L A T V I A ' S P A Y M E N T S T A T I S T I C S I N T H E S E C O N D H A L F O F 2 0 1 5

In the second half of 2015, 17 credit institutions registered in Latvia and six branches, registered in Latvia, of credit institutions registered in other countries (hereinafter, credit institutions), one licensed electronic money (hereinafter, e-money) institution, Latvijas Banka and the Treasury as well as the SJSC Latvijas Pasts (hereinafter, Latvijas Pasts) submitted payment statistics pursuant to Latvijas Banka's "Regulation for Compiling "Credit Institution, Electronic Money Institution and Payment Institution Payment Statistics Report"", which entered into force on 1 July 2014.

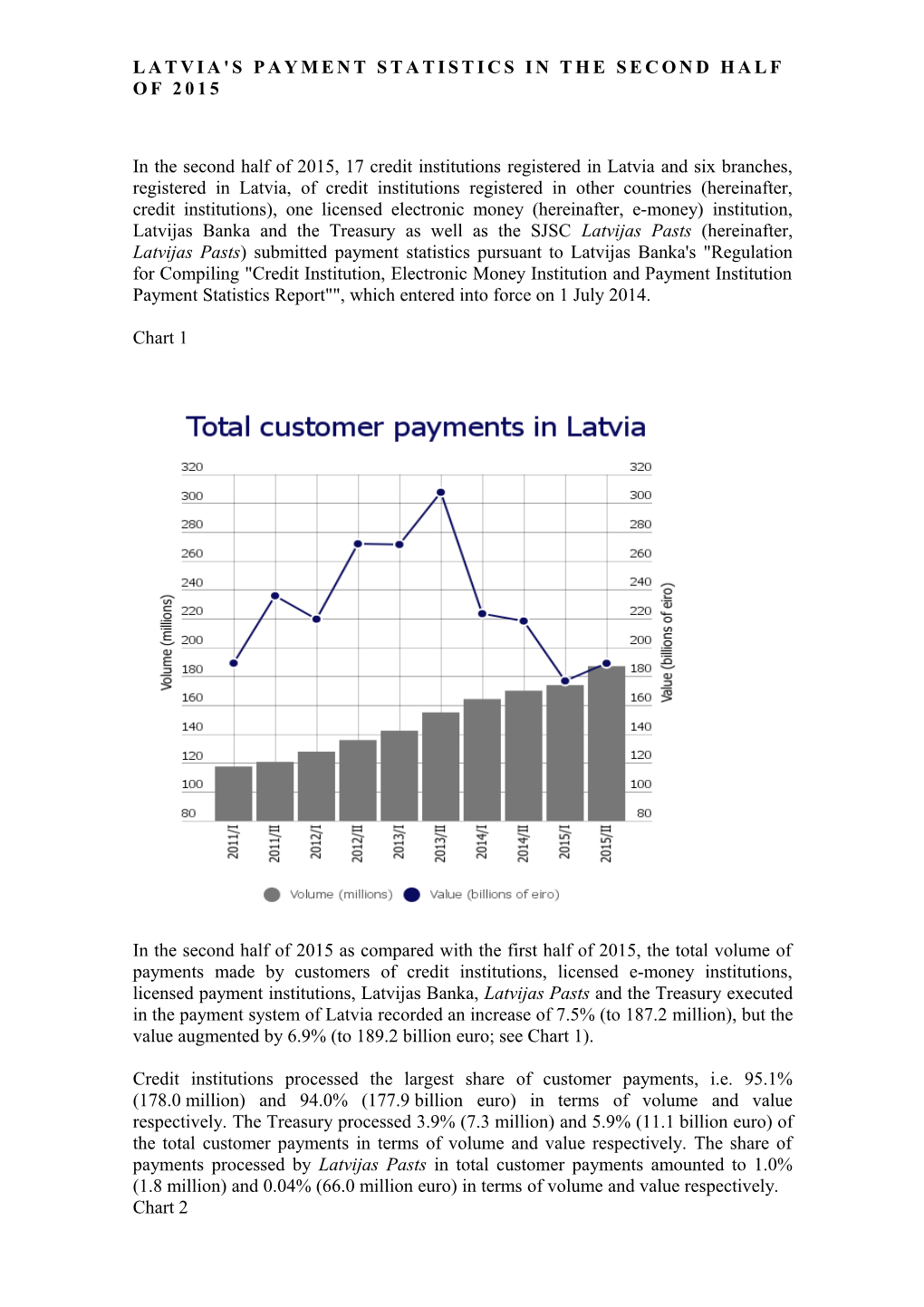

Chart 1

In the second half of 2015 as compared with the first half of 2015, the total volume of payments made by customers of credit institutions, licensed e-money institutions, licensed payment institutions, Latvijas Banka, Latvijas Pasts and the Treasury executed in the payment system of Latvia recorded an increase of 7.5% (to 187.2 million), but the value augmented by 6.9% (to 189.2 billion euro; see Chart 1).

Credit institutions processed the largest share of customer payments, i.e. 95.1% (178.0 million) and 94.0% (177.9 billion euro) in terms of volume and value respectively. The Treasury processed 3.9% (7.3 million) and 5.9% (11.1 billion euro) of the total customer payments in terms of volume and value respectively. The share of payments processed by Latvijas Pasts in total customer payments amounted to 1.0% (1.8 million) and 0.04% (66.0 million euro) in terms of volume and value respectively. Chart 2 In the second half of 2015, as in the first half of 2015, the most frequently used non- cash payment instrument was card payments (112.2 million payments; an increase of 9.0% as compared with the first half of 2015). The share of card payments continued to follow an upward path, and these payments constituted 63.0% of total payments made by customers of credit institutions. 94.2% of card payments were initiated at point-of- sale terminals (hereinafter, POSs), while other payments were initiated remotely with payment cards via the internet. In the second half of 2015 as compared with the first half of 2015, the value of card payments climbed by 10.3% and was 2.2 billion euro.

The volume and value of credit transfers made by customers of credit institutions increased by 5.9% (to 65.7 million) and 6.9% (to 175.7 billion euro) respectively.

