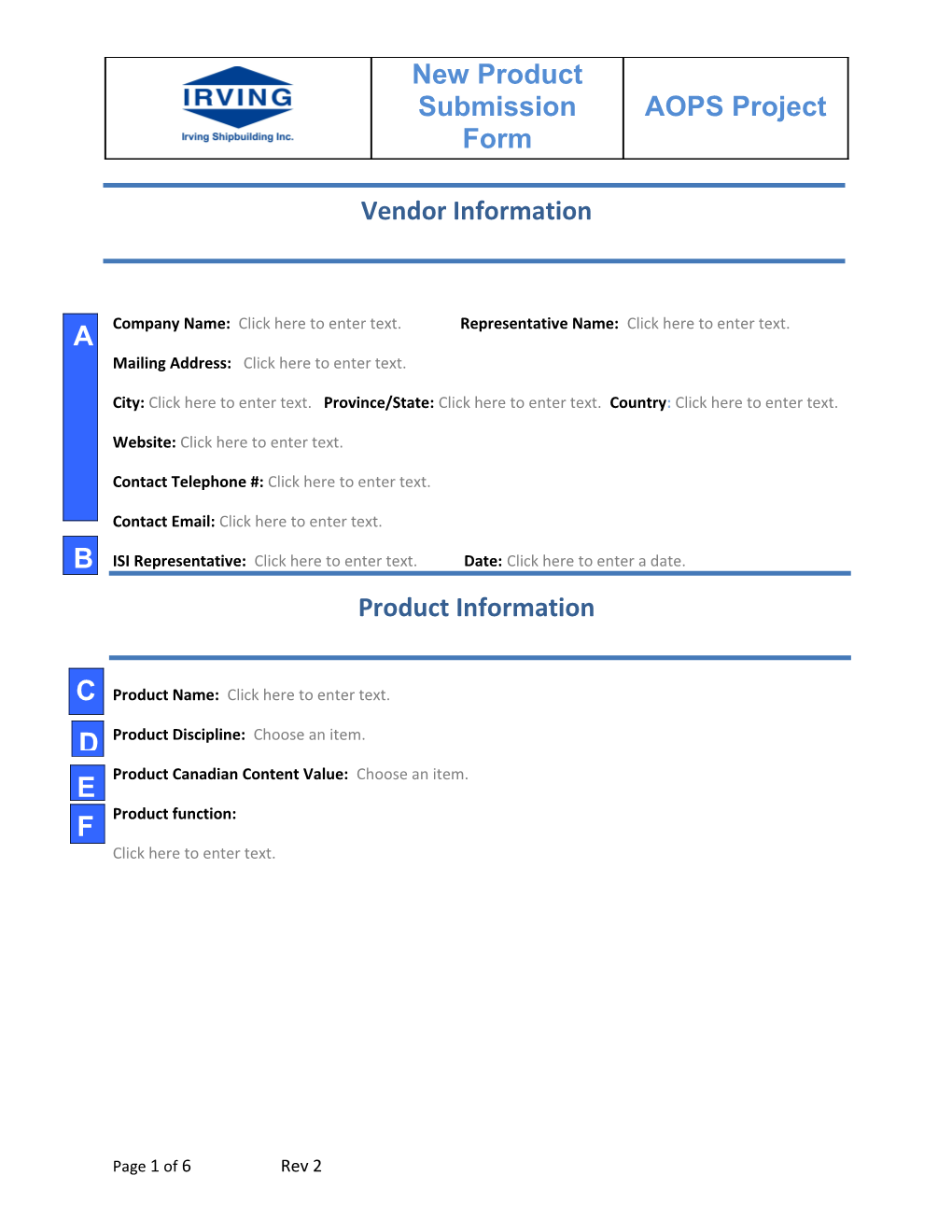

New Product Submission AOPS Project Form

Vendor Information

A Company Name: Click here to enter text. Representative Name: Click here to enter text. Mailing Address: Click here to enter text.

City: Click here to enter text. Province/State: Click here to enter text. Country: Click here to enter text.

Website: Click here to enter text.

Contact Telephone #: Click here to enter text.

Contact Email: Click here to enter text.

