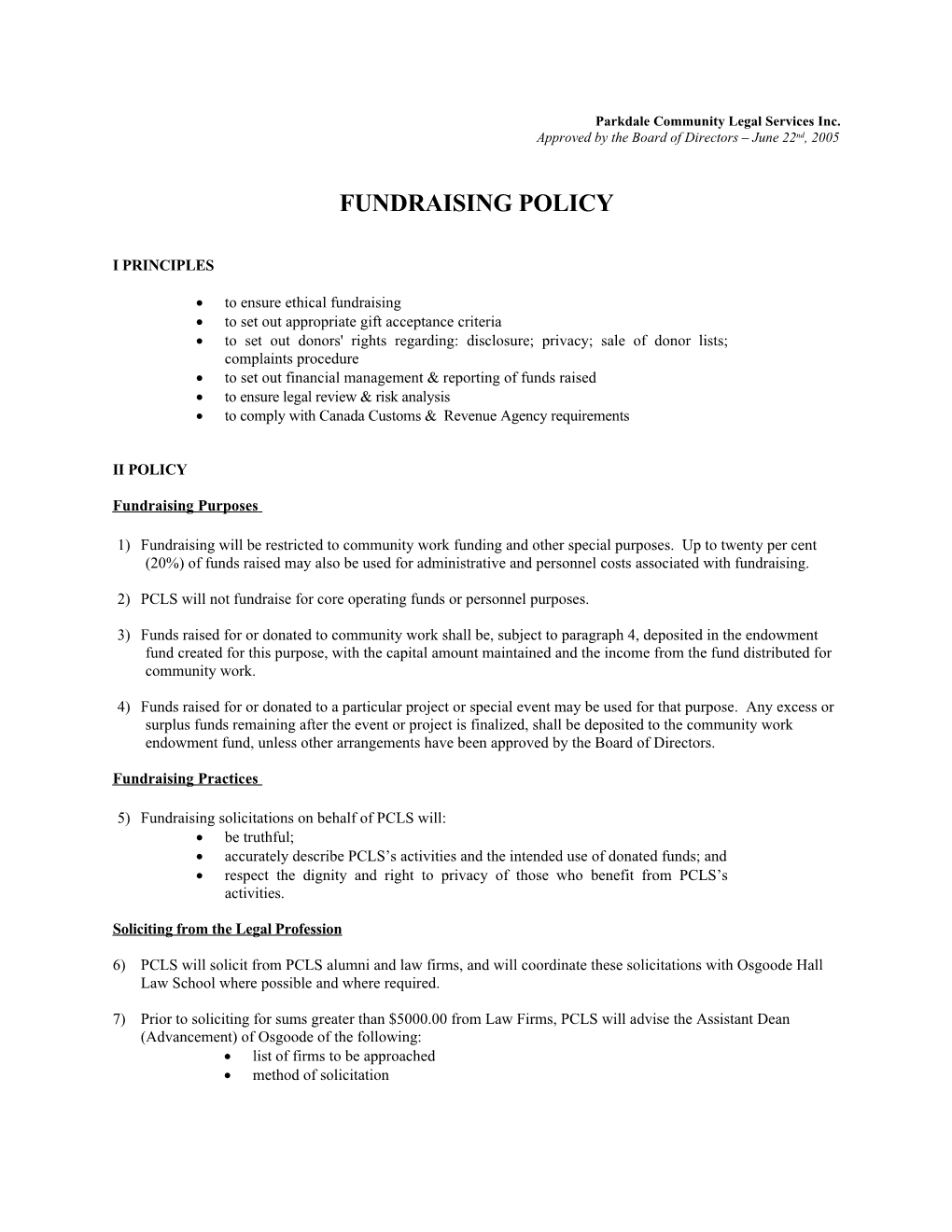

Parkdale Community Legal Services Inc. Approved by the Board of Directors – June 22nd, 2005

FUNDRAISING POLICY

I PRINCIPLES

to ensure ethical fundraising to set out appropriate gift acceptance criteria to set out donors' rights regarding: disclosure; privacy; sale of donor lists; complaints procedure to set out financial management & reporting of funds raised to ensure legal review & risk analysis to comply with Canada Customs & Revenue Agency requirements

II POLICY

Fundraising Purposes

1) Fundraising will be restricted to community work funding and other special purposes. Up to twenty per cent (20%) of funds raised may also be used for administrative and personnel costs associated with fundraising.

