Partnership According to Purpose o Commercial or Trading partnership Definition o Professional or Non-trading partnership A partnership is a meeting of the minds between two According to Legality of Existence or more persons, where in they bind themselves to contribute o De Jure partnership money property, and/or industry to a common fund, with the purpose of dividing the profit from among them or exercising o De Facto partnership a common profession. Kinds of Partners Characteristics General Partner Mutual Contribution Limited Partner Division of Profits or Losses Capitalist Partner Co-ownership of Contributed Assets Industrial Partner Mutual Agency Managing Partner Limited Life Liquidating Partner Unlimited Liability Dormant Partner Income Taxation Silent Partner Partner’s Equity Account Secret Partner Nominal Partner/ Partner by Estoppel Advantages versus Sole Proprietorship Brings greater financial capability to the business Limited Liability Partnership Combines special skills, expertise and experience of Indicate such to Name (LLP or Ltd.) the partners Offers relative freedom and flexibility of action in Articles of Partnership decision-making It is a document that contains the partners’ agreements. Advantage versus Corporation Easier and less expensive to organize Legalities Contributions of real or immovable properties must More personal and informal be done in a public instrument or else the partnership is void Disadvantages of Partnerships A partnership whose initial capital is at least P 3,000 Easily dissolved thus unstable compared to a must register to the SEC, however, still acquires legal corporation personality even without doing so. Mutual agency and unlimited liability may create personal obligations to partners GPP for CPAs Less effective than a corporation in raising large Provisions for such is found in R.A. 9298, the amounts of capital Philippine Accountancy Act of 2004

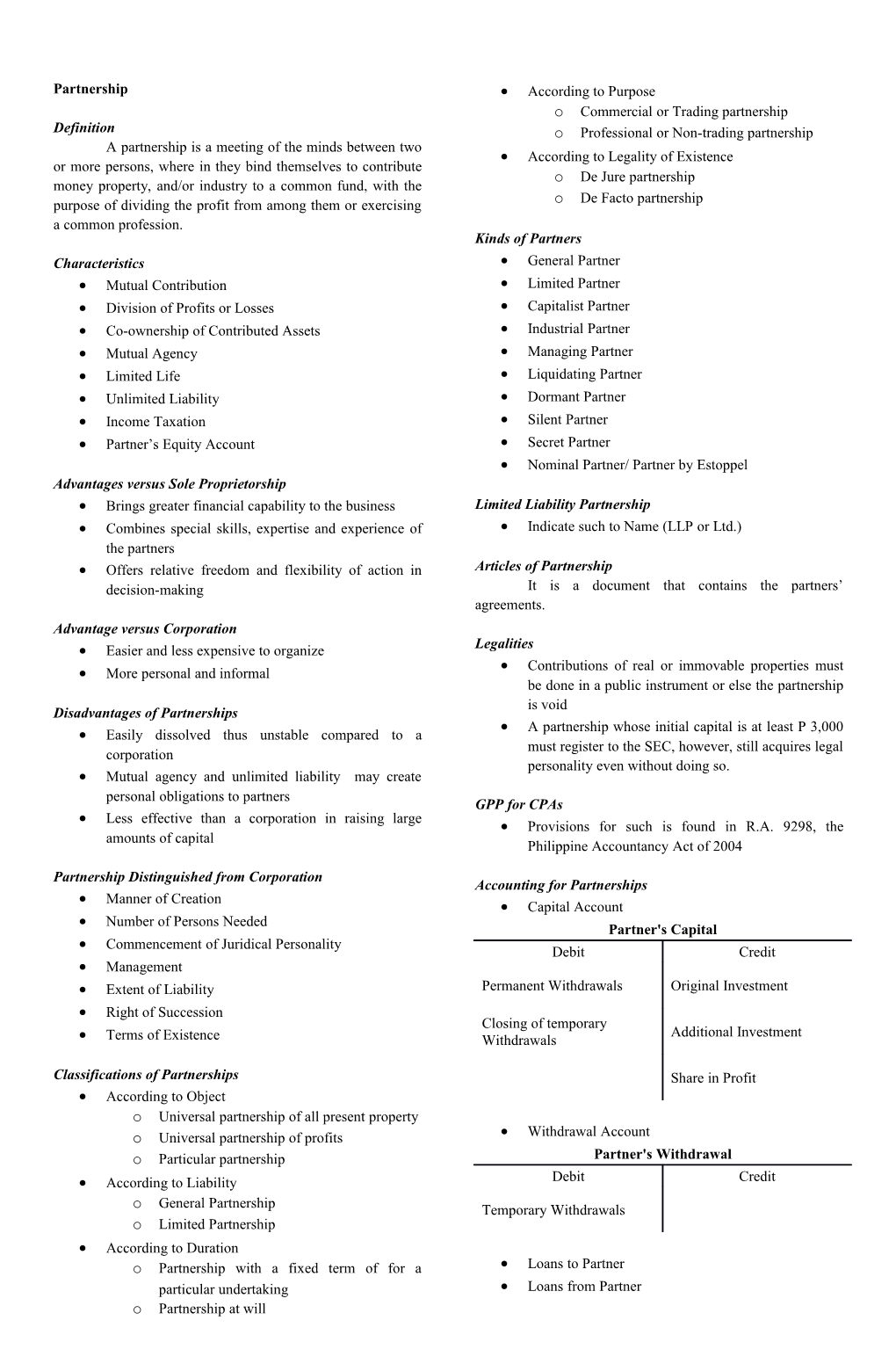

Partnership Distinguished from Corporation Accounting for Partnerships Manner of Creation Capital Account Number of Persons Needed Partner's Capital Commencement of Juridical Personality Debit Credit Management Extent of Liability Permanent Withdrawals Original Investment Right of Succession Closing of temporary Additional Investment Terms of Existence Withdrawals

Classifications of Partnerships Share in Profit According to Object o Universal partnership of all present property o Universal partnership of profits Withdrawal Account o Particular partnership Partner's Withdrawal According to Liability Debit Credit o General Partnership Temporary Withdrawals o Limited Partnership According to Duration o Partnership with a fixed term of for a Loans to Partner particular undertaking Loans from Partner o Partnership at will