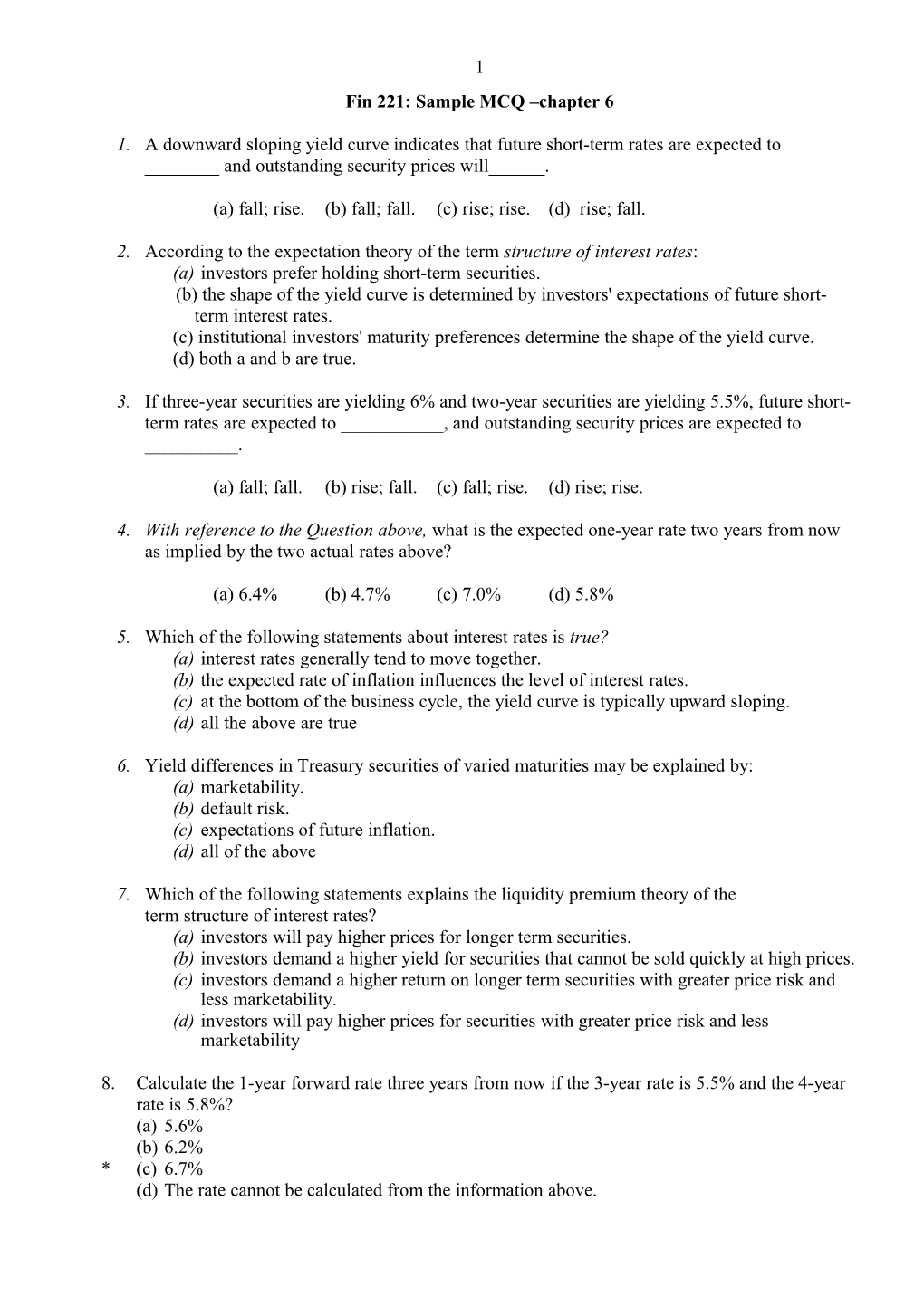

1 Fin 221: Sample MCQ –chapter 6

1. A downward sloping yield curve indicates that future short-term rates are expected to ______and outstanding security prices will______.

(a) fall; rise. (b) fall; fall. (c) rise; rise. (d) rise; fall.

2. According to the expectation theory of the term structure of interest rates: (a) investors prefer holding short-term securities. (b) the shape of the yield curve is determined by investors' expectations of future short- term interest rates. (c) institutional investors' maturity preferences determine the shape of the yield curve. (d) both a and b are true.

3. If three-year securities are yielding 6% and two-year securities are yielding 5.5%, future short- term rates are expected to ______, and outstanding security prices are expected to ______.

(a) fall; fall. (b) rise; fall. (c) fall; rise. (d) rise; rise.

4. With reference to the Question above, what is the expected one-year rate two years from now as implied by the two actual rates above?

(a) 6.4% (b) 4.7% (c) 7.0% (d) 5.8%

5. Which of the following statements about interest rates is true? (a) interest rates generally tend to move together. (b) the expected rate of inflation influences the level of interest rates. (c) at the bottom of the business cycle, the yield curve is typically upward sloping. (d) all the above are true

6. Yield differences in Treasury securities of varied maturities may be explained by: (a) marketability. (b) default risk. (c) expectations of future inflation. (d) all of the above

7. Which of the following statements explains the liquidity premium theory of the term structure of interest rates? (a) investors will pay higher prices for longer term securities. (b) investors demand a higher yield for securities that cannot be sold quickly at high prices. (c) investors demand a higher return on longer term securities with greater price risk and less marketability. (d) investors will pay higher prices for securities with greater price risk and less marketability

8. Calculate the 1-year forward rate three years from now if the 3-year rate is 5.5% and the 4-year rate is 5.8%? (a) 5.6% (b) 6.2% * (c) 6.7% (d) The rate cannot be calculated from the information above. 2

The following interest rates prevail in the market and are used to answer the next six questions. 90-day Treasury bills 8.36 percent 180-day Treasury bills 8.48 percent 3-year Treasury securities 9.25 percent 2-year Treasury securities 9.10 percent 90-day Commercial paper 9.15 percent 3-year Corporate bonds (AA) 10.1 percent 3-year Municipal (AA) 7.10 percent Expected 2-year inflation rate 3.50 percent

9. With reference to the data above what is the expected real rate of return on the 2-year Treasury security? (e) 12.6% (f) 3.5% (g) 5.6% (h) 4.2%

10. With reference to the data above, what is the default risk premium on commercial paper? a. 9.15% b. .95% c. .79% d. .55%

11. With reference to the data above, calculate the one-year forward rate on Treasury securities two years from now? a. 8.86% b. 9.55% c. 9.10% d. 9.18%

12. With reference to the data above, the yield curve slopes ______, indicating the market expectation of ______future short-term rates. a. downward; falling b. downward; rising c. upward; falling d. upward; rising

13. With reference to the data above, the expected after tax rate of return on the 3-year corporate bond for an investor in the 30 percent tax bracket is: a. 7.07 b. 7.10 c. 10.1 d. 9.25

_14. With reference to the data above, At what tax rate would an investor be indifferent between holding the 3-year municipal bond or the 3-year corporate bond? (a) 33% (b) 18% (c) 3% (d) 30% ______answers: 1. (a) 2. (b) 3. (b) 4. (c) 5. (d) 6. (c) 7. (c) 8. (c) 9. (c) 10. (c) 11. (b) 12. (d); 13, (a); 14. (d) 3