WHAT IF I: ADJUSTMENTS TO MOTOR VEHICLE BILLS

WHAT IF MY VEHICLE TRANSFERRED PLATES? From the category which best describes your WAS …. If you transferred your plates to a new vehicle, you situation entitled “What If My Vehicle Was?” are not entitled to an adjustment. In essence, the forward the appropriate 2 forms of proof to: adjustment follows the license plate. The original bill SOLD? for the old vehicle should be paid. A supplemental Assessor’s Office list will generate a bill for the new vehicle with a PO Box 84 credit (exemption) for the period that the old vehicle Southington, CT 06489 TOTALED? was no longer owned. Phone: (860) 276-6205 Fax: (860) 628-8669

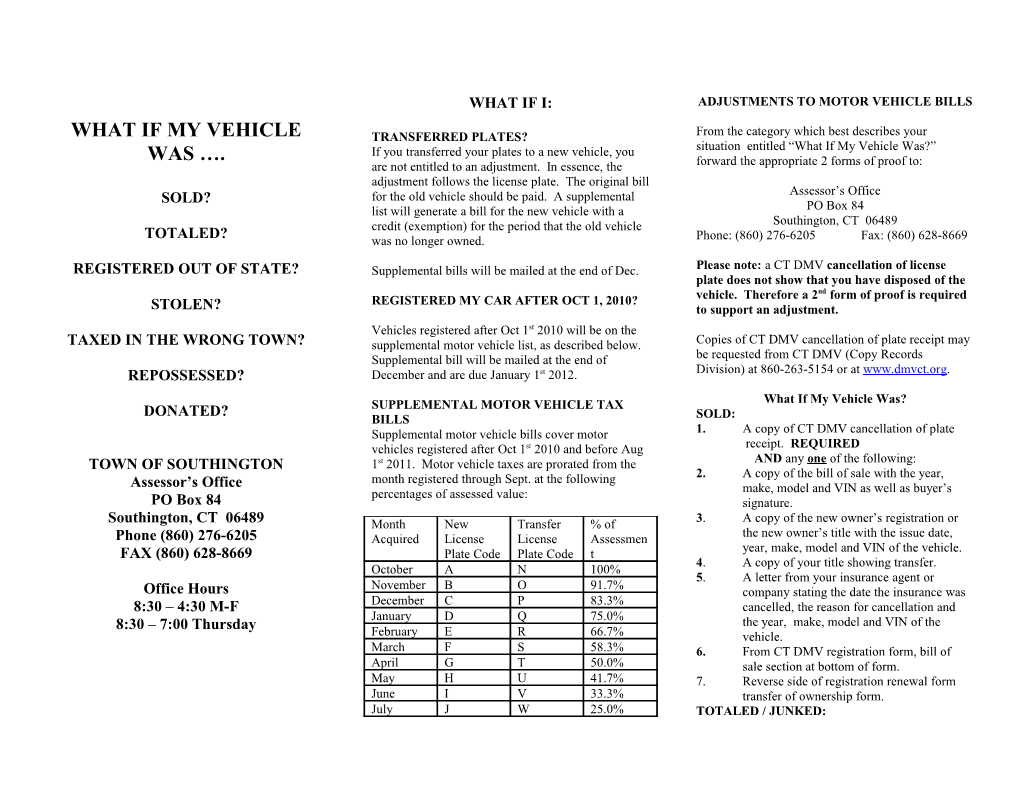

REGISTERED OUT OF STATE? Supplemental bills will be mailed at the end of Dec. Please note: a CT DMV cancellation of license plate does not show that you have disposed of the nd REGISTERED MY CAR AFTER OCT 1, 2010? vehicle. Therefore a 2 form of proof is required STOLEN? to support an adjustment. Vehicles registered after Oct 1st 2010 will be on the TAXED IN THE WRONG TOWN? supplemental motor vehicle list, as described below. Copies of CT DMV cancellation of plate receipt may Supplemental bill will be mailed at the end of be requested from CT DMV (Copy Records REPOSSESSED? December and are due January 1st 2012. Division) at 860-263-5154 or at www.dmvct.org. What If My Vehicle Was? DONATED? SUPPLEMENTAL MOTOR VEHICLE TAX BILLS SOLD: Supplemental motor vehicle bills cover motor 1. A copy of CT DMV cancellation of plate vehicles registered after Oct 1st 2010 and before Aug receipt. REQUIRED TOWN OF SOUTHINGTON 1st 2011. Motor vehicle taxes are prorated from the AND any one of the following: 2. A copy of the bill of sale with the year, Assessor’s Office month registered through Sept. at the following percentages of assessed value: make, model and VIN as well as buyer’s PO Box 84 signature. Southington, CT 06489 Month New Transfer % of 3. A copy of the new owner’s registration or Phone (860) 276-6205 Acquired License License Assessmen the new owner’s title with the issue date, FAX (860) 628-8669 Plate Code Plate Code t year, make, model and VIN of the vehicle. 4. A copy of your title showing transfer. October A N 100% 5. A letter from your insurance agent or November B O 91.7% Office Hours company stating the date the insurance was December C P 83.3% 8:30 – 4:30 M-F cancelled, the reason for cancellation and January D Q 75.0% 8:30 – 7:00 Thursday the year, make, model and VIN of the February E R 66.7% vehicle. March F S 58.3% 6. From CT DMV registration form, bill of April G T 50.0% sale section at bottom of form. May H U 41.7% 7. Reverse side of registration renewal form June I V 33.3% transfer of ownership form. July J W 25.0% TOTALED / JUNKED: 1. A copy of CT DMV cancellation of plate 1. A copy of CT DMV cancellation of plate vehicle list must be presented within 27 months receipt. REQUIRED receipt. REQUIRED of the assessment date. Example: the owner of a AND any one of the following: AND any one of the following: vehicle with a bill with an assessment date of 2. A letter from your insurance agent or 2. Letter from the finance company stating the October 1, 2009 has until December 31, 2011 to company stating that the vehicle was totaled, date vehicle was taken and that it was not present all proofs of disposal. the date of the accident and the year, make, redeemed by you and the year, make, model model and VIN of the vehicle. & VIN of the vehicle. Taxpayer failure to provide all forms of proof for 3. Dated receipt from junk dealer to whom the 3. Copy of bill of sale or auction papers that adjustment within the 27 months of the assessment vehicle was sold and the year, make, model show the year, make, model and VIN of the date forfeits the right to an adjustment of the bill by and VIN of the vehicle. vehicle and date of sale. Connecticut law (SS 12-71c).

REGISTERED OUT OF STATE: DONATED: Appeal Process 1. Owner must cease to be a resident of CT. 1. A copy of CT DMV cancellation of plate Questions about the motor vehicle appeal process Proof of new residency may be required. receipt. REQUIRED Should be directed to the Assessor’s Office at 860- AND 276-6205. 2. A copy of the original out of state 2. Letter from charitable organization on the registration OR title showing the issue date, organization’s letterhead, stating that the CLAIMED EXEMPT DUE TO ACTIVE year, make, model and VIN of the vehicle. vehicle was donated, the date of the MILITARY SERVICE REQUIRED donation and the year, make, model and Out of state resident based in Connecticut must AND VIN of the vehicle. file Soldiers & Sailors Civil Relief Act form 2. A copy of CT DMV cancellation of plate annually with the Assessor’s Office. receipt. DEADLINE FOR PRESENTATION Residents of Connecticut based out of state must file STOLEN: OF PROOF FOR ADJUSTMENT Active Duty form annually with the Assessor’s 1. A copy or CT DMV cancellation of plate Office. receipt. REQUIRED AND CT DMV does not inform towns when plates are Forms are available in the Assessor’s Office A statement from your insurance agent or company returned nor when vehicles are sold, registered out of stating that vehicle was stolen and not recovered, state or otherwise disposed of. It is the taxpayer’s date of theft and the year, make, model and VIN of responsibility to provide the required the vehicle. documentation within the time limits as provided under applicable Connecticut law. TAXED IN WRONG TOWN: st Proof of residency in another CT town on Oct. 1 Assessment Date Deadline for must be provided to the Southington Assessor. Presentation of Proof Bring your Southington bill to your local Assessor October 1, 2010 December 31, 2012 to add to his town’s list. The Assessor will then send October 1, 2009 December 31, 2011 it back to Southington to request its removal. October 1, 2008 December 31, 2010

The proof for adjustments (“prorates”) of motor REPOSSESSED: