ChangeWave Research: 3Q 2006 Corporate IT Spending June 2, 2006

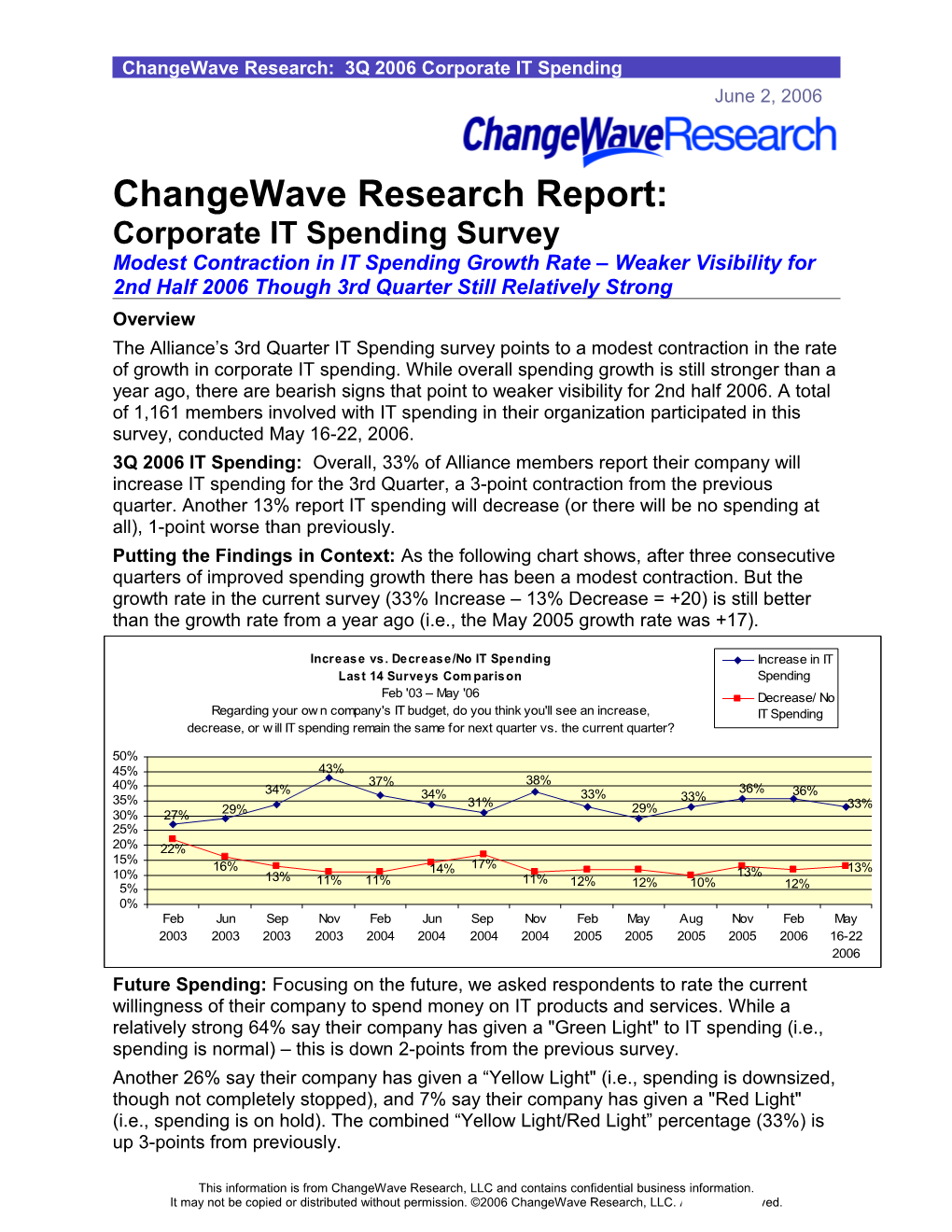

ChangeWave Research Report: Corporate IT Spending Survey Modest Contraction in IT Spending Growth Rate – Weaker Visibility for 2nd Half 2006 Though 3rd Quarter Still Relatively Strong Overview The Alliance’s 3rd Quarter IT Spending survey points to a modest contraction in the rate of growth in corporate IT spending. While overall spending growth is still stronger than a year ago, there are bearish signs that point to weaker visibility for 2nd half 2006. A total of 1,161 members involved with IT spending in their organization participated in this survey, conducted May 16-22, 2006. 3Q 2006 IT Spending: Overall, 33% of Alliance members report their company will increase IT spending for the 3rd Quarter, a 3-point contraction from the previous quarter. Another 13% report IT spending will decrease (or there will be no spending at all), 1-point worse than previously. Putting the Findings in Context: As the following chart shows, after three consecutive quarters of improved spending growth there has been a modest contraction. But the growth rate in the current survey (33% Increase – 13% Decrease = +20) is still better than the growth rate from a year ago (i.e., the May 2005 growth rate was +17).

