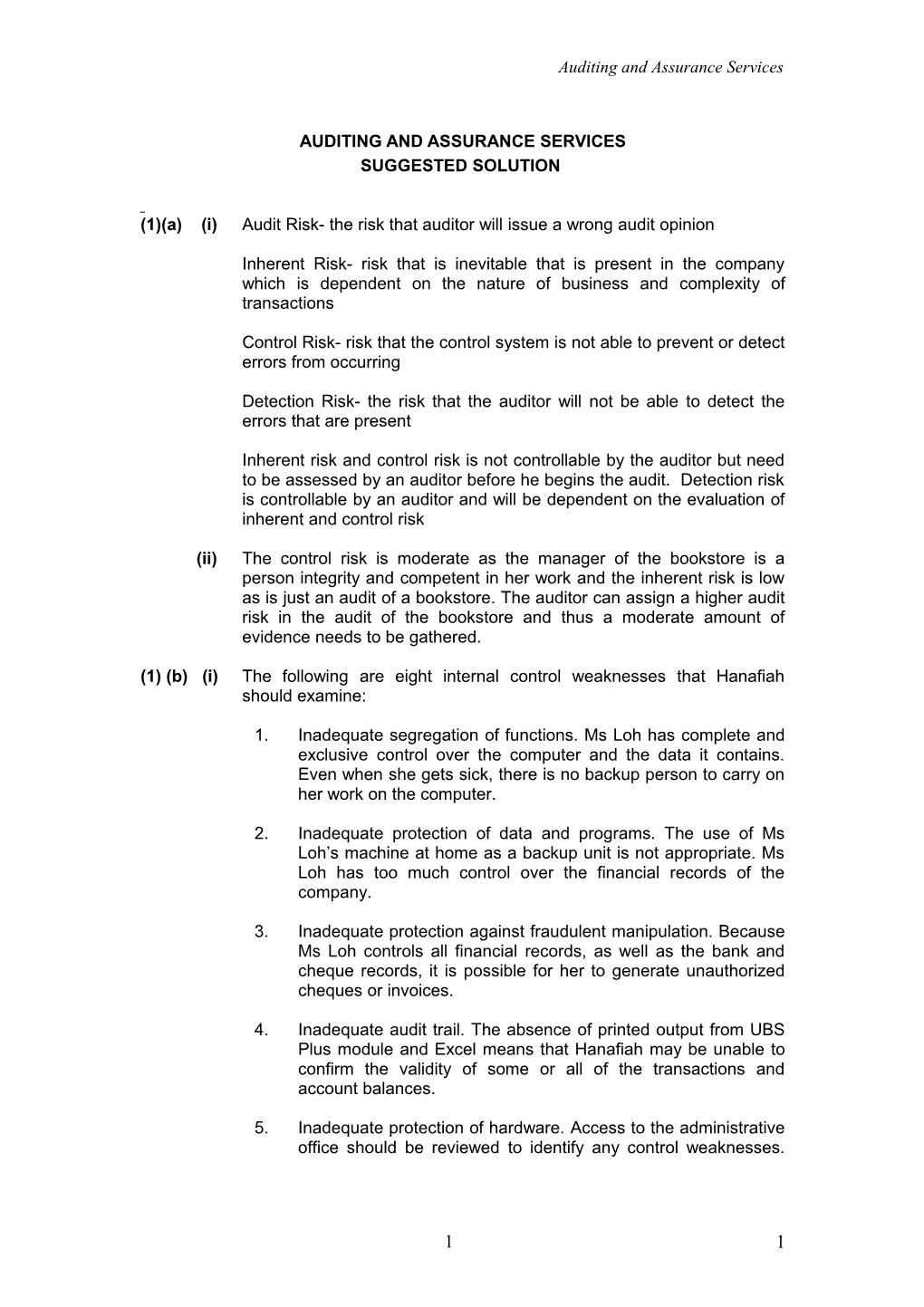

Auditing and Assurance Services

AUDITING AND ASSURANCE SERVICES SUGGESTED SOLUTION

(1)(a) (i) Audit Risk- the risk that auditor will issue a wrong audit opinion

Inherent Risk- risk that is inevitable that is present in the company which is dependent on the nature of business and complexity of transactions