2) PCLS will not fundraise for core operating funds or personnel purposes.

3) Funds raised for or donated to community work shall be, subject to paragraph 4, deposited in the endowment fund created for this purpose, with the capital amount maintained and the income from the fund distributed for community work.

4) Funds raised for or donated to a particular project or special event may be used for that purpose. Any excess or surplus funds remaining after the event or project is finalized, shall be deposited to the community work endowment fund, unless other arrangements have been approved by the Board of Directors.

Fundraising Practices

5) Fundraising solicitations on behalf of PCLS will: be truthful; accurately describe PCLS’s activities and the intended use of donated funds; and respect the dignity and right to privacy of those who benefit from PCLS’s activities.

Soliciting from the Legal Profession

6) PCLS will solicit from PCLS alumni and law firms, and will coordinate these solicitations with Osgoode Hall Law School where possible and where required.

7) Prior to soliciting for sums greater than $5000.00 from Law Firms, PCLS will advise the Assistant Dean (Advancement) of Osgoode of the following: list of firms to be approached method of solicitation the 'ask amount' [exceeding $5000.00]

Use Of Professional Fundraisers/Consultants

8) PCLS may use volunteers, employees and hired solicitors who solicit or receive funds on behalf of PCLS.

9) Volunteers, employees and hired solicitors who solicit or receive funds on behalf of PCLS shall: adhere to the provisions of this Fundraising Policy and Appendix A; act with fairness, integrity, and in accordance with all applicable laws; adhere to the provisions of applicable professional codes of ethics, standards of practice, etc.; cease solicitation of a prospective donor who identifies the solicitation as harassment or undue pressure; disclose immediately to PCLS any actual or apparent conflict of interest; and, not accept donations for purposes that are inconsistent with PCLS’s objects or mission.

10) Paid fundraisers, whether staff or consultants, will be compensated by a salary, retainer or fee, and will not be paid finders’ fees, commissions or other payments based on either the number of gifts received or the value of funds raised.

11) Compensation policies for fundraisers will be consistent with PCLS’s policies and practices that apply to non- fundraising personnel.

Gift Acceptance Criteria

12) PCLS will not accept funds or gifts-in-kind which were, in PCLS's opinion, raised or manufactured in an unethical manner, or which raise human rights concerns.

13) PCLS will not accept gifts that include restrictions that are too onerous, too costly or which are, in PCLS's opinion, unethical or give rise to human rights issues.

14) PCLS may fundraise using 'gaming' such as: bingo; raffles; Nevada tickets; Monte Carlo nights; and/or 50/50 draws, as permitted by law.

15) The following planned gifts must be reviewed and approved by the Board. Before acceptance, relevant information about the gift shall be ascertained, including a copy of any appraisal secured by the donor. PCLS also reserves the right to secure its own appraisal. Outright gifts of real estate, tangible personal property, partnership interests, and other property interests not readily negotiable Residual interest gifts Charitable remainder trusts.

16) Outright gifts of cash, life insurance, and reinsured gift annuities do not require approval by the Board. Any gift, however, may be referred to the Board if subject to possibly unacceptable restrictions.

17) PCLS will not issue gift annuities but may accept assets from a donor, pursuant to an agreement authorising PCLS to: a) use a portion of the assets to purchase a commercial annuity paying a stipulated amount to the donor and/or other annuitant; and, b) retain the remaining assets for charitable purposes. 18) PCLS will not serve as trustee of charitable remainder trusts but may refer the donor to a trust institution that has agreed to provide this service.