Increase vs. Decrease/No IT Spending Increase in IT Last 14 Surveys Com parison Spending Feb '03 – May '06 Decrease/ No Regarding your ow n company's IT budget, do you think you'll see an increase, IT Spending decrease, or w ill IT spending remain the same for next quarter vs. the current quarter?

50% 45% 43% 37% 38% 40% 34% 36% 36% 35% 34% 33% 33% 31% 29% 33% 30% 27% 29% 25% 20% 22% 15% 16% 17% 13% 10% 14% 13% 13% 11% 11% 11% 12% 5% 12% 10% 12% 0% Feb Jun Sep Nov Feb Jun Sep Nov Feb May Aug Nov Feb May 2003 2003 2003 2003 2004 2004 2004 2004 2005 2005 2005 2005 2006 16-22 2006 Future Spending: Focusing on the future, we asked respondents to rate the current willingness of their company to spend money on IT products and services. While a relatively strong 64% say their company has given a "Green Light" to IT spending (i.e., spending is normal) – this is down 2-points from the previous survey. Another 26% say their company has given a “Yellow Light" (i.e., spending is downsized, though not completely stopped), and 7% say their company has given a "Red Light" (i.e., spending is on hold). The combined “Yellow Light/Red Light” percentage (33%) is up 3-points from previously.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: 3Q 2006 Corporate IT Spending

Green Light vs. Red/Yellow Light Last 14 Surveys Com parison G r e e n L i g h t How w ould you characterize the current w illingness of your R e d / Y e l l o w L i g h t company to spend money on IT products and services? 80% 70% 63% 66% 64% 63% 61% 57% 60% 62% 60% 55% 54% 53% 54% 54% 49% 50% 40% 46% 36% 43% 41% 43% 42% 41% 38% 30% 34% 35% 33% 32% 30% 33% 20% 10% 0% Feb Jun Sep Nov Feb Jun Sep Nov Feb May Aug Nov Feb May 2003 2003 2003 2003 2004 2004 2004 2004 2005 2005 2005 2005 2006 16-22, 2006

A Bearish 2nd Half 2006? In a bearish sign, when we looked ahead to all of second half 2006 (Jul-Dec), only 29% think their company's IT budget will be greater than first half 2006 – an 11-point drop from our previous survey results. Moreover, 19% think their IT budget will be less than first half 2006, 4-points more than previously. 2Q 2006 IT Spending. Respondents were also asked if their corporate IT spending is on track thus far in the 2nd Quarter. A total of 17% say they have spent “More than Planned” to date, up 3-points from the previous survey. Another 20% say they have spent “Less than Planned,” – up 2-points since previously. Of particular note, spending on Storage looks bullish (Change in Net Difference Score = +3), with 9% of respondents saying their companies have spent more than planned thus far in the quarter–the highest level since we began asking this question in August 2003. Corporate Servers. Spending on Servers (-2) appears to be slowing, with 9% saying they’ve spent less than planned on Servers thus far in the 2nd quarter, 4-points worse than previously. Moreover, one-in-three (32%) say their company will not be buying servers during 3rd Quarter 2006 – a huge 12-point rise from the previous survey. Of note, Dell’s server market share has declined the most of any company – down 5-pts.

A Slowdown in Corporate PC Purchases. One-in-four respondents (24%) say their company is not planning to buy desktops in the 3rd Quarter – up 6-points from our February 2006 survey. Another 22% say they’re not planning to buy laptops – also up 6-points. In terms of Corporate PC sales, this is the highest percentages of non-buyers we’ve seen in more than a year. There has been little real movement among the major PC manufacturers. While Dell remains the leader in both Corporate desktops (40%) and laptops (38%), it has lost 1- point in market share within each category since February. Bottom Line: The current survey findings point to a modest contraction in the Corporate IT Spending growth rate for the 3rd Quarter. Corporate PC and Server sales look particularly vulnerable. While overall spending growth is still stronger than a year ago, there are bearish signs that point to weaker visibility for 2nd half 2006.

