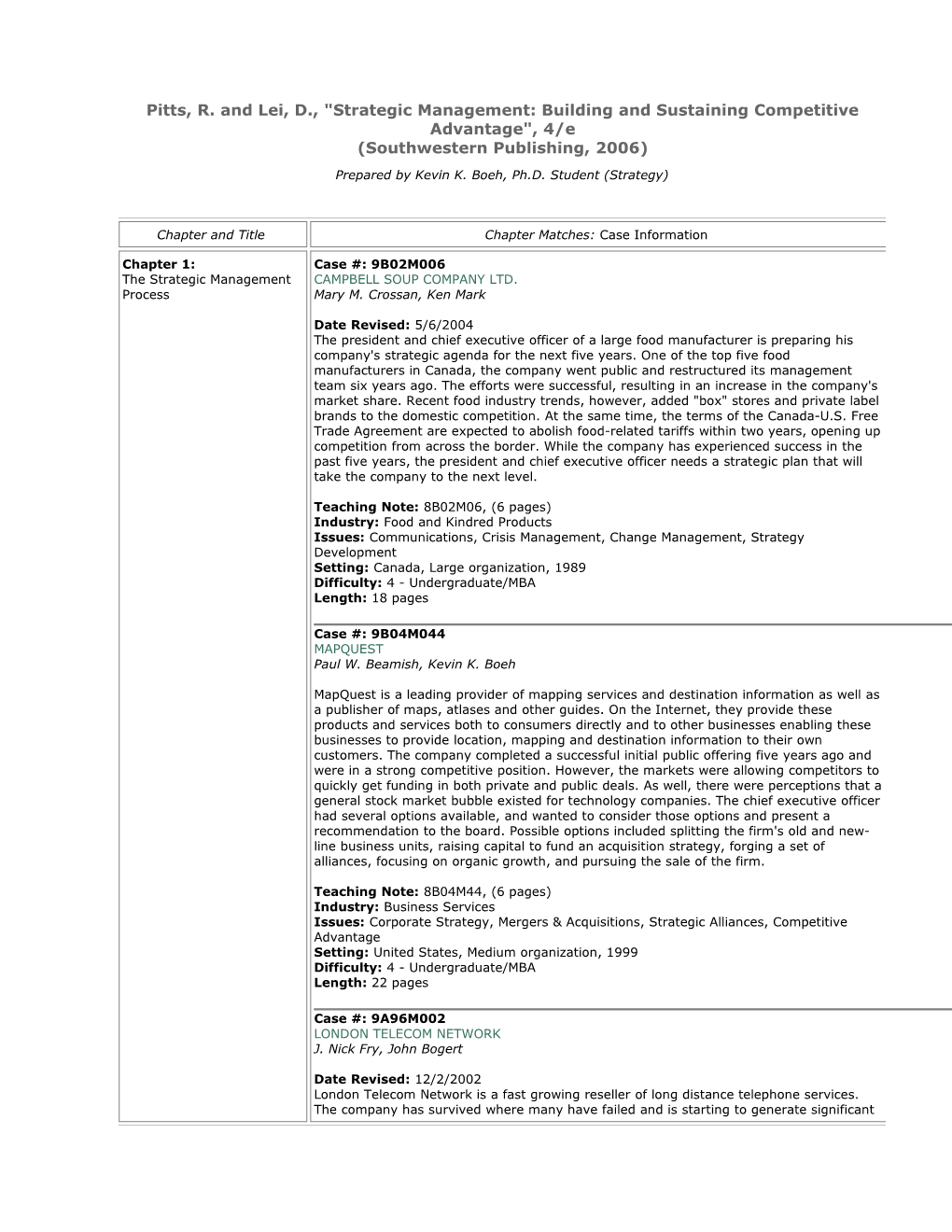

Pitts, R. and Lei, D., "Strategic Management: Building and Sustaining Competitive Advantage", 4/e (Southwestern Publishing, 2006)

Prepared by Kevin K. Boeh, Ph.D. Student (Strategy)

Chapter and Title Chapter Matches: Case Information

Chapter 1: Case #: 9B02M006 The Strategic Management CAMPBELL SOUP COMPANY LTD. Process Mary M. Crossan, Ken Mark

Date Revised: 5/6/2004 The president and chief executive officer of a large food manufacturer is preparing his company's strategic agenda for the next five years. One of the top five food manufacturers in Canada, the company went public and restructured its management team six years ago. The efforts were successful, resulting in an increase in the company's market share. Recent food industry trends, however, added "box" stores and private label brands to the domestic competition. At the same time, the terms of the Canada-U.S. Free Trade Agreement are expected to abolish food-related tariffs within two years, opening up competition from across the border. While the company has experienced success in the past five years, the president and chief executive officer needs a strategic plan that will take the company to the next level.

