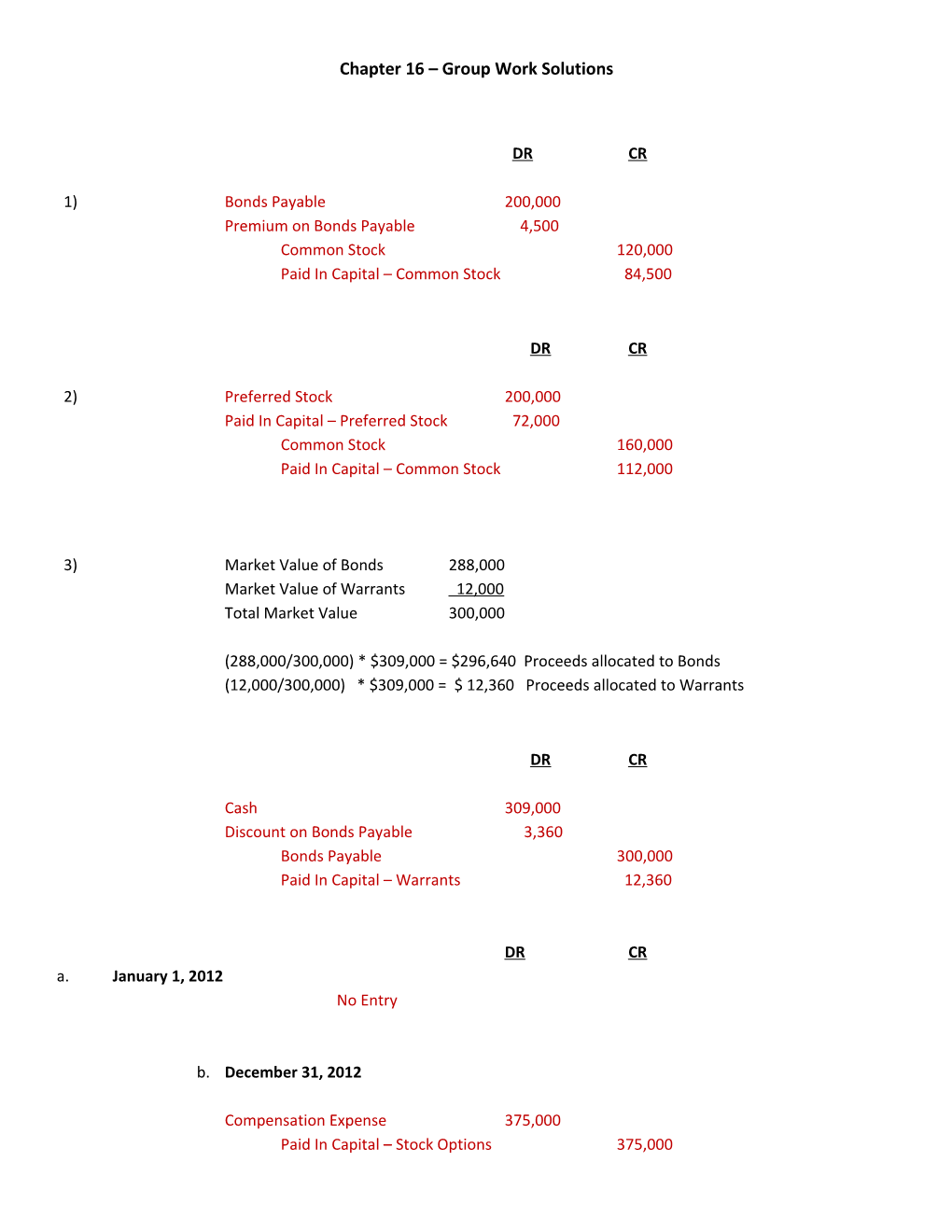

Chapter 16 – Group Work Solutions

DR CR

1) Bonds Payable 200,000 Premium on Bonds Payable 4,500 Common Stock 120,000 Paid In Capital – Common Stock 84,500

DR CR

2) Preferred Stock 200,000 Paid In Capital – Preferred Stock 72,000 Common Stock 160,000 Paid In Capital – Common Stock 112,000

