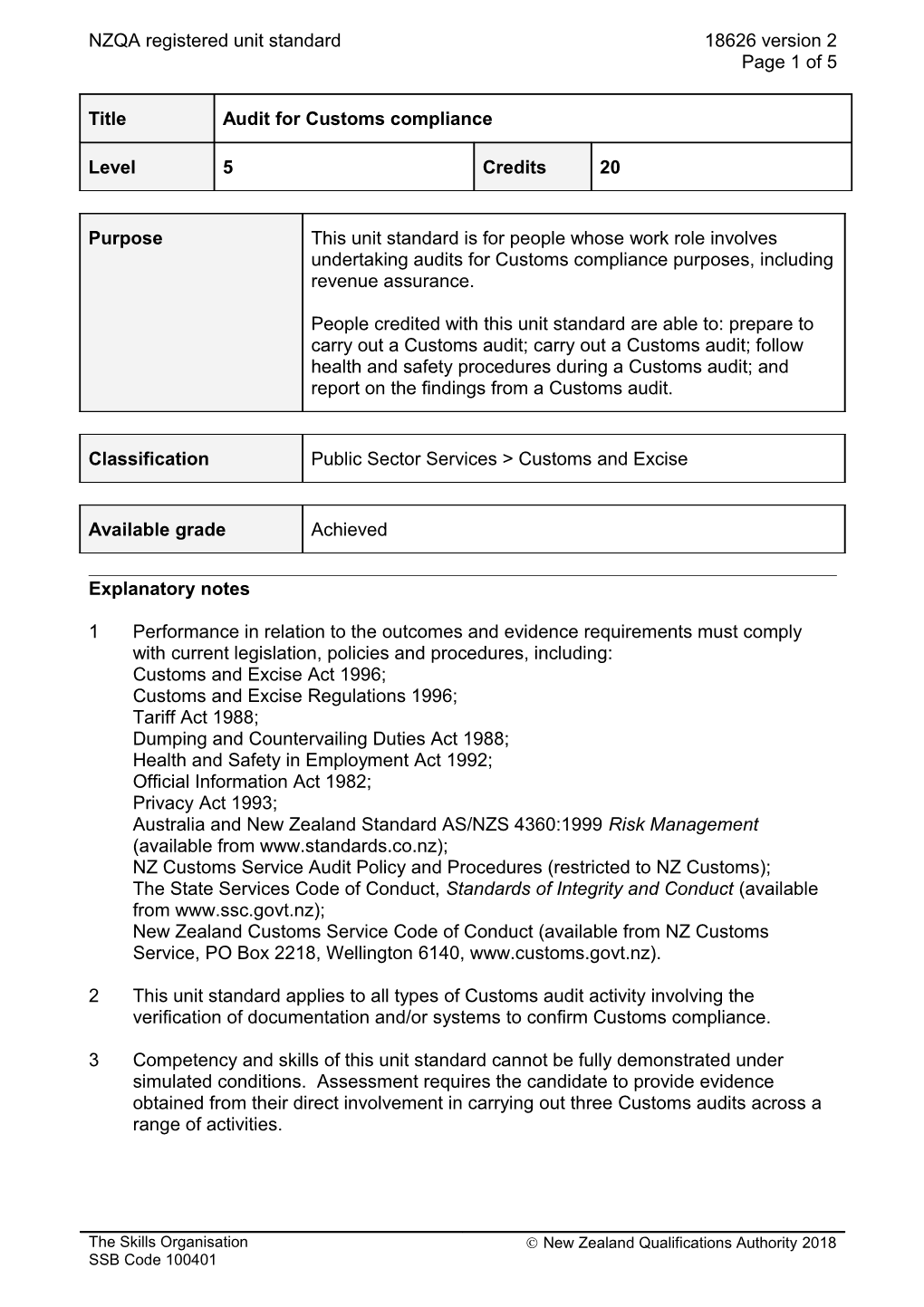

NZQA registered unit standard 18626 version 2 Page 1 of 5

Title Audit for Customs compliance

Level 5 Credits 20

Purpose This unit standard is for people whose work role involves undertaking audits for Customs compliance purposes, including revenue assurance.

People credited with this unit standard are able to: prepare to carry out a Customs audit; carry out a Customs audit; follow health and safety procedures during a Customs audit; and report on the findings from a Customs audit.

Classification Public Sector Services > Customs and Excise

Available grade Achieved

Explanatory notes

1 Performance in relation to the outcomes and evidence requirements must comply with current legislation, policies and procedures, including: Customs and Excise Act 1996; Customs and Excise Regulations 1996; Tariff Act 1988; Dumping and Countervailing Duties Act 1988; Health and Safety in Employment Act 1992; Official Information Act 1982; Privacy Act 1993; Australia and New Zealand Standard AS/NZS 4360:1999 Risk Management (available from www.standards.co.nz); NZ Customs Service Audit Policy and Procedures (restricted to NZ Customs); The State Services Code of Conduct, Standards of Integrity and Conduct (available from www.ssc.govt.nz); New Zealand Customs Service Code of Conduct (available from NZ Customs Service, PO Box 2218, Wellington 6140, www.customs.govt.nz).

2 This unit standard applies to all types of Customs audit activity involving the verification of documentation and/or systems to confirm Customs compliance.

3 Competency and skills of this unit standard cannot be fully demonstrated under simulated conditions. Assessment requires the candidate to provide evidence obtained from their direct involvement in carrying out three Customs audits across a range of activities.