Donors Lists

19) PCLS will not sell its donor list[s].

20) If applicable, any rental, exchange or other sharing of PCLS’s donor list will exclude the names of donors who have so requested (as provided in Appendix 'A,' below).

21) If a list of PCLS’s donors is exchanged, rented or otherwise shared with another organization, such sharing will be for a specified period of time and a specified purpose.

Use of Website

22) PCLS website may be used for the following fundraising purposes: .a To cultivate donors by keeping them up-dated on PCLS’ plans, activities, financial situation, fundraising initiatives, etc; .b To develop chat-rooms or other methods to exchange information and comment on matters of importance to the clinic, its client community, its membership and its donors; .c To solicit for donations and to raise funds, including through sponsorships; .d To build a “mailing list” and to identify any donors interested in ‘planned giving’

23) PCLS will not use 'cookies' to collect personal information.

Financial Accountability

24) PCLS’s fundraising will be conducted in a responsible manner, consistent with the ethical obligations of stewardship and the legal requirements of provincial and federal regulators.

25) All donations will be used to support PCLS’s objects, as registered with CCRA.

26) All restricted or designated donations will be used for the purposes for which they are given. If necessary due to program or organizational changes, alternative uses will be discussed where possible with the donor or the donor’s legal designate. If the donor is deceased or legally incompetent and PCLS is unable to contact a legal designate, the donation will be used in a manner that is as consistent as possible with the donor’s original intent.

27) Annual fundraising reports will provided to the PCLS Board of Directors, which will: be factual and accurate in all material respects; disclose: - the total amount of fundraising revenues (receipted and non-receipted); - the total amount of fundraising expenses (including salaries and overhead costs); - the total amount of donations that are receipted for income tax purposes (excluding bequest commitments, endowed donations that cannot be expended for at least 10 years, and gifts from other charities); - accounting separately for restricted funds, pledges and endowments - the total amount of expenditures on charitable activities (including gifts to other charities); - any complaints arising as provided in Appendix A, para 17; and - a review of the cost-effectiveness of the fundraising program. identify government grants and contributions separately from other donations; and be prepared in accordance with generally accepted accounting principles and standards established by the Canadian Institute of Chartered Accountants, in all material respects.

28) No more will be spent on administration and fundraising than is required to ensure effective management and resource development, and in any event not more than twenty per-cent (20%) of the receipted donations from the previous taxation year -- excluding bequests, endowed donations that cannot be expended for at least 10 years, and gifts from other charities.

29) PCLS will also expend no more than 4.5% of its assets in support of its charitable programs.

Legal Review & Risk Analysis

Special Events 30) Special events at PCLS may include a fundraising aspect. The following points will be canvassed in any special event planning: need for permits [liquor; street closing] risk identification and risk management insurance coverage security & personal safety child care emergency planning incident reporting system

Fundraising Campaigns 31) Specific fundraising campaigns may be organized at PCLS. Fundraising campaigns must be relevant to PCLS's mission, reflects its needs and resources, as well as its legal authority and mandate.

32) See Appendix 'C' for the points that must be addressed in any fundraising campaign. A campaign plan addressing these points must receive prior approval from the Clinic Director before any fundraising campaign may begin. Appendix A - Donor Rights

Donor Rights Generally

33) All donors to PCLS (individuals, corporations, and foundations) are entitled to receive an official receipt for income tax purposes for the amount of the donation. Twenty-five dollars ($25.00) is the minimum amount for the automatic issuance of receipts. Smaller donations ($10 and up) will only be receipted upon request.

34) Donors of non-monetary eligible gifts (or gifts-in-kind) are entitled to receive an official receipt that reflects the fair market value of the gift. If valued over $1000.00, an independent evaluation will be required.

35) All fundraising solicitations by or on behalf of PCLS will disclose PCLS’s name and the purpose for which funds are requested. Printed solicitations (however transmitted) will also include PCLS's address and other contact information.

