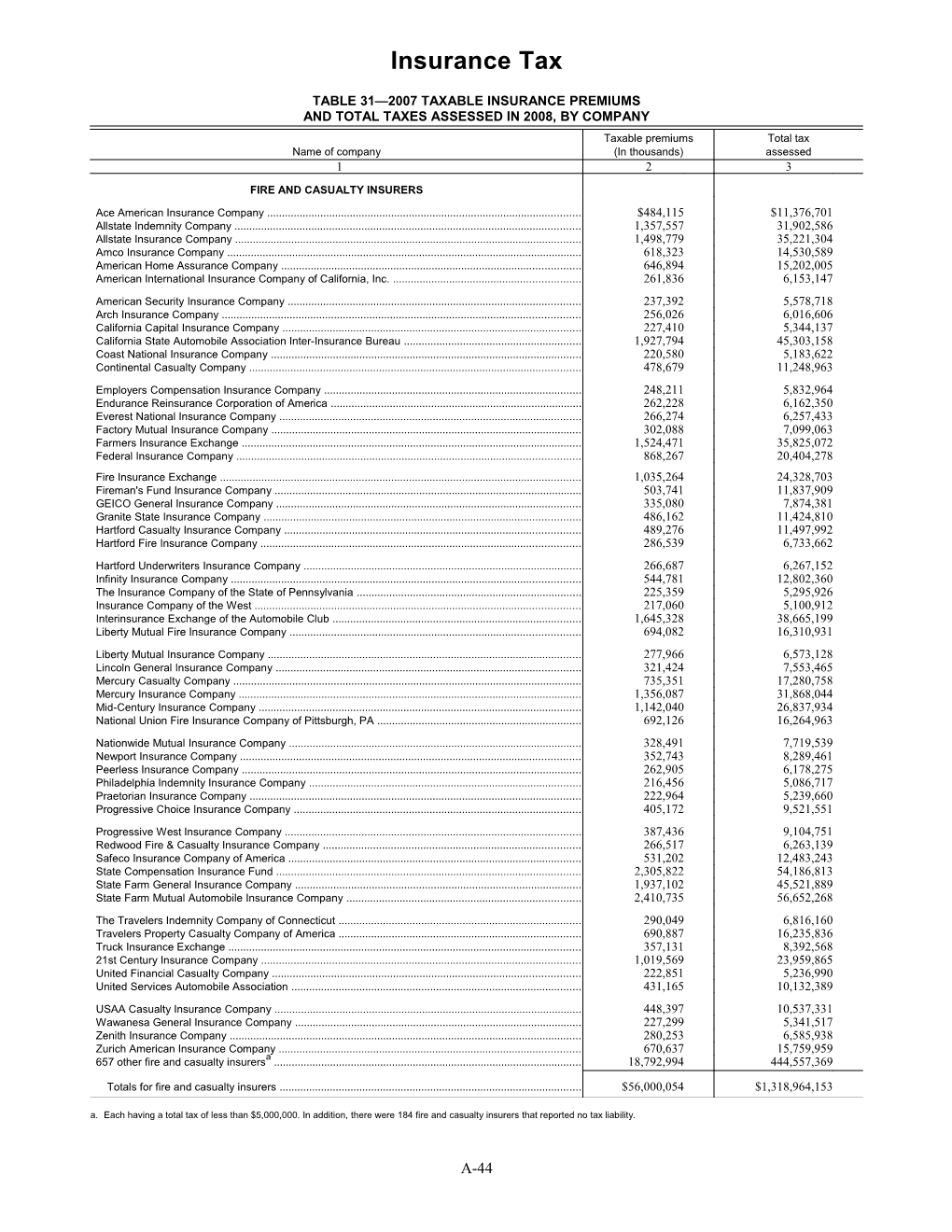

Insurance Tax

TABLE 31—2007 TAXABLE INSURANCE PREMIUMS AND TOTAL TAXES ASSESSED IN 2008, BY COMPANY Taxable premiums Total tax Name of company (In thousands) assessed 1 2 3