Teaching Note: 8B02M06, (6 pages) Industry: Food and Kindred Products Issues: Communications, Crisis Management, Change Management, Strategy Development Setting: Canada, Large organization, 1989 Difficulty: 4 - Undergraduate/MBA Length: 18 pages

Case #: 9B04M044 MAPQUEST Paul W. Beamish, Kevin K. Boeh

MapQuest is a leading provider of mapping services and destination information as well as a publisher of maps, atlases and other guides. On the Internet, they provide these products and services both to consumers directly and to other businesses enabling these businesses to provide location, mapping and destination information to their own customers. The company completed a successful initial public offering five years ago and were in a strong competitive position. However, the markets were allowing competitors to quickly get funding in both private and public deals. As well, there were perceptions that a general stock market bubble existed for technology companies. The chief executive officer had several options available, and wanted to consider those options and present a recommendation to the board. Possible options included splitting the firm's old and new- line business units, raising capital to fund an acquisition strategy, forging a set of alliances, focusing on organic growth, and pursuing the sale of the firm.

Teaching Note: 8B04M44, (6 pages) Industry: Business Services Issues: Corporate Strategy, Mergers & Acquisitions, Strategic Alliances, Competitive Advantage Setting: United States, Medium organization, 1999 Difficulty: 4 - Undergraduate/MBA Length: 22 pages

Case #: 9A96M002 LONDON TELECOM NETWORK J. Nick Fry, John Bogert

Date Revised: 12/2/2002 London Telecom Network is a fast growing reseller of long distance telephone services. The company has survived where many have failed and is starting to generate significant profits. Now management is beginning to look at a range of initiatives to further build the business. The situation raises some interesting questions for Rob Freeman, the founder and owner of the business. Are the circumstances right for the company to be pursuing new ideas? If so, which of the several proposals deserves priority attention?

Teaching Note: 8A96M02, (11 pages) Industry: Communications Industry Issues: Management Behaviour, Strategic Planning, Competitive Advantage Setting: Canada, Small organization, 1995 Difficulty: 4 - Undergraduate/MBA Length: 18 pages

Chapter 2: Case #: 9B03M016 Assessing Industry AMERICAN FAST FOOD IN KOREA Attractiveness and the Paul W. Beamish, Jaechul Jung, Hun-Hee Kim Competitive Environment A major U.S.-based fast food company with extensive operations around the world was contemplating whether or not they should enter the Korean market. The Korean fast food market was hit badly by the Asian economic crisis in the late 1990s, but the economy was turning around. Thus, fast food demand in Korea was expected to increase. For the industry analysis, this case provides information on various competitors, substitute foods, new entrants, consumers and suppliers. In addition, social issues are included as potential forces.

Teaching Note: 8B03M16, (15 pages) Industry: Eating and Drinking Places Issues: Industry Analysis, International Business, Fast Food, Market Entry Setting: Korea, Large organization, 2002 Difficulty: 4 - Undergraduate/MBA Length: 14 pages

Case #: 9B03M001 NOTE ON THE CUBAN CIGAR INDUSTRY Paul W. Beamish, Akash Kapoor

The cigar industry in Cuba has a mythical aura and renown that give it unparalleled recognition worldwide. The relationship between Cuba and the United States makes the situation in this industry particularly intriguing. Cuban cigars cannot currently be sold in the United States, even though it is the largest premium cigar market in the world. This note provides an opportunity for a structured analysis using Porter's five forces model and to consider several scenarios including the possible lifting of the U.S. embargo and the relaxation of Cuba's land ownership laws.