Control Risk- risk that the control system is not able to prevent or detect errors from occurring

Detection Risk- the risk that the auditor will not be able to detect the errors that are present

Inherent risk and control risk is not controllable by the auditor but need to be assessed by an auditor before he begins the audit. Detection risk is controllable by an auditor and will be dependent on the evaluation of inherent and control risk

(ii) The control risk is moderate as the manager of the bookstore is a person integrity and competent in her work and the inherent risk is low as is just an audit of a bookstore. The auditor can assign a higher audit risk in the audit of the bookstore and thus a moderate amount of evidence needs to be gathered.

(1) (b) (i) The following are eight internal control weaknesses that Hanafiah should examine:

1. Inadequate segregation of functions. Ms Loh has complete and exclusive control over the computer and the data it contains. Even when she gets sick, there is no backup person to carry on her work on the computer.

2. Inadequate protection of data and programs. The use of Ms Loh’s machine at home as a backup unit is not appropriate. Ms Loh has too much control over the financial records of the company.

3. Inadequate protection against fraudulent manipulation. Because Ms Loh controls all financial records, as well as the bank and cheque records, it is possible for her to generate unauthorized cheques or invoices.

4. Inadequate audit trail. The absence of printed output from UBS Plus module and Excel means that Hanafiah may be unable to confirm the validity of some or all of the transactions and account balances.

5. Inadequate protection of hardware. Access to the administrative office should be reviewed to identify any control weaknesses.

1 1 Auditing and Assurance Services

Hanafiah should be particularly concerned with the possible theft of the computer.

6. Unlawful use of software. Hanafiah should verify that copies of the software used in ME’s computer and Ms Loh’s machine at home are legitimate copies.

7. Theft or illegal distribution of company software. Hanafiah should ensure that the copies of the software installed on Ms Loh’s machine have a separate license from those installed on the office machine, and that these copies are authorized by Datuk Kamal.

8. Compulsory vacations do not appear to be enforced. All office staff, including Ms Loh, should be required to take vacations annually. During this time, her duties should be performed by another individual trained in maintaining the financial and business records of the business. This will act as a deterrent to fraud, since any unauthorized transactions would probably be detected by this other individual.

(1) (b) (ii) Hanafiah cannot rely on the security system provided by UBS because Ms Loh has absolute control over the security system. While the security system prevents unauthorized access by third parties, it does not prevent Ms Loh from tampering with the financial records. Hanafiah needs to verify the accuracy of the financial records kept in the UBS modules, and not rely on the internal controls implemented on UBS.

(2) The following significant accounting ratios are based on the accounts provided in the question:

2001 2002 2003 Gross profit (%) 14.20 20.20 19.70 Other expenses: sales (%) 14.40 14.40 15.30 Interest: sales (%) 5.20 5.50 6.20 Net profit (%) (5.40) 0.30 (1.80) Current ratio 0.73 0.73 0.76 Liquidity ratio 0.46 0.37 0.34 Gearing 9.52 9.58 20.69 Stock (months) 2.26 2.77 3.57 Debtors (months) 3.24 2.26 2.32 Creditors (months) 3.80 3.54 4.09

Notes:

Stock age = year end stock x 12 Cost of sales

Debtors age = year end debtor x 12

2 2 Auditing and Assurance Services

Sales

Creditor age = year end creditor x 12 Sales

Gearing = long term loans + bank overdraft + hire purchase Shareholders funds

(2) (i) The various factors in the accounts which may be indicative of going concern problems are: Losses or low profits only being made- the company is not generating enough funds to finance the expansion required Increase in bank overdraft Signs of overtrading High and increasing gearing Low current ratio Low and decreasing liquidity ratio Increasing stock levels Increasing value and age of creditors High and increasing interest charges Fluctuating gross profit

(2) (ii) The other important steps to be taken by the auditor in determining whether or not the company may be properly regarded as a going concern at year end include:

. Reviewing carefully the cash and profit forecasts for the next year to see if they suggested any improvement in the company’s position . Seeking some evidence that the company’s bank is prepared to continue supporting the company . Review the level of post balance sheet trading to see if this supports the forecasts and show any signs of improvement in the company’s position . Examine correspondence files for any evidence that creditors might be putting pressure on the company for repayment of amount owing . Consider how the company’s position compares with similar companies in the same business . Generally discuss the situation with management and review any recovery plans which they have in mind

