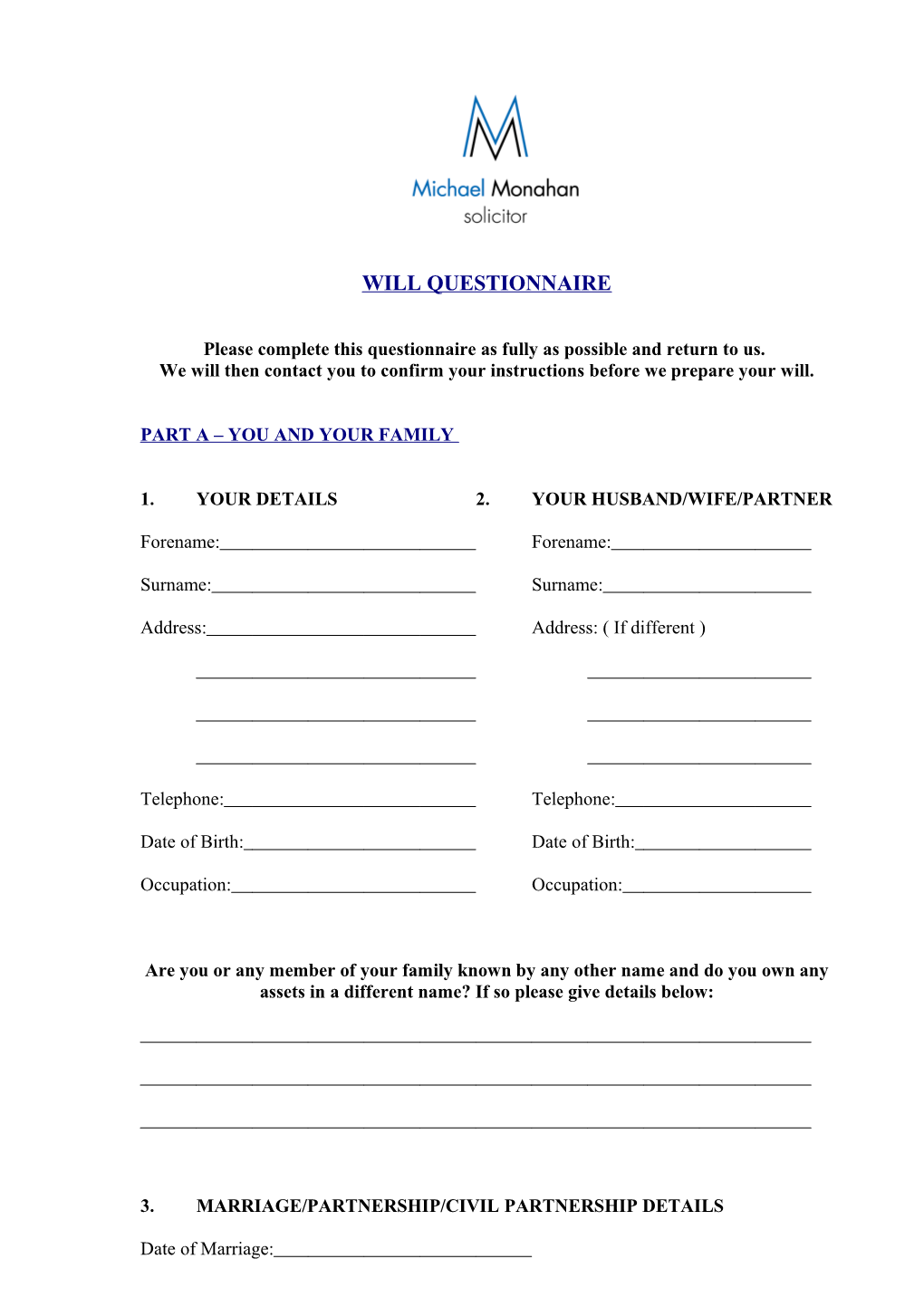

WILL QUESTIONNAIRE

Please complete this questionnaire as fully as possible and return to us. We will then contact you to confirm your instructions before we prepare your will.

PART A – YOU AND YOUR FAMILY

1. YOUR DETAILS 2. YOUR HUSBAND/WIFE/PARTNER

Forename: Forename:

Surname: Surname:

Address: Address: ( If different )

Telephone: Telephone:

Date of Birth: Date of Birth:

Occupation: Occupation:

Are you or any member of your family known by any other name and do you own any assets in a different name? If so please give details below:

3. MARRIAGE/PARTNERSHIP/CIVIL PARTNERSHIP DETAILS

Date of Marriage: Location of Marriage:

Please tick this box if you are not married to your partner:

Please tick this box if you are intending to marry/re-marry in the near future:

Please tick this box if either of you have been married before:

4. YOUR CHILDREN – INCLUDING CHILDREN FROM A PREVIOUS MARRIAGE OR RELATIONSHIP

Forename: Forename:

Surname: Surname:

Address: Address:

Date of Birth: Date of Birth:

Forename: Forename:

Surname: Surname:

Address: Address:

Date of Birth: Date of Birth:

Please note that children born outside of marriage and adopted children but not stepchildren generally have the same right of inheritance as other children. Children excluded from benefit under your Will may have a right to claim a share of your property in certain circumstances. Please ask for advice if appropriate.

5. CHILDREN OF YOUR HUSBAND/WIFE/PARTNER’S PREVIOUS MARRIAGE OR RELATIONSHIP

Forename: Forename:

Surname: Surname: Address: Address:

Date of Birth: Date of Birth:

PART B – YOUR ASSETS AND LIABILITIES

6. YOUR HOME

(a) If your home is owned – is it? (Please tick) Y N (i) In your sole name? (ii) In joint names with your husband/wife/ partner? (iii) In the sole name of your husband/wife/partner?