Teaching Note: 8B03M01, (19 pages) Industry: Tobacco Issues: Government and Business, Industry Analysis, International Business, Internationalization Setting: Cuba/USA/Canada, Large organization, 2002 Difficulty: 4 - Undergraduate/MBA Length: 23 pages

Chapter 3: Case #: 9A98M006 Matching Firm Capabilities STARBUCKS with Opportunities Mary M. Crossan, Ariff Kachra

Date Revised: 10/7/2002 Starbucks is faced with the issue of how it should leverage its core competencies against various opportunities for growth, including introducing its coffee in McDonalds, pursuing further expansion of its retail operations, and leveraging the brand into other product areas. The case is written so that students need to first identify where Starbucks competencies lie along the value chain, and assess how well those competencies can be leveraged across the various alternatives. It also provides an opportunity for students to assess what is driving growth in this company. Starbucks has a tremendous appetite for cash since all its stores are corporate, and investors are betting that it will be able to continue its phenomenal growth so it needs to walk a fine line between leveraging its brand to achieve growth while not eroding it in the process. It is an exciting case that quickly captures the attention of students given the subject matter.

Teaching Note: 8A98M06, (13 pages) Industry: Eating and Drinking Places Issues: Growth Strategy, Industry Analysis, Competitiveness, Core Competence Setting: USA, Large organization, 1997 Difficulty: 4 - Undergraduate/MBA Length: 28 pages

Case #: 9A97M005 SANDVIK AB SAWS & TOOLS: THE ERGO STRATEGY Rod E. White, Julian M. Birkinshaw

Date Revised: 11/18/2002 The Saws and Tools division of Sandvik AB has developed a competence in ergonomic hand tools. Arguably, they are the world leader in this area. The division president hopes the Ergo strategy, coupled with selective acquisitions, will enable Sandvik to dominate the global market for professional hand tools. But after investing in this strategy for several years, it has produced, to date, mixed results. Many customers, particularly those in North America, appear unwilling to pay a premium for ergonomic hand tools. The president must decide whether to continue to invest in the Ergo hand tool strategy. Two issues are central to this case: (1) understanding that a successful strategy represents a balance between core competencies and customer value, and (2) one competency is hardly enough to break into a new market. Success of the Ergo strategy in Europe was not solely attributable to a competence in the manufacture of ergonomic hand tools; other elements like distribution also played a key role.

Teaching Note: 8A97M05, (7 pages) Industry: Fabricated Metal Products Issues: Globalization, Core Competence, Global Product Setting: Sweden, Large organization, 1996 Difficulty: 4 - Undergraduate/MBA Length: 26 pages

Chapter 4: Case #: 9B04M033 Building Competitive JINJIAN GARMENT FACTORY: MOTIVATING GO-SLOW WORKERS Advantage through Tieying Huang, Junping Liang, Paul W. Beamish Distinction Jinjian Garment Factory is a large clothing manufacturer based in Shenzhen with distribution to Hong Kong and overseas. Although Shenzhen had become one of the most advanced garment manufacturing centres in the world, managers in this industry still had few effective ways of dealing with the collective and deliberate slow pace of work by the employees, of motivating workers, and of resolving the problem between seasonal production requirements and retention of skilled workers. However, the owner and managing director of the company must determine the reasons behind the deliberately slow pace of the workers, the pros and cons of the piecework system and the methods he could adopt to motivate the workers effectively.

Teaching Note: 8B04M33, (11 pages) Industry: Apparel and other Finished Products Issues: Employee Attitude, Productivity, Work-Force Management, Performance Measurement, Piece Work Setting: China, Small organization, 1999 Difficulty: 4 - Undergraduate/MBA Length: 8 pages

Case #: 9B00A019 GLOBAL BRANDING OF STELLA ARTOIS Paul W. Beamish, Anthony Goerzen

Date Revised: 11/22/2002 Interbrew had developed into the world's fourth largest brewer by acquiring and managing a large portfolio of national and regional beer brands in markets around the world. Recently, senior management had decided to develop one of their premium beers, Stella Artois, as a global brand. The early stages of Interbrew's global branding strategy and tactics are examined, enabling students to consider these concepts in the context of a fragmented but consolidating industry. It is suitable for use in courses in consumer marketing, international marketing and international business.

