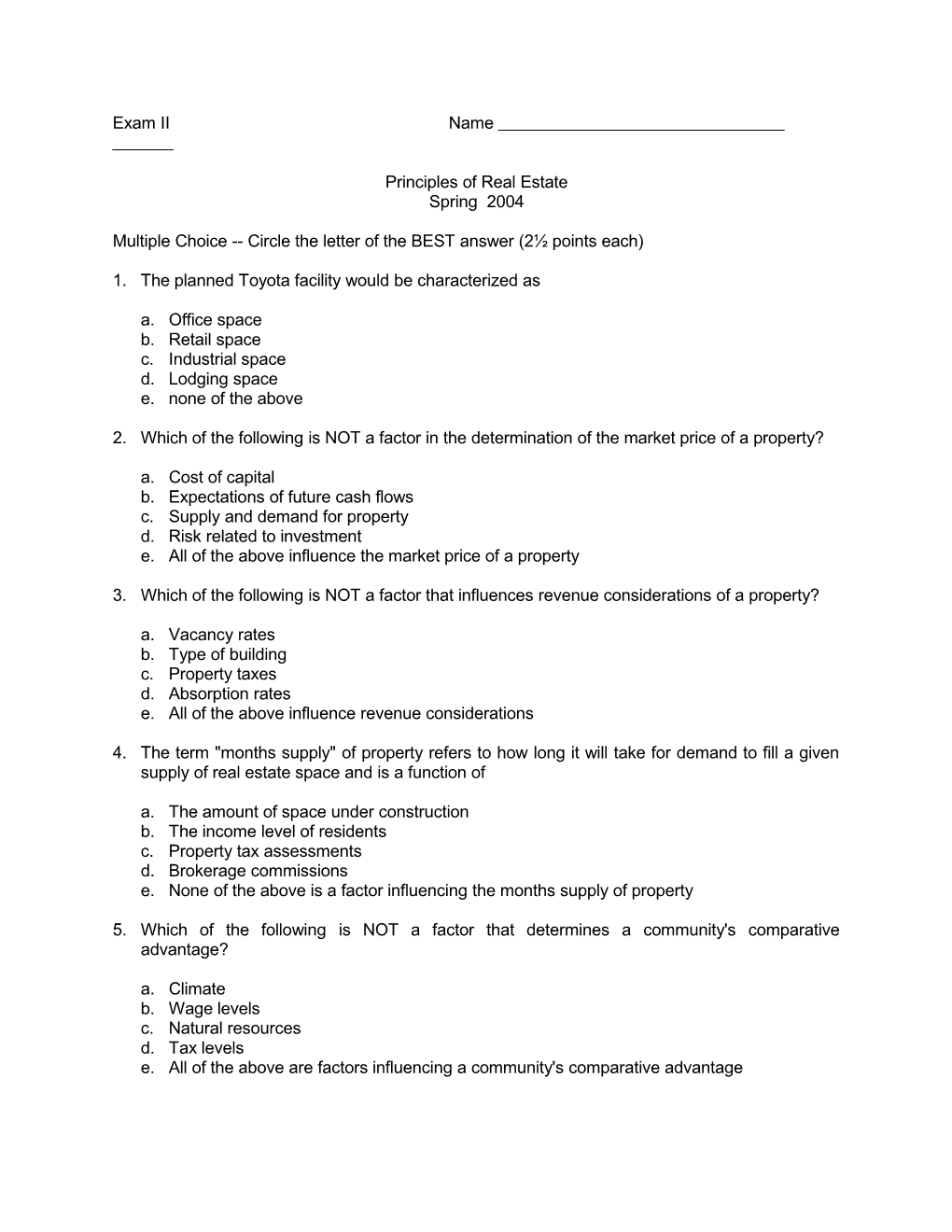

Exam II Name

Principles of Real Estate Spring 2004

Multiple Choice -- Circle the letter of the BEST answer (2½ points each)

1. The planned Toyota facility would be characterized as

a. Office space b. Retail space c. Industrial space d. Lodging space e. none of the above

2. Which of the following is NOT a factor in the determination of the market price of a property?

a. Cost of capital b. Expectations of future cash flows c. Supply and demand for property d. Risk related to investment e. All of the above influence the market price of a property

