Name:______Block:______Date:______

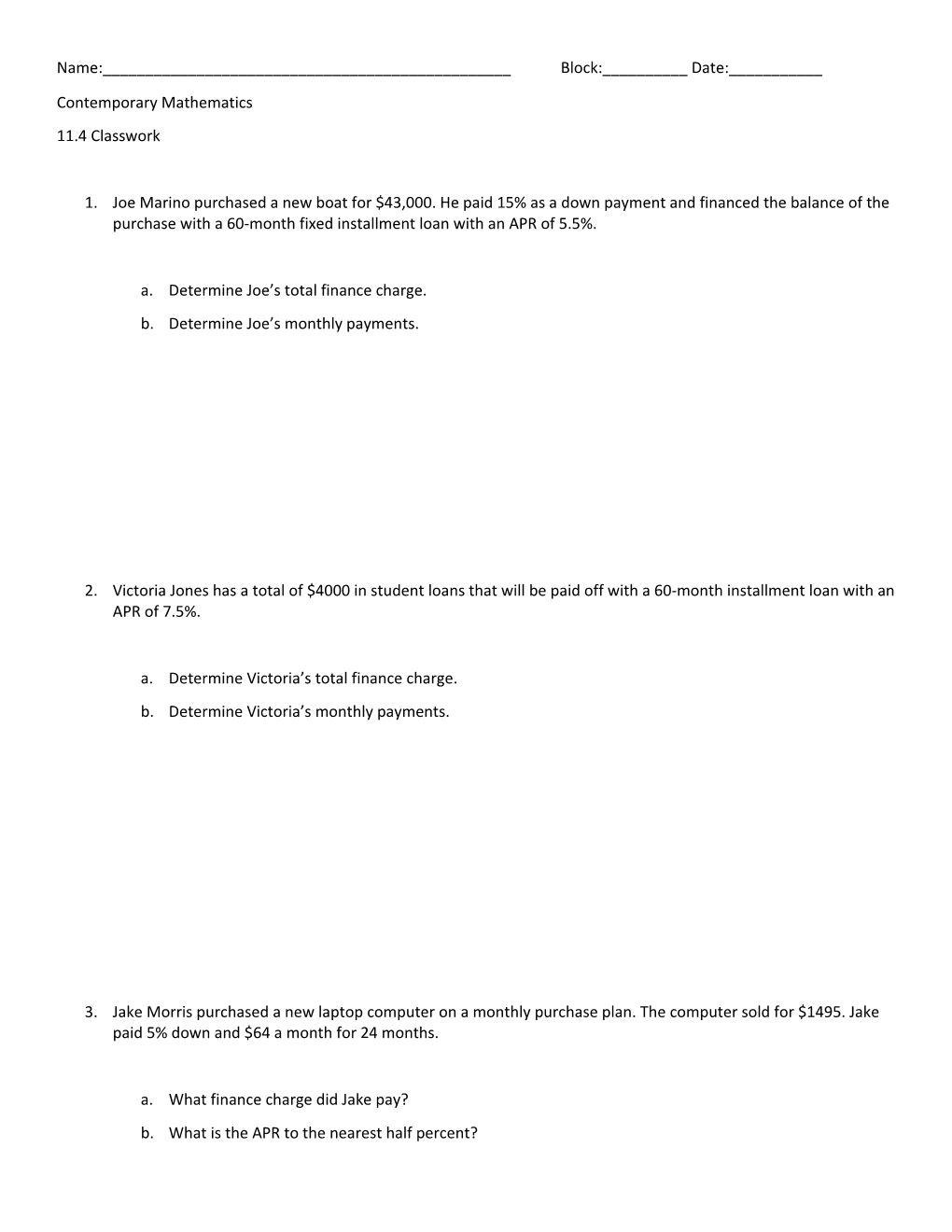

Contemporary Mathematics 11.4 Classwork

1. Joe Marino purchased a new boat for $43,000. He paid 15% as a down payment and financed the balance of the purchase with a 60-month fixed installment loan with an APR of 5.5%.

a. Determine Joe’s total finance charge. b. Determine Joe’s monthly payments.

2. Victoria Jones has a total of $4000 in student loans that will be paid off with a 60-month installment loan with an APR of 7.5%.

a. Determine Victoria’s total finance charge. b. Determine Victoria’s monthly payments.

3. Jake Morris purchased a new laptop computer on a monthly purchase plan. The computer sold for $1495. Jake paid 5% down and $64 a month for 24 months.

a. What finance charge did Jake pay? b. What is the APR to the nearest half percent? 4. Mr. and Mrs. Chan want to buy furniture that has a cash price of $3450. On the installment plan they must pay 25% of the cash price as a down payment and make six monthly payments of $437.

a. What finance charge did the Chans pay? b. What is the APR to the nearest half percent?

5. Rick Grimes took out a 60-month fixed installment loan of $12,000 to open a new pet store. He paid no money down and began making monthly payments of $232. Rick’s business does better than expected and instead of making his 24th payment, Rick wishes to repay his loan in full.

a. Determine the APR of the installment loan.

b. How much interest will Rick save (use the actuarial method)?

c. What is the total amount due to pay off the loan? 6. Sansa Stark uses her credit card in August to purchase the following college supplies: books ($425), yearlong bus pass ($175), food service meal ticket ($450), and season tickets to the basketball games ($125). On September 1, she used $650 of her financial aid check to reduce the balance. The issuing bank charges 1.2%interest per month and requires full payment within 36 months. Sansa had a previous balance of zero and she makes no other purchases with her card.

a. What is the minimum payment due September 1?

b. What is the balance due on October 1?