Teaching Note: 8B00A19, (7 pages) Industry: Food and Kindred Products Issues: Brands, International Business, International Marketing, Global Product Setting: Western Europe/Asia Pacific, Large organization, 2000 Difficulty: 4 - Undergraduate/MBA Length: 23 pages

Chapter 5: Case #: 9B01M055 Responding to Shifts in KODAK'S HEALTH IMAGING DIVISION IN ASIA (A) Competitive Advantage Richard DeMartino

Kodak's Health Imaging division is the second largest business unit within Kodak, a worldwide provider of consumer, professional and health imaging products. The regional manager of the Health Imaging division is preparing her presentation for the company's senior management retreat. The East Asian Crisis and its impact on the division are on the agenda. The regional manager reflects on the magnitude of the crisis, and she wonders if the company's responses were reactive instead of strategic. There will be some tough questions to rake through at the meeting. Did the Health Imaging department respond effectively to the crisis? Is Kodak better off because of the crisis? What will the short-term and long-term effects be? Will Kodak's response to the East Asian Crisis preserve customer relationships for the years to come? Information pertaining to Health Imaging's strategic view of the region, the company's organizational structure and the levers employed by Kodak in response to the crisis all serve to produce some answers for the division's future consideration. A supplementary (B) case is available, product 9B01M056.

Teaching Note: 8B01M55, (8 pages) Industry: Measuring & Analyzing Instruments Issues: Foreign Exchange, International Business, International Marketing, Pricing Strategy Setting: Asia, Large organization, 1999 Difficulty: 4 - Undergraduate/MBA Length: 17 pages

Case #: 9B00A009 COMPAQ COMPUTER CORPORATION: THE DELL CHALLENGE Adrian B. Ryans, Mark B. Vandenbosch

Date Revised: 7/12/2000 The new CEO of Compaq Computer, the world's second largest computer company, is facing some difficult decisions about how to combat the increasing threat posed by Dell Computer Corporation. The case describes the strategic moves made by Compaq in the late 1990s under the leadership of a previous CEO who was dismissed by Compaq's board earlier in the year. It also describes in some detail the history of Dell Computer and the evolution of the Dell Direct model. Compaq's new CEO faces some major issues, one of which is the resolution of the channel issues, particularly in the commercial personal computing segment. It is clear he faces some very tough strategic and marketing choices. The power of information technology and standards that have allowed Dell to build a powerful ecosystem with its customers, suppliers and complementers are illustrated in this powerful teaching case. With the support of these other players, Dell has been able to topple one of the great companies of the late 20th century from its leadership position. It also illustrates how difficult it is for a market leader to effectively respond to such a challenge.

Teaching Note: 8B00A09, (10 pages) Industry: Machinery except Electrical Issues: Competition, Marketing Channels, Market Strategy, E-Commerce Setting: International, Large organization, 1999 Difficulty: 5 - MBA/Postgraduate Length: 25 pages

Case #: 9A95M006 CANADA POST CORPORATION & THE I-WAY Mary M. Crossan, D. Bruce Lanning, Iris Tiemessen

Date Revised: 3/8/2002 The newly appointed senior vice-president of Canada Post Corporation's (CPC's) electronic products and services faced the challenge of assessing what impact the Information Superhighway (I-way) would have on CPC's future. CPC had transformed mail service in Canada from "simplistic" physical sorting to "intelligent" mechanized distribution. Although commercialization of the I-way attracted increasing news media and business attention daily, no one could answer exactly what the I-way would become, who would have access to it, who would administer the network, and how it would change CPC and other information transfer businesses. The case challenges students to analyze a complex and rapidly changing competitive environment where industry boundaries are blurred. (A 25-minute video can be purchased with this case, video 7A95M006.)

Teaching Note: 8A95M06, (15 pages) Industry: Communications Industry Issues: Industry Analysis, Policy Formulation/Implementation, Management of Technology, Competitiveness Setting: Canada, Large organization, 1994 Difficulty: 4 - Undergraduate/MBA Length: 17 pages

Chapter 6: Case #: 9B00M010 Corporate Strategy: NEWELL COMPANY: THE RUBBERMAID OPPORTUNITY Leveraging Resources J. Nick Fry

The Newell Company, a multi-billion dollar company dealing in hardware and home furnishings, office products and housewares, was contemplating a merger with Rubbermaid, a renowned manufacturer of plastic products. Newell had a remarkable record of success in growth by acquisition. Rubbermaid would mark a quantum step in this program, but equally, would pose a formidable challenge to Newell's capacity to integrate and strengthen acquisitions. Corporate strategy and advantage is studied, particularly through the Collis and Montgomery framework, to determine if the proposed merger is a step too far.