(2) (iii) Modified report- that do not affect the auditor’s opinion: emphasis of a matter. (Should be presented after the opinion paragraphs)

Without modifying our opinion, we draw attention to the accounts. The Company incurred a net loss of RM68, 000 during the year ended September 2003 and as of that date the company’s current liabilities exceeded its current assets by RM504, 000. These factors raise substantial doubt that the Company will be able to continue as a going concern.

(3) (i) Quality Components Bhd. SCHEDULE OF POSSIBLE PLANNING MATERIALITY AMOUNTS

BASE AMOUNT PERCENT PLANNING

3 3 Auditing and Assurance Services

(RM) MATERIALITY(RM) Income Before 600,000 5 – 10% 30,000 - 60,000 Taxes Current Assets 3,900,000 10% 390,000 Total Assets 6,500,000 1 - 5% 65,000 - 325,000 Equity 3,337,500 10% 333,750 Turnover/Sales 8,500,000 ½ -1% 42,500-85000

(3) (ii) Examples include:

i. Unusual dependence on a related party ii. Heavy dependence on a key customer/supplier iii. Non-recurring items iv. Legislative requirements, including accounting standard v. Integrity of records and personnel

(4) (a) The audit objectives for the audit of purchases and account payables are: Occurrence or Existence Recorded purchase transactions represent goods received during the period under audit. Recorded payment transactions represent payments made during the period to suppliers. Recorded accounts payable represent amounts owed by the company on the balance sheet date.

Completeness All purchase and payment transactions that occurred during the period have been recorded. Accounts payable includes all amounts owed by the company to suppliers of goods to date.

Rights and obligations Recorded credit purchase transactions represent the liabilities of the company. Accounts payable is the liability of the company on the balance sheet date. Valuation or measurement Purchase transactions and payment transactions are correctly recorded. Accounts payable liability is stated at the correct amount owed.

Disclosure The details of purchase and payment transactions support their presentation in the financial report, including their classification and disclosure. Accounts payable liability is properly identified and classified in the financial report. Disclosures pertaining to related party creditors are adequate. .

(4) (b) The additional audit procedures I should perform to ensure that the accounts payable balance is fairly stated:

4 4 Auditing and Assurance Services

I will seek explanations for decrease in payables by RM200, 000 from 2002 to 2003. The accounts payable balance may be immaterial compared to the overall materiality, but it is probably not immaterial compared to the materiality allocated to accounts payable. Potential errors in relation to accounts payable may be material. This is because the main risk associated with accounts payable is understatement. Therefore, I will perform work searching for unrecorded liabilities through review of subsequent period’s purchase and payment transactions. The sample selected by Jamal is inappropriate. Selecting the four largest balances is not proper because the main risk associated with payables is understatement not overstatement. Therefore, I will take a random sample from the whole population of payables by using sampling techniques. I will make sure that accounts payable that have decreased significantly from 2002 are included in the sample. The balances of the creditors so selected for testing will be reconciled to the original supplier’s statement and not with the photocopies of such statements. I will carry out more audit work on cut-off of purchases and payables.

(4) (c) (i) The following could be some of the reasons for a difference in the balance as per the purchase ledger and as per the supplier’s statement Khir Sdn Bhd: Unrecorded invoices by Popular Bhd. Unrecorded discounts by Khir Sdn Bhd. Payments in transit Goods in transit Incorrect recording of the invoices by Popular Bhd.

(4) (c) (ii) In the absence of supplier’s statement from Jamshed & Co the balance in their account can be verified by: Vouching the entries in the accounts of Jamshed & Co to the invoices received from them and/or Carrying out confirmation process. A positive form of confirmation should be used. Unrecorded obligations may be identified by carrying out extensive cut-off testing.

