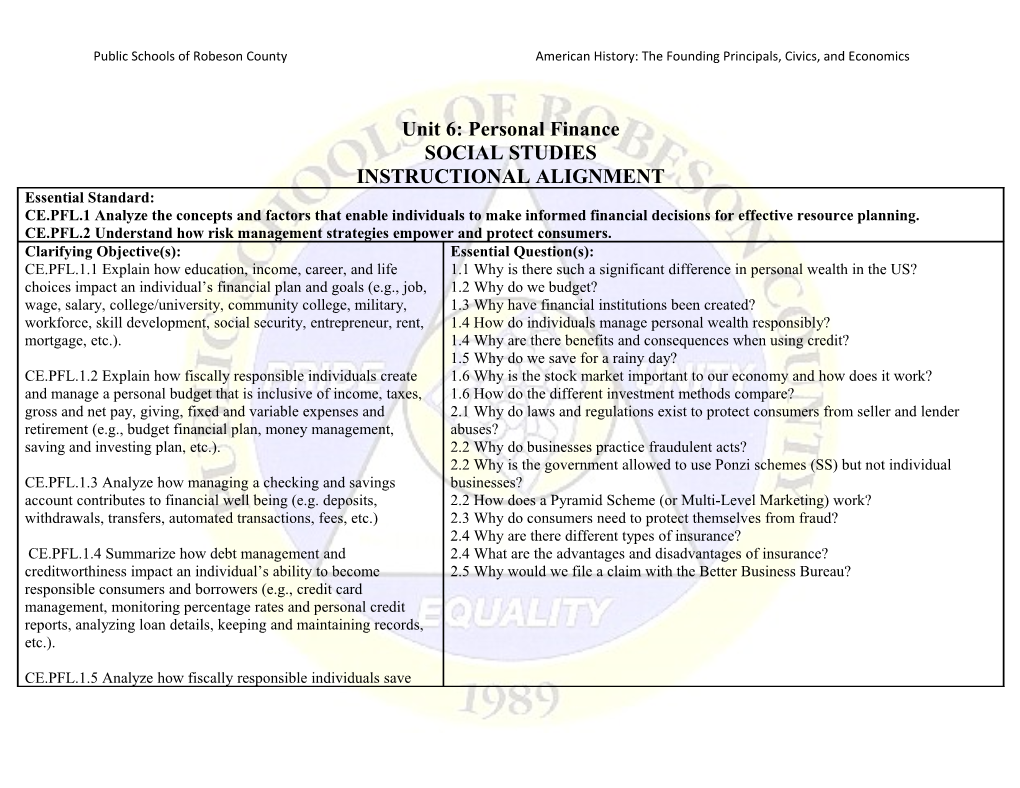

Public Schools of Robeson County American History: The Founding Principals, Civics, and Economics

Unit 6: Personal Finance SOCIAL STUDIES INSTRUCTIONAL ALIGNMENT Essential Standard: CE.PFL.1 Analyze the concepts and factors that enable individuals to make informed financial decisions for effective resource planning. CE.PFL.2 Understand how risk management strategies empower and protect consumers. Clarifying Objective(s): Essential Question(s): CE.PFL.1.1 Explain how education, income, career, and life 1.1 Why is there such a significant difference in personal wealth in the US? choices impact an individual’s financial plan and goals (e.g., job, 1.2 Why do we budget? wage, salary, college/university, community college, military, 1.3 Why have financial institutions been created? workforce, skill development, social security, entrepreneur, rent, 1.4 How do individuals manage personal wealth responsibly? mortgage, etc.). 1.4 Why are there benefits and consequences when using credit? 1.5 Why do we save for a rainy day? CE.PFL.1.2 Explain how fiscally responsible individuals create 1.6 Why is the stock market important to our economy and how does it work? and manage a personal budget that is inclusive of income, taxes, 1.6 How do the different investment methods compare? gross and net pay, giving, fixed and variable expenses and 2.1 Why do laws and regulations exist to protect consumers from seller and lender retirement (e.g., budget financial plan, money management, abuses? saving and investing plan, etc.). 2.2 Why do businesses practice fraudulent acts? 2.2 Why is the government allowed to use Ponzi schemes (SS) but not individual CE.PFL.1.3 Analyze how managing a checking and savings businesses? account contributes to financial well being (e.g. deposits, 2.2 How does a Pyramid Scheme (or Multi-Level Marketing) work? withdrawals, transfers, automated transactions, fees, etc.) 2.3 Why do consumers need to protect themselves from fraud? 2.4 Why are there different types of insurance? CE.PFL.1.4 Summarize how debt management and 2.4 What are the advantages and disadvantages of insurance? creditworthiness impact an individual’s ability to become 2.5 Why would we file a claim with the Better Business Bureau? responsible consumers and borrowers (e.g., credit card management, monitoring percentage rates and personal credit reports, analyzing loan details, keeping and maintaining records, etc.).

CE.PFL.1.5 Analyze how fiscally responsible individuals save Public Schools of Robeson County American History: The Founding Principals, Civics, and Economics

and invest to meet financial goals (e.g. investment, stock market, bonds, mutual funds, etc.).

