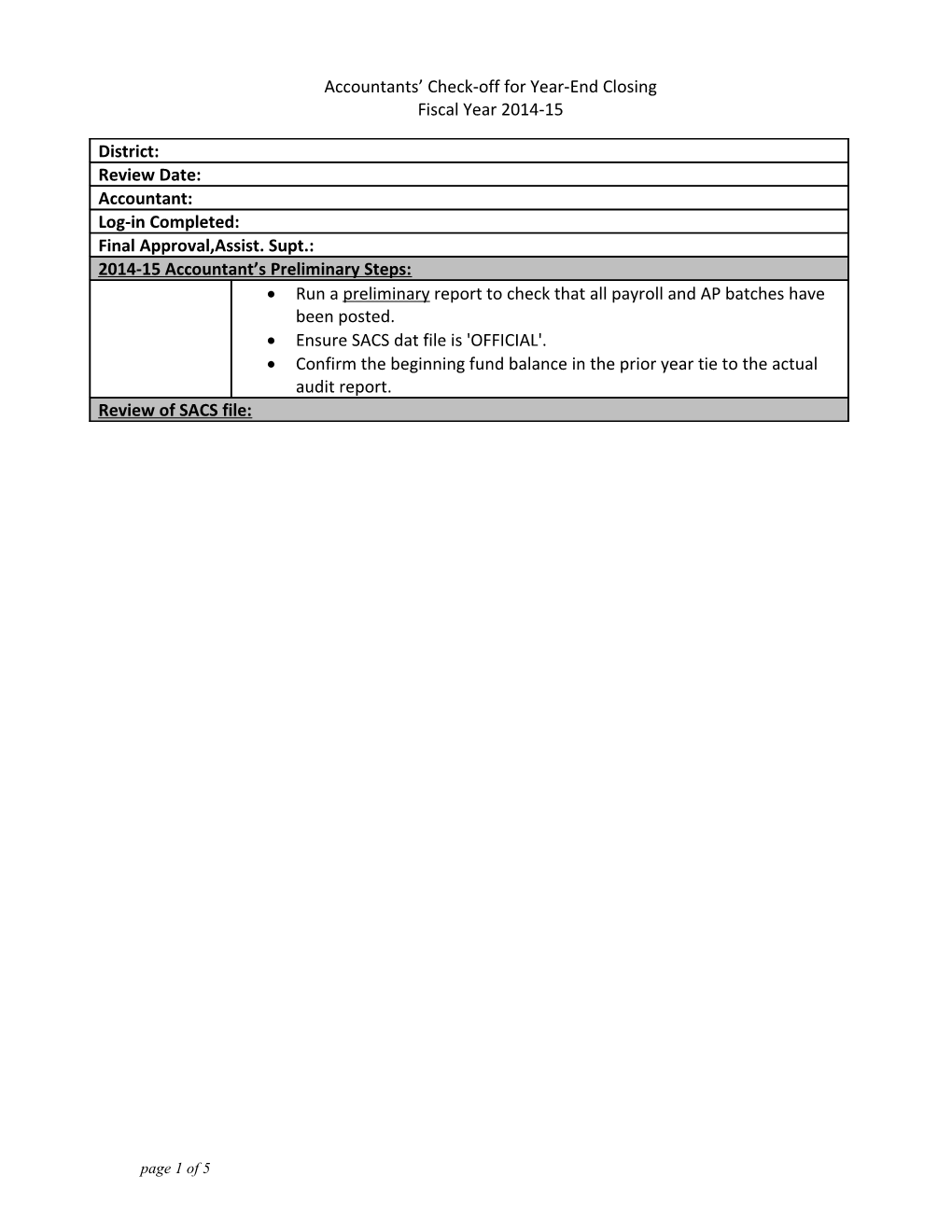

Accountants’ Check-off for Year-End Closing Fiscal Year 2014-15

District: Review Date: Accountant: Log-in Completed: Final Approval,Assist. Supt.: 2014-15 Accountant’s Preliminary Steps: Run a preliminary report to check that all payroll and AP batches have been posted. Ensure SACS dat file is 'OFFICIAL'. Confirm the beginning fund balance in the prior year tie to the actual audit report. Review of SACS file:

page 1 of 5 Accountants’ Check-off for Year-End Closing Fiscal Year 2014-15

14-15 Unaudited Check that technical review corrections (TRC) errors are cleared or Actuals explained. 15-16 Adopted Verify accuracy and appropriateness of explanations to all (W) exceptions Budget Form A: Attendance Compare P2 column to the District's ADA to ensure accuracy Compare Annual column to the District's to ensure accuracy Compare Funded column to the District's to ensure accuracy Form ASSET - Schedule of Capital Assets Compare beginning balances to ending balances in prior year audit report Verify the reasonableness of the "Increases" column with the GL for capital outlay Form DEBT - Schedule of Long-Term Liabilities Compare beginning balances to ending balances in prior year audit report Determine reasonableness of the "Increases" by reviewing against object 897X Determine reasonableness of the "Decreases" by reviewing against object 793X and “Amounts Due Within One Year” to prior year audit report