(4) (d) The following audit procedures should be performed to verify the accuracy of the inventory count:

(i) Before the count Ascertaining the location and approximate value of stock at each location. Identifying stock that are likely to be individually material and will require selective testing. Planning attendance at physical inventory count. Reviewing last year's audit file to identify problems encountered previously and how they have been dealt with in the year under audit. Obtaining a copy of the company's physical inventory instructions. Ensuring that the team responsible for the count is different from those responsible for custody and record keeping of inventory. Ensuring adequate documentation for recording the count. Ensuring adequate instructions exist to carry out cut-off procedures.

5 5 Auditing and Assurance Services

Staff involved in the physical count has been adequately briefed. Any weaknesses in the company's plans are identified and rectified before the count. Reviewing revised procedures, if any. Inventory held by third parties should be identified in order to get confirmation of such items.

(ii) On the day of the count

Observing the count in progress and ensuring that the instructions are being complied with. Ascertaining that those responsible for physical count are really independent of those responsible for the custody and record keeping of inventory. Ascertaining that the count teams appear to be adequately briefed. Make sure that the count teams are following the instructions and are and are properly supervised. Ensure that documentation for recording the count is adequate. Ensure that there is no movement of goods during the count. In case of any movement ensure that the items are not double counted. Observe completeness of count. Perform test counts from count sheets to physical inventory and from physical inventory to count sheets. Observe that all areas are covered and tagged. Observe the condition of inventory for items that may be damaged, obsolete or slow moving. Observe that inventory belonging to third parties has been properly identified and confirmed. Recording in the working papers details of test counts, details of goods that may be worth less than cost, details of cut-off numbers of dispatch and goods received notes and details of the numbers of count sheets issued and used.

(5)

1. Holding shares in an audit client – A violation - Shares should not be held by a reporting partner for a particular client or any staff involved in the audit of such client. If shares are held, the staff involved should dispose them off before starting the audit or the staff should not work on a particular assignment.

2. Acting for two clients who are in competition – Indeterminate - A conflict of interest could arise when an audit firm acts for two clients who are in competition. It should be remembered by the audit firm that the rules of confidentiality apply to both clients’ affairs and the auditor must be careful to ensure that neither client is disadvantaged as a result of acting for both. Where possible, different staff should be employed on the two audits with strict instructions not to discuss either client’s affairs.

3. Audit Fees – A violation - It is unacceptable to charge audit fees on the basis of a percentage of profits. Such arrangement would compromise the auditor’s independence as the auditor will have a direct financial link to the financial statements being audited.

6 6 Auditing and Assurance Services

4. Overdue Fees – Not a violation - Significant overdue fees from a client may be considered as a loan, thus may be a threat to objectivity. By-law 5-4A states that a member may decline reappointment as an auditor if the client has not paid fees for statutory audit for two consecutive financial years.

5. Loan from client company – Indeterminate - Saari’s conduct would only be unethical if the loan was granted on terms more favourable then normal. However, Saari should be cautioned that in the interest of appearance he should refrain from engaging in business dealings with acquaintances, who are also officers or employees of audit client.

(6) The due diligence work will involve the following:

1. Reviewing the working papers of previous auditors (assuming permission is obtained) to ascertain the accuracy of the values placed on assets and liabilities. 2. Evaluating assets valuation of the company as it forms an important element for calculation of purchase consideration along with profits. If the assets have been recently valued I will assess the qualifications, experience and independence of the valuer. 3. Reviewing the income statement to determine the accuracy of profits. 4. Reviewing quarterly or half yearly interim figures which will help in evaluating the accuracy and achievement of the forecasts. 5. If interim figures are not available management accounting records will be used for assessing business trends. 6. Analytical review will be carried out. Any unusual items or problems will be discussed with the management and financial statements will be reconciled to underlying records. 7. The effect of any unusual terms of trade will be considered on the performance of the company. For example in dealing with a subsidiary. 8. The future prospects of the company will be evaluated. For example comparing the level of outstanding orders of current year with that of the previous year. 9. Competence and honesty and integrity of the senior management of the company should be evaluated. The information on their resumes will be scrutinized. 10. Enquire should be made of any claim against the company for non- compliance of any law. Company’s legal adviser should be consulted on these matters. 11. Enquire if the company is facing any problems relating to its products which would result in claims by the customers. 12. Verify all material items in the balance sheet. 13. Review capital commitments 14. Review Statutory Records.

7 7