1

The institutional structure of corruption: firm competition and the choice of institutional strategy.

Vincent Fitzsimons*

Whilst governance and particularly corruption have been the focus of much attention in both the economic literature and also the ‘policy community’ of the Washington institutions, the determinants of corruption are still dealt with too often using ad hoc models that fail to satisfactorily explain the determinants or likely patterns of corruption. Generally corruption has been explained in terms of administrative pay and efficiency wages, suggesting that the relative levels of state and private sector pay may determine the motivation for officials to become corrupt. In addition the extent of government regulation has been criticised on the grounds that it creates effective ‘shadow prices’ for state-provided services (Ehrlich and Liu, 1999) that may differ sharply from their market values, thus creating an opportunity for officials to extract rents during the provision of public services. In fact these models should be seen in a complementary way, explaining in combination the corruption of the provision of state services.

Whilst the ‘supply’ of corruption has thus been covered in a fairly thorough fashion, the companies who become involved as clients to corrupt officials are examined in relation to the general levels of economic performance that prevail in highly corrupt economies. Corruption, like taxation and regulation, has generally been viewed as a restrictive factor in the performance of economies (see Mauro, 1995; Wei, 2000; Jaffe et al., 1995 respectively). This paper extends the examination of the ‘demand’ side for corruption by placing it against alternative strategies that firms may adopt using different institutional routes: through forms of activity seeking to win advantage within the market, political and legal institutional structures of the economy. In this perspective, the attempts of firms to perform acts of ‘state capture’ (Hellman et al, 2000) rather than simple bribing of administrative or judicial officials (see Kaufmann & Wei, 2000) appears more a rational strategy to pursue competitive advantage by use of the most efficient institutional arrangements. This approach has a distinct advantage in realistically explaining actual behaviour of firms as it emphasises the inevitability of corruption from opportunistic firms operating in an environment where redistribution of property rights need not only be pursued through the ‘pursuit of profit’ as described by the orthodox economic analysis.

Ultimately, corruption should be seen as a complementary form of competition to that conducted in the market arena, and the inevitability of corruption should be seen as strong grounds for the imposition of (considered) regulation rather than its removal as often advocated by neo-liberal economists in both academic economics and the Washington institutions.

Paper presented at Institute for Development Policy and Management and Global Poverty Research Group conference ‘Redesigning the State? Political Corruption in Development Policy and Practice’, Dalton-Ellis Hall, University of Manchester, UK, Friday 25 November 2005.

*Vincent G. Fitzsimons Senior Lecturer in Economics University of Huddersfield Queensgate Huddersfield HD1 3DH, United Kingdom [email protected] 2

The institutional structure of corruption: firm competition and the choice of institutional strategy.

I Introduction The concept of corruption is one of general relevance to economists. From both historical and current occurrences of corruption it is evident that it is a problem of a fundamental type to economic as well as political institutions. And yet despite this there appears a resistance against the need to admit its significance and adequately integrate corruption into the analysis of mainstream economic problems as well, to some degree, as a failure to apply mainstream analysis to corruption itself.

Those seriously considering corruption may be right to be wary of an over-reliance on mainstream economic principles. The simplifying assumptions of orthodox economics often produce models of behaviour with one-dimensional theoretical agents who are either entirely beneficent or opportunistic, neither of which sits easily with their assumed tendency to calculate appropriate strategic responses to the institutional and incentive structures within which they exist. Instead of broadening the scope of economic analysis in reflection of complex real-world situations, many mainstream analyses simply map out the implications of initial assumptions to unremarkable and unrealistic conclusions. Whilst this criticism may also be levelled to a degree at the New Institutional school of economics which often incorporates neoclassical or orthodox economic assumptions into their analysis, a broader economic analysis has been applied to economic problems by others groups such as the post-Keynesian and Old Institutional economists in a way that expands the scope for incorporating realistic elements into economic theory. It is argued here that a broad institutional approach to economic problems enables us to create more realistic representations of economic activity in a way that is particularly suited to the analysis of corruption.

Shleifer and Vishny (1993) define corruption as ‘the sale by government officials of government property for personal gain’ and particularly where ‘they charge personally for goods that the state officially owns’ such as the rights to certain activities regulated by the state, or physical property (p.599). The destructive potential of corruption is now recognised as ‘corruption has two major defects. The first of these is that many government activities are desirable; hence, permitting bribes to get rid of them is undesirable… The second problem is once corruption becomes established in a government, laws may be enacted for the specific purpose 3 of maximizing the bribes available for permitting people to avoid them.’ (Tullock, 1989, p.659)

Surprisingly, corruption has not always been seen as a cost to economies or an obstacle to the operation of markets, despite its distortionary and redistributive potential. Much of the early work on corruption reflects the typical analysis of political corruption amongst an American academic community concerned with the imperfect nature of government interventions into the economy, as reviewed in Werlin (1973). Werlin quotes Key (1970) that ‘ “bribery has been a convenient way to avoid legal requirements which may be impracticable of application” ’ (Werlin, p.71) and that underprivileged groups had used corruption constructively to overcome obstacles to their development. In fact, legal systems in underdeveloped countries were such that ‘corruption is functional in emerging countries because of the conditions under which legislation is generally formulated and administered’ (p.72, attributed to Samuel Huntington, 1968). He concludes that corruption, at its most blatant during the nineteenth century in the U.S., did not significantly restrict the development of its economy in this period. Despite this, he cites cases from Ghanaian commissions of investigation that demonstrated the disruptive effects of corruption. He cites distortions to government activity that included selection of products for government contracts on the basis of the ‘commission’ available on them rather than suitability, and granting of export licences, out of export quotas, that were excessively large for the companies involved in order to increase the size of the appropriate associated kick-back (p.74).