Form ICR-Indirect Cost Rate Compare the indirect cost rate to the prior year. If the historical trend is inconsistent or evidences a large swing, analyze the underlying calculation Check coding of audit fee (Function 7191 = if LEA expends less than 500k in federal funds. Function 7190 = single audit if LEA expends more than 500k in federal funds.) Form CEA - Current Expense Formula/Minimum Classroom Compensation Verify that the district is at the minimum allowable amount, or is exempt. If under, and not exempt, discuss or e-mail district that adjustments will be required. Check that the following general ledger balances were cleared:

P & L insurance (9538) TRAN (9641)

page 2 of 5 Accountants’ Check-off for Year-End Closing Fiscal Year 2014-15

Outdated warrants (9515) PR adjustment (9530/9531) PR AR (9213) Check that general ledger accounts were cleared to their actual liability Check for reasonableness and materiality. Medicare – (9558/333X) STRS (9551-310X) PERS – (9552-320X) OASDI – (9553-331X) Review any balances in 9540 Review any balances in 9511 Workers’ Comp – (9556-360X). P&L Insurance final year-end adjustment. Health and Welfare GL clearing accounts (957X) in all funds. Check for reasonableness, balances must be explainable. Due to/from accounts to ensure they are within the required 75%/120 days; if not, discuss with district. Specific to Fund 21: The amount loaned by Fund 21 to other funds does not exceed the district's deferred state apportionment amount. Confirm that Fund 21 loans existing at the beginning were paid back during the current year. In-lieu of property taxes (8096) is in balance between the district and charter. Unemployment insurance (9555), SDI (9557), Use tax (9580) in current year is reasonable based on amounts paid in the prior year. If not, discuss with district. Ensure that journals were not posted to fund balance accounts (9790 or 9791). Ensure that prior year audit adjustment(s) were completed. Query various items Review objects 761X & 891X if budgeted. Were the transfers made? Are the contributions reasonable? If Deferred Maintenance (Fund 14) exists, review revenue coding. Flexed revenue must be reported directly in Fund 14 using Res. 0000, Object 8590. An inter-fund transfer would only be used to cover additional costs. Review sub agreements for reasonableness – objects 58xx, 51xx Reconcile 8011 & 8015 to the CDE apportionment schedule. Check that 8012 (EPA) is more than State Aid. If not, 8011 will not balance w/o dr. to 8012, cr. 9299 in 2014-15. 2015-16, dr. 9299, cr. 8019.

page 3 of 5 Accountants’ Check-off for Year-End Closing Fiscal Year 2014-15

Review 898X/899X contributions. Were they over or under the amount necessary to balance the resource? PERS object 380x should be zero for internal charters Res. 3205: are subject to PERS reduction (380X) Districts receiving Redevelopment Funds – check that they transferred from Fund 01, res. 0000, obj. 8625 to Fund 14, 21, 25, 40, or a designated resource in Fund 01.

Check restricted resources: Compare ending deferred revenue by resource to object 9650 in the G/L

Compare ending accounts rec by resource to object 92XX in the G/L. Investigate any material differences. Review Form NCMOE (NCLB Maintenance of Effort) and check District's status in meeting MOE and identify any deficiency amount here:

Verify that the District meets MOE in both SEMA and SEMB in the Special Education MOE Form

Check that SACS Fund 01, restricted/unrestricted and ensure: No negative balances Resource 3310 = 0 Review Transportation (Resource 7230) if not 0 fund balance. Important! See Transportation entitlement (amount before cut). Did district spend up to that amount? If not, have discussion with district to make sure all appropriate transportation expenses are applied to Resource 7230. Resource 6500 = 0, or if positive the encroachment is not overstated No EFB or Cash in closed resources (TRC should give error if EFB does exist)

page 4 of 5 Accountants’ Check-off for Year-End Closing Fiscal Year 2014-15

Run Ledger 02 Payables/Receivable: Check A/R’s and A/P’s for reasonableness. Check that ALL 2014-15 entries were posted. Review 9299 & 9599. Check 9210/9510 & 9211. Should not include any due to/from Government AR/AP’s. Review district’s CLOSING CHECK LIST After all validations are complete and journals posted, review and compare the budget to actuals by major object code, all funds, at the fund level to ensure budget sufficiency. Note the existence of over, as well as under, appropriations and adjust if necessary.

Run a final report to check that all batches have been posted. Lastly, if any changes were made to the original data, re-extract into the SACS software to run through the Technical Review. Make sure all tests have passed. If changes made, recheck the forms ICR, CEA to see if they are still accurate and valid. Calculate the district’s economic reserve requirement and make sure that object 9790 is sufficient to cover. Notes: Estimated Ending Cash Balance =

page 5 of 5