CE.PFL.1.6 Compare various investing strategies and tax implications for their potential to build wealth (e.g. individual stocks and bonds with investing in stock, giving, bonds, mutual funds, retirement plans, etc.).

CE.PFL.2.1 Explain how consumer protection laws and government regulation contribute to the empowerment of the individual (e.g., consumer credit laws, regulation, FTC-Federal Trade Commission, protection agencies, etc.).

CE.PFL.2.2 Summarize various types of fraudulent solicitation and business practices (e.g., identity theft, personal information disclosure, online scams, Ponzi schemes, investment scams, internet fraud, etc.).

CE.PFL.2.3 Summarize ways consumers can protect themselves from fraudulent and deceptive practices (e.g., do not call lists, reading the fine print, terms and conditions, personal information disclosure, investment protection laws, fees, etc.).

CE.PFL.2.4 Classify the various types of insurance and estate planning including the benefits and consequences (e.g., car, health, renters, life, liability, travel, disability, long-term care, natural disaster, etc.).

CE.PFL.2.5 Summarize strategies individuals use for resolving consumer conflict (e.g., contacting Attorney General, filing claims, Better Business Bureau, Secretary of State, etc.). Public Schools of Robeson County American History: The Founding Principals, Civics, and Economics

Pacing Guide:

Unit of Study Major Instructional Task Essential Instructional Resources Sample Assessment Concepts Vocabulary Prompts Personal 1.1: Financial Income and 1. Explain the Pre: Text Resources: 1. Have students use Responsibilities Careers difference between Newspapers (want ads) local newspapers to Financial wages and salaries Loans Wall Street Journal research jobs, homes, Responsibility 2. Define entrepreneur Savings Smart Money Magazine and cars. Have Decision 3. Explain the Great Depression Money Magazine students balance their Making difference between rent Checking/Savings Fortune Magazine checkbook using these Saving and and mortgage Accounts Forbes Magazine prices. Investing 4. Evaluate decision- Scams Consumer Reports Magazine Credit and Debt making using the Smart Money Magazine 2. Have students opportunity cost model. complete planned Risk Current: activities found in the Management 1.2: High School Financial and Insurance 1. Define budget Types of workers Planning Program. Planning and 2. Define equilibrium White collar Digital Resources: (See website under Money 3. Explain the Blue collar Curriculum Pathways Resources Digital Resources to Management difference between Skilled workers (Available at: www.sasinschool.com) order materials) gross and net income Unskilled workers http://hsfpp.nefe.org 4. Explain money Cash NEFE High School Financial Planning 3. Have students management Savings Program research tuition prices techniques. Checking EverFi Program for various schools. Public Schools of Robeson County American History: The Founding Principals, Civics, and Economics

Loans http://www.everfi.com/ Have students create a 1.3: Debts SAS Curriculum Pathways Activities budget to pay for their 1. Explain the Bonds http://www.sascurriculumpathways.com/portal college expenses. difference between 401ks checking and savings Credit Cards 4. Develop a accounts Debit Cards retirement plan based 2. Explain benefits and Budgeting Literary Connections: on a set salary found drawbacks of using Stock Brokers Current Events based on career banks Banking System Wall Street Journal research. 3. Demonstrate how to Wall Street Smart Money Magazine manage a NASDAQ Money Magazine 5. Develop an checking/savings Dow Jones Fortune Magazine insurance portfolio account Taxation Forbes Magazine based on quotes Better Business Consumer Rep obtained by research. 1.4: Bureau 1. Define debt. State Laws 6. Develop a stock 2. Explain the Regulatory portfolio and follow importance of personal Commissions the stocks for a period credit ratings Great Depression of time and explain 3. Explain interest Federal Trade how they changed. percentage rates Commission Determine after a 4. Demonstrate credit Investments period of time if management Stock Market students lose money or techniques Consumer Credit gain money, etc. Laws 1.5: Budgets 1. Define investment. Fraud/Scams 2. Explain/describe Liability Interest different Rates investment/savings Collateral techniques. Federal Reserve 3. Discuss setting Monetary Policy Public Schools of Robeson County American History: The Founding Principals, Civics, and Economics

financial goals. Security Exchange State Regulations 1.6: Federal 1. Compare and Regulations contrast investing Interest Rates options Federal Reserve 2. Explore tax codes FBI dealing with FDIC investments. SBI 3. Analyze mutual US Justice funds, 401ks, and IRA Department portfolios for their investment potential. Introductory: 2.1: Wall Street 1. Define consumer Great Depression 2. Describe the Federal Trade Commission 3. Explain FDIC

2.2: 1. Describe and analyze Ponzi schemes 2. Define identity theft 3. Explain methods for keeping credit cards/personal information safe

2.3: 1. Summarize various ways consumers can Public Schools of Robeson County American History: The Founding Principals, Civics, and Economics

protect themselves from various deceptive practices

2.4: 1. List the various types of insurance 2. Compare and contrast the difference between mortgage and renting property 3. Discuss the implications for the Social Security Program

2.5: 1. Describe civil trials and civil cases 2. Compare and contrast various ways to initiate consumer complaints. 3. Evaluate the effectiveness of the Better Business Bureau and NC State Department at dealing with consumer complaints.