3. Which of the following is NOT a factor that influences revenue considerations of a property?

a. Vacancy rates b. Type of building c. Property taxes d. Absorption rates e. All of the above influence revenue considerations

4. The term "months supply" of property refers to how long it will take for demand to fill a given supply of real estate space and is a function of

a. The amount of space under construction b. The income level of residents c. Property tax assessments d. Brokerage commissions e. None of the above is a factor influencing the months supply of property

5. Which of the following is NOT a factor that determines a community's comparative advantage?

a. Climate b. Wage levels c. Natural resources d. Tax levels e. All of the above are factors influencing a community's comparative advantage 6. Which of the following would NOT be considered an "export" activity of the economic base of a community?

a. Landscaping b. Agriculture c. Research and development activities d. Tourism e. All of the above are export activities contributing to the economic base of a community

7. Which of the following would have the greatest impact on employment in San Antonio?

a. New car dealership b. New Frost Bank branch c. New credit card call center d. New gated residential neighborhood e. All of the above would have about the same impact on employment

8. The growth of San Antonio along the interstate highways is characteristic of which growth model?

a. Concentric-circle growth b. Axial growth c. Sector growth d. Multiple nuclei growth e. None of the above

9. Beltways and loops, such as Loop 410 and Loop 1604, help the city by

a. Improving access to different areas b. Reducing the cost of providing utilities and services to residents c. Accelerating the rate of in-filling between neighborhoods d. All of the above e. None of the above

10. The replacement of residents in a neighborhood by lower income residents in a neighborhood with declining housing prices is referred to as

a. Gestation b. Incipient decline c. Gentrification d. Pacification e. None of the above

11. Which of the following is NOT a part of the real estate brokerage function?

a. Marketing the property b. Qualifying the buyer c. Financing the property d. Closing the sale of the property e. All of the above are parts of the real estate brokerage function 12. Which of the following is NOT a common mistake that occurs when a broker lists a property?

a. Listing at a low price to encourage a fast sale b. Failing to make a comparative market analysis c. Not advising sellers of ways to make the property more marketable (such as new paint) d. Listing without personally inspecting the property e. All of the above are common mistakes made by brokers in listing a property

13. Which of the following should NOT be included in a listing agreement?

a. The rate of interest on the mortgage b. The duration of the agreement c. The amount of commission to be paid d. The asking price of the property e. All of the above should be included in the listing agreement

14. One of the fiduciary responsibilities of a broker to the seller is

a. Disclose any negative aspects of the property b. Communicate any and all offers c. Negotiate the lowest price d. All of the above e. None of the above

15. The broker-owner agency relationship may be terminated without liability when which of the following occurs?

a. The listed property is sold b. The property is destroyed by fire c. The agreement expires d. The parties mutually agree to terminate the agreement e. All of the above

16. The Texas Deceptive Trade Practices Act when applied to real estate does NOT include

a. Representing that the property is of a particular standard or quality if it is not b. Representing that the property involves rights (e.g., mineral rights) or obligations (e.g., easements) that it does not have c. Disclosing negative aspects of the property (e.g., it is built on top of a dump) d. Advertising that the builder was a different company than the actual construction company that built the structure e. All of the above are violations of the Texas Deceptive Trade Practices Act

17. The Multiple Listing Service (MLS) is

a. A service where a broker contracts with an individual seller to sell multiple properties b. An electronic network linking brokers by computer in order to facilitate referrals c. The type of listing in which the selling broker receives the entire commission d. A disease afflicting older brokers from years of exposure to attorneys at property closings e. None of the above 18. Which of the following parties is NOT concerned about the value of a property?

a. Closing attorneys b. Tax assessors c. Insurance adjusters d. Mortgage lenders e. All of the above are concerned with the value of a property

19. The value of a property to a specific individual is referred to as

a. Investment value b. Market value c. Assessed value d. Insurable value e. None of the above

20. Which of the following is NOT a principle of appraisal?

a. Anticipation b. Contribution c. Restitution d. Substitution e. All of the above are principles of appraisal

21. Highest and best use refers to using the land to

a. generate the highest value of the property possible b. build the tallest structure possible c. protect flora and fauna as much as possible d. generate the most property taxes possible e. none of the above