The ChangeWave Alliance is a group of 7,500 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

Helping You Profit From A Rapidly Changing World ™

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 2 ChangeWave Research: 3Q 2006 Corporate IT Spending

www.ChangeWave.com Table of Contents

Summary of Key Findings...... 4

Chart One: 3rd Quarter 2006 IT Spending...... 4

Putting the Findings in Context...... 5

Chart Two: Last 14 IT Spending Surveys...... 5

Future Spending...... 5

Chart Three: Willingness of Company to Spend on IT...... 5 Chart Four: Willingness to Spend – A Comparison...... 6

A Closer Look at 2006...... 6

Chart Five: IT Budget for 2nd Half 2006...... 6 Chart Five A: IT Budget for Next Half – A Comparison ...... 7

Spending So Far in 2nd Quarter...... 7

Chart Six: Actual IT Spending Thus Far in 2Q...... 7 Chart Seven: IT Spending Thus Far in Quarter – A Comparison...... 8

Corporate PCs ...... 11

PC Purchasing ...... 11

ChangeWave Research Methodology...... 14

About ChangeWave Research...... 15

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 3 ChangeWave Research: 3Q 2006 Corporate IT Spending

I. Summary of Key Findings Modest Contraction in Still a Green Light on PC & Server Sales IT Spending Growth Future Corporate Look Particularly Rate for 3rd Quarter Spending Vulnerable 33% report their company 64% say their company is PCs will increase IT spending giving a "Green Light" to 24% say their company is for 3Q 2006 – 3-pts less IT spending – down 2- not planning to buy than previous quarter pts from all time high desktops in 3Q – up 6-pts 13% report a decrease or recorded in previous 22% say they’re not no IT spending for 3Q – survey in February planning to buy laptops – 1-pt worse But There Are Bearish also up 6-pts Steady Spending to Signs for 2nd Half ‘06 Servers Date for 2nd Quarter 29% think their overall IT 32% say they’re not 17% say they’ve spent budget will be greater for planning to buy servers in “More than Planned” so 2nd half 2006 than for 3Q – up 12-pts far in 2Q – up 3-pts 1st half 2006 – down 11- But Storage Spending 20% say they’ve spent pts from previously Looks Bullish “Less than Planned” – 19% think overall IT 9% say they’ve spent up 2-pts budget will be less – more than planned on 52% “Same as Planned” up 4-pts from previously storage so far in 2Q

The Alliance’s 3rd Quarter IT Spending survey points to a modest contraction in the rate of growth in corporate IT spending. While overall spending growth is still stronger than a year ago, there are bearish signs that point to weaker visibility for 2nd half 2006. A total of 1,161 members involved with IT spending in their organization participated in this survey, conducted May 16-22, 2006. 3Q 2006 IT Spending: Overall, 33% of Alliance members report their company will increase IT spending for the 3rd Quarter, a 3-point contraction from the previous quarter. Another 13% report IT spending will decrease (or there will be no spending at all), 1-point worse than previously.

Chart 1 With regard to your ow n company's IT budget, do you think you'll see an increase in IT spending, a decrease, or w ill IT spending remain the same for the 3rd Quarter (Jul-Sep) 2006 vs. the current quarter?

8 0 % 7 0 % 51% 6 0 % 5 0 % 33% 4 0 % 3 0 % 13% 2 0 % 3% 1 0 % 0 % Increase Remain the Same Decrease/No IT Don't Know Spending

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 4 ChangeWave Research: 3Q 2006 Corporate IT Spending

Putting the Findings in Context: As the following chart shows, after three consecutive quarters of improved spending growth there has been a modest contraction. But the growth rate in the current survey (33% Increase – 13% Decrease = +20) is still better than the growth rate from a year ago (i.e., the May 2005 growth rate was +17).

Chart 2: Increase vs. Decrease/No IT Spending Increase in IT Last 14 Surveys Com parison Spending Feb '03 – May '06 Decrease/ No Regarding your ow n company's IT budget, do you think you'll see an increase, IT Spending decrease, or w ill IT spending remain the same for next quarter vs the current quarter?