Teaching Note: 8B00M10, (7 pages) Industry: Rubber & Miscellaneous Plastics Products Issues: Corporate Strategy, Mergers & Acquisitions Setting: United States, Large organization, 1998 Difficulty: 4 - Undergraduate/MBA Length: 11 pages

Case #: 9B02A021 MCDONALD'S AND THE HOTEL INDUSTRY Mark B. Vandenbosch, Ken Mark

Date Revised: 1/5/2004 McDonald's, one of the world's strongest and most recognizable brands, intends to extend its "world's best quick service restaurant experience" brand into the hotel industry by launching a hotel in Illinois. An industry observer examines the hotel venture's positioning options and the McDonald's brand extension into a different product class.

Teaching Note: 8B02A21, (8 pages) Industry: Eating and Drinking Places Issues: Market Analysis, Brand Extension, Brand Management Setting: United States, Large organization, 2002 Difficulty: 4 - Undergraduate/MBA Length: 12 pages Chapter 7: Case #: 9B06M015 Global Strategy: Harnessing CAMERON AUTO PARTS (A) - REVISED New Markets Harold Crookell, Paul W. Beamish

This case is about a small American auto parts producer trying to diversify his way out of dependence on the major automakers. A promising new product is developed and the company gets a chance to license it to a Scottish manufacturer. The issue of whether to license or go it alone in international markets is central to the case. (A sequel to this case is available titled Cameron Auto Parts (B) - Revised, case 9B06M016.)

Teaching Note: 8B06M15, (8 pages) Industry: Transportation Equipment Issues: Corporate Strategy, Exports, International Business, Licensing Setting: US/United Kingdom, 2004 Difficulty: 4 - Undergraduate/MBA Length: 13 pages

Case #: 9B06M016 CAMERON AUTO PARTS (B) - REVISED Harold Crookell, Paul W. Beamish

Two years after signing a license agreement in the U.K., the company now faces an opportunity to establish with another firm a joint venture in France for the European market. However, the prospect upsets the U.K. licensee who is clearly doing very well, and who even wants Cameron to consider joint venturing with him in Australia. The case ends with Cameron, run off its feet in North America, trying to decide whether to enter Europe via licensing, joint venture or direct investment. (This case is a sequel to Cameron Auto Parts (A) - Revised, case 9B06M015.)

Teaching Note: 8B06M16, (7 pages) Industry: Transportation Equipment Issues: Corporate Strategy, International Business, Joint Ventures, Licensing Setting: US/Australia/EU Difficulty: 4 - Undergraduate/MBA Length: 11 pages

Chapter 8: Case #: 9B04M016 Strategic Alliances: ELI LILLY IN INDIA: RETHINKING THE JOINT VENTURE STRATEGY Partnering for Advantage Charles Dhanaraj, Paul W. Beamish, Nikhil Celly

Eli Lilly and Company is a leading U.S. pharmaceutical company. The new president of intercontinental operations is re-evaluating all of the company's divisions, including the joint venture with Ranbaxy Laboratories Limited, one of India's largest pharmaceutical companies. This joint venture has run smoothly for a number of years despite their difference in focus, but recently Ranbaxy was experiencing cash flow difficulties due to its network of international sales. In addition, the Indian government was changing regulations for businesses in India, and joining the World Trade Organization would have an effect on India's chemical and drug regulations. The president must determine if this international joint venture still fits Eli Lilly's strategic objectives.