Explanations of corruption have generally depended on a critical approach to the role of the state and to state-regulation in particular, suggesting that corruption, and general problems of governance, follow closely on from state interference in the economy. Ehrlich and Liu (1999) summarise the view stating that ‘any government intervention in the economy assigns some resource allocation responsibilities to a bureaucratic structure. Since the shadow prices generated thereby typically deviate from free-market prices, an incentive arises to close the gap by various side payments, or bribes. Exercising the opportunity to obtain such rents is what is here meant by corruption.’ (p.S272) They conclude that corruption is inevitable in a bureaucratic system, due to the potential of administrative price-setting and allocation for the creation of rents or unearned benefits which will attract individual and collective attempts to ‘capture’ these. As indicated in the early literature on corruption, such rent-seeking behaviour involves many groups in expenditures that 4 are entirely non-productive, in the attempt to persuade administrators to favour their claims to the rents created and win the potential gains (see Krueger, 1974) imposing potentially significant social losses on developing economies in particular. Tullock (1998) notably points out in his work that rent-seeking behaviour is in many cases a negative-sum game.

Where the corrupt payments are simply transfer payments, say between an absolute monarch owning monopoly rights and a firm purchasing them, the corruption need not have an immediate social cost, but this is rarely the case. In a competitive economy with a relatively democratic state practicing widespread transfer payments the market valuation has already deviated from that of a competitive market economy in the creation of both non-market shadow prices for public goods and non-market prices in marketed goods. Although the pre-existing nature of the distortion ensures that direct economic impacts cannot be deduced, groups will offer large incentives to create further distortions. The most direct impact of such distortions is simply to create significant new incentives for the acquisition of political capital that gives access to such rents, an activity that is already seen as a rational economic strategy (Olson, 1982). In such a way, a ‘capture economy’ (Hellman et al, 2000) may develop.

Overall, corruption is old and it is widespread, a problem of both the developed and the developing worlds. The problems of corruption surely appear significant enough to motivate any government to act decisively against it. The economists’ view of government, however, appears to have initially been too simplistic in this respect. Certainly bad and failing policies are as common in developed as developing countries (Ritzen et al., 2000) as policy makers are committed to policies due to domestic and short-term considerations that may appear irrational in view of long-run analyses of impacts. Also Guasch & Hahn’s (1997) recognition that the difficulties of evidence on policy/regulation impact assessments is often unpersuasive for the purposes of electoral politics suggests that governments are hindered in a variety of ways in their attempts to deal with problems such as corruption. Possibly due to this, evidence demonstrates that policing of ‘victimless crimes’ is much less successful than that of common crime (Ehrlich and Liu, 1999, p.S272).

II Evidence on corruption As well as the evidence of commissions of enquiry in specific countries, work by authors such as Mauro (1995) and Wei (2000) has brought the issue of corruption to 5 greater prominence in recent years. The investigation and quantification of negative impacts of corruption for economies has renewed the impetus behind efforts to explain corruption and, as is now assumed to be appropriate, combat it. Such studies have demonstrated a negative relationship between corruption and forms of investment, with negative impacts on investment being greater than established deterrents such as taxation for international investment decisions. The evidence is limited in two respects, however, as corruption measures are less robust when included in larger growth models than might be expected. In addition existing measures of corruption are questionable due to the range of influences on them and their subjective nature, being based largely on surveys of opinions of relative corruption such as those conducted by organisations such as Transparency International and Freedom House. Whilst World Bank attempts to combine various subjective measures into composite indices of corruption and other institutional variables (see Kaufmann, Kraay & Zoido-Lobaton, 2002) provide promising improvements in reliability, the risk of systematic bias in opinion surveys remains a significant problem for the interpretation of empirical work based on such data.

Recent attempts have been made to produce more objective data using detailed research into corrupt behaviour that quantifies the impacts of corruption on firms and in the public sector. Reinikka & Svensson (2002) cite evidence from surveys of budget allocation versus delivery (Public Expenditure Tracking Surveys, or PETS, executed at the various levels of public administration) and firm-level surveys of bribe-paying in the Ugandan economy. The evidence suggests stark facts of life in corrupt economies: 13% of the non-wage school budget of Uganda reaches actual schools, with individual cases’ allocation depending largely on their ‘socio-political endowment’ (p.136), whilst more than 80% of businesses typically have to pay bribes to do business, with the incidence of payment depending largely on the balance of profitability (ability to pay) and reallocation costs (“ability to refuse to pay” p.136). The latter in particular reflects the evidence of Indian and Ghanaian commissions of enquiry suggesting that corrupt officials may create delays in order to levy bribes to overcome them (Santhanam report cited in Myrdal, 1968) or inflate the allocation of licence rights above the levels requested by applicants in order to levy larger charges for their corrupt provision (Ollennu commission cited in Werlin, 1973). In such cases corrupt officials obviously solicit payments due to self-interest or dissatisfaction.

