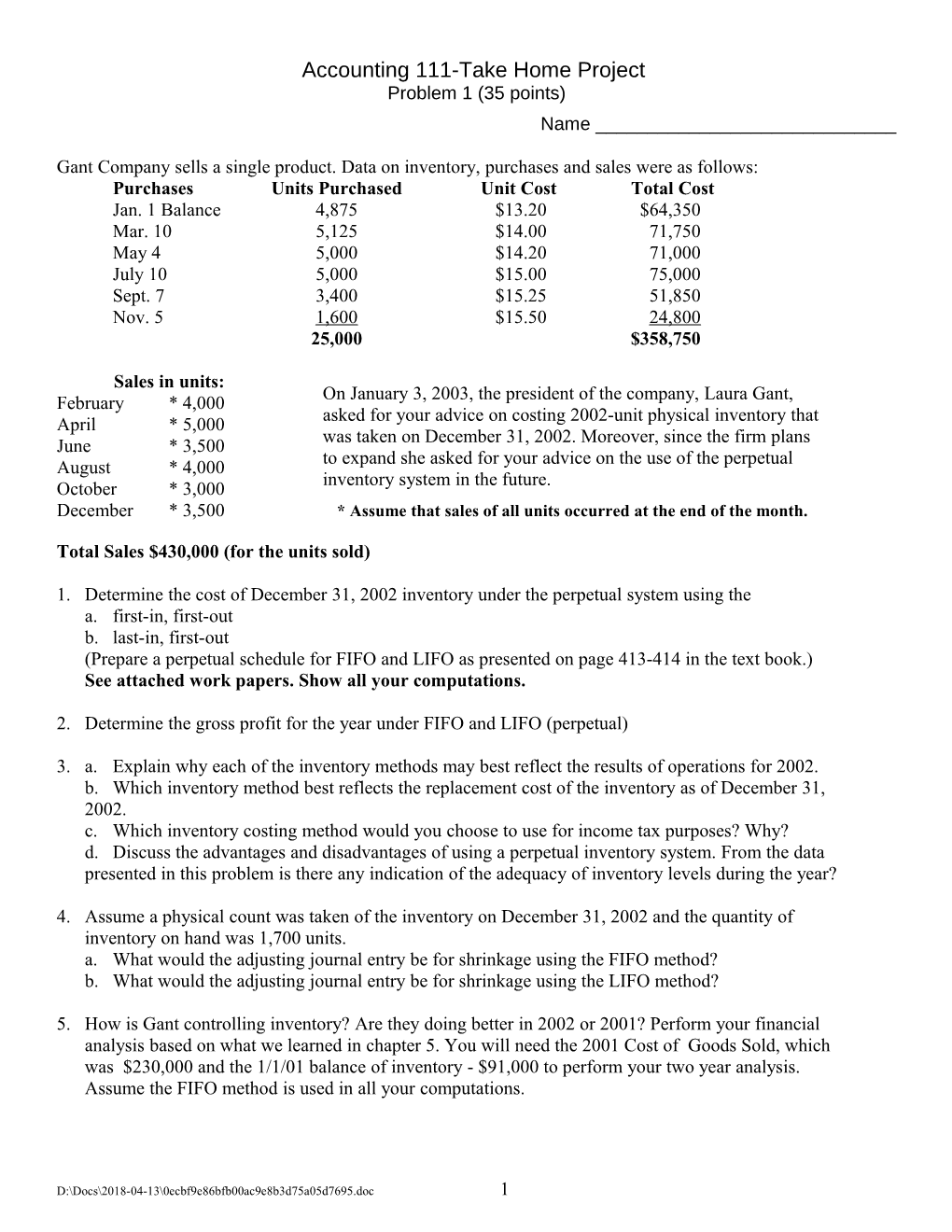

Accounting 111-Take Home Project Problem 1 (35 points) Name ______

Gant Company sells a single product. Data on inventory, purchases and sales were as follows: Purchases Units Purchased Unit Cost Total Cost Jan. 1 Balance 4,875 $13.20 $64,350 Mar. 10 5,125 $14.00 71,750 May 4 5,000 $14.20 71,000 July 10 5,000 $15.00 75,000 Sept. 7 3,400 $15.25 51,850 Nov. 5 1,600 $15.50 24,800 25,000 $358,750

Sales in units: On January 3, 2003, the president of the company, Laura Gant, February * 4,000 asked for your advice on costing 2002-unit physical inventory that April * 5,000 was taken on December 31, 2002. Moreover, since the firm plans June * 3,500 to expand she asked for your advice on the use of the perpetual August * 4,000 inventory system in the future. October * 3,000 December * 3,500 * Assume that sales of all units occurred at the end of the month.

Total Sales $430,000 (for the units sold)

1. Determine the cost of December 31, 2002 inventory under the perpetual system using the a. first-in, first-out b. last-in, first-out (Prepare a perpetual schedule for FIFO and LIFO as presented on page 413-414 in the text book.) See attached work papers. Show all your computations.