Teaching Note: 8B04M16, (15 pages) Industry: Chemicals and Allied Products Issues: Joint Ventures, Strategic Alliances, Emerging Markets, International Management Setting: India/United States, Large organization, 2001 Difficulty: 4 - Undergraduate/MBA Length: 25 pages

Case #: 9B06M006 NORA-SAKARI: A PROPOSED JV IN MALAYSIA (REVISED) Paul W. Beamish, R. Azimah Ainuddin

This case presents the perspective of a Malaysian company, Nora Bhd, which was in the process of trying to establish a telecommunications joint venture with a Finnish firm, Sakari Oy. Negotiations have broken down between the firms, and students areasked to try to restructure a win-win deal. The case examines some of the most common issues involved in partner selection and design in international joint ventures.

Teaching Note: 8B06M06, (12 pages) Industry: Communications Industry Issues: Joint Ventures, Negotiation, Emerging Markets, Intercultural Relations Setting: Malaysia/Finland, Large organization, 2003 Difficulty: 4 - Undergraduate/MBA Length: 21 pages

Chapter 9: Case #: 9A94G005 Designing Organizations for GE ENERGY MANAGEMENT INITIATIVE (A) Advantage J. Nick Fry, Julian M. Birkinshaw

Date Revised: 7/4/2006 The business development manager for General Electric (GE) Canada, met with executives from GE Supply, a US-based distribution arm of GE. The purpose of the meeting was to discuss new business opportunities in energy management and efficiency. The business development manager had identified some opportunities for business development in Canada, while leveraging GE's strategic capabilities did not fit well with GE's corporate structure. He was keen to work with GE Supply but wanted to retain a high level of operating autonomy. The challenge was to put together an appropriate organizational structure and find a home for the new development idea. (A sequel to this case is available, titled GE Energy Management Initiative (B), case 9A94G006. A 12- minute video may also be purchased with this case, video 7A94G005.)

Teaching Note: 8A94G05, (13 pages) Industry: Electric & Electronic Equipment Supplies Issues: International Business, Multinational, Organizational Structure Setting: Canada, Large organization, 1992 Difficulty: 4 - Undergraduate/MBA Length: 10 pages

Case #: 9A94G006 GE ENERGY MANAGEMENT INITIATIVE (B) J. Nick Fry, Julian M. Birkinshaw

Date Revised: 6/13/2003 Six months into the operation of the energy management business, GE Energy Management Initiative has lost a bid for a large contract. Its general manager learns that the division to which it reports is getting out of the energy management business because of a questionable strategic fit within the division, and a lack of results. The general manager wonders how to proceed. (This is a sequel to The GE Energy Management Initiative (A), case 9A94G005.)

Teaching Note: 8A94G05, (13 pages) Industry: Electric & Electronic Equipment Supplies Issues: International Business, Multinational, Organizational Structure Setting: Canada, Large organization, 1992 Difficulty: 4 - Undergraduate/MBA Length: 4 pages

Chapter 10: Case #: 9B01M004 Organizing and Learning to VICTORIA HEAVY EQUIPMENT LIMITED - 2001 Sustain Value Tom A. Poynter, Paul W. Beamish

Victoria Heavy Equipment (Victoria) was a family owned and managed firm which had been led by an ambitious, entrepreneurial chief executive officer who now wanted to take a less active role in the business. Victoria had been through two reorganizations in recent years, which contributed to organizational and strategic issues which would need to be addressed by a new president.

Teaching Note: 8B01M04, (8 pages) Industry: Machinery except Electrical Issues: Decentralization, Growth Strategy, Leadership, Organizational Structure Setting: Canada, Large organization, 2001 Difficulty: 4 - Undergraduate/MBA Length: 14 pages

Case #: 9A98M034 MABUCHI MOTOR CO., LTD. Paul W. Beamish, Anthony Goerzen

Date Revised: 2/11/2000 A year had elapsed since Mabuchi Motor Co., Ltd. of Japan, the world's most successful producer of small electric motors, had implemented a new management training program at one of its foreign operations in China. The program had two objectives. First, it was intended to enable the corporation to maintain its strategy of cost minimization by making it possible to reduce Japanese expatriate levels by improving the management skills of local managers in foreign subsidiaries. Second, by overcoming the shortage of qualified Japanese managers, the program would also allow the continued aggressive expansion of production that had become a cornerstone of corporate strategy. The teaching purpose is to illustrate the difficulties associated with transferring a management style and corporate culture into a different national culture.

