EXECUTIVE SUMMARY INTERNAL AUDIT OF RECEIVABLE BALANCE

This audit was initiated by a request from the office of Taylor Goldsmith to mitigate the problems associated with the accounts receivable balance.

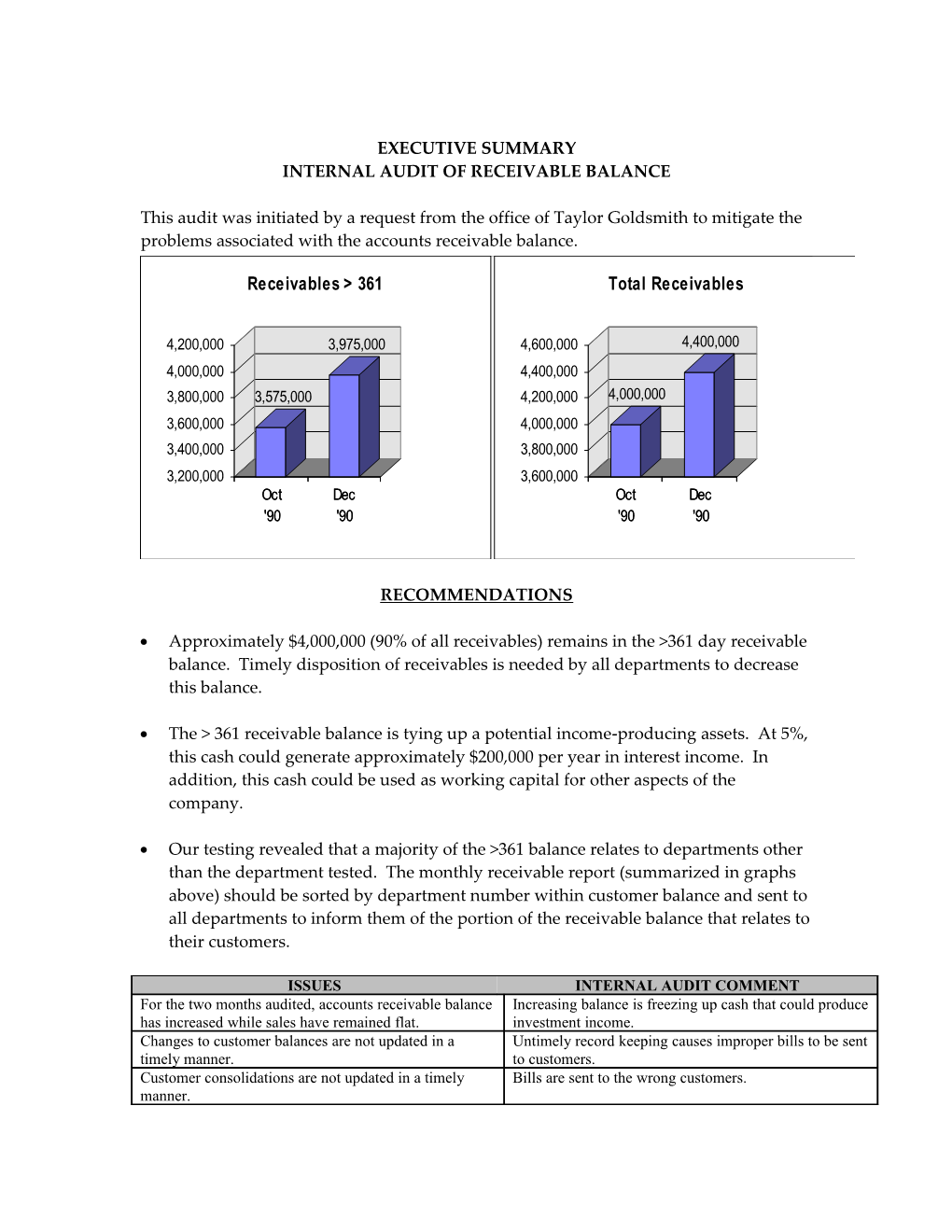

Receivables > 361 Total Receivables

4,200,000 3,975,000 4,600,000 4,400,000 4,000,000 4,400,000 3,800,000 3,575,000 4,200,000 4,000,000 3,600,000 4,000,000 3,400,000 3,800,000 3,200,000 3,600,000 Oct Dec Oct Dec '90 '90 '90 '90

RECOMMENDATIONS

Approximately $4,000,000 (90% of all receivables) remains in the >361 day receivable balance. Timely disposition of receivables is needed by all departments to decrease this balance.

The > 361 receivable balance is tying up a potential income-producing assets. At 5%, this cash could generate approximately $200,000 per year in interest income. In addition, this cash could be used as working capital for other aspects of the company.

Our testing revealed that a majority of the >361 balance relates to departments other than the department tested. The monthly receivable report (summarized in graphs above) should be sorted by department number within customer balance and sent to all departments to inform them of the portion of the receivable balance that relates to their customers.

ISSUES INTERNAL AUDIT COMMENT For the two months audited, accounts receivable balance Increasing balance is freezing up cash that could produce has increased while sales have remained flat. investment income. Changes to customer balances are not updated in a Untimely record keeping causes improper bills to be sent timely manner. to customers. Customer consolidations are not updated in a timely Bills are sent to the wrong customers. manner. The monthly accounts receivable aging is only sent to A large part of the receivable balance relates to other the department tested. departments.