50% 45% 43% 38% 40% 37% 36% 34% 34% 36% 35% 33% 33% 33% 31% 29% 29% 30% 27% 25% 20% 22% 15% 16% 17% 13% 14% 13% 13% 10% 12% 11% 11% 11% 12% 10% 12% 5% 0% Feb Jun Sep Nov Feb Jun Sep Nov Feb May Aug Nov Feb May 2003 2003 2003 2003 2004 2004 2004 2004 2005 2005 2005 2005 2006 16-22 2006

Future Spending: Focusing on the future, we asked respondents to rate the current willingness of their company to spend money on IT products and services. While a relatively strong 64% say their company has given a "Green Light" to IT spending (i.e., spending is normal) – this is down 2-points from the previous survey.

Chart 3 How w ould you characterize the current w illingness of your company to spend money on IT products and services?

80% 64% 70%

60%

50%

40% 26% 30% 20% 7% 3% 10%

0% Green Light Yellow Light Red Light Don't Know

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 5 ChangeWave Research: 3Q 2006 Corporate IT Spending

Chart 4: Green Light vs. Red/Yellow Light Last 14 Surveys Com parison Green Light How w ould you characterize the current w illingness of your Red/Yellow Light company to spend money on IT products and services? 80% 66% 70% 64% 63% 61% 60% 62% 63% 60% 57% 53% 54% 54% 55% 54% 49% 50% 43% 46% 40% 41% 43% 42% 41% 36% 38% 30% 34% 35% 33% 32% 30% 33% 20% 10% 0% Feb Jun Sep Nov Feb Jun Sep Nov Feb May Aug Nov Feb May 2003 2003 2003 2003 2004 2004 2004 2004 2005 2005 2005 2005 2006 16-22, 2006

Another 26% say their company has given a “Yellow Light" (i.e., spending is downsized, though not completely stopped), and 7% say their company has given a "Red Light" (i.e., spending is on hold). The combined “Yellow Light/Red Light” percentage (33%) is up 3-points from previously. A Closer Look at 2nd Half 2006. In a somewhat bearish sign, when we looked ahead at second half 2006 (Jul-Dec), only 29% think their company's IT budget will be greater than first half 2006 – an 11-point drop from our previous survey results. Moreover, 19% think their IT budget will be less than first half 2006, 4-points more than previously.

Chart 5 Looking at the second half of 2006 (Jul-Dec '06), do you think your overall IT spending budget w ill prove to be greater than, equal to, or less than your overall IT spending for the first half of 2006 (Jan-Jun '06)?

80%

70%

60% 47% 50%

40% 29% 30% 19% 20% 6% 10%

0% Greater Than Equal to Less Than Don't Know 1st Half 1st Half 1st Half

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 6 ChangeWave Research: 3Q 2006 Corporate IT Spending

Chart 5A Looking ahead to the next half, do you think your overall IT spending budget w ill prove to be greater than, equal to, or less than your overall IT spending for the current half?

Nov '05 Survey 80% Feb '06 Survey 70% Current Survey 60% 47% 50% 40% 40% 39% 35% 40% 29% 30% 19% 16% 15% 20% 10% 0% Greater Than Equal to Less Than

Spending So Far in the 2nd Quarter

We asked respondents several questions on planned vs. actual 2Q IT Spending to date:

(1) Question Asked: We’re halfway through the 2nd Quarter. Based upon your IT Spending plans of three months ago, have you spent more than planned, less than planned, or the same as planned on IT products/services thus far in 2Q?

Chart 6 Based upon your IT spending plans of three months ago, have you actually spent more than planned, less than planned, or the same as planned on IT products and services thus far during the 2nd Quarter?

80% 70% 60% 52% 50% 40% 30% 20% 17% 20% 10% 10% 0% More Than Same as Less Than Don't Know Planned Planned Planned

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 7 ChangeWave Research: 3Q 2006 Corporate IT Spending

Chart 7 IT Spending Thus Far-Last 12 Surveys Com parison Based upon your IT spending plans of three months ago, have you actually spent more than planned, less than planned, or the same as planned on IT products and services thus far in the quarter?