Whilst this may give the impression that corruption is a problem created by administration, evidence from the World Bank’s ‘BEEPS’ survey of countries in 6 transition in Central and Eastern Europe suggests that new or foreign entrant firms may seek corrupt arrangements strategically as a way to ‘finesse’ existing relationships and patterns of influence in an economy (Hellman, Jones & Kauffman, 2000). In this situation, firms act strategically to outmanoeuvre competitors who enjoy advantages of possessing what might be termed corrupt ‘network capital’ in a rational response to an imperfect market environment, largely in line with the principles of neoclassical models of the firm, although these ‘transactions’ occur outside economic markets but instead occur in the political or legal marketplace. Influence, rather than explicit capture or purchase of officials favours, is unclear in nature from the mainstream economic viewpoint as it is not associated with direct economic gains, but rather seems to be a consequence of connections and socio- political association in former planned economies. In order for a theoretical analysis to capture the balance of influences in such circumstances, a wider institutional interpretation is essential.

It is clear from above that the anecdotal evidence on corruption’s impacts appears largely mixed, leading to recent attempts to analyse the positive ‘greasing the wheels’ view of corruption by Kaufmann and Wei (2000). Lui (1985) had already argued that bribe-payers with varying time-preferences could find an ‘optimal’ re-ordering of service provision without leading to administrators artificially creating delays. Kaufmann & Wei (2000), however, suggest that bribes are only effective in ‘managing’ red tape when the extent of bureaucratic burdens and process delays are exogenously determined. In a model where these are endogenised, delay-creation is a popular strategy amongst administrators, as suggested by evidence from the real- world, and firms who pay bribes and by doing so, presumably, reveal their time- preference are in response subject to higher bureaucratic and regulatory burdens.

Of course, corruption is a concept which is difficult to precisely define, such as in the distinction between state capture for some pecuniary or other gain versus influence which would by many be viewed as separate from corruption. As Rose-Ackerman (1999) recognises: ‘corruption has different meanings in different societies. One person’s bribe is another person’s gift. A political leader or public official who aids friends, family members, and supporters may seem praiseworthy in some societies and corrupt in others.’ (p.5) Subjective assessments of corruption, which form the basis of many of the existing datasets, are vulnerable to significant bias, and this may explain why high-profile 7

‘political scandals’ in Western democracies such as the USA or UK do not feed through to poorer ratings for corruption in survey data. Where to draw the line between legitimate and illegitimate activities is a decision with few objective points of reference and is largely culturally specific. Incumbent groups may view their accumulated political capital as property whose associated rights are ‘wrongly’ threatened by reforms, and particularly by anti-corruption strategies, and so act to undermine the actions of reformers. In this context even the actions of NGOs are inherently tied up in problems of distributive conflicts and potentially bear negative impacts on the economy just as in studies of ‘open’ political re-distribution through the democratic process (see for instance Przeworski & Limongi, 1993).

III Anticorruption strategies The problem of corruption is significantly complicated by its frequent embeddedness in the political institutions, either formal or informal, of corrupt economies. Tullock (1989), reflecting on the work of Robert Klitgaard, concluded that ‘governments in Third World countries normally have no objection to corruption on the part of their officials. Indeed, the president is rather likely getting a rake-off.’ (p.658) Whilst international financial institutions (IFIs) are now attempting to deal with such problems, those working at the country level, and aid executives for donor organisations, must be ‘willing to turn off the faucet. In general, they really are not willing to do so, and in any event, frequently do not have the power to do so.’ (p.659). The author of this paper found similar attitudes when discussing the problem of Russian extortion of ‘aid’ with World Bank executives. One anonymously summarised the attitude of IFIs to the Russian problem succinctly: ‘at least we’re still talking.’ Other considerations all too often prevail.

Advice on how to deal with corruption varies widely, but a number of principles have been suggested variously as being ‘central’ to the problem of corruption. Studies have attempted to design anti-corruption strategies that adopt a principal-agent approach that depends on shirker-style efficiency wage models after Shapiro & Stiglitz (1984) which incorporate relative rewards and risks to economic agents, given a framework of supporting institutions, to prevent corruption. Corruption is often conducted by members of ruling elites, however, who cannot be easily described as being corrupt for reasons of being poor or unsatisfactorily rewarded. The focus of such models on the decision making of the individual also tends to reinforce the view that officials are sole instigators of corruption, a view which is not compatible with evidence from the transition countries (see Hellman et al., 2000, and above). 8

Others treat corruption as the consequence of poorly defined legal rights or poorly delivered government interventions. North (1990), for instance, has emphasised the need for an efficient legal system to reduce or at least deter corruption and foster the development of trust in economies, although Huntington’s criticism of the development of legal systems (above) makes it unlikely that such efficient systems will develop where most needed, and may perhaps account for the persistence in many countries of well-documented corruption.