B ISI Representative: Click here to enter text. Date: Click here to enter a date. Product Information

C Product Name: Click here to enter text. D Product Discipline: Choose an item. E Product Canadian Content Value: Choose an item. F Product function: Click here to enter text.

Page 1 of 6 Rev 2 New Product Submission AOPS Project Form

Cost Saving and/or Manufacturing Improvement Proposal:

Click here to enter text.

G

Page 2 of 6 Rev 2 New Product Submission AOPS Project Form

Additional Submissions

H The following files were submitted with this proposal: ☐Product Specification

☐Class Certificate

☐General Company Information

☐Other (Specify): Click here to enter text.

*Please forward your form and all associated documentations combined into one (1) file preferably in PDF format to [email protected] in order for us to process your request and get back to you.

Page 3 of 6 Rev 2 New Product Submission AOPS Project Form

FORM GUIDELINES

Vendor Information This section collects Vendor general information including: Registered Company Name, Mailing A Address, Phone, Website, Location, Rep Details, etc.

Name of the ISI Representative that was spoken to. B ISI Representative Name of product being offered. C Product Name Refers to the product category (i.e. Mechanical, Outfit, Electrical, etc.) D Product Discipline

Product Canadian Content Value Provides an estimate in percentage for the product content value if Canadian. (See Appendix A: E Industrial and Regional Benefits)

Product function Describes the product features and capabilities. Highlights of product specifications and Details.

F Cost Saving and/or Manufacturing Describe how your product will result in material or labor savings, improvements, or otherwise add G value to the program Improvement Proposal

Refers to additional documentations to submit when applicable: Brochures, Product Specification, H Additional file submissions Class Certificate, General Company Information.

Page 4 of 6 Rev 2 New Product Submission AOPS Project Form

APPENDIX A

A: Industrial and Regional Benefits

The Canadian Government has established a policy that provides the framework for using government procurement to enhance long-term industrial, regional, and small business development. This policy, referred to as Industrial and Regional Benefits (IRB), is mandatory on all large Defense Programs. The objective of the IRB policy is to maximize Canadian Content Value (CCV) on a project.

As a Contractor on these Programs, Irving Shipbuilding must ensure, to the extent that it is possible, active participation of Canadian Suppliers/Vendors. The portion of the cost of work, on a product or service, which is actually completed within Canada, is referred to as the Canadian Content Value (CCV).

The following items are examples of eligible costs or business activities in calculating CCV for IRB purposes:

Wages, salaries, and benefits paid to Canadian Workers.

Parts and materials of Canadian origin for the Work. Transportation costs within Canada performed by Canadian carriers Facility costs in Canada (including utilities, taxes, insurance, rent, administration, maintenance, depreciation). Engineering and professional services in Canada. Travel expenses on Canadian carriers. Overhead, administrative, and general charges charged to the invoice Profits earned in Canada that are reasonably attributable to the IRB work.

Page 5 of 6 Rev 2 New Product Submission AOPS Project Form

The following items are examples of ineligible costs or business activities in calculating CCV for IRB purposes:

the value of materials, labor and services imported into Canada the value of any accommodation, relocation cost, remuneration and premiums paid to non- Canadian citizens who may work on the Project the amount of all Canadian Excise Taxes, Import Duties, Federal and Provincial Sales Taxes, Goods and Services Taxes, Harmonized Sales Taxes and other Canadian duties the value of goods and services with respect to which credit has been received or is being claimed by the Supplier/Vendor as an IRB to Canada under any other IRB Agreement transportation costs outside of Canada license fees paid to a foreign company by the Canadian IRB recipient and any ongoing royalty payments

The method by which CCV is calculated must be one of the following:

• Net Selling Price Method: Take the selling price of a product and/or service and subtract any ineligible cost or business activities. • Cost Aggregate Method: For any product, service or activity that cannot be assigned a substantiated selling price the CCV should be the aggregate of the eligible items.

It is the responsibility of the supplier to become fully aware of all aspects of the Government of Canada’s IRB policy and to comply with its requirements. We encourage all suppliers to visit Industry Canada’s website for further information.

http://www.ic.gc.ca/eic/site/042.nsf/eng/home

Page 6 of 6 Rev 2