Name:______First Midterm Exam MBAC 6060 Spring 2003

This exam will serve as the answer sheet. You should have enough room, however if you require more space in which to write your answers I have additional paper at the front. There are 4 full problems (some with multiple parts) on this exam, be sure you are aware of them all. If you would like to have the possibility of partial credit for any of the questions, be sure to show how you developed the answers rather than simply reporting an answer. You have the entire class period, budget about 15 minutes per question. Remember, if it were easy they’d call it snowboarding.

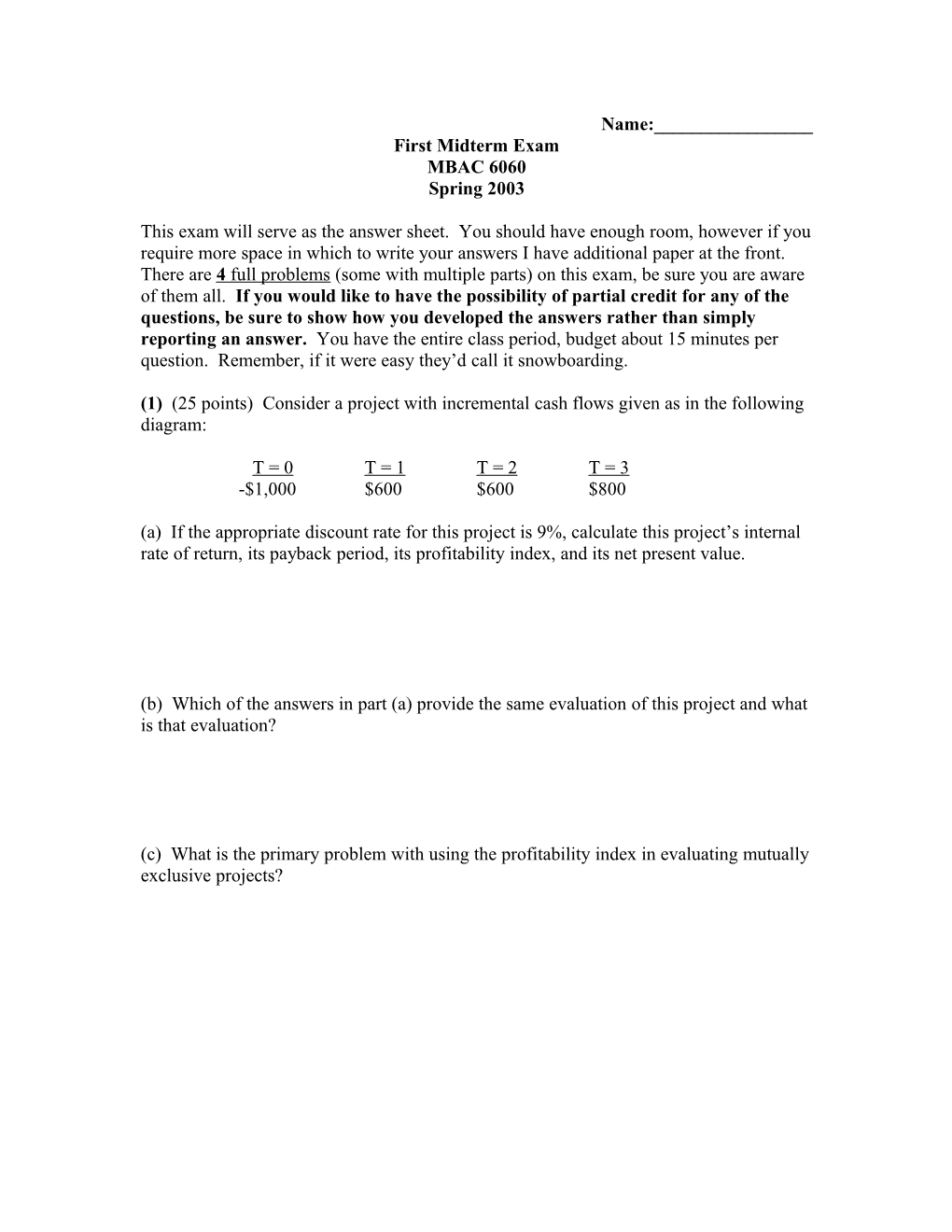

(1) (25 points) Consider a project with incremental cash flows given as in the following diagram:

T = 0 T = 1 T = 2 T = 3 -$1,000 $600 $600 $800

(a) If the appropriate discount rate for this project is 9%, calculate this project’s internal rate of return, its payback period, its profitability index, and its net present value.

(b) Which of the answers in part (a) provide the same evaluation of this project and what is that evaluation?

(c) What is the primary problem with using the profitability index in evaluating mutually exclusive projects? (2) (45 points) Calculate the value of each of the securities described below:

(a) What is the current value of a semi-annual coupon bond with a face value of $1,000, a coupon rate of 7.8%, and 18 years till maturity if its yield to maturity is a stated annual rate of 8.5%?

(b) If the bond described in part (a) (face value and coupon level) were selling for $1011.60 what would be its yield to maturity on an effective annual rate basis?

(c) Crisco Systems Inc paid a $1.00 per share dividend yesterday. The dividend per share paid by Crisco is expected to grow by 10% for each of the next 17 years and after that it is expected to grow by 2% each year forever. If the appropriate discount rate for the dividends of Crisco is 12% what would you pay for a share of Crisco stock?

(d) Clive Inc. is expected to pay a dividend of $2 per share in one year. These dividends are expected to grow at 1% per year and be paid annually forever. A stated annual interest rate of 14% is appropriate to value this stock. What is the current price per share of Clive Inc. stock?

(e) Firm Z’s charter firm allows it to invest only in T-Bills and T notes of maturities equal to 1, 2, 3, or 4 years. The firm recently used all its assets to purchase $250,000 worth (current value) of treasury securities of each of these maturities. If the current spot rates are 2%, 2.4%, 2.8%, and 3.6% respectively, what is the current value of firm Z? (3) (25 points) The following is the actual balance sheet for 2002, the projected balance sheet for 2003, and the projected income statement for 2003 for Clive Inc. What is the associated estimate for the Free Cash Flow to be generated by Clive in 2003.

Income Statement 2003 Net sales 6250 Cost of goods sold 1050 SG&A expenses 600 Depreciation 200 Operating Profit 4400 Interest expense 60 Earnings before tax 4340 Taxes 2170 Earnings after tax 2170

Balance Sheets 2002 2003 Cash 700 700 Accounts Receivable 1000 1500 Inventory 1000 1200 Current Assets 2700 3400

Gross PP&E 5000 7000 Accum. Depreciation 3000 3200 Net PP&E 2000 3800 Total Assets 4700 7200

Current Portion of Long Term Debt 1000 1000 Accounts Payable 1500 1200 Wages Payable 100 100 Current Liabilities 2600 2300

Long Term Debt 500 3300 Total Liabilities 3100 5600

Owner’s Equity 1600 1600 Liabilities plus Owners Equity 4700 7200 (4) (30 points) You manage a firm that has only risk free treasury securities as existing assets. The current value of these securities total $50,000 and there are 1,000 shares of stock outstanding in this company. You discover a risk free investment project that will cost $50,000 now and will provide a payoff of $100,000 in 2 years. There is a zero coupon bond issued by the treasury with a maturity of 2 years and has a $1,000 face value that sells for $694.44.

(a) What is the NPV of this project? Does this value depend on how the project is financed?

(b) What will the price per share of equity be when investors learn of this opportunity?

(c) If you purchase one of the 1,000 shares of equity at the price in part (b) what will be your return (on an annual basis) if you hold it for 2 years? Is that appropriate? Why?