Some models examine the possibility that ‘indoctrination’ can have beneficial consequences on levels in specific cultures (see Shleifer & Vishny, 1993, p.599-600), in essence reducing the relative benefits of being corrupt. Dobel (1978) outlines various approaches to the problem of corruption that associate it with negative cultural changes damaging to the society in which it occurs. This ‘demise of loyalty to the commonwealth… results in certain identifiable patterns of political conflict and competition.’ (p.958) Thus corruption forms a connection between cultural, economic and governance institutions that determine patterns of economic behaviour. Whilst this is not as clearly focussed on officials as the decision makers responsible for ‘creating’ corruption, this focus partly remains, as does the problem of the acceptability of cultural manipulation by largely Western or Western-backed institutions already subject to criticisms of neo-colonialism in their policies.

International financial institutions have an obvious incentive in reducing corruption’s negative impacts in order to enhance the effectiveness of their own projects and so have paid increasing attention to combating corruption recently. The efforts of the World Bank to reduce corruption in the transitional countries of central and eastern Europe have gone some way to correct the massive losses to corruption experienced by the IMF and World Bank in the region by developing a more complex anti- corruption framework (World Bank, 2000, p.xxii) reforming political accountability, (creating) competitive private sector, (meritocratic) public sector management, civil society participation and institutional restraints, each of these elements involving a range of detailed sub-sector reforms. The Asian Development Bank’s (ADB) success in reducing corruption levels in Hong Kong and Singapore, however, is attributed to a much simpler approach. Its July 1998 Anticorruption Policy simply focussed on: ‘ ’ supporting competitive markets, and efficient, effective, accountable, and transparent public administration, in the belief that efforts towards prevention will ultimately be more effective in the long run; supporting promising 9

anticorruption efforts on a case-by-case basis and improving the quality of the dialogue with our developing member countries (DMCs) on a range of governance issues, including corruption; and ensuring that our projects and our staff adhere to the highest ethical standards.’ (Shin, 1999, p.2)

A long-run approach to the problem, and assessing anticorruption policies on their merits and in their specific context appears to increase the overall effectiveness of an anti-corruption strategy, from the ADB case. It also views corruption in the context of general governance rather than as an isolated problem. This is also raised in the World Bank’s more recent anti-corruption approach for transition (Gray et al., 2004) which emphasises the complex and changing nature of corruption where ‘the more effective that existing measurement efforts are at shedding light on corrupt practices in society, the more efforts will be made by corrupt members of that society to transform those practices into less visible and measurable forms.’ (p.6) In view of these strategies, it is increasingly important that a general framework for the examination of corruption in its more general context is developed in order to help the future analysis of this complex problem. Such an approach is outlined below.

IV Model Whilst the issue of corruption may be analysed or tackled somewhat problematically in the ways discussed above, the lack of an overall framework inevitably hampers efforts to provide systematic analysis of the problem itself, and hence constrains attempts at producing sound anti-corruption policy. The pragmatic, one-by-one approach to assessing and implementing corruption fixes has met with great success in certain cases, but these would be made considerably simpler if a greater understanding of the problem existed.

The theoretical framework that has been applied to corruption has only slowly developed despite its prevalence. It is only recently that more detailed analysis has been conducted into patterns of corruption and the differences between forms of and motivation for corruption. In fact, different types of corruption exist – state capture, administrative influence, basic bribes, all induce individuals in ‘agent’ positions (assuming a democratic political system, mandates, and compatible responsibilities within the administration of the state) to act in violation of their positions as stated by ‘principals’. The ‘corruption decision’, where it has been considered at all for the firm, has largely been viewed in isolation, however, with little recognition of its position within the range of strategic opportunities to the firm. 10

The strategic nature of corruption has received partial recognition in that corruption may be seen as a normal business behaviour in certain circumstances (Hellman et al., 2000) and is subject to the usual calculative criteria with the problem of calculating optimal bribes given corrupt environments (Lui, 1985). Baumol (1990) has also recognised that entrepreneurial decision-making includes choices between legitimate (‘productive’) activity such as competitive innovation and illegitimate (‘destructive’) forms of activity such as rent-seeking (p.893).

The admission that entrepreneurs may solicit corrupt behaviour in administrators appears to be some ‘omerta’ of neoclassical economics only broken by the most respected economists (see for instance Baumol, 1990). Rather than admit the ability of organisations to pursue influence through a range of institutional avenues and through both legitimate and illegitimate means, economists normally impose implicit constraints on collective organisational activity to the ‘legitimate’ sphere of business, namely market exchange, which has lead to the perpetuation of unrealistic theory of only limited relevance in its application. The parallel can be drawn to the pursuit in regulation theory of a market-based solution to market failure (see Shleifer, 2000) which appears at least slightly contradictory in its fundamental terms, and whose logic depends crucially on implicit behavioural assumptions. In this way, judges are ascribed different motivations from entrepreneurs or politicians as individuals. This has at least the advantage that it moves beyond the theoretical assumption of a beneficent state which undermined public choice theory in its infancy, but this approach to regulation of course also places ‘the court’ as an impartial arbitrator where ‘the state’ was not, ignoring both strong evidence of legal corruption and also legal ineffectiveness.

