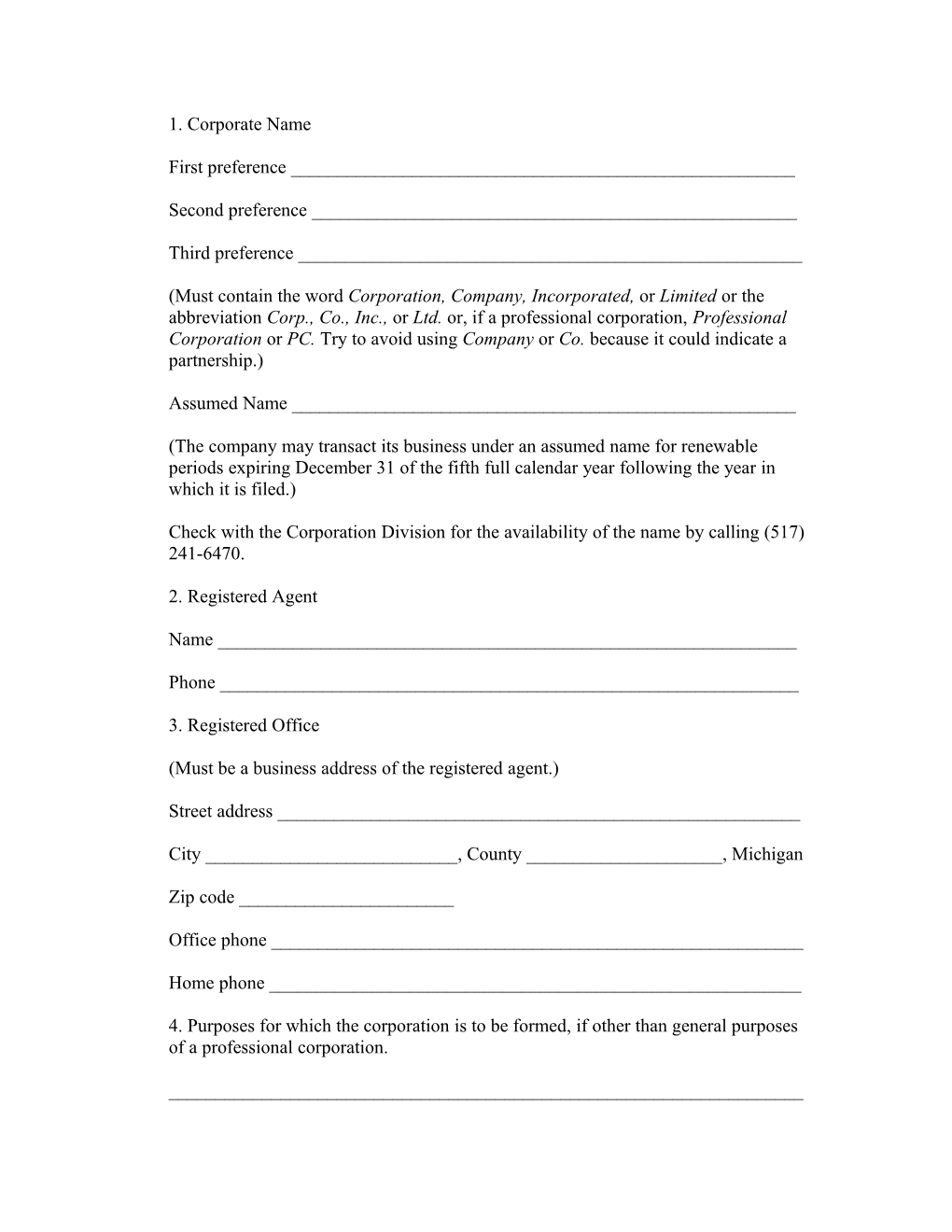

1. Corporate Name

First preference ______

Second preference ______

Third preference ______

(Must contain the word Corporation, Company, Incorporated, or Limited or the abbreviation Corp., Co., Inc., or Ltd. or, if a professional corporation, Professional Corporation or PC. Try to avoid using Company or Co. because it could indicate a partnership.)

Assumed Name ______

(The company may transact its business under an assumed name for renewable periods expiring December 31 of the fifth full calendar year following the year in which it is filed.)

Check with the Corporation Division for the availability of the name by calling (517) 241-6470.

2. Registered Agent

Name ______

Phone ______

3. Registered Office

(Must be a business address of the registered agent.)

Street address ______

City ______, County ______, Michigan

Zip code ______

Office phone ______

Home phone ______

4. Purposes for which the corporation is to be formed, if other than general purposes of a professional corporation.

______

______

5. Incorporators

One incorporator is required, but try to have all proposed shareholders act as the incorporators to take advantage of the registration exemption in Michigan Blue Sky Law.

