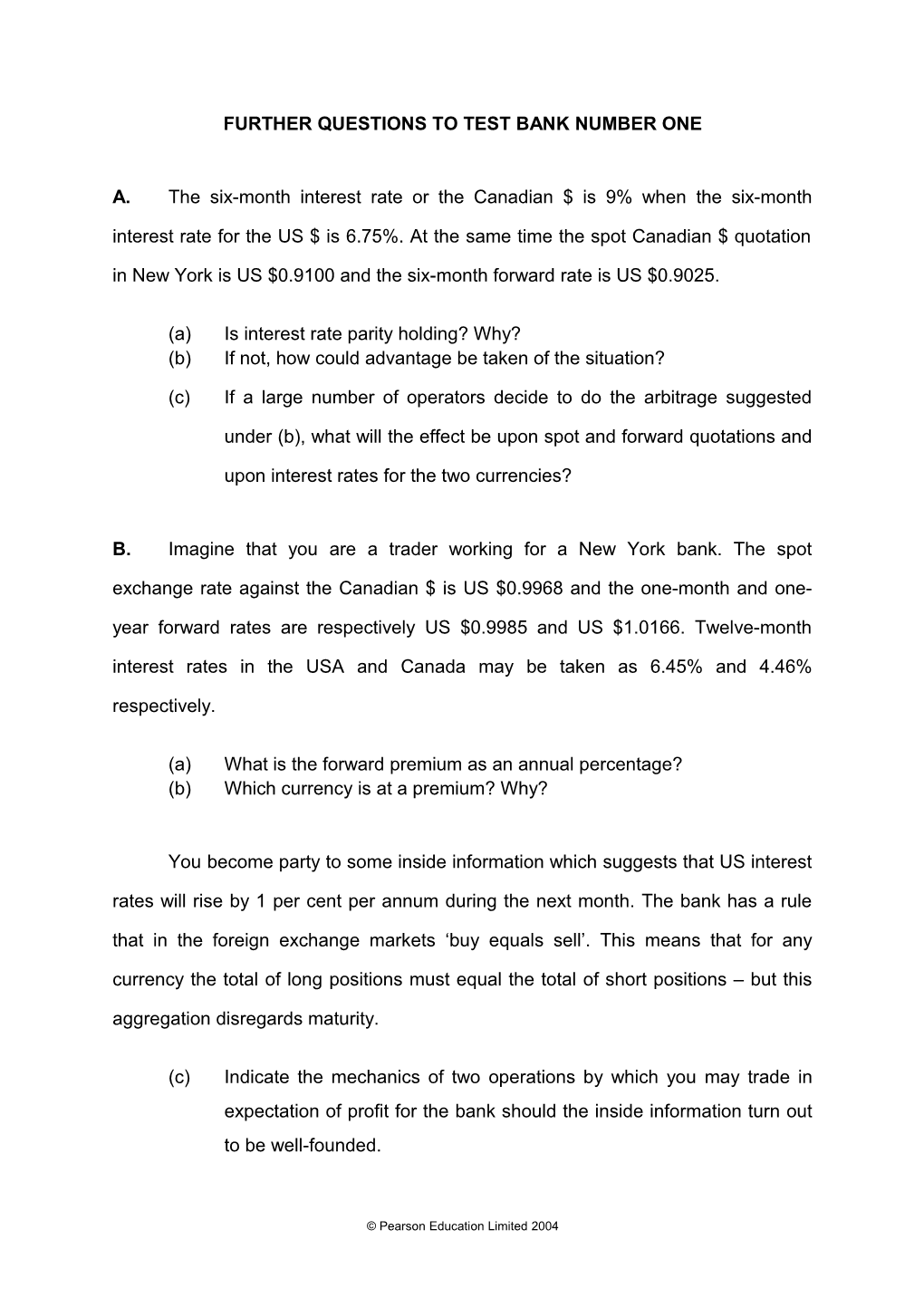

FURTHER QUESTIONS TO TEST BANK NUMBER ONE

A. The six-month interest rate or the Canadian $ is 9% when the six-month interest rate for the US $ is 6.75%. At the same time the spot Canadian $ quotation in New York is US $0.9100 and the six-month forward rate is US $0.9025.

(a) Is interest rate parity holding? Why? (b) If not, how could advantage be taken of the situation?

(c) If a large number of operators decide to do the arbitrage suggested

under (b), what will the effect be upon spot and forward quotations and

upon interest rates for the two currencies?

B. Imagine that you are a trader working for a New York bank. The spot exchange rate against the Canadian $ is US $0.9968 and the one-month and one- year forward rates are respectively US $0.9985 and US $1.0166. Twelve-month interest rates in the USA and Canada may be taken as 6.45% and 4.46% respectively.

(a) What is the forward premium as an annual percentage? (b) Which currency is at a premium? Why?

You become party to some inside information which suggests that US interest rates will rise by 1 per cent per annum during the next month. The bank has a rule that in the foreign exchange markets ‘buy equals sell’. This means that for any currency the total of long positions must equal the total of short positions – but this aggregation disregards maturity.

(c) Indicate the mechanics of two operations by which you may trade in expectation of profit for the bank should the inside information turn out to be well-founded.

© Pearson Education Limited 2004 C. On 27 March 2004 the following applied:

£/krone spot value 3.79–3.80 11 9 £ three-month interest 13 /16–13 /16

1 15 Krone three-month interest 6 /16–5 /16

1 £/krone three-month forward 7 /8–7pm

(The ensuing three months consists of 90 days)

The treasurer of a £-based company decided to hedge a krone receivable due in three months time. What are two alternative methods, and what are the effective interest rates for each? Why are they not the same?

D. A UK company has a requirement for krone for 3 months. A proposition is put that the currency should be borrowed direct due to the low interest rate. At 27 March

2004:

£/krone spot 3.2075–3.2175 £/krone three-month forward 2.75–2.25 cents pm

11 9 £ three-month interest 13 /16–13 /16

7 3 krone three-month interest 5 /8–5 /4

Should the proposition be carried?

E. Given the exchange rate and interest rate information below, what quote would you expect for buying and selling forward Doppels:

(a) for one month forward? (b) for two months forward?

(c) if the quotes obtained were different from these what factors would

determine the corporate response to the existence of such differentials

© Pearson Education Limited 2004 Exchange Rate

1 1 £/Doppel spot £1 3.33 /4 3.34 /4

Eurocurrency Interest Rates one month three months 1 1 15 Sterling 10 /4–10 /8 10–9 /16

1 5 1 5 Doppel 4 /2–4 /8 4 /2–4 /8

F. You are a Foreign Exchange Dealer in a large UK-based company, in which the treasury is a profit centre. Your dealing limit is £10m. You are given the following quotes:

Spot 12 month Forward £/$ £1 $1.5802/12 515/505

$/Doppel $1 DP2.0065/75 359/354

£/Doppel 1763/1728

You are also aware of the following 12-month euro interest rates:

1 15 £ 13 /16–12 /16 3 1 $ 9 /8–9 /4

5 3 Doppel 7 /16–7 /16

(a) If your only objective is to generate a profit, what would you do and why? (b) Does this course of action involve any drawbacks for the company?

© Pearson Education Limited 2004