30% 26% 26% 25% 23% 22% 23% 22% 20% 20% 20% 19% 20% 18% 21% 20% 18% 19% 18% 17% 18% 18% 18% 15% 16% 16% 17% 14% 10% More Than Planned 5% Less Than Planned

0% Sep Nov Feb Jun Sep Nov Feb May Aug Nov Feb May 2003 2003 2004 2004 2004 2004 2005 2005 2005 2005 2006 16-22, 2006

2Q 2006 IT Spending. Respondents were also asked if their corporate IT spending is on track thus far in the 1st Quarter. A total of 17% say they have spent “More than Planned” to date, up 3-points from the previous survey. Another 20% say they have spent “Less than Planned,” – up 2-points since previously.

(2) Question Asked: For which of the following main IT Spending categories - if any - have you spent more than planned thus far in the 2nd Quarter? (Check All That Apply) Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ’06 Feb ’06 Nov ’05 Aug ‘05 May ‘05 PCs 12% 9% 8% 11% 12% Security 11% 11% 13% 15% 14% Servers 10% 8% 9% 11% 8% Software: Application Development 9% 10% 10% 9% 8% Networking 9% 7% 8% 9% 8% Storage 9% 6% 7% 8% 7% Software: Enterprise Applications 7% 8% 8% 9% 7% Outsourced Services 7% 6% 8% 9% 5% Communications 5% 4% 4% 4% 5% Software: Platforms 3% 4% 4% 5% 5% Don't Know 21% 20% 19% 17% 19% Other 4% 3% 4% 2% 2%

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 8 ChangeWave Research: 3Q 2006 Corporate IT Spending

(3) Question Asked: And for which of the following main IT Spending categories – if any – have you spent less than planned thus far in the 2nd Quarter? (Check All That Apply) Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ’06 Feb ’06 Nov ’05 Aug ‘05 May ‘05 PCs 16% 12% 15% 12% 15% Outsourced Services 10% 8% 9% 9% 10% Servers 9% 5% 7% 8% 8% Software: Application Development 7% 7% 8% 7% 6% Software: Enterprise Applications 7% 6% 8% 5% 7% Software: Platforms 6% 4% 5% 5% 6% Storage 6% 6% 7% 6% 5% Networking 6% 5% 6% 5% 7% Communications 5% 4% 5% 4% 3% Security 5% 5% 4% 4% 5% Don’t Know 27% 25% 23% 22% 23% Other 3% 2% 2% 1% 1%

Net Difference Score – Current Survey (May 2006) Spent Spent More Net Less Than Overall IT Spending Categories Than Difference Planned Planned Score in 2Q in 2Q Security 11% 5% +6 Networking 9% 6% +3 Storage 9% 6% +3 Software: Application Development 9% 7% +2 Servers 10% 9% +1 Software: Enterprise Applications 7% 7% 0 Communications 5% 5% 0 Software: Platforms 3% 6% -3 Outsourced Services 7% 10% -3 PCs 12% 16% -4

Change in Net Difference Score – Current Survey (May 2006) vs. Previous Survey (February 2006) This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 9 ChangeWave Research: 3Q 2006 Corporate IT Spending

Current Previous Survey Survey Change Net Net in Net Overall IT Spending Categories Differenc Differenc Difference e Score e Score Score (May ’06) (Feb ’06) Storage +3 0 +3 Networking +3 +2 +1 Security +6 +6 0 Communications 0 0 0 Software: Application Development +2 +3 -1 PCs -4 -3 -1 Outsourced Services -3 -2 -1 Software: Enterprise Applications 0 +2 -2 Servers +1 +3 -2 Software: Platforms -3 0 -3

