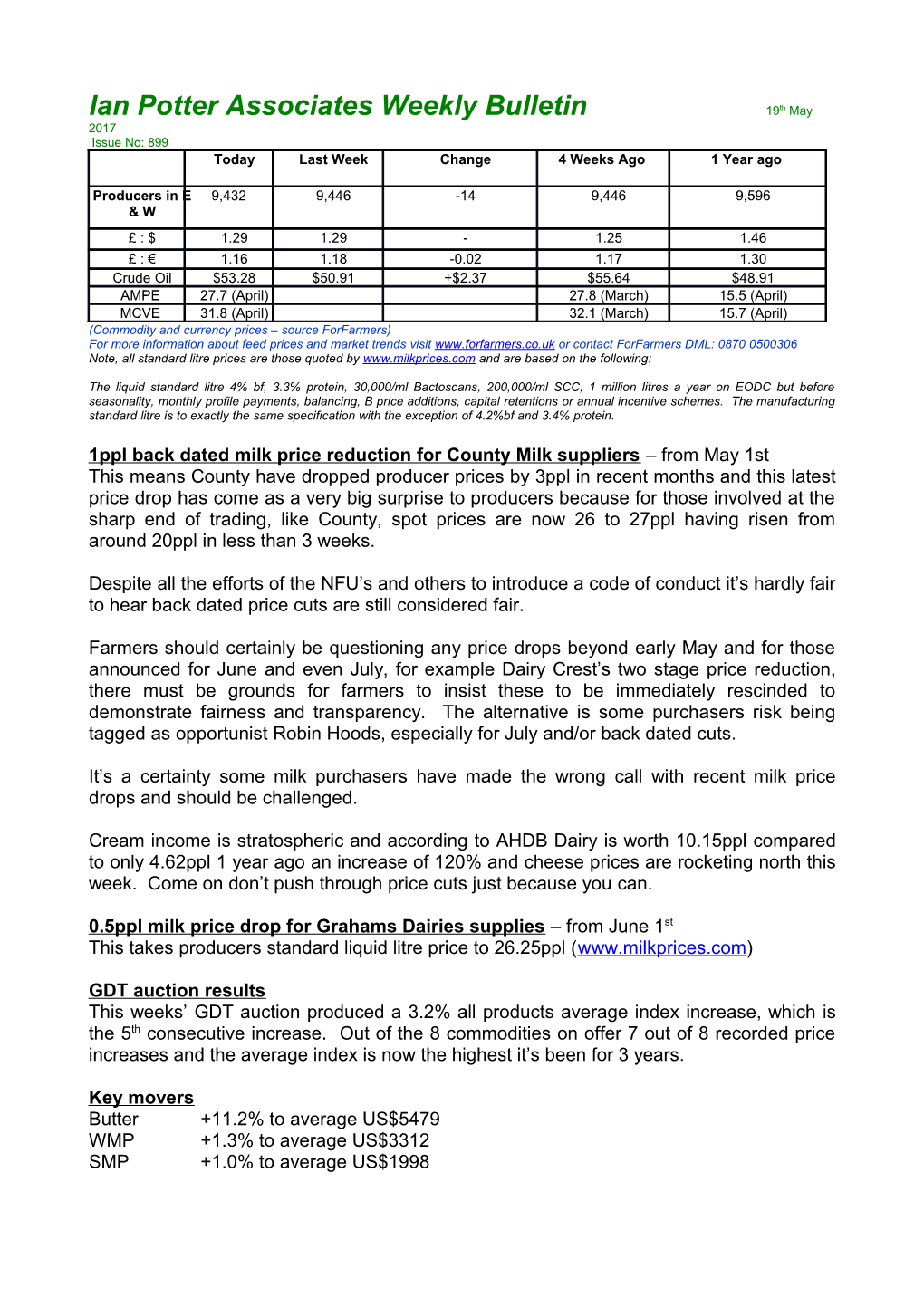

Ian Potter Associates Weekly Bulletin 19th May 2017 Issue No: 899 Today Last Week Change 4 Weeks Ago 1 Year ago

Producers in E 9,432 9,446 -14 9,446 9,596 & W £ : $ 1.29 1.29 - 1.25 1.46 £ : € 1.16 1.18 -0.02 1.17 1.30 Crude Oil $53.28 $50.91 +$2.37 $55.64 $48.91 AMPE 27.7 (April) 27.8 (March) 15.5 (April) MCVE 31.8 (April) 32.1 (March) 15.7 (April) (Commodity and currency prices – source ForFarmers) For more information about feed prices and market trends visit www.forfarmers.co.uk or contact ForFarmers DML: 0870 0500306 Note, all standard litre prices are those quoted by www.milkprices.com and are based on the following:

The liquid standard litre 4% bf, 3.3% protein, 30,000/ml Bactoscans, 200,000/ml SCC, 1 million litres a year on EODC but before seasonality, monthly profile payments, balancing, B price additions, capital retentions or annual incentive schemes. The manufacturing standard litre is to exactly the same specification with the exception of 4.2%bf and 3.4% protein.

1ppl back dated milk price reduction for County Milk suppliers – from May 1st This means County have dropped producer prices by 3ppl in recent months and this latest price drop has come as a very big surprise to producers because for those involved at the sharp end of trading, like County, spot prices are now 26 to 27ppl having risen from around 20ppl in less than 3 weeks.

Despite all the efforts of the NFU’s and others to introduce a code of conduct it’s hardly fair to hear back dated price cuts are still considered fair.

Farmers should certainly be questioning any price drops beyond early May and for those announced for June and even July, for example Dairy Crest’s two stage price reduction, there must be grounds for farmers to insist these to be immediately rescinded to demonstrate fairness and transparency. The alternative is some purchasers risk being tagged as opportunist Robin Hoods, especially for July and/or back dated cuts.