Many types of economic agents in the mainstream analysis are implicitly constrained in their activities only to within prescribed roles. Corruption and opportunism must, more realistically, be at least considered a possibility in all institutional structures. The true implications of the neoclassical assumptions of rationality and self- interested behaviour by amoral economic agents, however, if followed to their logical conclusion is that corruption is in fact inevitable, with the extent of corruption depending on both the costs and benefits of corruption, but also on the relative costs and benefits of all other strategic possibilities. 11

It is argued here that the principles of competitive equilibrium, neoclassical behavioural assumptions, and a recognition that firms may participate in any institutional form of collective action strategically, produce a more complex but also more realistic and accurate framework for the determination of levels of corruption. Other authors have generalised the principle of consumer equilibrium before, with benefits to the accuracy of their models. Dorfman & Steiner (1954) apply the concept of a general consumer equilibrium to the firm’s decision on its ‘consumption’ of marketing when faced with a range of strategies capable of maximising profits. Similarly we can extend the concept of competitive equilibrium to the problem of corruption, viewing it as one of a range of strategic approaches to acquisition of property rights.

The concept of consumer equilibrium is one of a small number that form the foundation of economic analysis of consumer behaviour, and which jointly produce the positive conclusions for the beneficial role of the market mechanism in maximising welfare levels in economies. It can be simply stated for a selection of ‘i’ goods that, in order to maximise utility, consumers of products will consume the range of goods in a combination which meets their budget constraints, raising their consumption of the goods until the ratio of (declining) marginal utility to unit price is the same for every good such that:

MU1 / P1 = MU2 / P2 = … = MUi /Pi (1)

The principle can be simply adapted into a more general form by considering these principles as comparable to those of marginal cost and benefit such that a general ‘consumption’ equilibrium for a range of strategic behaviours ‘i’ can be stated:

MB1 / MC1 = MB2 / MC2 = … = MBi / MCi (2)

This principle would definitely lead to similar outcomes to that of a consumer equilibrium if the benefits of a strategic course decline as its use increases, similar to the decline in utility return to consumption as levels rise; and more controversially, if marginal costs of these strategies rise in line with their use (which is not always assumed to be the case)i. In this case, use of each strategy would increase until (MB – MC) for a ‘unit’ of the strategy was equal 12

for each strategic possibility. In considering this ‘equilibrium’ for competitive firms, these strategic behaviours could take any form, not simply the pursuit of profit through normal market competition. Any institutional avenue may be open to the firm in practice, not excluding ones that are technically proscribed, if we view this in its practical application. Firms may consider expenditures in lobbying for self-beneficial changes in legal codes, open market competition, public relations and promotions all to be comparable strategic behaviours that may benefit the firm.