(b) If your home is not owned – is it? Y N (i) Rented? (ii) Provided by a relative or friend?

(c) What is the approximate value of your home:

7. OTHER PROPERTY Y N (a) Do you own any other property or land?

(i) If yes please provide details including approximate value and if it is solely or jointly owned.

Y N (b) Do you have a business?

(i) If yes - please state type of business

Y N (ii) If yes – is it: Company Partnership In your sole name

8. OTHER ASSETS

(a) Please list your other assets below and give approximate values. Please include bank and building society accounts, life insurance policies, other investments, trust funds, personal belongings and household contents.

ASSET SOLE/JOINTLY OWNED VALUE OF YOUR SHARE

Y N (b) Do you own any assets abroad?

(i) If yes - please provide details

9. YOUR LIABILITIES Y N (a) Do you have a Mortgage?

(i) If yes – how much approximately is left on your mortgage?

Y N (ii) Is it covered by insurance on death? (iii) Do you have any other significant loans?

(iv) If yes – please provide details:

Y N (v) Are these loans covered by insurance on death?

PART C – FUNERAL EXECUTORS AND GUARDIANS

10. YOUR FUNERAL

You may specify in your Will if you wish to be:

Buried Cremated No preference

Please note you should make these wishes known to your immediate family as well and not rely solely on what is in your Will. If you wish to leave any part of your body for medical purposes please inform your family and your doctor and carry an owner donor card.

11. EXECUTORS

You must appoint Executors to carry out the instructions in your Will. It is wise to have at least two and you may appoint your husband/wife/partner as one. You should name other Executors to act if he/she is unable to do so. Partners of our Firm will be pleased to act as your Executors either alone or with a member of your family or a friend.

(a) Please list up to four chosen Executors:

Forename: Forename:

Surname: Surname:

Address: Address:

Occupation: Occupation: Forename: Forename:

Surname: Surname:

Address: Address:

Occupation: Occupation:

Y N (b) If you would like a Partner of this Firm to act as your Executor please confirm:

12. GUARDIANS

You may wish to appoint one or two people to act as Guardian(s) for children under 18. The appointment will usually only apply if you and the child’s other parent are both dead. The position may be different if you are a single parent. Guardianship involves a lot of responsibility and you should ask people to agree to act before appointing them.

Forename: Forename:

Surname: Surname:

Address: Address:

Occupation: Occupation:

PART D – BENEFICIARIES

The main part of your estate is called the residue. (This is dealt with in section 15).Before giving away the residue you may wish to make certain gifts of cash or personal belongings to individual children, grandchildren, friends or to charities. These will be known as “beneficiaries”.

13. CASH GIFTS

(a) Please give the name and address of the beneficiary and the amount to be given. If the proposed beneficiary is under the age of 18 please state their age.

Amount: Amount:

Name : Name: Address: Address:

Date of Birth: Date of Birth:

Amount: Amount:

Name : Name:

Address: Address:

Date of Birth: Date of Birth:

14. GIFTS OF ARTICLES

Please give the names and addresses of people to whom you wish to leave specific items and a full description of the article to enable it to be identified. Please note that if you sell or replace one of these items the beneficiary will get nothing – he or she will not be given the substituted items or the cash equivalent.

Article: Article:

Name : Name:

Address: Address:

Article: Article:

Name : Name:

Address: Address:

If you wish to gift more than a few items it may be best to use a Memorandum of Wishes. We may contact you again if appropriate.

15. THE RESIDUE

This is all that you own, except jointly owned property and the gifts made in section 13 & 14. Please state below who is to receive it if that person dies before you. If there are gifts to your children may we suggest a provision that if any of them dies before you leaving children of his/her own those children will inherit their parent’s share.

The following are the more common provisions made. If you wish to use one of these tick the appropriate box. If not please proceed to section 16.

(a) Everything to my husband/wife/partner named above at section 2 outright but if he/she has died then to my children named above at section 4.

(b) Everything to my children named at section 4 above equally and any other children of mine.

You may choose the age at which your children will receive their entitlement 18 21 25

(c) Everything to my husband/wife/partner named at section 2 above but if he/she has died before me to the person(s) or organisation(s) named below.

If not in equal shares please provide details of the share each party is to receive:

(d) If none of the above choices are appropriate to your wishes please set out below who is to receive the residue and if more than one person or organisation is involved in what share?

Share: Share:

Name : Name:

Address: Address:

Share: Share:

Name : Name:

Address: Address:

(e) Who is to benefit if the recipient dies before you?

Name : Name:

Address: Address:

PART E – GENERAL NOTES

1. A Will is usually completely cancelled if you marry after making it. You will need to draft another Will immediately or one which takes a forthcoming marriage into account.

2. On divorce, gifts to your husband/wife are cancelled as is his/her appointment as Executor but the rest of the Will still stands. This can create problems and it is better to make a new Will.

3. If you are not making provision for a husband/wife/partner it is possible that he/she could make a claim against your estate. If this does apply please seek further advice from us.

4. Please feel free to ask for our help or advice on more information on any topic relating to your Will by contacting us at our office at 47 John Street, Sligo, by phone on 071 9129070 or 071 9129071 or email to [email protected]

Michael Monahan Solicitor 47 John Street Sligo Ph. 071 91 29070 Email [email protected] Web http://www.michaelmonahansolicitor.ie