Cards were used not only for making card payments but also for cash deposits in ATMs and withdrawals from ATMs, cash withdrawals from POSs and initiation of credit transfers at ATMs. Transactions of cash withdrawals from and deposits in ATMs augmented both in terms of volume and value. In the second half of 2015, 28.5 million withdrawals amounting to 2.8 billion euro were performed from ATMs (in comparison with the first half of 2015, the increase constitutes 3.3% and 8.7% in terms of volume and value). The volume of cash deposits in ATMs went up by 2.6% (4.2 million deposits), but the value rose by 10.8% (to 1.4 billion euro). Cash was also withdrawn from POSs. This service provides an opportunity to receive cash with a payment card at points of sale specially designated for this purpose. In the second half of 2015, the option of cash withdrawals from POSs was used 145.6 thousand times in the total of 6.2 million euro (the volume of cash withdrawals as compared to the first half of 2015 decreased by 1.0%, while the value of withdrawals increased by 8.7%). Chart 3 The number of customer payment accounts recorded a drop of 3.9% (to 3.4 million) in the second half of 2015 in comparison with the first half of 2015 (see Chart 3). On average, 1.7 payment accounts per capita were opened at the end of 2015.

Chart 4

The number of cards issued remained broadly unchanged in the second half of 2015 in comparison with the first half of 2015 (an increase of 1.0% to 2.4 million) or 1.2 cards per capita. 72.0% (1.7 million) of the total number of cards were cards with a debit function, which provided an opportunity to make payments from customer funds, while 15.2% (362.1 thousand) were cards with a credit function enabling card holders to effect settlement from the credit limit allocated by credit institutions. The number of cards with a credit function went up by 2.1% year-on-year. 13.5% of cards (321.3 thousand) were cards with a delayed debit function. Such cards provide an opportunity to use the credit line granted by a credit institution for settlement, repaying the granted loan in full at the end of the set period.

Chart 5

The number of Latvian credit institutions' POSs in Latvia and abroad stood at 31.0 thousand at the end of the second half of 2015 (which was 3.3% more than in the first half of 2015 (see Chart 5). At the end of 2015, 15 595 POSs were available per million inhabitants in Latvia.

Chart 6 The number of ATMs rose by 0.9% (to 1 058) at the end of the second half of 2015 (see Chart 6). At the end of the second half of 2015, 533 ATMs were installed per million inhabitants in Latvia.