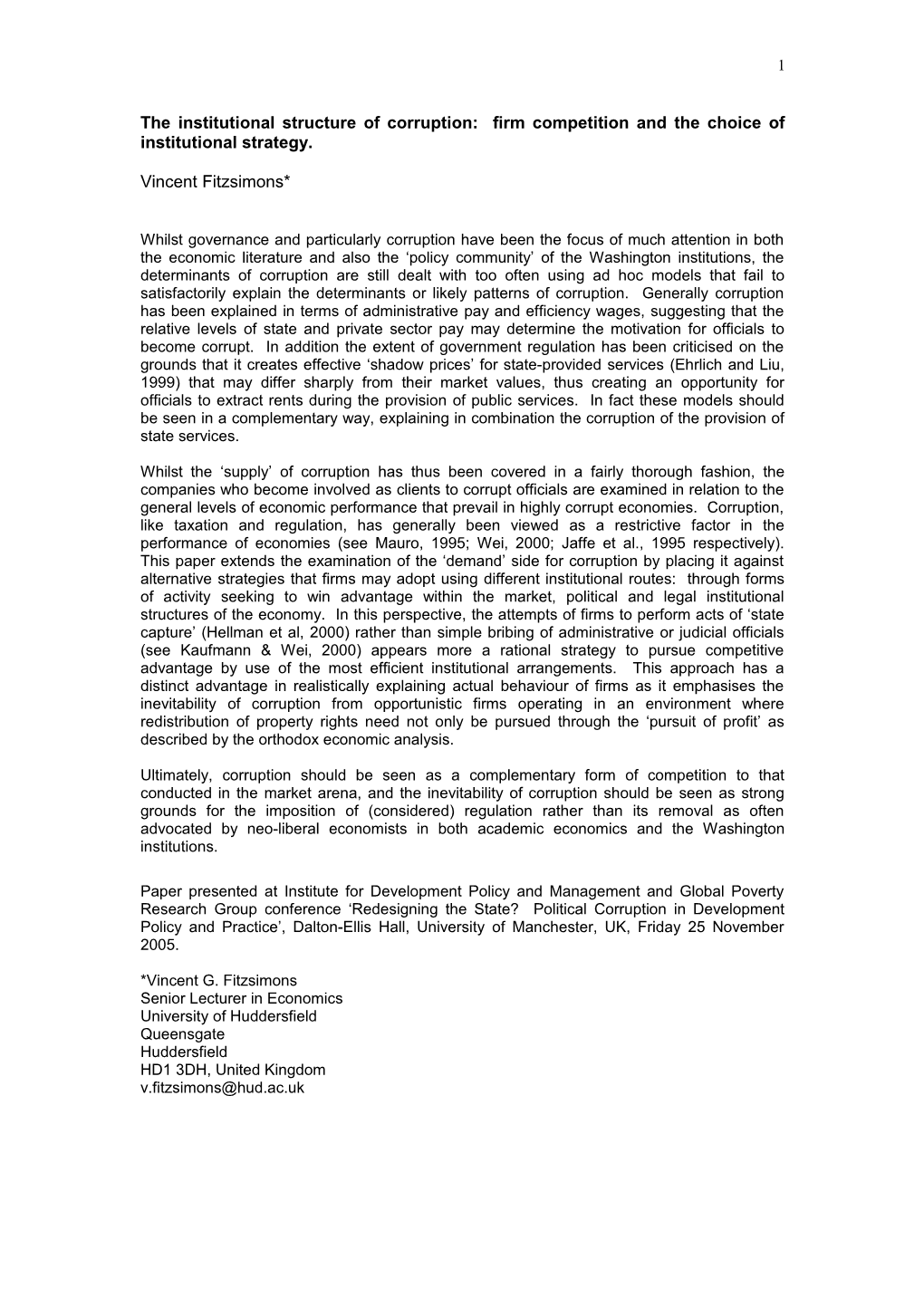

Table I Economics of Institutions (NIE view)

Level Frequency Purpose (NIE view) (years) L4: Neoclassical Resource allocation Continuous Get the marginal conditions economics/agency and employment right. 3rd order economizing theory (prices and quantities; incentive alignment) L3: Transaction cost Governance: play of 1 to 10 Get the governance economics the game – esp. structures right. 2nd order contract (aligning economizing governance structures with transactions) L2: Economics of Institutional 10 to 100 Get the institutional property rights/positive environment: formal environment right. 1st order political economy rules of the game – economizing esp. property (polity, judiciary, bureaucracy) L1: Social theory Embeddedness: 100 to 1000 Often noncalculative; informal institutions, spontaneous customs, traditions, norms, religion Source: adapted from Williamson (2000) p.597. Each level determines the institutions of that level above, and is in turn susceptible to feedback effects from those institutions above. North (1971) calls levels 1&2 fundamental/primary and level 3 secondary institutions. The classification of the formal, hierarchical and market levels as ‘economizing’, and the social level ‘non-calculative’ reflects the NIE, and particularly not the OIE, view of social institutions.

Corruption, it appears obvious from its nature, is institutionally determined. Institutional theory claims to explain a vast range of economic phenomena within its analytical framework and yet only a limited range of institutional analysis has been applied to corruption. The institutional structure of the society overall has impacts on the economic elements of individual interaction, and a wide and complexly evolving range of institutional forms exist in any modern economy (Table I). Typically research looks into the social, legal & political, organisational and market levels of institutionalised behaviour, and each of these may offer avenues for strategic behaviour to enhance the earnings of a firm. Firms may participate in ‘good works’ in order to prove social credentials that may ultimately create some pay back for the business. Similarly the firms may specifically target legal or political institutions for 13 their concerted or individual action. The opportunities open to firms across the full range of institutional types creates a considerably more complex view of the potential behaviour of the firm.

If we view the firm as the ‘consumer’ of corruption, or more specifically of the under- supplied or discretionary public services which provide firms with potential gains if corruption is possible, then a consumer equilibrium will occur across a range of types of institutional strategy which would accrue gains for the firm. Many of the firm’s activities in the purchase of political or social capital are largely, although not universally, interpreted as corruption, but these are in fact only some of a wider range of strategies that firms may use, both legitimate and illegitimate, or perhaps constructive and destructive or purely redistributive, to produce gains for themselves.

V Implications The treatment of corruption as a largely institutionally determined behaviour and the recognition of the firm as a potential consumer of corruption, rather than being necessarily an innocent victim of it, rectify some of the problems in the existing analysis. Several issues obviously remain, however, that require further examination. In particular, the treatment above is not open to criticisms of being simplistic and one-dimensional, but a detailed analysis of the demand for corruption still needs an examination of the determinants of all the relative costs and benefits of the forms of institutional strategy of which corruption is one. Of course, several such factors have already been examined in the theoretical and empirical literature, such as the nature and effectiveness of legal systems following North (1990).

