Present Value of an Annuity: Amortization 1. Present value of an annuity 2. Amortization 3. Amortization schedule

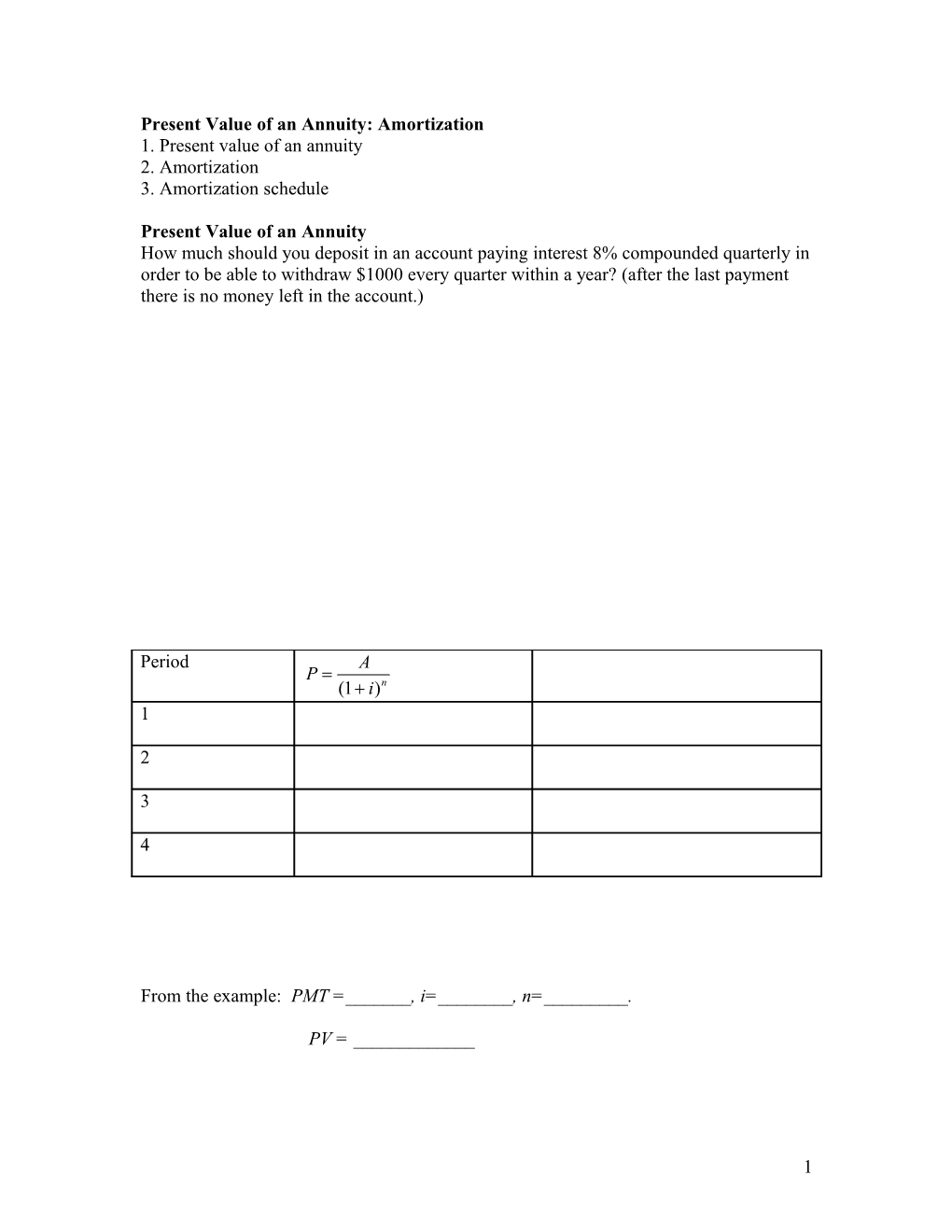

Present Value of an Annuity How much should you deposit in an account paying interest 8% compounded quarterly in order to be able to withdraw $1000 every quarter within a year? (after the last payment there is no money left in the account.)

Period A P = (1+ i )n 1

2

3

4

From the example: PMT =______, i=______, n=______.

PV = ______

1 Example 1. How much should you deposit in an account paying 8% compounded quarterly in order to receive quarterly payments of $1,000 for the next 4 years? r = ______m=______i = ______n = ______

PV =

2. A relative wills you an annuity paying $4,000 per quarter for the next 10 years. If money is worth 8% compounded quarterly, what is the present value of this annuity?

2 Amortization

Amortizing a debt means that the debt is retired in a given length of time by equal periodic payments that include compound interest.

Example 1. Suppose you want to buy a television set for $600 and agree to pay for it in 18 equal installments at 1% interest per month on the unpaid balance, how much is your monthly payment? How much interest will you pay?

Interpret the problem

PV = ______i = ______n = ______PMT = ______

How much interest do you pay?

Total interest paid = Amount of total payment – amount of initial loan

2. Assume you borrow $2,000 from a bank to buy a computer and agree to repay the loan in 20 equal monthly payments, including all interest due. If the bank charges 1.5% per month on the unpaid balance, how much should each payment be to retire the total debt including interest in 20 months?

Interpret the problem

PV = ______i = ______n = ______PMT = ______

How much interest do you pay?

Total interest paid = Amount of total payment – amount of initial loan

3 Amortization schedule Example 1. Construct amortization schedule for a $1,000 debt that is to be amortized in four equal monthly payments at 1.25% interest per month on the unpaid balance.

Step1 :

PMT = ______

Step2: Find interest paid on unpaid balance Unpaid balance reduction Unpaid balance

Payment No. Payment Interest ( 1.25% of Unpaid Balance Unpaid unpaid balance) Reduction balance

0

1

2

3

4

4 1. A couple purchased a home 20 years ago for $65,000. The home was financed by paying 20% down and signing a 30 year mortgage at 8% on the unpaid balance. The net market value of the house is now 130,000, and the couple wishes to sell the house. How much equity ( to the nearest dollar) does the couple have in the house now after making 240 monthly payments?

Note : Equity = (Current net market value) – (Unpaid loan balance)

2. A woman borrows $6,000 at 12% compounded monthly, which is to be amortized over 3 years in equal monthly payments. For tax purposes, she needs to know the amount of interest paid during each year of the loan. Find the interest paid during the first year, the second year, and the third year of the loan.

5