Teaching Note: 8A98M34, (11 pages) Industry: Electric & Electronic Equipment Supplies Issues: Corporate Culture, Organizational Change, Subsidiaries, Management Training Setting: China/Japan, Large organization, 1995 Difficulty: 4 - Undergraduate/MBA Length: 14 pages

Case #: 9B02M041 SELKIRK GROUP IN ASIA (CONDENSED) Paul W. Beamish, Lambros Karavis

Selkirk Group is a family-owned brick manufacturer which has built an export business to Japan and other Asian markets from zero to 10% of its volume in seven years. The managing director of the company raises the question of whether it is time to change their regional export strategy and organizational structure in light of the Asian economic crisis and the reasons for their competitive success in both Australia and Asia.

Teaching Note: 8A99M03, (9 pages) Industry: Stone, Clay, Glass and Concrete Products Issues: Exports, International Business, International Marketing, Organizational Structure Setting: Australia/Asia, Medium organization, 1998 Difficulty: 4 - Undergraduate/MBA Length: 12 pages

Chapter 11: Case #: 9B02M045 Corporate Governance: CCL INDUSTRIES INC.: BUILDING AND MAINTAINING AN EFFECTIVE BOARD Instilling Long-Term Value Lawrence G. Tapp, Trevor Hunter

CCL Industries Inc. is one of the top packagers of consumer products in the world. Over its 50-year history the company had grown from a small room to a multinational firm employing 7,500 people with over $1.6 billon in sales. CCL faces an uncertain environment that had already led to a major strategic reorientation when its plan to sell its largest division was cancelled. A global economic slowdown and lower consumer confidence coupled with extensive international operations, significantly increased the risk to CCL's sales and already slim profits. In the past, the company prospered through product diversification gained through acquisition. The economic slowdown and increased uncertainty meant that this strategy may not be appropriate in the future. The chief executive officer recognizes the time, attention, advice, composition and operations of the board of directors would likely have to be altered to reflect this new reality.

Teaching Note: 8B02M45, (7 pages) Industry: Chemicals and Allied Products Issues: Board of Directors, Corporate Governance Setting: Canada, Large organization, 2002 Difficulty: 4 - Undergraduate/MBA Length: 13 pages

Case #: 9B00M042 CALGAS Lawrence G. Tapp, Gail Robertson

Calgas is one of Canada's top 25 oil and gas producers, with multinational principal shareholders and a multinational board of directors. A board member has been shopping the company without the board's knowledge or approval, and has been unsuccessful. His actions have caused employee anger and a loss of industry credibility. The board of directors must decide how to deal with the board member and determine a strategy for both damage control and moving forward.

Teaching Note: 8B02M42, (17 pages) Industry: Petroleum Refining & Related Industries Issues: Board of Directors, International Business, Corporate Governance Setting: Canada/Hong Kong, Medium organization, 2000 Difficulty: 4 - Undergraduate/MBA Length: 8 pages

Case #: 9B01M031 FISHERY PRODUCTS INTERNATIONAL LTD.: A NEW CHALLENGE W. Glenn Rowe, Tami Hynes

Date Revised: 10/16/2003 Fishery Products International (FPI) is one of the largest seafood companies in North America. FPI has experienced its best performance in a decade and has recently survived a hostile takeover bid by three competitors who acted in concert. The chief executive officer (CEO) has just returned from New Zealand where he was visiting a major competitor to see if there was the possibility of a strategic alliance. The CEO knew he had to do something to prevent another hostile takeover and to continue to grow shareholder value while still maintaining the social conscience of FPI. Some of the issues facing FPI were: performance, strategic leadership and corporate governance, and implementing an integrated product differentiation/cost leadership strategy.

Teaching Note: 8B01M31, (12 pages) Industry: Food and Kindred Products Issues: Government and Business, Return on Investment, Corporate Governance, Strategy Implementation Setting: Canada/New Zealand, Large organization, 2000 Difficulty: 4 - Undergraduate/MBA Length: 25 pages

For more information or to order any of these or other materials, contact:

Ivey Publishing Richard Ivey School of Business The University of Western Ontario London, Ontario N6A 3K7 Tel: (519) 661-3208 or (800) 649-6355 Fax: (519) 661-3882 E-mail: [email protected] or visit our Web site at http://cases.ivey.uwo.ca/cases