22. The first step of the appraisal process, the definition of the problem, is to

a. Determine the legal definition of the term "appraisal" b. Clearly define the assignment and purpose of the valuation c. Establish the lowest bidders for repairs that must be performed d. Clearly state the dollar amount that the appraisal will conclude e. None of the above

23. Which of the following is NOT necessary for a comparison to be valid using the sales comparison approach to value?

a. Property rights conveyed should be the same b. Land size should be similar c. Location should be similar d. Income of buyers should be similar e. All of the above are necessary for valid comparisons

24. In general, which approach is the preferred method of appraising a property? a. Sales comparison b. Reproduction cost c. Replacement cost d. Income e. All of the above are equally preferred

25. In the cost approach to appraising property value

a. Economic depreciation must be estimated and subtracted from the value b. Land cost is unimportant since only the cost of construction is considered c. Identical construction materials must always be considered d. Operating costs are essential to know e. None of the above

26. The income approach to property appraisal employs a term called the "cap" rate. The cap rate is

a. The reciprocal of a price-earnings multiple b. The maximum property tax rate that can be applied by the taxing authority c. Equal to the rate of interest on the mortgage d. The percentage depreciation allowed for tax purposes e. None of the above

27. Which of the following would be most likely to be appraised using the cost approach as the primary method?

a. Condominium b. Office building c. Strip center d. Oil refinery e. All of the above would most likely be appraised using the cost approach

28. Which of the following is NOT a step in the income approach to value?

a. Estimating the revenues b. Estimating the vacancy rate c. Estimating the operating expenses d. Estimating the property taxes e. All of the above are necessary steps in the income approach

29. According to the text, characteristics of the particular financing of a property would influence

a. The sales comparison approach to appraisal value b. The cost approach to appraisal value c. The income approach to appraisal value d. All of the above e. None of the above

30. The management agreement between a property owner and a property manager should NOT include a. The names of the owner and manager b. The manner in which the manager is compensated c. The appraised value of the property d. The term of the agreement e. All of the above should be included in a property management agreement

31. Unlike a property manager, a corporate asset manager is also responsible for

a. Locating and acquiring properties b. Financing properties c. Selling properties d. All of the above e. None of the above

32. Most property managers are compensated based upon a

a. Percentage of gross income (rents) b. Percentage of net income c. Percentage of operating expenses d. Base salary plus a percentage of cash flow e. None of the above

33. A management plan prepared prior to entering into a management agreement would NOT normally include

a. Physical inspection of the property b. Reviewing previous ownership records c. Drawing up a budget d. A neighborhood analysis of social and economic characteristics e. All of the above would be included

34. In negotiating leases, the property manager would normally NOT consider

a. Rental rates b. Payment due dates c. Hours the property is occupied d. Duration of the tenancy e. All of the above would be considered in the lease negotiations

35. In property insurance terminology, indirect losses refer to

a. Cost of obtaining alternative property for use b. Loss of income while property is being restored c. Loss of customers resulting from a temporary relocation d. All of the above e. None of the above

36. The Law of Large Numbers

a. Allows individuals to pay for losses based on the probability of a loss occurring and the average amount of a loss b. Allows insurance companies to charge larger premiums for smaller companies c. Makes the amount of losses incurred by a company equal to the amount of losses that the insurance company incurs d. All of the above e. None of the above

37. Typical insurance policies, such as homeowner's insurance, do NOT insure against

a. Structural damage due to fire b. Indirect losses c. Liability losses d. All of the above are typically covered e. None of the above are typically covered

38. Coinsurance

a. Is a sharing of the costs should damage occur b. Increases the amount of the premiums charged c. Covers buildings as well as motor vehicles d. All of the above e. None of the above

39. Which of the following is NOT typically required by a lender on the purchase of a property?

a. Property insurance b. Liability insurance c. Mortgage life insurance d. All of the above are required e. None of the above are required

40. An umbrella insurance policy

a. Replaces property insurance for businesses b. Covers damages over the limits of regular property and liability insurance c. Covers damages for structures in flood plains d. Is issued only by Traveler's Insurance company e. None of the above