In addition to efforts at elaborating upon the theory of ‘consumption of corruption’, however, the supply side of corruption still needs to be comprehensively re-examined in order to enable analysis to better predict actual levels of corruption. Whilst the model of consumption or demand for corruption above may indicate as yet un- examined determinants of corruption and relationships between corruption and other related phenomena, both supply factors and demand factors would of course need careful and co-ordinated examination in order to form accurate predictions of levels of corruption, if this is possible. It is possible that certain factors are joint determinants of both the demand for and supply of corruption, and it would be purely fortuitous for these relationships to operate in a simple fashion. For example, if lax legal institutions encourage both the demand for corruption and supply of corruption, 14 the impacts would remain unclear overall. Such contradictions, once exposed, could at least help explain failures in current models to accurately describe corruption in the real world.

In addition to the above, the model has implications for the generally hostile approach of IFIs to state regulation in their analysis of corruption. Corruption, taxation and regulation, have generally been viewed as a restrictive factor in the performance of economies (see Mauro, 1995; Wei, 2000; Jaffe et al., 1995 respectively). Deregulation is thought to be essential in order to create efficient markets: the analysis above of course has serious implications for firms’ market activity. In particular, World Bank anti-corruption strategies explicitly emphasise the central role of deregulation, advocating broadly neo-liberal economic policies: ‘reducing the benefits to these firms from capture… can be achieved in part by deepening price and trade liberalisation, increasing transparency… and introducing greater competition... Reducing the ability of the state to extort bribes from the private sector requires deregulation.’ (World Bank, 2000, p.xxiii) Examples cited involve ‘the elimination of unnecessary licenses and rules and creating effective institutions for regulation’ (p.xxiii) and the approach does recognise the essential need for regulation as well as deregulation, leaving an unclear position overall. The general hostility of IFIs towards regulation creates the risk that the emphasis on deregulation may lead to excessive reduction of state powers that may be necessary either in terms of corruption reduction or other key state objectives.

It is clear from the above that, whilst regulation may create inaccurate ‘shadow prices’ for publicly provided or regulated services, it is also clear from the analysis of the demand for corruption that it will remain a potential strategy of organisations in all economies. This in turn creates a universal need for regulation. On balance, this invalidates the common assumption that simple de-regulation is a necessary and effective strategy for improving the operation of economies, and corrupt economies in particular. It suggests, more realistically, that regulation is a complex and difficult task that needs to be done sensitively in order to address its potentially destructive impacts.

Overall, corruption is doubly linked to regulation. Regulation (in price or market entry interventions) does create rents that attract firms to corrupt behaviour (despite this straying outside the typical model of firm behaviour!) but it is also required 15

by the existence of other corruption patterns that would exist independently of the existence of such regulations. It is a market failure that cannot be reduced entirely by deregulation. This confusion requires us to examine the causes or motivations for corruption. An overall theoretical framework thus aids the analysis of corruption and regulation by linking explanations why it occurs rather than simply describing what forms occur and how, and thus the analytical framework should aid in policy creation.

VI Conclusion The treatment of corruption outlined above should have two advantages that should enable greater clarity in the analysis of corruption as well as providing a greater potential for the integration of corruption theory and mainstream theories of firm behaviour. Firstly, an emphasis on the ‘demand’ for or consumption of corruption counters the strong emphasis in many analyses of corruption that corruption is a problem of the state. Evidence from the transition economies (Hellman et al., 2000; Gray et al, 2004) suggests that the relationship between enterprises and the state is both less uniform and more complex. Secondly, an analysis of the decision making process for ‘consumers’ of corruption suggests that levels of corruption are not just dependent on the specific anti-corruption strategies, or even the costs and benefits of specific cases of corruption, but are in fact dependent on a more complex set of factors across the institutional forms which firms may participate in for the purpose of gain. The narrow conception of the activity of the firm and the entrepreneur as being constrained to a narrow set of economic institutions is dangerously over-simple and accordingly produces simplistic and misleading conclusions for anti-corruption policy. A broader, institutional view of economic activity provides the potential to open up the analysis of corruption in constructive new ways.

This paper extends the examination of the ‘demand’ side for corruption by placing it against alternative strategies that firms may adopt using different institutional routes: through forms of activity seeking to win advantage within the market, political and legal institutional structures of the economy. In this perspective, the attempts of firms to perform acts of ‘state capture’ (Hellman et al, 2000) rather than simple bribing of administrative or judicial officials (see Kaufmann & Wei, 2000) appears more a rational strategy to pursue competitive advantage by use of the most efficient institutional arrangements. This approach has a distinct advantage in realistically explaining actual behaviour of firms as it emphasises the inevitability of corruption from opportunistic firms operating in an environment where redistribution of property 16 rights need not only be pursued through the ‘pursuit of profit’ as described by the orthodox economic analysis.

Ultimately, corruption should be seen as a complementary form of competition to that conducted in the market arena, and the inevitability of corruption should be seen as strong grounds for the imposition of (considered) regulation rather than its removal as often advocated by neo-liberal economists in both academic economics and the Washington institutions.