2. Determine the gross profit for the year under FIFO and LIFO (perpetual)

3. a. Explain why each of the inventory methods may best reflect the results of operations for 2002. b. Which inventory method best reflects the replacement cost of the inventory as of December 31, 2002. c. Which inventory costing method would you choose to use for income tax purposes? Why? d. Discuss the advantages and disadvantages of using a perpetual inventory system. From the data presented in this problem is there any indication of the adequacy of inventory levels during the year?

4. Assume a physical count was taken of the inventory on December 31, 2002 and the quantity of inventory on hand was 1,700 units. a. What would the adjusting journal entry be for shrinkage using the FIFO method? b. What would the adjusting journal entry be for shrinkage using the LIFO method?

5. How is Gant controlling inventory? Are they doing better in 2002 or 2001? Perform your financial analysis based on what we learned in chapter 5. You will need the 2001 Cost of Goods Sold, which was $230,000 and the 1/1/01 balance of inventory - $91,000 to perform your two year analysis. Assume the FIFO method is used in all your computations.

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 1 Parts 2-4

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 2 Parts 2-4

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 3 Purchases Cost of Goods Sold Inventory Date Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 4 Purchases Cost of Goods Sold Inventory Date Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 5 Purchases Cost of Goods Sold Inventory Date Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 6 Problem 2 (30 points),

Part 1 New tire re-treading equipment, acquired at a cost of $120,000 at the beginning of a fiscal year, has an estimated useful life of 5 years and an estimated residual value of $10,000. The manager requested information regarding the alternative methods on the amount of depreciation expense each year.

Instructions: Determine the amount of depreciation expense, accumulated depreciation, and book value for the years ended December 31, 1996, 1997, 1998, 1999, 2000 by a. the straight line method b. the declining balance at twice the straight line rate c. units of production Assume that it is estimated that the equipment will be used for 10,000 operating hours. (2,500 (96), 3,000 (97), 2,750 (98), 1,500 (99), 250 (2000)). a. Straight Line Accumulated Depreciation Depreciation Book Value Year Expense End of Year 1 2 3 4 5 b. Declining Balance at twice the straight line rate Accumulated Depreciation Depreciation Book Value Year Expense End of Year 1 2 3 4 5 c. Units of Production Accumulated Depreciation Depreciation Book Value Year Expense End of Year 1 2 3 4 5

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 7 Part 2 Assume that the manager decided to use the declining balance method at twice the straight line rate beginning in year 1. Record the following journal entries:

1. In year 1 paid $1,000 for an ordinary repair. 2. On January 1, of year 2 paid $10,000 for a major engine overhaul. 3. On July 1, year 4, sold the equipment for $20,000. SHOW ALL SUPPORTING COMPUTATIONS IN GOOD FORM

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 8 Problem 3 (35 points),

Use a Journal from your work papers and attach. Journalize the transactions below of Grainger Company, completed during the fiscal year ended December 31, are as follows:

March 1 Purchased merchandise inventory on account from Perry Co., $15,000. April 10 Issued a 60-day, 12% note for $15,000 to Perry Co. on account. June 9 Paid Perry Co. the amount owed on the note of April 10. November 14 Record the bi-weekly employee compensation journal entry based on the following data. Salaries: Deductions: Sales Salaries $9,500 Federal Income tax withheld $2,950 Office Salaries 4,500 FICA Tax Withheld 900 $14,000

Unemployment tax rates assumed: Salaries subject to federal and state unemployment taxes State unemployment 3.8% $2,000 Federal unemployment .8%

Nov. 14 Journalized the employers payroll taxes on the payroll of November 14. Nov. 19 Issued a check in payment of the employee compensation accrued on November 14. Nov. 19 Issued a check in payment of employees federal income tax and FICA Taxes on the Nov. 14 payroll. Nov. 20 Purchased Office Equipment from Bunn Company for $80,000, paying $8,000 and issuing a single one-year note and that the terms required principal payments of $6,000 each 30 days, plus interest at 12% on the principal before applying the $6,000 payment. Dec. 20 Paid the amount due (Principle plus interest) on the first installment to Bunn Company on the note issued on November 20. Dec. 31 Journalize the adjusting entry for the accrued interest at December 31 on the note owed to Bunn Company. Jan. 19 Journalize the entry for the second payment on the 11/20 note.

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 9 Journal

Post Date Description Debit Credit Ref. 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 15 15 16 16 17 17 18 18 19 19 20 20 21 21 22 22 23 23 24 24 25 25 26 26 27 27 28 28 29 29

30 30 Journal

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 10 Post Date Description Debit Credit Ref. 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 15 15 16 16 17 17 18 18 19 19 20 20 21 21 22 22 23 23 24 24 25 25 26 26 27 27 28 28 29 29 30 30

D:\Docs\2018-04-13\0ecbf9e86bfb00ac9e8b3d75a05d7695.doc 11