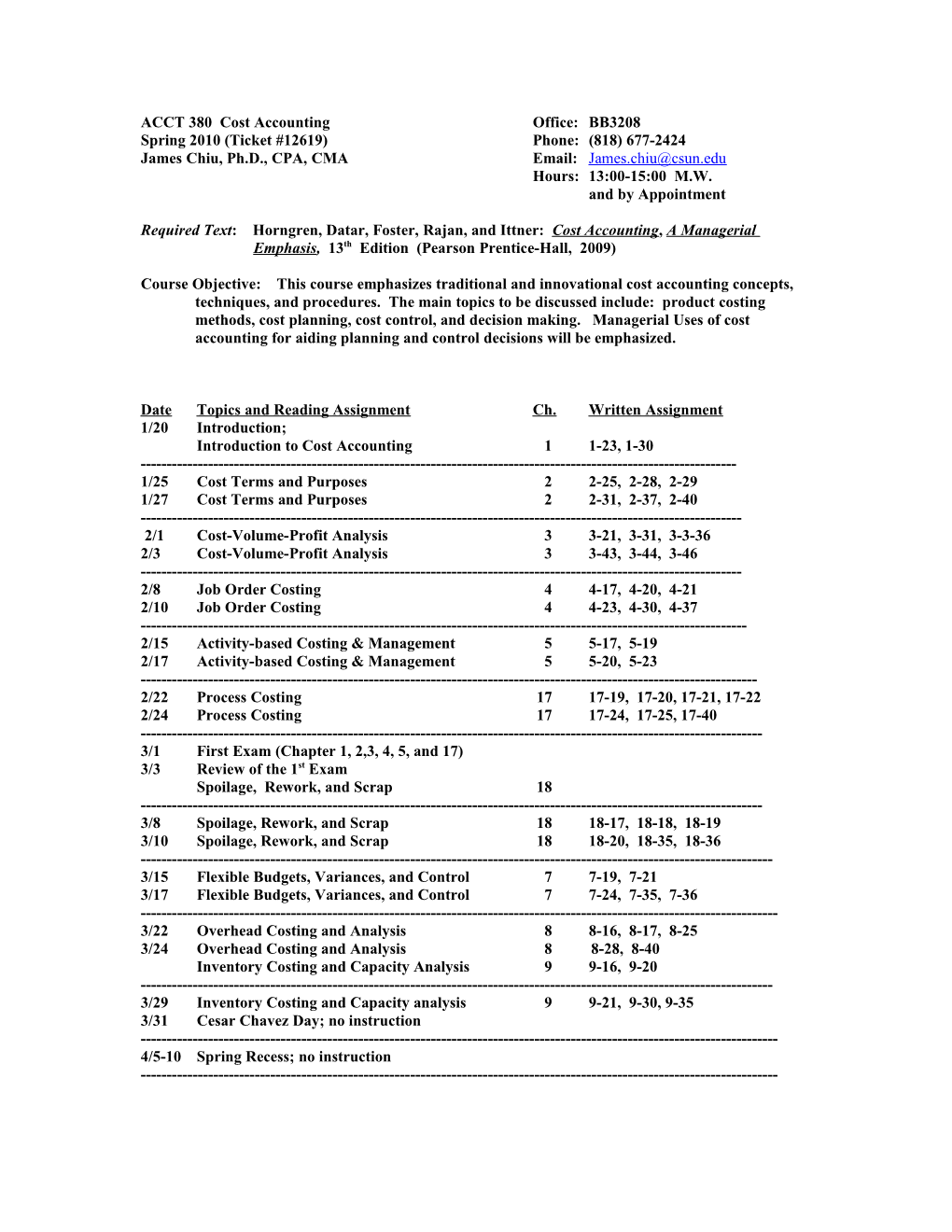

ACCT 380 Cost Accounting Office: BB3208 Spring 2010 (Ticket #12619) Phone: (818) 677-2424 James Chiu, Ph.D., CPA, CMA Email: [email protected] Hours: 13:00-15:00 M.W. and by Appointment

Required Text: Horngren, Datar, Foster, Rajan, and Ittner: Cost Accounting, A Managerial Emphasis, 13th Edition (Pearson Prentice-Hall, 2009)

Course Objective: This course emphasizes traditional and innovational cost accounting concepts, techniques, and procedures. The main topics to be discussed include: product costing methods, cost planning, cost control, and decision making. Managerial Uses of cost accounting for aiding planning and control decisions will be emphasized.

Date Topics and Reading Assignment Ch. Written Assignment 1/20 Introduction; Introduction to Cost Accounting 1 1-23, 1-30 ------1/25 Cost Terms and Purposes 2 2-25, 2-28, 2-29 1/27 Cost Terms and Purposes 2 2-31, 2-37, 2-40 ------2/1 Cost-Volume-Profit Analysis 3 3-21, 3-31, 3-3-36 2/3 Cost-Volume-Profit Analysis 3 3-43, 3-44, 3-46 ------2/8 Job Order Costing 4 4-17, 4-20, 4-21 2/10 Job Order Costing 4 4-23, 4-30, 4-37 ------2/15 Activity-based Costing & Management 5 5-17, 5-19 2/17 Activity-based Costing & Management 5 5-20, 5-23 ------2/22 Process Costing 17 17-19, 17-20, 17-21, 17-22 2/24 Process Costing 17 17-24, 17-25, 17-40 ------3/1 First Exam (Chapter 1, 2,3, 4, 5, and 17) 3/3 Review of the 1st Exam Spoilage, Rework, and Scrap 18 ------3/8 Spoilage, Rework, and Scrap 18 18-17, 18-18, 18-19 3/10 Spoilage, Rework, and Scrap 18 18-20, 18-35, 18-36 ------3/15 Flexible Budgets, Variances, and Control 7 7-19, 7-21 3/17 Flexible Budgets, Variances, and Control 7 7-24, 7-35, 7-36 ------3/22 Overhead Costing and Analysis 8 8-16, 8-17, 8-25 3/24 Overhead Costing and Analysis 8 8-28, 8-40 Inventory Costing and Capacity Analysis 9 9-16, 9-20 ------3/29 Inventory Costing and Capacity analysis 9 9-21, 9-30, 9-35 3/31 Cesar Chavez Day; no instruction ------4/5-10 Spring Recess; no instruction ------4/12 2nd Exam (Chapters 7, 8, 9, and 18) 4/14 Review of the 2nd Exam Cost allocation ------4/19 Customer-Profitability Analysis & Sales-Variance Analysis 14 14-16, 14-18 4/21 Sales-Variance Analysis 14 14-22, 14-32, 14-33 ------4/26 Allocation of Support Department Costs 15 15-16, 15-21 4/28 Allocation of Support Department Costs 15 15-22, 15-27, 15-30 ------5/3 Cost Allocation: Joint Products and Byproducts 16 16-20, 25 5/5 Cost Allocation: Joint Products and Byproducts 16 16-29, 16-35 ------Final Exam **********************************************************************************

C L A S S P O L I C I E S

1. Class attendance is required; it is important that you participate in class questions and discussions.

2. Course grade will be based on the following:

First Exam 25% Second Exam 25% Final Exam 35% Case 5% Class participation and quizzes 10% Total 100%

90% -100% A 80% - 89% B 70% - 79% C 60% - 69% D Under 60% F

Plus/minus will be incorporated in the grading

3. Assignment should be completed prior to the class meeting. It is imperative that you bring up in class for discussion any problem that you have trouble understanding.

4. No make-up exam will be given.