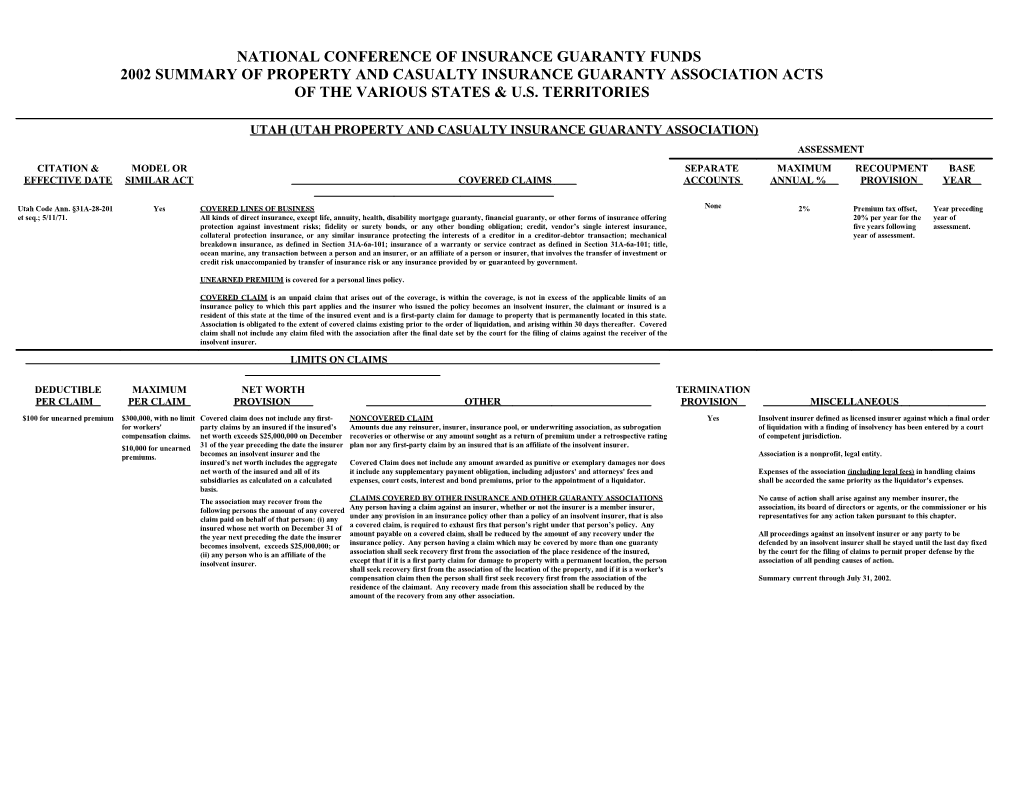

NATIONAL CONFERENCE OF INSURANCE GUARANTY FUNDS 2002 SUMMARY OF PROPERTY AND CASUALTY INSURANCE GUARANTY ASSOCIATION ACTS OF THE VARIOUS STATES & U.S. TERRITORIES

UTAH (UTAH PROPERTY AND CASUALTY INSURANCE GUARANTY ASSOCIATION) ASSESSMENT CITATION & MODEL OR SEPARATE MAXIMUM RECOUPMENT BASE EFFECTIVE DATE SIMILAR ACT COVERED CLAIMS ACCOUNTS ANNUAL % PROVISION YEAR

Utah Code Ann. §31A-28-201 Yes COVERED LINES OF BUSINESS None 2% Premium tax offset, Year preceding et seq.; 5/11/71. All kinds of direct insurance, except life, annuity, health, disability mortgage guaranty, financial guaranty, or other forms of insurance offering 20% per year for the year of protection against investment risks; fidelity or surety bonds, or any other bonding obligation; credit, vendor’s single interest insurance, five years following assessment. collateral protection insurance, or any similar insurance protecting the interests of a creditor in a creditor-debtor transaction; mechanical year of assessment. breakdown insurance, as defined in Section 31A-6a-101; insurance of a warranty or service contract as defined in Section 31A-6a-101; title, ocean marine, any transaction between a person and an insurer, or an affiliate of a person or insurer, that involves the transfer of investment or credit risk unaccompanied by transfer of insurance risk or any insurance provided by or guaranteed by government.

UNEARNED PREMIUM is covered for a personal lines policy.

COVERED CLAIM is an unpaid claim that arises out of the coverage, is within the coverage, is not in excess of the applicable limits of an insurance policy to which this part applies and the insurer who issued the policy becomes an insolvent insurer, the claimant or insured is a resident of this state at the time of the insured event and is a first-party claim for damage to property that is permanently located in this state. Association is obligated to the extent of covered claims existing prior to the order of liquidation, and arising within 30 days thereafter. Covered claim shall not include any claim filed with the association after the final date set by the court for the filing of claims against the receiver of the insolvent insurer. LIMITS ON CLAIMS

DEDUCTIBLE MAXIMUM NET WORTH TERMINATION PER CLAIM PER CLAIM PROVISION OTHER PROVISION MISCELLANEOUS $100 for unearned premium $300,000, with no limit Covered claim does not include any first- NONCOVERED CLAIM Yes Insolvent insurer defined as licensed insurer against which a final order for workers' party claims by an insured if the insured’s Amounts due any reinsurer, insurer, insurance pool, or underwriting association, as subrogation of liquidation with a finding of insolvency has been entered by a court compensation claims. net worth exceeds $25,000,000 on December recoveries or otherwise or any amount sought as a return of premium under a retrospective rating of competent jurisdiction. $10,000 for unearned 31 of the year preceding the date the insurer plan nor any first-party claim by an insured that is an affiliate of the insolvent insurer. premiums. becomes an insolvent insurer and the Association is a nonprofit, legal entity. insured’s net worth includes the aggregate Covered Claim does not include any amount awarded as punitive or exemplary damages nor does net worth of the insured and all of its it include any supplementary payment obligation, including adjustors' and attorneys' fees and Expenses of the association (including legal fees) in handling claims subsidiaries as calculated on a calculated expenses, court costs, interest and bond premiums, prior to the appointment of a liquidator. shall be accorded the same priority as the liquidator's expenses. basis. The association may recover from the CLAIMS COVERED BY OTHER INSURANCE AND OTHER GUARANTY ASSOCIATIONS No cause of action shall arise against any member insurer, the following persons the amount of any covered Any person having a claim against an insurer, whether or not the insurer is a member insurer, association, its board of directors or agents, or the commissioner or his claim paid on behalf of that person: (i) any under any provision in an insurance policy other than a policy of an insolvent insurer, that is also representatives for any action taken pursuant to this chapter. insured whose net worth on December 31 of a covered claim, is required to exhaust firs that person’s right under that person’s policy. Any the year next preceding the date the insurer amount payable on a covered claim, shall be reduced by the amount of any recovery under the All proceedings against an insolvent insurer or any party to be becomes insolvent, exceeds $25,000,000; or insurance policy. Any person having a claim which may be covered by more than one guaranty defended by an insolvent insurer shall be stayed until the last day fixed (ii) any person who is an affiliate of the association shall seek recovery first from the association of the place residence of the insured, by the court for the filing of claims to permit proper defense by the insolvent insurer. except that if it is a first party claim for damage to property with a permanent location, the person association of all pending causes of action. shall seek recovery first from the association of the location of the property, and if it is a worker's compensation claim then the person shall first seek recovery first from the association of the Summary current through July 31, 2002. residence of the claimant. Any recovery made from this association shall be reduced by the amount of the recovery from any other association.