Storage Spending Looking Up. Spending on Storage looks particularly bullish (Change in Net Difference Score = +3), with 9% of respondents reporting their companies have spent more than planned thus far in the quarter–the highest level since we began asking this question in August 2003. Software Platforms Spending Down. Conversely, spending on Software Platforms is down thus far in the 2nd Quarter (Change in Net Difference Score = -3). Server Spending Also Looks Down. Spending on Servers (-2) also shows a slowdown, with 9% saying they’ve spent less than planned on Servers thus far in the 2nd quarter, 4-points worse than previously. We do note that the percentage saying they’ve spent more than planned increased by 2-points. Moreover, looking ahead, one-in-three (32%) say their company will not be buying servers during 3rd Quarter 2006 – a huge 12-point rise from the previous survey. Importantly – as the following Chart shows – Dell’s market share for servers has declined 5-points, more than any other company. Question Asked: From which of the following vendors is your company purchasing servers from in 3rd Quarter 2006? (Check All That Apply) Current Previous Previous Survey Survey Survey May ’06 Feb ’06 Nov ’05 Dell 21% 25% 20% Hewlett-Packard 15% 16% 14% IBM 10% 11% 10% Sun Microsystems 10% 8% 8% Generic White Box 3% 3% 2% Gateway 1% 0% 0% Not Buying Servers in 3rd Quarter 2006 32% 20% 19% Don’t Know 14% 14% 17%

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 10 ChangeWave Research: 3Q 2006 Corporate IT Spending

II. Corporate PCs (1) Question Asked: (FOR THOSE COMPANIES BUYING COMPUTERS IN 3RD QUARTER 2006) Who is the manufacturer and what computer type(s) is your company planning on buying? (Check All That Apply) Desktops

Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ’06 Feb ’06 Nov ’05 Aug ‘05 May ‘05 Dell - Desktop Computer 40% 41% 42% 45% 39% Hewlett-Packard (including 15% 16% 15% 14% 12% Compaq) - Desktop Computer Lenovo (formerly IBM) - 6% 6% 5% N/A N/A Desktop Computer Apple - Desktop Computer 3% 4% 3% 3% 2% Gateway/eMachines - Desktop 2% 2% 1% N/A N/A Computer Sony - Desktop Computer 0% 0% 1% 1% 0% Other - Desktop Computer 5% 3% 5% 8% 8% Don't Know 5% 5% 8% 6% 9% Not Buying Desktops in 2nd 24% 18% 17% 18% 16% Quarter Laptops Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ’06 Feb ’06 Nov ’05 Aug ‘05 May ‘05 Dell - Laptop Computer 38% 39% 37% 40% 37% Lenovo (formerly IBM)- Laptop 13% 11% 10% 10% 13% Computer Hewlett-Packard (including 13% 13% 13% 10% 10% Compaq) - Laptop Computer Toshiba - Laptop Computer 6% 6% 6% 6% 5% Apple - Laptop Computer 3% 4% 4% 4% 2% Sony - Laptop Computer 3% 2% 3% 3% 3% Gateway/eMachines - Laptop 1% 2% 1% N/A N/A Computer Other - Laptop Computer 3% 2% 3% 4% 2% Don't Know 6% 6% 7% 6% 8% Not Buying Laptops in 2nd 22% 16% 16% 18% 12% Quarter Slowdown in Corporate PC Purchases. One-in-four respondents (24%) say their company is not planning to buy desktops in the 3rd Quarter – up 6-points from our February 2006 survey. Another 22% say they’re not planning to buy laptops – also up 6-points. In terms of Corporate PC sales, this is the highest percentages of non-buyers we’ve seen in more than a year. This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 11 ChangeWave Research: 3Q 2006 Corporate IT Spending

There has been little real movement among the major PC manufacturers. While Dell remains the leader in both Corporate desktops (40%) and laptops (38%), it has lost 1- point in market share within each category since February. Hewlett-Packard remains second overall, down 1-point in desktops and unchanged in laptops. We note that Lenovo (13%) has moved into a tie for second place with Hewlett- Packard in the corporate laptop market – having picked up 2-points to 13%.

(2) Question Asked: How satisfied is your company with the following PC manufacturers? (Please rate only those that your company has previously purchased products from or had experiences with.)

Current Survey – May 2006 Very Somewhat Somewhat Very Satisfied Satisfied Unsatisfied Unsatisfied Apple 40% 47% 11% 2% Dell 42% 45% 10% 3% Lenovo (formerly IBM) 38% 45% 12% 5% Toshiba 28% 51% 15% 6% Hewlett-Packard 30% 50% 14% 6% Sony 28% 42% 22% 8% Gateway/eMachines 12% 43% 25% 20%

Previous Survey – February 2006 Very Somewhat Somewhat Very Satisfied Satisfied Unsatisfied Unsatisfied Apple 48% 39% 6% 7% Dell 44% 42% 9% 5% Lenovo (formerly IBM) 33% 48% 11% 7% Toshiba 33% 43% 17% 7% Hewlett-Packard 27% 53% 14% 6% Sony 25% 44% 18% 13% Gateway/eMachines 16% 40% 25% 19%