FIRE AND CASUALTY INSURERS

Ace American Insurance Company ...... $484,115 $11,376,701 Allstate Indemnity Company ...... 1,357,557 31,902,586 Allstate Insurance Company ...... 1,498,779 35,221,304 Amco Insurance Company ...... 618,323 14,530,589 American Home Assurance Company ...... 646,894 15,202,005 American International Insurance Company of California, Inc...... 261,836 6,153,147 American Security Insurance Company ...... 237,392 5,578,718 Arch Insurance Company ...... 256,026 6,016,606 California Capital Insurance Company ...... 227,410 5,344,137 California State Automobile Association Inter-Insurance Bureau ...... 1,927,794 45,303,158 Coast National Insurance Company ...... 220,580 5,183,622 Continental Casualty Company ...... 478,679 11,248,963 Employers Compensation Insurance Company ...... 248,211 5,832,964 Endurance Reinsurance Corporation of America ...... 262,228 6,162,350 Everest National Insurance Company ...... 266,274 6,257,433 Factory Mutual Insurance Company ...... 302,088 7,099,063 Farmers Insurance Exchange ...... 1,524,471 35,825,072 Federal Insurance Company ...... 868,267 20,404,278 Fire Insurance Exchange ...... 1,035,264 24,328,703 Fireman's Fund Insurance Company ...... 503,741 11,837,909 GEICO General Insurance Company ...... 335,080 7,874,381 Granite State Insurance Company ...... 486,162 11,424,810 Hartford Casualty Insurance Company ...... 489,276 11,497,992 Hartford Fire Insurance Company ...... 286,539 6,733,662 Hartford Underwriters Insurance Company ...... 266,687 6,267,152 Infinity Insurance Company ...... 544,781 12,802,360 The Insurance Company of the State of Pennsylvania ...... 225,359 5,295,926 Insurance Company of the West ...... 217,060 5,100,912 Interinsurance Exchange of the Automobile Club ...... 1,645,328 38,665,199 Liberty Mutual Fire Insurance Company ...... 694,082 16,310,931 Liberty Mutual Insurance Company ...... 277,966 6,573,128 Lincoln General Insurance Company ...... 321,424 7,553,465 Mercury Casualty Company ...... 735,351 17,280,758 Mercury Insurance Company ...... 1,356,087 31,868,044 Mid-Century Insurance Company ...... 1,142,040 26,837,934 National Union Fire Insurance Company of Pittsburgh, PA ...... 692,126 16,264,963 Nationwide Mutual Insurance Company ...... 328,491 7,719,539 Newport Insurance Company ...... 352,743 8,289,461 Peerless Insurance Company ...... 262,905 6,178,275 Philadelphia Indemnity Insurance Company ...... 216,456 5,086,717 Praetorian Insurance Company ...... 222,964 5,239,660 Progressive Choice Insurance Company ...... 405,172 9,521,551 Progressive West Insurance Company ...... 387,436 9,104,751 Redwood Fire & Casualty Insurance Company ...... 266,517 6,263,139 Safeco Insurance Company of America ...... 531,202 12,483,243 State Compensation Insurance Fund ...... 2,305,822 54,186,813 State Farm General Insurance Company ...... 1,937,102 45,521,889 State Farm Mutual Automobile Insurance Company ...... 2,410,735 56,652,268 The Travelers Indemnity Company of Connecticut ...... 290,049 6,816,160 Travelers Property Casualty Company of America ...... 690,887 16,235,836 Truck Insurance Exchange ...... 357,131 8,392,568 21st Century Insurance Company ...... 1,019,569 23,959,865 United Financial Casualty Company ...... 222,851 5,236,990 United Services Automobile Association ...... 431,165 10,132,389 USAA Casualty Insurance Company ...... 448,397 10,537,331 Wawanesa General Insurance Company ...... 227,299 5,341,517 Zenith Insurance Company ...... 280,253 6,585,938 Zurich American Insurance Company ...... 670,637 15,759,959 a 657 other fire and casualty insurers ...... 18,792,994 444,557,369

Totals for fire and casualty insurers ...... $56,000,054 $1,318,964,153 a. Each having a total tax of less than $5,000,000. In addition, there were 184 fire and casualty insurers that reported no tax liability.