The Skills Organisation Ó New Zealand Qualifications Authority 2018 SSB Code 100401 NZQA registered unit standard 18626 version 2 Page 2 of 5

4 Definitions Client refers to the person or organisation that is the focus of the Customs audit. A client may be an importer, Customs licensee, permit holder, exporter, or Customs broker. Customs Computer System is the term used to describe the Customs technology system. Customs Computer System is a complex computer system that receives a wide range of Customs data, and provides a mechanism for the processing of passenger, goods and Customs information. This system may also be known as CusMod. Organisational requirements refer to instructions to staff on policies, procedures, and methodologies which are documented and are available in the workplace. They must be consistent with applicable legislation and any other applicable compliance requirements.

Outcomes and evidence requirements

Outcome 1

Prepare to carry out a Customs audit.

Evidence requirements

1.1 The scope and objectives for the planned audit are set.

Range auditor, Chief Customs officer, management, intelligence.

1.2 Client history, including previous Customs audits, is reviewed to establish possible impacts on the conducting of the present audit.

1.3 Audit plan is established that matches the requirements of the audit and enables the objectives to be met.

Range timelines, resources, costs, Chief Customs officer briefing.

1.4 Working papers and other material are assembled to enable collection of the required information.

Range examples of working papers and material include – checklists, compliance standards, organisation charts, previous audit reports, quality systems documentation, client's CusMod entries, intelligence reports, entry history, refund and drawback history, inspections reports, prohibited goods history, analysis of ‘duty paid’ history.

1.5 The audit is scheduled at a mutually agreeable time and the client is advised of what they are to provide for the purpose of the audit.

Outcome 2

Carry out a Customs audit.

Evidence requirements

The Skills Organisation Ó New Zealand Qualifications Authority 2018 SSB Code 100401 NZQA registered unit standard 18626 version 2 Page 3 of 5

2.1 Audit objectives, audit process, and availability of resources are confirmed with the client before the auditing activity commences.

2.2 Audit approach and methodology is determined and tests are developed to be used for the audit.

2.3 Comparisons of observations with client's systems and procedures to identify possible non-compliance are made.

2.4 Testing regime is undertaken to verify compliance in accordance with organisational requirements.

2.5 Evaluative decisions are made on the basis of sufficient and verifiable evidence so that the extent of compliance and opportunities for improvement in compliance ability can be determined.

Range evaluative decisions – collation of recorded observations, identification of patterns, judgements.

2.6 Test procedures are documented and results are recorded in accordance with organisational requirements.

2.7 Inconsistencies and potential risk to revenue are identified in accordance with organisational requirements.

Range errors and fraudulent activities.

2.8 Communication with the client ensures that all parties remain informed of the progress of the audit and of any circumstances that could alter planned arrangements.

2.9 Respect for client property is shown at all times during the audit.

Range includes but is not limited to – equipment, product, documents, personal effects

Outcome 3

Follow health and safety procedures during a Customs audit.

Evidence requirements

3.1 All health and safety procedures are followed when working on a client's premises in accordance with organisational requirements.

3.2 The safety of persons present during the audit is protected in accordance with organisational requirements.

3.3 Safety protective aids are used during the audit in accordance with organisational requirements.

The Skills Organisation Ó New Zealand Qualifications Authority 2018 SSB Code 100401 NZQA registered unit standard 18626 version 2 Page 4 of 5

Range includes but is not limited to – safety helmet, eye and ear protectors, reflective overshirt.

3.4 Items of potential danger are dealt with in accordance with organisational requirements.

Range includes but is not limited to – fork lifts, operating machinery, vehicles, cranes.

Outcome 4

Report on the findings from a Customs audit.

Evidence requirements

4.1 Report is prepared on alignment of outcome with audit objectives.

4.2 Exit interview with the client conducted regarding the audit findings and any corrective actions required to achieve compliance.

4.3 Report is disseminated to all required parties.

Range includes but is not limited to – Chief Customs officer, Intelligence Business Unit of Customs.

4.4 Follow-up with client is actioned.

4.5 Outstanding issues related to the audit findings are actioned.

Range examples of outstanding issues include – duty assessment, audit requirements, follow-up audit requirement.

4.6 Outstanding issues relative to other Customs work areas are reported.

Range examples of outstanding issues include – advice on the amendment to Procedure Statements, advice on Customs policy.

4.7 Activity report is created in Customs Computer System and completed in accordance with organisational requirements.

Status and review information Registration date 16 July 2010 Date version published 16 July 2010 Planned review date 1 February 2015

Accreditation and Moderation Action Plan (AMAP) reference 0121 This AMAP can be accessed at http://www.nzqa.govt.nz/framework/search/index.do.

Please note

The Skills Organisation Ó New Zealand Qualifications Authority 2018 SSB Code 100401 NZQA registered unit standard 18626 version 2 Page 5 of 5

Providers must be granted consent to assess against standards (accredited) by NZQA, or an inter-institutional body with delegated authority for quality assurance, before they can report credits from assessment against unit standards or deliver courses of study leading to that assessment.

Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards.

Providers and Industry Training Organisations, which have been granted consent and which are assessing against unit standards must engage with the moderation system that applies to those standards.

Consent requirements and an outline of the moderation system that applies to this standard are outlined in the Accreditation and Moderation Action Plan (AMAP). The AMAP also includes useful information about special requirements for organisations wishing to develop education and training programmes, such as minimum qualifications for tutors and assessors, and special resource requirements.

Comments on this unit standard

Please contact The Skills Organisation [email protected] if you wish to suggest changes to the content of this unit standard.

The Skills Organisation Ó New Zealand Qualifications Authority 2018 SSB Code 100401