References Bardhan, Pranab (1997) ‘Corruption and development: a review of issues,’ Journal of Economic Literature. 35/3 (Sept): 1320-1346. Baumol, William J. (1990) ‘Entrepreneurship: productive, unproductive and destructive,’ Journal of Political Economy. 98/5: 893-921. Dorfman, Robert and Steiner, Peter O. (1954) ‘Optimal advertising and optimal quality,’ American Economic Review. 44/5: 826-836. Ehrlich, I. & Lui, F.T. (1999) ‘Bureaucratic corruption and endogenous economic growth,’ Journal of Political Economy, 107/6 (Part 2: Symposium on the Economic Analysis of Social Behavior in Honor of Gary S. Becker): S270- S293 Freedom House (2001) Nations in Transit 2001: Civil Society, Democracy and Markets in East Central Europe and the Newly Independent States. (New Brunswick NJ: Freedom House/Transaction Publishers) Gray, Cheryl, Hellman, Joel, & Ryterman, Randi (2004) Anticorruption in Transition 2: Corruption in Enterprise-State Interaction in Europe and Central Asia 1999-2002. (Washington: World Bank) Guasch, J. Luis and Hahn, Robert W. (1997) ‘The costs and benefits of deregulation: some implications for developing countries.’ (Washington: World Bank Working Paper WPS1773) Handelman, Stephen (2001) ‘Thieves in power: the new challenge of corruption’, in Freedom House (2001), pp.45-54 Hellman, Joel S., Jones, Geraint & Kaufmann, Daniel (2000) ‘Seize the State, Seize the Day: State Capture, Corruption and Influence in Transition.’ (World Bank Policy Research Working Paper 2444) Huntington, Samuel (1968) Political Order in Changing Societies. (London: Yale University Press) 17

Jaffe, A.B., Peterson, S.R., Portney, P.R., & Stavins, R.N. (1995) ‘Environmental regulation and the competitiveness of U.S. manufacturing: what does the evidence tell us?,’ Journal of Economic Literature. 33/1: 132-163. Kaufmann, D., A. Kraay & P. Zoido-Lobaton (2002) ‘Governance Matters II: Updated indicators for 2000/01’ (World Bank Policy Research Working Paper 2772, February 2002) Kaufmann, Daniel & Wei, Shang-Jin (2000) ‘Does ‘Grease Money’ Speed Up the Wheels of Commerce?’ (IMF Working Paper WP/00/64) Krueger, Anne O. (1974) ‘The political economy of the rent-seeking society,’ American Economic Review, 64/3 (June): 291-303 Lui, Francis T. (1985) ‘An equilibrium queuing model of bribery,’ Journal of Political Economy. 93/4: 760-781. Mauro, P. (1995) ‘Corruption and Growth,’ Quarterly Journal of Economics. 110/3: 681-712 Myrdal, G. (1968) Asian Drama: an inquiry into the poverty of nations. (NY: Pantheon) cited in Lui, (1985), p.761. North, Douglass C. (1971) ‘Institutional change and economic growth,’ Journal of Economic History. 31/1: 118-25. North, Douglass C. (1990) Institutions, Institutional Change and Economic Performance. (Cambridge: Cambridge University Press) Przeworski, Adam & Limongi, Fernando (1993) ‘Political regimes and economic growth’, Journal of Economic Perspectives. 7/3 (Summer 1993): 51-69. Reinikka, R. & Svensson, J. (2002) ‘Measuring and understanding corruption at the micro level.’ Chapter 8 in Della Ports, Donatella and Rose-Ackerman, Susan (eds.) Corrupt Exchanges: empirical themes in the politics and political economy of corruption. (Baden-Baden: Nomos Verlagsgesellshaft) Ritzen, Jo, Easterly, William and Woolcock, Michael (2000) ‘On “good” politicians and “bad” policies: social cohesion, institutions and growth.’ (Washington: World Bank Working Paper WPS 2448) Rose-Ackerman, Susan (1999) Corruption and Government: causes, consequences and reform. (Cambridge: Cambridge University Press) Shapiro, Carl and Stiglitz, Joseph E. (1984) ‘Equilibrium unemployment as a worker discipline device,’ American Economic Review. 74/3: 433-444. Shin, Myoung-Ho (1999) ‘Developing effective anti-corruption strategies in a changing world.’ Paper presented at the 9th International Anti-Corruption Conference, Durban, 1999. 18

Shleifer, Andrei (2000) ‘Understanding regulation,’ European Financial Management. 11/4: 439-451. Tullock, Gordon (1989) ‘Controlling corruption,’ Journal of Economic Literature. 27/2: 658-659. Tullock, Gordon (1998) ‘The fundamentals of rent-seeking,’ The Locke Luminary. I/2 (Winter 1998) Part 2 Wei, S-J. (2000) ‘How taxing is corruption on international investors?,’ Review of Economics and Statistics. 82/1: 1-11 Werlin, H.H. (1973) ‘The consequences of corruption: the Ghanaian case,’ Political Science Quarterly. 88/1: 71-85. Williamson, Oliver E. (2000) ‘The new institutional economics: taking stock, looking ahead,’ Journal of Economic Literature. 38/3 (September): 595-613. i Although the result may apply even when deviations from these conditions occur, depending on particular circumstances.