For employees in AKASTOR Defined Contribution Pension and Disability Pension in DNB LIV

This is a brief introduction to the pension scheme Akastor has established for the employees.

Defined Contribution Pension Akastor pays an annual agreed contribution for each employee. The contributions are placed directly in the employee’s pension account. The total pension capital (contributions + return on investments) is paid as a retirement pension at the age of 67.

The contribution is as follows: 5 % of salary between 1 G* (NOK 90.068) and 6 G (NOK 540.408) 8 % of salary between 6 G (NOK 540.408) and 12 G (NOK 1.080.816) * G: Basic amount in the National Insurance Scheme = NOK 90.068 as of 1. May 2015

Contributions are not paid for salary above 12 G.

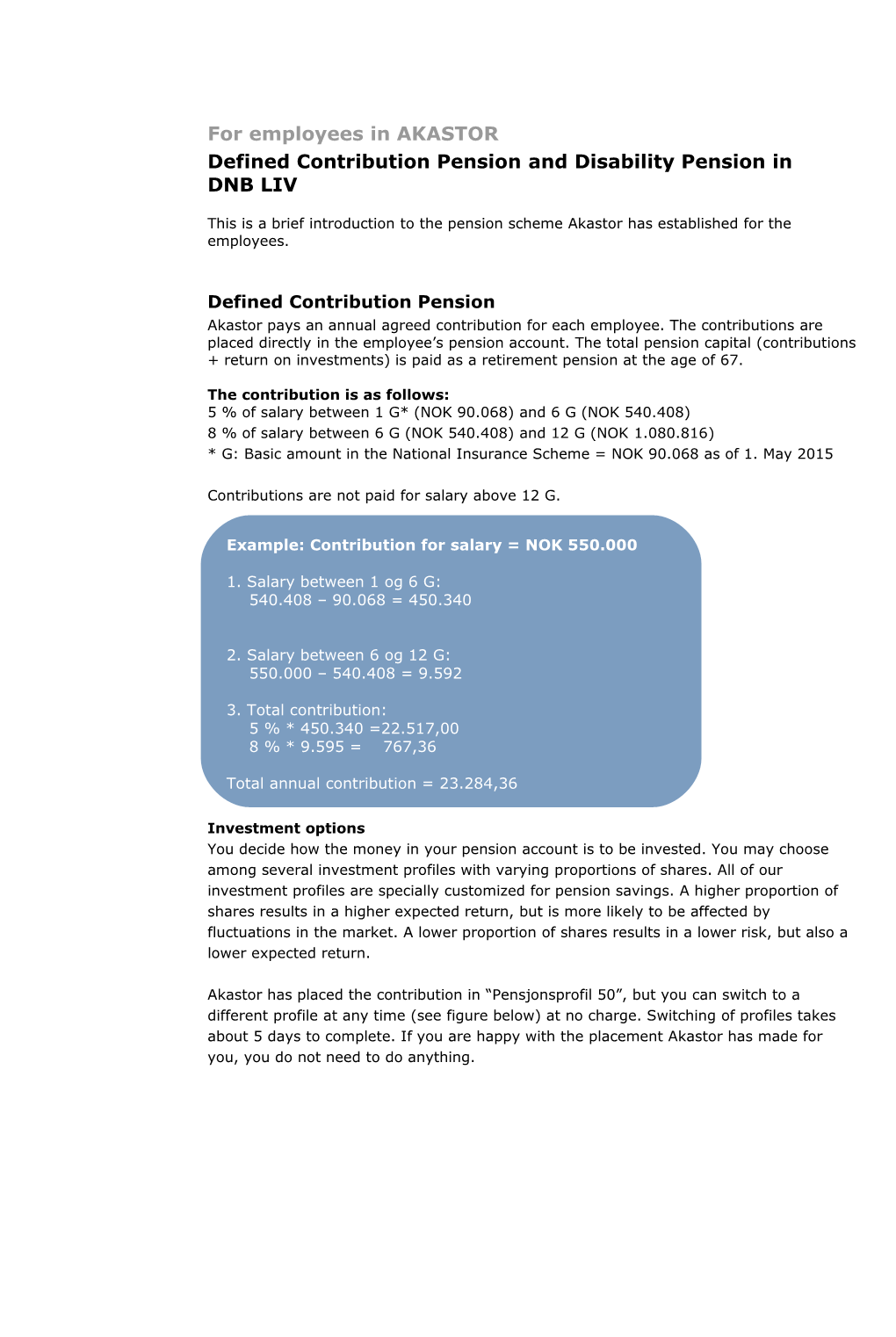

Example: Contribution for salary = NOK 550.000

1. Salary between 1 og 6 G: 540.408 – 90.068 = 450.340

2. Salary between 6 og 12 G: 550.000 – 540.408 = 9.592

3. Total contribution: 5 % * 450.340 =22.517,00 8 % * 9.595 = 767,36

Total annual contribution = 23.284,36

Investment options You decide how the money in your pension account is to be invested. You may choose among several investment profiles with varying proportions of shares. All of our investment profiles are specially customized for pension savings. A higher proportion of shares results in a higher expected return, but is more likely to be affected by fluctuations in the market. A lower proportion of shares results in a lower risk, but also a lower expected return.

Akastor has placed the contribution in “Pensjonsprofil 50”, but you can switch to a different profile at any time (see figure below) at no charge. Switching of profiles takes about 5 days to complete. If you are happy with the placement Akastor has made for you, you do not need to do anything. The investment profiles are named according to the proportion of equities. “Pensjonsprofil 50”, for example, consists of 50 % equities and is therefore less vulnerable to stock market fluctuations than “Pensjonsprofil 80”.

Asset mix “Pensjonsprofil 30 “Pensjonsprofil 50” “Pensjonsprofil 80”

Equities 30 % 50 % 80 %

Bonds 50 % 40 % 20 %

Money Market 20 % 10 % 0 %

Total assets 100 % 100 % 100 %

As an alternative to the profiles described above you can also choose “Pensjonsprofil 10”. “Pensjonsprofil 10” is mainly for employees who wish to reduce risk as they approach the age of retirement, but the profile can also be an alternative for those who seek less risk.

The proportion of equities in the profiles will be reduced during the last 10 years before retirement and will be 10 % at the age of 67.

Online services At www.dnb.no/akastor you can log on to our online services. Here, you can follow the development on your pension account and change your investment profile.