36) Donors and prospective donors are entitled to the following, promptly upon request: PCLS’s most recent annual report and financial statements as approved by the governing board; PCLS’s charitable registration number (BN) as assigned by CCRA; any information contained in the public portion of PCLS’s most recent Charity Information Return (form T3010) as submitted to CCRA; a list of the names of the members of PCLS’s Board of Directors; and a copy of this Fundraising Policy.

37) Donors and prospective donors are entitled to know, upon request, whether an individual soliciting funds on behalf of PCLS is a volunteer, an employee, or a hired solicitor.

38) Donors will be encouraged to seek independent advice if PCLS has any reason to believe that a proposed gift might significantly affect the donor’s financial position, taxable income, or relationship with other family members.

39) Donors’ requests to remain anonymous will be respected

40) The privacy of donors will be respected. Any donor records that are maintained by PCLS will be kept confidential to the greatest extent possible. Donors have the right to see their own donor record, and to challenge its accuracy.

41) If PCLS exchanges, rents, or otherwise shares its fundraising list with other organizations, such as Osgoode Hall Law School, a donor’s request to be excluded from the list will be honoured.

42) Donors and prospective donors will be treated with respect. Every effort will be made to honour their requests to: limit the frequency of solicitations; not be solicited by telephone or other technology; receive printed material concerning PCLS.

Donor Complaints

43) PCLS will respond promptly to a complaint by a donor or prospective donor about any matter that is addressed in this Fundraising Policy.

44) A designated staff member or volunteer will attempt to satisfy the complainant’s concerns in the first instance. Appendix A – Donor Rights Page ii

45) A complainant who remains dissatisfied will be informed that he/she may complaint to PCLS Board, in accordance with the PCLS Complaints Policy.

46) PCLS’s Board of Directors will be informed at least annually of the number, type and disposition of complaints received from donors or prospective donors about matters that are addressed in this Fundraising Policy. Appendix B - Gift Receipt Guidelines

Guidelines

1. Outright Gifts

1. PCLS will accept an outright gift of any amount.

2. PCLS welcomes outright gifts of property as well as cash, but all property other than publicly-traded securities and life insurance policies must be approved by the Board before they can be received.

3. A donor may complete a gift in a single transaction or make a pledge to be paid over a 5 year period or longer with Board approval.

2. Gifts of Publicly Listed Securities

1. Notice of intended gifts of publicly-listed securities shall be given to the Clinic Director. Upon notification the donor will be sent a Securities Donation Form (detailing types of accounts and brokerage account numbers) that is to be filled out and returned by the donor’s broker. In the event that the securities are not transferred electronically, the form will accompany the signed and notarized certificates.

2. A receipt will be issued to the donor based on the average of the high and low trading value of the shares on the day the transfer was made. For book-based (electronic) transfers, the day the transfer was made shall be deemed to be the day the donation was received into PCLS’s account. In the case of non-electronically transferred shares, the date post marked on the envelope or the hand- delivery date will be considered the date of transfer.

3. The Clinic Director will sell the donated shares as soon as possible except if the value of the donated shares is over $10,000 in which case the Clinic Director will seek approval from the Fundraising Committee to sell or hold these donated shares.

4. The net proceeds from the sale of the shares will be directed to fund the charitable purposes of PCLS. This value may be higher or lower than the amount on the tax receipt.

3. The Reinsured Gift Annuity

1. The minimum amount PCLS will accept for a reinsured gift annuity is $10,000.00.

2. The cost of the commercial annuity generally should not exceed 70-75 percent of the assets transferred in order to result in a significant gift for PCLS.

3. The donor may designate how the gift (amount retained) will be used subject to the consent of PCLS.

4. The commercial insurance company shall be selected, and the terms of the annuity contract negotiated, by PCLS’s Clinic Director.

4. Gift of a Residual Interest

Upon transfer to PCLS of a residual interest, the donor shall continue to be responsible for real estate taxes, insurance, utilities and maintenance unless PCLS, upon prior approval of the Clinic Director, agrees to Appendix B – Gift Receipt Guidelines Page ii

assume responsibility for any portion of these items. The terms of the gift and responsibilities for expenses shall be specified in a deed of gift executed by the donor(s) and PCLS.