3) Market Value of Bonds 288,000 Market Value of Warrants 12,000 Total Market Value 300,000

(288,000/300,000) * $309,000 = $296,640 Proceeds allocated to Bonds (12,000/300,000) * $309,000 = $ 12,360 Proceeds allocated to Warrants

DR CR

Cash 309,000 Discount on Bonds Payable 3,360 Bonds Payable 300,000 Paid In Capital – Warrants 12,360

DR CR 4) a. January 1, 2012 No Entry

b. December 31, 2012

Compensation Expense 375,000 Paid In Capital – Stock Options 375,000 *$750,000/2 = $375,000 DR CR

c. December 31, 2013

Compensation Expense 375,000 Paid In Capital – Stock Options 375,000 *$750,000/2 = $375,000

d. April 16, 2014

Cash 3,500,000 Paid In Capital – Stock Options 525,000 Common Stock 700,000 Paid In Capital – Common Stock 3,325,000

70,000 * $50 = $3,500,000 (70,000/100,000) * $750,000 = $525,000 70,000 * $10 = $700,000

e. September 4, 2014

Cash 1,500,000 Paid In Capital – Stock Options 225,000 Common Stock 300,000 Paid In Capital – Common Stock 1,425,000

30,000 * $50 = $1,500,000 (30,000/100,000) * $750,000 = $225,000 30,000 * $10 = $300,000

DR CR

5) a. January 1, 2012

Unearned Compensation 236,000 Common Stock 30,000 Paid In Capital – Common Stock 206,000 DR CR

b. December 31, 2012

Compensation Expense 47,200 Unearned Compensation 47,200

$236,000/5 = $47,200

c. December 31, 2013

Compensation Expense 47,200 Unearned Compensation 47,200

$236,000/5 = $47,200

d. June 10, 2014

Common Stock 30,000 Paid In Capital – Common Stock 206,000 Unearned Compensation 141,600 Compensation Expense 94,400

6. a. January 1 250,000 * 2/12 * 1.4 * 2 = 116,667

Issued 80,000 March 1 330,000 * 2/12 * 1.4 * 2 = 154,000

Acquired (30,000) May 1 300,000 * 1/12 * 1.4 * 2 = 70,000

Issued 40% Stock Dividend 120,000 June 1 420,000 * 3/12 * 2 = 210,000

Issued 100,000 September 1 520,000 * 1/12 * 2 = 86,667

Issued 2 for 1 Stock Split 520,000 October 1 1,040,000 * 3/12 = 260,000 Weighted Average Number of Shares Outstanding for Year 897,334 b. Earnings Per Share (with Non-Cumulative Preferred Stock)

(1,,410,000 – 0)/897,334 shares = 1.57 EPS

c. Earnings Per Share (with Cumulative Preferred Stock)

(1,410,000 – 350,000)/897,334 shares = 1.18 EPS

7. a. Basic Earnings Per Share

$576,000/210,000 = 2.74 Basic EPS

b. Diluted Earnings Per Share – with Convertible Bonds

Weighted Average Shares Outstanding 210,000 6% Bond Converted to CS Shares 10,000 8% Bond Converted to CS Shares 1,500* Total Weighted Average Shares if Converted 221,500

*6,000 * 3/12 = 1,500

Net Income 576,000 Interest Expense Avoided if Converted – 6% Bond 21,000* Interest Expense Avoided if Converted – 8% Bond 4,200** Net Income if Converted 601,200

*$500,000 * .06 * (1-.30) = $21,000 **$300,000 * .08 * (1-.30) * 3/12 = 4,200

$601,200/221,500 = 2.71 Diluted Earnings Per Share 8. Diluted Earnings Per Share – with Stock Options

If Exercised 50,000 * $30 per share = $1,500,000 Proceeds Potential Buy Back $1,500,000/$40 per share = 37,500 Shares we are able to Buy Back for Treasury

Weighted Average Shares Outstanding 112,500 Shares Issued if Options Exercised 50,000 Shares We Buy Back with Proceeds (37,500) Adjusted Weighted Average Shares Outstanding 125,000

$360,000/125,000 = 2.88 Diluted Earnings Per Share