The easiest way to log on is to use “BankID”.

For questions, please contact DNB at tlf 05226

At retirement age From the age of 62, you may choose when to start your pension payment. You may also choose the number of years the pension is to be disbursed over, but minimum to the age of 77 years If the funds are low, the payment time will be shorter than described. You can choose to take a full or partial retirement, and you can combine the payment with continued work.The pension will be paid monthly, less tax, and comes in addition to the pension from the Norwegian National Insurance Scheme. See more details on the calculation of National Insurance on www.nav.no Inheritance of capital In the event of death, the balance in your pension account will be used as a pension for your survivors. Children under 21 have first priority, and an annual children’s pension of up to 1 G will be paid to each child. The remaining capital will be disbursed as pension to your spouse/cohabitant. If you have no children or spouse/ cohabitant, the balance will be paid as a lump sum to the estate.

Disability pension and contribution waiver Disability Pension The annual disability pension amounts to approx.. 60 % of the member's pensionable income (max 12 G), less calculated National Insurance benefit (3/4 basic pension). The size of the disability pension is proportionate to the degree of occupational disability. Full occupational disability entitles the member to full disability pension, and partial occupational disability entitles the member to partial disability pension that is proportionate to the degree of occupational disability.

The assumption to get full disability pension is that you can achieve a time period of 30 years with a pensionable age of 67. Enrolement in the pension plan at age 37 or older will shorten your pension according to the number of years to pensionable age of 67.

An additional 10 % of the disability pension is covered for supported children under age 21.

Contribution waiver A full or partial waiver for payment of pension contributions is granted in the case of full or partial incapacity for work. The contribution waiver means that Vital covers the contributions for members who have been at least 20 % disabled for work for a continuous period of 12 months. The size of the contribution waiver is proportionate to the degree of occupational disability.

If you leave Akastor If you leave Akastor, you will be withdrawn from the pension scheme. If you have been a member for more than 12 months, you keep the right to the pension capital that has been saved. If you have been a member for a shorter time than this, the capital goes back to the company.

More information? For more information contact your HR-dept., or contact DNB at telephone 05226