Name ______, Social Security #_____-_____-_____

Address ______

Number of shares to be purchased ______, Class ______

Name ______, Social Security #_____-_____-_____

Address ______

Number of shares to be purchased ______, Class ______

Name ______, Social Security #_____-_____-_____

Address ______

Number of shares to be purchased ______, Class ______

6. Directors

(One or more is required.)

Name ______

Address ______

Name ______

Address ______

Name ______

Address ______

7. Officers One person may hold two or more offices. However, an officer cannot execute, acknowledge, or verify an instrument in more than one capacity if law, the articles, or bylaws require two or more officers to execute the instrument, e.g., stock certificates. Avoid having spouses as officers and/or directors to protect entireties’ property against tax officials and/or creditors who pierce the corporate veil.

President ______Social Security #_____-_____-_____

Home address ______

Home phone ______Date of birth ______

Vice president ______Social Security #_____-_____-_____

Home address ______

Home phone ______Date of birth ______

Secretary ______Social Security #_____-_____-_____

Home address ______

Home phone ______Date of birth ______

Treasurer ______Social Security #_____-_____-_____

Home address ______

Home phone ______Date of birth ______

8. What do each of the participants expect to gain from the enterprise, e.g., employment, dividends, interest on loans, fringe benefits, capital appreciation?

Name ______

Name ______

Name ______

9. Authorized Equity Capitalization

Number of Shares Use Standard Preferred ______Common ______Number of Shares Other Common ______Preferred ______Rights and Restrictions: Standard: ______Other

Stock Restrictions and/or Designations. Describe voting, dividend, liquidation, cumulative voting, preemptive and other rights, preferences, and limitations for common and preferred stock if different from those contained in the sample articles of incorporation.

10. Actual Capitalization

a. Equity.

Promoter, Address and # of Shares and Price Cash or Property and Phone Class Terms ______$______$______$______$______$______

Issue shares in name of promoters, jointly with spouses, or to a trust?

______

Contact the attorney handling their estate plan?______

b. Options.

______

______

c. Debt.

Name of Lender Amount To Be Paid On % Secured ______$______$______$______d. Thin incorporation. Discuss the tax and nontax dangers (e.g., dividend treatment on “loan” payments and loss of limited liability) of thin incorporation with the client. Compute the initial debt-equity ratio.

Shareholder Debt + Nonshareholder Debt = ______+ ______Equity

Then ask the following questions:

___ Is there a promissory note evidencing the obligation?

___ Is there an unconditional obligation for payment of principal and interest?

___ Are there payments at a fixed date not unreasonably far in the future (8–10 years)?

___ Is there interest at the prevailing fair market rate and not dependent on earnings or the discretion of the board of directors?

___ Is there no subordination in priority to general creditors?

___ Are there no voting rights?

___ Are there disproportionate holdings of stock and debt?

___ Are there corporate formalities clearly showing what assets are transferred for debt and stock, respectively?

___ Is there a debt-equity ratio of 10:1 or less?

___ Is there equity investment sufficient to cover the assets “essential” to the enterprise?

___ Are there earnings projections showing sufficient cash flow to repay the debt according to its terms?

___ Is there approval and treatment of the debt as such in the corporate minutes and financial records and statements?

___ Are there actual payments made according to the terms of the note?

e. Section 351. Is this a Section 351 transaction, and is there any recognition of gain by any shareholder because of his or her receipt of boot (property other than the corporation’s stock) or the assumption of liabilities by the corporation or liens on the property transferred to the corporation? Will there be a change from accelerated depreciation to straight-line on nonrecovery property? f. Price differences. Is there any difference in the price of stock or a discriminatory valuation of the property transferred to the corporation that will give the Internal Revenue Service a basis to allege that a gift was made or compensation received under Treas Reg 1.351-1(b)(1)?

g. Section 1244. Provide for Section 1244 stock in the minutes and on the certificates. Does the client understand the trade-off of advantages between use of Section 1244 stock and debt?

h. Leasing. What assets that are owned by the shareholders can be leased? ______

What are their fair market values? ______

What is the term of the lease? ______

What is the fair market lease rate? ______

Should the lessor carry product liability insurance? ______

i. Sales to corporation. What assets can be sold to the corporation by shareholders?

Asset Fair Market Value Seller’s Basis Sale Price and Terms ______

Will there be gain, recapture of depreciation, or investment tax credit on any of the above assets? ______

j. Initial balance sheet. What will the initial balance sheet of the corporation look like immediately after the purchase of the stock?