It’s a certainty some milk purchasers have made the wrong call with recent milk price drops and should be challenged.

Cream income is stratospheric and according to AHDB Dairy is worth 10.15ppl compared to only 4.62ppl 1 year ago an increase of 120% and cheese prices are rocketing north this week. Come on don’t push through price cuts just because you can.

0.5ppl milk price drop for Grahams Dairies supplies – from June 1st This takes producers standard liquid litre price to 26.25ppl (www.milkprices.com)

GDT auction results This weeks’ GDT auction produced a 3.2% all products average index increase, which is the 5th consecutive increase. Out of the 8 commodities on offer 7 out of 8 recorded price increases and the average index is now the highest it’s been for 3 years.

Key movers Butter +11.2% to average US$5479 WMP +1.3% to average US$3312 SMP +1.0% to average US$1998 Average +3.2% to average US$3313

UK product goes into Intervention According to AHDB dairy UK produced SMP has gone into the EU’s Intervention store for the first time in 12 months during the first week of May with 1,132 tonnes taking total EU stocks to an eye-watering 356,000 tonnes! Do not let anyone try to tell you that SMP prices are why price cuts are needed because cream values are eclipsing that red herring.

The liquid milk merry-go-round kicks in as Morrisons do some shuffling Morrisons have moved to sole supplier for all their own brand liquid milk, estimated to be around 400 million litres to Arla from March 2018 for three years until 2021.

Arla already had an estimated 260 million litres and the 140 million litres which they gain from next March is at the expense of Muller and is in effect the 140 million litres Muller acquired as part of the take over of Dairy Crest’s liquid division.

Whilst Morrisons are unlikely to go to a segregated pool they are moving towards what some would call a nominated pool with specific farmers nominated with whom Morrisons will presumably want to engage in return for which additional funds will be paid to the retailer.

The loss of such a large quantity will be a blow to Muller as it would be to any processor.

More rides on the merry-go-round are still on the cards with next up the outcome of the Lidl re-shuffle followed by the big Aldi tender and in summer by the co-op group (CTRG). Nett milk movements during the 12 months ending April 2018 will undoubtedly leave some milk buyers smiling and some crying over the spilt milk.

Dairy Crest’s year end results Dairy Crest’s results show adjusted profit was up 5% to over £60 million (57.7m in 2015/2016) with net debt up by 9% to £249.8m.

The dividend paid to shareholders up 2% to 16.3p.

Dairy Crest shares were trading at £5.80 a fall from the £6.16 briefly recorded on Wednesday.

Ulster Farmer’s Union retaliates against Go Vegan World’s anti-dairy campaign UFU President Barclay Bell has no issues with the less than 1% of the population who for whatever reason have decided to go vegan, however, their organisations anti-dairy campaign targeting dairy farming systems is “one-sided and unfair”, which the President has criticised on behalf of the 99% plus of the population who enjoy eggs, meat and dairy products.

Meanwhile, in the US, an industry campaign called Undeniably Dairy has been launched to better engage with consumers with clear transparent messaging about dairy products which has and is currently twisted, distorted and misrepresented! The campaign realises that consumers are being spoon fed what is predominantly conflicting inaccurate information often by anti-dairy groups. The same could be said in the UK, especially when it comes to facts on TB in cattle and badgers.

Fake invoices and forgery once again in the Midlands It’s by no means the first time middle ground family wholesaler J N Dairies has been the subject of unlawful activities (2008) lies and propaganda (2014) and its returned to their doorstep again.

No fair and honest dairy competition in the Wolverhampton and Birmingham area that’s too simple and now it’s the return of doctored documents painting “an untruthful image of your honest and ethical supplier.” When will these clowns learn this is not how the dairy industry operates in the UK?

Back in 2011 Johal Dairies and J N Dairies were locked in a multi-million pound expensive high court battle involving the theft of confidential information belonging to J N Dairies in 2008 and an alleged bribe of £40,000 plus.

The end result was that the court ordered Johal Dairies to pay J N Dairies almost £1.3 million in relation to legal costs, damages and interest on top of which they had their own costs.

Arla opens new Danish innovation centre As part of its aim to ensure a minimum of 10% of Arla UK’s net revenue is derived from new products Arla has officially opened its new innovation centre in Aarhus, Denmark.

The site employs 150 people some of whom will, with respect, resemble Umpa Lumpa’s working on up to 50 new ideas at any one time.

Arla in winning ways Arla have received international recognition having been listed under two ingredients categories in the 2017 Ingredient of the Year Nutra Ingredients Awards in Geneva, winning one category and runner up in another.

Few things in life are for free & if you enjoy reading this bulletin then please give us a chance to quote next time you order livestock tags!

We have a fantastic bulk deal on BVD tags and are now offering them at incredibly competitive prices! We also offer a full range of visual livestock tags. Please don’t hesitate to call the office on 01335 320016 or email [email protected] for more information, alternatively go to our website http://www.ipaquotas.com

BVD Tag Permutations Ian Potter Associates Price Large & Large £4.30 Large & Button £4.30 Large & Metal £4.30 Medium & Medium £4.30 Medium & Button £4.30 Medium & Metal £4.30 Match up tag £4.20 Large BVD tag Only £4.20 Management BVD £4.20 Applicator £15.00 (free with large orders)

Remember this bulletin at the moment continues to be available free of charge and takes Ian & the team considerable time to produce. The only encouragement to keep producing it is a combination of enthusiasm as well as tag sales & enquiries from our readers.

All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept any liability for any errors or omissions. Professional advice must always be taken before any decision is reached.