PCLS reserves the right to inspect the property from time to time to assure that its interest is properly safeguarded.

5. Charitable Remainder Trusts

1. A charitable remainder trust may be funded with cash, securities or real estate.

2. The trust may be funded with any property of any value that is acceptable to the trustee.

3. The trust agreement shall be drafted by the donor's own legal counsel.

6. Life Insurance

There are various methods by which a life insurance policy may be contributed to PCLS. A donor may:

1. Assign irrevocably a paid-up policy to PCLS; 2. Assign irrevocably a life insurance policy on which premiums remain to be paid; or 3. Name PCLS as a primary or successor beneficiary of the proceeds.

When ownership is irrevocably assigned to PCLS, the donor is entitled to a gift receipt for the net cash surrender value (if any) and for any premiums subsequently paid.

Any of these types of life insurance gifts are acceptable to PCLS. In the event a policy is contributed on which premiums remain to be paid, PCLS will pay the premiums provided the donor makes equivalent contributions for that purpose.

7. Gifts of Real Estate

The following guidelines pertain to gifts of real estate in general (outright transfers, residual interest in the property, or to fund a charitable remainder trust). Where real estate is transferred to a charitable remainder trust, additional requirements of the trustee must be met.

1. The donor shall secure a qualified appraisal of the property.

2. Unless PCLS has reason to believe this appraisal does not reflect the property's true value, a gift receipt will be issued for the appraised value (or present value of the residual interest computed on the appraised value in the case of residual interest gifts). However, PCLS reserves the right to secure its own appraisal and issue a gift receipt based on it.

3. PCLS shall determine if the donor has clear title to the property.

4. PCLS shall review other factors, including zoning restrictions, marketability, current use and cash flow, to ascertain that acceptance of the gift would be in the best interests of PCLS.

5. PCLS shall ordinarily conduct an environmental assessment, which may include an environmental audit, and accept the property only if (a) it contains no toxic substances, or (b) they are removed or other remedies taken assuring that PCLS assumes no liability whatsoever.

8. Bequests Appendix B – Gift Receipt Guidelines Page iii

Donors will be invited to provide information about their bequest provision and, if they are willing, to send a copy of that section of their will naming PCLS.

During the probate of estates containing a bequest to PCLS and during the post-death administration of revocable trusts containing provisions benefiting PCLS, the Clinic Director shall represent PCLS in all dealings with the lawyer and executor of the estate. In the case of a dispute or challenge to the bequest, the Board shall be informed. Appendix C PCLS Fundraising Campaign Checklist

1. identify why campaign needed: community work account; endowment;or, special project:______; combination of the above capital campaign;

2. set campaign goal: $______.__

3. assess fundraising strategies: grants sale of goods/services personal solicitations special events door-to-door canvassing corporate sponsorships direct mail planned giving telemarketing charitable gaming advertising product sales

4. prepare the draft case for support, including identifying how the campaign may: increase public awareness of PCLS or charitable purpose or issue; attract new members or volunteers build a donor base for future use support or enhance PCLS' reputation; identify and rate prospective donors;

5. conduct a feasibility & legal review– an assessment of the legal risk including: analysis of PCLS's corporate documents; by-laws & relevant policies; identification of any legal restrictions, prohibitions or requirements [e.g. - any licenses or permits required] registering under the Gaming Control Act if any gaming involved in the campaign review any potential violations of copyrights or trademarks ensure any transfers are voluntary with no benefit provided to the donor or person selected by the donor, unless the gift is of nominal value risk management – obtain any necessary liability insurance see paragraph 29 of policy regarding special events any other specific measures to ensure adequate oversight of the campaign

6. donor assurances: what will funds be used for? what will happen to the funds if the campaign is oversubscribed or cancelled? [e.g. - returned to donor? used for similar projects or purposes at the discretion of PCLS?]