Assets Liabilities Cash ______Accounts payable ______Equipment ______Notes payable ______Notes receivable ______Equity Inventory ______Common stock ______Real estate ______Paid-in surplus (optional) Preferred stock ______Total assets ______Total equity ______TOTAL LIABILITIES AND EQUITY ______k. Securities law. Which exemptions to federal and state law will apply?

State Federal ______Limited offering exemption ______Intrastate offering §3(a)(11) (MCL 451.2202(1)(n)) (15 USC 77c) and Rule 147 (17 CFR 230.147) promulgated thereunder ______Employee plan exemption ______Private offering §4(2) (15 (MCL 451.2202(1)) USC 77d) and Regulation D promulgated thereunder Regulation A §3(b) public offerings not exceeding $5 million in any 12-month period (17 CFR 230.251-.263) (effective June 19, 2015, the exemption increases to $20 million for tier 1 offerings and $50 million for tier 2 offerings; see 80 Fed Reg 21,806 (2015)) Regulation D and Rules 504, 505, and 506 promulgated thereunder (17 CFR 230.501 to 230.508) Accredited Investors §4(6) (15 USC 77d(a)(5), §2(15) and Rule 215 (17 CFR 230.215) Sales of Securities/Employee Benefit Plans under Rule 701 (17 CFR 230.701)

Despite the exemptions from registration, is there any hint of misrepresentation or a reluctance to disclose by any of the promoters?

11. S Corporation Election

S corporation election may be advisable; many factors must be taken into account: the shareholders may not have a sufficient loan and equity investment to be able to pass through the losses; the shareholders may wish for any losses to be carried forward in the corporation; or the corporation may not qualify initially for S status. The new corporation must be able to meet all of the following tests to qualify as an S corporation:

___ The S corporation may not be a member of an affiliated group (a series of 80 percent owned corporations connected through a common parent). ___ Only one class of stock may be issued and outstanding, i.e., no preferred stock can be issued.

___ No shareholder can be a nonresident alien.

___ All shareholders must be individuals, estates, certain exempt organizations, qualified plans, tax-qualified retirement plans, tax-exempt organizations under IRC 501(c)(3), or qualified trusts including an electing small business trust, i.e., no corporate shareholders.

___ There must be 100 or fewer shareholders.

___ The S corporation may be wholly owned by another S corporation.

12. Other Tax Elections

a. Books (IRC 446) are to be kept on the following:

Cash Accrual Hybrid Tax purposes ______Corporate purposes ______Describe the hybrid method ______

The above decisions should be made after discussions with the corporation’s accountant.

b. Organizational expenses (IRC 248) will be deducted over [number] months (not more than 80 months).

c. Inventory (IRC 472) will be valued using first-in, first-out ______or last-in, last-out ______.

d. Bad debts (IRC 166) will be accounted for on the reserve method ______or specific write-off ______.

e. Regarding surtax allocations, what other corporations are owned by the shareholders and in what percentages? ______

______.

Is the corporation a member of an 80 percent parent-subsidiary or brother-sister control group under IRC 1563? ______. If yes, discuss the need for an election to allocate the one surtax exemption with the annual return and the limit this puts on the tax advantages of the corporation (and possibly other corporations owned by the shareholders). f. Fiscal year election (IRC 441).

______

g. Depreciation. Standard ACRS? ______Straight line? ______Accelerated? ______First year write-off? ______

13. Stock Restrictions and/or Designations

Describe voting, dividend, liquidation, cumulative voting, preemptive and other rights, preferences, and limitations for common and preferred stock if different from those contained in the sample articles of incorporation.

______

______

______

14. Annual meeting—board of directors ______

15. Annual meeting—shareholders ______

16. Banking

(List name of account, bank, and branch and include signatures.)

1.______

______

2. ______

______

17. Shareholder Agreement

(Compulsory or elective buyout?) Initial value? $[amount]. If no value, reset in two years, then book value plus ______times corporation’s earnings for past ______years. Funded by insurance? ______Other provisions

______

______

18. Accountant Name ______

Address ______

Phone ______

19. Insurance Agent

Name ______

Address ______

Phone ______

20. Employment Agreement

Employee ______

Address ______

Phone ______

Term ______Salary ______Bonus______

Fringe benefits—medical and hospital insurance, standard or luxury car, expense allowance, gas, $[amount] term life insurance, [number] weeks vacation, other

______

______

21. Qualify in other states? ______

22. Medical reimbursement plan? ______Employees covered ______Limits ______

23. Other Counsel

Which participants are represented by corporate counsel? ______

Which other participants have separate counsel reviewing their participation in this corporation or estate planning? ______

How much consultation should there be with other counsel? ______What understanding is there of possible conflicts of interest with counsel?

______