A-44 Insurance Tax

TABLE 31—2007 TAXABLE INSURANCE PREMIUMS AND TOTAL TAXES ASSESSED IN 2008, BY COMPANY—Concluded Taxable premiums Total tax Name of company (In thousands) assessed 1 2 3

LIFE INSURERS

Aetna Life Insurance Company ...... $1,140,784 $26,798,254 American Family Life Assurance Company of Columbus ...... 277,796 6,528,211 American General Life Insurance Company ...... 484,273 10,980,680 Anthem Blue Cross Life & Health Insurance Company ...... 3,180,910 74,751,386 AXA Equitable Life Insurance Company ...... 322,125 7,782,012 Blue Shield of California Life & Health Insurance Company ...... 486,540 11,433,686 Connecticut General Life Insurance Company ...... 687,769 16,150,948 Farmers New World Life Insurance Company ...... 245,175 5,745,585 Genworth Life & Annuity Insurance Company ...... 247,513 5,647,921 Genworth Life Insurance Company ...... 274,160 6,338,362 The Guardian Life Insurance Company of America ...... 515,709 11,984,765 Hartford Life & Accident Insurance Company ...... 261,674 6,149,345 Hartford Life & Annuity Insurance Company ...... 164,453 3,861,117 Hartford Life Insurance Company ...... 748,215 17,554,185 Health Net Life Insurance Company ...... 757,586 17,803,273 John Hancock Life Insurance Company ...... 205,650 3,694,637 John Hancock Life Insurance Company (U.S.A.) ...... 433,941 10,070,911 John Hancock Variable Life Insurance Company ...... 200,957 4,699,750 Liberty Life Assurance Company of Boston ...... 154,737 3,636,020 Life Insurance Company of North America ...... 246,100 5,783,339 Lincoln Benefit Life Company ...... 217,047 5,135,861 The Lincoln National Life Insurance Company ...... 536,579 12,529,294 Massachusetts Mutual Life Insurance Company ...... 302,817 6,464,438 Metropolitan Life Insurance Company ...... 1,364,915 31,928,014 Minnesota Life Insurance Company ...... 165,290 3,864,698 Nationwide Life Insurance Company ...... 374,901 8,681,186 New York Life Insurance & Annuity Corporation ...... 371,698 8,006,365 New York Life Insurance Company ...... 711,906 16,299,999 The Northwestern Mutual Life Insurance Company ...... 637,108 14,490,253 Om Financial Life Insurance Company ...... 173,525 3,729,393 Pacific Life Insurance Company ...... 553,166 11,466,535 Pacificare Life & Health Insurance Company ...... 545,458 12,818,271 Primerica Life Insurance Company ...... 277,267 6,515,762 Principal Life Insurance Company ...... 454,903 9,934,967 Protective Life Insurance Company ...... 202,274 4,748,083 Pruco Life Insurance Company ...... 199,236 4,677,915 The Prudential Insurance Company of America ...... 553,620 15,981,800 Reliance Standard Life Insurance Company ...... 131,041 3,079,471 Reliastar Life Insurance Company ...... 231,014 5,397,080 Riversource Life Insurance Company ...... 180,043 4,205,784 Standard Insurance Company ...... 293,170 6,867,931 State Farm Life Insurance Company ...... 300,227 6,992,953 Sun Life Assurance Company of Canada ...... 183,894 4,306,807 Sun Life Assurance Company of Canada (U.S.) ...... 161,200 3,755,490 Transamerica Occidental Life Insurance Company ...... 336,743 7,906,894 United Healthcare Insurance Company ...... 792,520 18,624,216 United of Omaha Life Insurance Company ...... 182,467 3,688,904 Unum Life Insurance Company of America ...... 381,041 8,954,457 Western Reserve Life Assurance Company of Ohio ...... 251,663 5,912,730 b 369 other life insurers ...... 7,014,594 155,516,157 c Totals for life insurers ...... $29,117,394 $669,876,095 c Totals for fire and casualty insurers ...... 56,000,054 1,318,964,153 d Totals for title insurers ...... 413,651 9,888,267c

Totals for all insurers ...... $85,531,099 $1,998,728,515 b. Each having a total tax of less than $3,000,000. In addition, there were 51 life insurers that reported no tax liability. c. Retaliatory taxes of $2,962,991 for fire and casualty insurers, $442,667 for life insurers, and $167,501 for title insurers have been included in the assessments by company. d. Includes 19 insurers. In addition, there were four title insurers that reported no tax liability.

NOTE: Detail may not compute to total due to rounding.

A-45