7. identify campaign leadership – honourary chair?

8. identify resources needed and develop a budget – ensure that cost of fundraising is no more than twenty- five per cent (25%) of funds raised

9. develop a campaign action plan: who will do what, when, and where

10. implement the campaign: recruit and train volunteers ensure for any product sales disclosure of: name of charity price of product, and Appendix B – Gift Receipt Guidelines Page 5

any material restrictions, terms or conditions ensure for any lottery or gaming: that delivery of a prize or benefit is not conditional on any prior payment adequate disclosure of: # of prizes values of prizes the areas they relate to and any facts within person's knowledge that affects materially the chances of winning cultivate donors and prospective donors secure the donations follow up on prospective donors donor appreciation collect donations following up on pledges ongoing monitoring, accounting [books & records]and reporting of results plan for approval of adjustments where necessary;

11. the post-mortem review: did it meet the objectives? identify strengths, opportunities and weaknesses for future campaigns was campaign consistent with established policies? did campaign enhance the clinic and/or its reputation? was campaign carried out in accordance with the law and ethical standards? were corrections made where necessary to do so?

12. written report to the Board of Directors: summary of the campaign amount raised? did it meet the objectives? was it consistent with established policies? did it enhance the organization Appendix D Definitions bequests – a gift by will of money or personal property [disposition of realty in a will is termed a "devise"] charitable remainder trust – a form of a residual interest gift. The donor ("settlor") transfers property to a trustee who holds and manages it. If the property is income-producing, the net income will be paid to the donor and/or other named beneficiary. When the trust terminates (either at the death of the beneficiary(ies) or after a term of years), the trust remainder is distributed to PCLS. If the trust is irrevocable, the donor is entitled to a gift receipt for the present value of the residual interest. restricted contributions – external restrictions on uses, either a particular purpose like a building fund, or certain uses may be prohibited endowment contributions – a specific type of restricted contribution, in that the endowment fund is permanent, and only the revenue [interest earned] can be used unrestricted contributions – can be used for any charitable purpose or activity within the organization eligible gifts – gifts-in-kind permitted by CCRA. A full definition can be found in CCRA's Interpretation Bulletin dealing with gifts and official donation receipts. Some common gifts, such as donations of volunteer time, services, food, etc. are not eligible. gifts – includes cash, publicly listed securities, reinsured gift annuities, bequests, gifts of residual interest, charitable remainder trusts, gifts of life insurance policies and proceeds, and such other gift arrangements as the Board of Directors (hereinafter "the Board") may from time to time approve. gift annuity – a contractual arrangement whereby a donor transfers assets to PCLS pursuant to an agreement authorising PCLS to purchase a commercial prescribed annuity that will pay the stipulated amount for the life of the annuitant(s) or for a term of years. Assets in excess of the amount required for purchase of the commercial annuity are retained by PCLS and used for purposes specified by the donor and acceptable to PCLS. Determination of the gift receipt and taxation of annuity payments will be in accordance with the Canada Customs and Revenue Agency guidelines. frugging –fundraising under the guise of conducting market research or public opinion polls planned giving – a philanthropic program by which a donor can arrange a substantial gift to PCLS for either a future or a current need. The emphasis is on planning and is focused on financial, estate and tax planning. outright gift – a contribution of cash or property that the donor gives and retains no interest in and which can be used currently by PCLS. Securing outright gifts is PCLS’s highest priority, and donors who are able to make outright gifts will be encouraged to do so. publicly-traded securities – includes stocks, bonds, mutual fund units and shares listed on a public exchange residual interest – an arrangement (ordinarily in the form of a trust) where property is irrevocably committed to PCLS, but the donor retains use of the property for life or a term of years. For example, the donor might give a residual interest in a residence and continue to live in it or in a painting and retain possession of it. The donor is entitled to a gift receipt from PCLS for the present value of the residual interest in accordance with CCRA (Canada Customs and Revenue Agency) guidelines.