Lenovo Also Gains in PC Satisfaction. While Apple (87% Very/Somewhat Satisfied) and Dell (87%) are tied for the lead in terms of overall customer satisfaction, we note that Lenovo has experienced the biggest positive increase since February – up 2-pts to 83%.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 12 ChangeWave Research: 3Q 2006 Corporate IT Spending

(3) Question Asked: (FOR COMPANIES PURCHASING APPLE COMPUTERS IN 3RD QUARTER) Has your company purchased any Apple computers in the past, or are you purchasing Apple computers for the first time? (n=50)

Current Previous Previous Survey Survey Survey May ’06 Feb ’06 Nov ’05 We have purchased Apple computers 68% 78% 79% within the past 10 years We have purchased Apple computers, 6% 4% 5% but more than 10 years ago We are purchasing Apple computers for 26% 18% 16% the first time Apple Computer Purchasers. Among the relatively small group of companies buying Apple computers in the 3rd Quarter, 26% say they are purchasing Apple for the first time, an 8-point jump from our February 2006 survey.

(3A) Question Asked: Apple's new Macintosh computers now use Intel microprocessor chips. Has this development made your company more likely to buy Apple computers in the future, less likely to buy Apple computers, or has it had no effect?

Current Previous Survey Survey May ‘06 Aug ‘05 Significantly More Likely to Buy Apple Computers in the Future 3% 3% Somewhat More Likely to Buy Apple Computers in the Future 14% 11% Somewhat Less Likely to Buy Apple Computers in the Future 0% 1% Significantly Less Likely to Buy Apple Computers in the Future 1% 1% No Effect 70% 55% Other 0% 1% Don’t Know/No Answer 12% 27%

Impact of Intel Chip. A total of 17% say the new Intel-based Macs make them More Likely to buy an Apple computer in the future, 3-points more than in August 2005.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 13 ChangeWave Research: 3Q 2006 Corporate IT Spending

III. ChangeWave Research Methodology

These findings are based on a survey of ChangeWave Alliance members involved with IT spending in their organization, conducted between May 16-22, 2006. The goal of the survey was to get an up-to-date picture of IT spending for the 3rd Quarter of 2006. To this end, the survey was composed of a sample of 1,161 accredited Alliance members.

The Alliance’s proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, interprets and reconciles the information in a cohesive manner and converts the information into valuable quantitative and qualitative reports.

The Alliance has assembled its membership team from senior technology and business executives in leading companies of select industries. Nearly 3 out of every 5 members (56%) have advanced degrees (e.g., Master’s or Ph.D.) and 93% have at least a four- year bachelor’s degree.

The business and investment intelligence provided by the Alliance provides a real-time view of companies, technologies and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 14 ChangeWave Research: 3Q 2006 Corporate IT Spending

IV. About ChangeWave Research

ChangeWave Research, a subsidiary of Phillips Investment Resources, LLC, identifies and quantifies "change" in industries and companies through surveying a network of thousands of business executives and professionals working in more than 20 industries.

ChangeWave has a very unique asset in its 7,500-member Alliance. We have assembled our membership team from a broad cross section of more than 20 vertical markets such as telecom, semiconductors, data storage, and biotechnology, along with a wide range of professional disciplines including CIOs, IT managers and programmers, executive management, scientists, engineers and sales personnel.

The ChangeWave Alliance is composed of senior technology and business executives in leading companies - credentialed professionals who spend their everyday lives working on the frontline of technological change.

This proprietary research and business intelligence gathering system provides a real- time view of companies, technologies and business trends in key market sectors along with an in-depth perspective of the macro economy - well in advance of other available sources. ChangeWave surveys its 7,500 Alliance members on a wide range of investment research topics and converts the findings into valuable investment and business intelligence reports. ChangeWave delivers its products and services on the Web at www.ChangeWave.com.

ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

For More Information:

ChangeWave Research Telephone: 301-279-4200 9420 Key West Avenue Fax: 301-610-5206 Rockville, MD 20850 www.ChangeWave.com USA [email protected]

Helping You Profit From A Rapidly Changing World ™ www.ChangeWave.com

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 15