Name ______Date ______Period ___

The Cost of Living Source: AVID Have you given much thought to the standard of living you would like to achieve someday? If not, you should. Having high expectations is great, but meeting those expectations takes planning…and a good education. For this project, you will be researching today’s costs associated with housing, transportation, clothing, food, sundries, recreation, and entertainment. The purpose of this project is to help you look ahead to the life you want and to help make you aware of the costs associated with that chosen life.

Consider this: According to the U.S. Census Bureau in 2014, a family of three making less than $18,518 is below the poverty line. If you have a minimum wage job that pays $10.50 per hour and you work full time (40 hours per week) with no holidays, your annual income would be $20,160. Would this pay for all that you want? Do the following activity to find out what income you’ll need to support the lifestyle you would like.

This project is due on ______. Housing

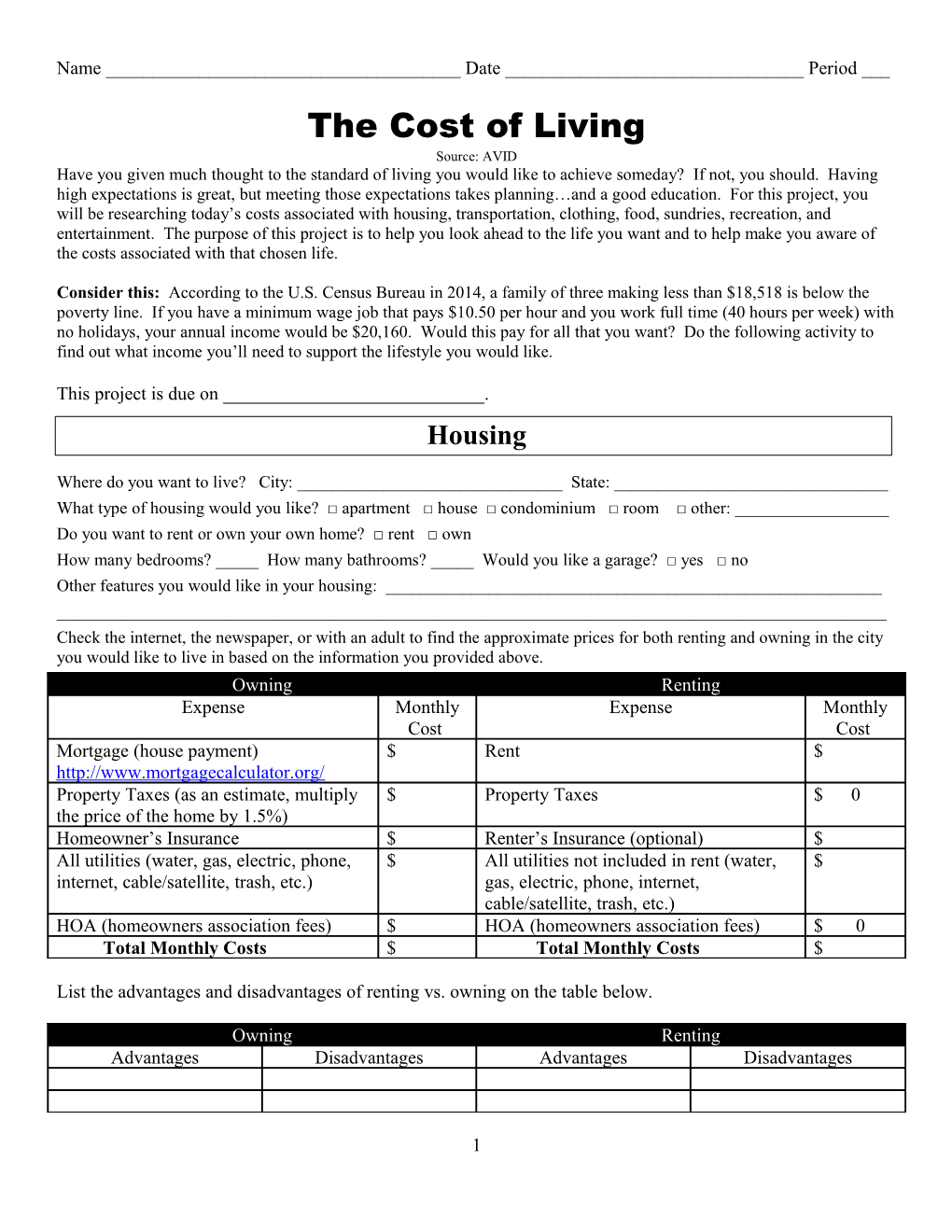

Where do you want to live? City: ______State: ______What type of housing would you like? □ apartment □ house □ condominium □ room □ other: ______Do you want to rent or own your own home? □ rent □ own How many bedrooms? _____ How many bathrooms? _____ Would you like a garage? □ yes □ no Other features you would like in your housing: ______Check the internet, the newspaper, or with an adult to find the approximate prices for both renting and owning in the city you would like to live in based on the information you provided above. Owning Renting Expense Monthly Expense Monthly Cost Cost Mortgage (house payment) $ Rent $ http://www.mortgagecalculator.org/ Property Taxes (as an estimate, multiply $ Property Taxes $ 0 the price of the home by 1.5%) Homeowner’s Insurance $ Renter’s Insurance (optional) $ All utilities (water, gas, electric, phone, $ All utilities not included in rent (water, $ internet, cable/satellite, trash, etc.) gas, electric, phone, internet, cable/satellite, trash, etc.) HOA (homeowners association fees) $ HOA (homeowners association fees) $ 0 Total Monthly Costs $ Total Monthly Costs $

List the advantages and disadvantages of renting vs. owning on the table below.

Owning Renting Advantages Disadvantages Advantages Disadvantages

1 Transportation

Think about the area you would like to live in. Do you plan on driving, biking, or taking public transportation (bus, train, subway, etc.)?

How would you like to travel to and from work?

□ Walk □ Bicycle □ Motorcycle □ Car or Truck □ Public Transportation

If you would like to own your own car or motorcycle, indicate the:

Make ______Model ______Year ______

For new cars, you may go to any car/motorcycle dealership website for prices. For used vehicles, go to http://www.kbb.com/ and research the price of the car or motorcycle you would like to own. If you listed a new vehicle above, then also research the same vehicle as if it were 4 years old.

To figure out your monthly loan payment, go to http://www.lotpro.com/finance/calculators/auto_loan_payment On the website, fill in all the information in the table. For the purposes of this assignment, let’s say you have no cash down, no trade allowance, no amount owed on trade, an 8% interest rate, no fees, and sales tax of 8.25%.

Research the cost of insurance by going to https://quote2.mercuryinsurance.com/WebQuote/ . Type in your zip code in the “Get a Quick Estimate” box. Get an insurance estimate for a new and used car. Record what you find in the table below.

New Vehicle Used Vehicle Expense Monthly Cost Expense Monthly Cost Loan Payment $ Loan Payment $ Insurance (required by law) $ Insurance (required by law) $ Gasoline $ Gasoline $ Maintenance (oil change, parts, etc.) $ Maintenance (oil change, parts, etc.) $ Total Monthly Costs $ Total Monthly Costs $

Considering all the costs in table above, is a new car the best choice for you right now? □ Yes □ No

At your age, what is the difference (per month) in the cost of insurance between a new and used vehicle? $ ______

Why do you think insurance is so expensive for people your age? ______

What is the estimated cost per month of public transportation in the city you would like to live in? $ ______

2 Clothing

Think about the types of clothing that you like to wear. Clothing expenses can include shirts/blouses, skirts, dresses, pants/slacks/jeans, shoes, hats, swimwear, coats, jackets, rain gear, underwear, pajamas/nightgowns, belts, socks, purses, etc.

When purchasing clothing, I plan to (check one or more):

□ Buy used clothing □ Buy clothes from discount stores □ Shop at department stores and/or boutiques □ Buy designer fashions □ Shop online □ Buy clothes on sale □ Other: ______

Talk with other family members and see how much they spend on clothing per month. If you plan on having a family, multiply that amount times the number of people in your future family.

Clothing Expense Monthly Cost Monthly clothing amount for one person $ The number of people in your future family Multiply the numbers in the two rows above for a monthly family total $

Food and Sundries

When figuring out the cost of food per month, consider the cost of groceries for the number of people in your future family.

Sundries include personal items like soap, shampoo, deodorant, etc., as well as cleaning supplies, toilet paper, paper towels, etc.

Ask your parents for an approximate monthly amount for food and sundries for the number of people you plan to have in your family.

Food and Sundries Expense Monthly Cost Monthly Food Amount $ Monthly Amount for Sundries $ Total $

3 Extras: Recreation and Entertainment

Although you don’t need the following budget items to survive, recreation and entertainment items make life more fun. You may find that at certain times in your life, you are able to spend more or less on these items. Think about your budget and what you will want to spend on the following areas.

Recreation and Entertainment Expense Monthly Cost Dining out $ Movies, DVDs, music, concerts, sporting events, amusement parks, etc. $ Books, newspapers, magazines, etc. $ Hobbies/lessons (golf, singing, tennis, etc.) $ Memberships (gym, club stores, Jenny Craig, etc.) $ Cable/Satellite (if not included in the utilities section of “Housing”) $ Internet (if not included in the utilities section of “Housing”) $ Cell Phone (if not included in the utilities section of “Housing”) $ Other (please specify): $ Total $

Total Cost of Living

Now add together the monthly amounts for housing, transportation, clothing, food, sundries, recreation, entertainment, other expenses, savings, and taxes. This will give you an approximate total for your expenses each month. Keep in mind that things like childcare, emergencies, gifts, etc. are not included.

Total Cost of Living Expense Monthly Cost Housing $ Transportation $ Clothing $ Food and Sundries $ Recreation/Entertainment $ Other Expenses (please specify): $ Savings $ Subtotal $ Taxes (add 30% to the subtotal) $ Total Monthly Cost of Living $

Annual Income Needed For This Lifestyle (Total Monthly Cost of Living X 12 Months) $

Educational level needed to generate this income: ______

4