Decision Tree– SYST 473

1. Assume you have a ticket that will let you participate in a game of chance (a lottery) that will pay off $10 with a 45% chance (or a 55% chance of getting nothing). Your friend has a ticket to a different lottery that has a 20% chance of paying $25 (or an 80% chance of paying nothing). Your friend has offered to let you have his ticket if you will give him your ticket plus one dollar. Analyze this decision using a decision tree. Also represent this decision problem as an influence diagram.

2. A major league baseball team is considering moving to a new city. There are two possible new locations that would like them to come. City 1 promises to build a new stadium that would likely produce high attendance for the team, and therefore high revenue. Unfortunately there is some opposition to public funding of the stadium in this city, which might result in no stadium at all, or that the team would have to make a significant contribution to the construction cost. City 2 had a team before and there is an existing stadium. The city is committed to improvements, but not to the level of a new stadium. Although the city has great support for bringing in the team, there was a previous failure that must be considered. Of course, the team could also stay in place. Draw a decision tree that represents this problem. Also represent this decision problem as an influence diagram. What data would be necessary to populate this model?

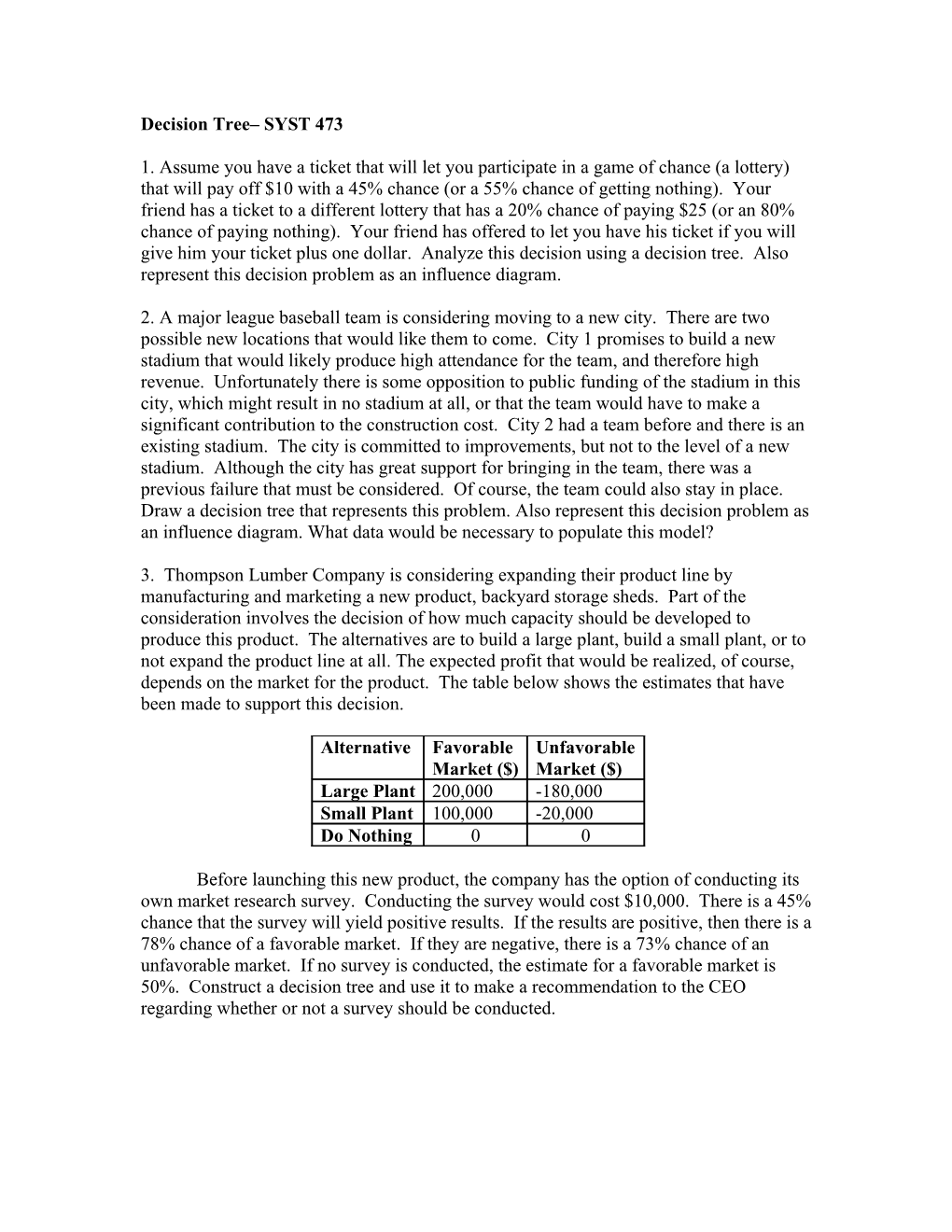

3. Thompson Lumber Company is considering expanding their product line by manufacturing and marketing a new product, backyard storage sheds. Part of the consideration involves the decision of how much capacity should be developed to produce this product. The alternatives are to build a large plant, build a small plant, or to not expand the product line at all. The expected profit that would be realized, of course, depends on the market for the product. The table below shows the estimates that have been made to support this decision.

Alternative Favorable Unfavorable Market ($) Market ($) Large Plant 200,000 -180,000 Small Plant 100,000 -20,000 Do Nothing 0 0

Before launching this new product, the company has the option of conducting its own market research survey. Conducting the survey would cost $10,000. There is a 45% chance that the survey will yield positive results. If the results are positive, then there is a 78% chance of a favorable market. If they are negative, there is a 73% chance of an unfavorable market. If no survey is conducted, the estimate for a favorable market is 50%. Construct a decision tree and use it to make a recommendation to the CEO regarding whether or not a survey should be conducted.