Financial Statement Analysis Deliverable FIN333: Financial Management Instructor: Jim Wehrley EDP III, Spring Semester, Online

Name: ______Key______

Good Luck!

This is an individual assignment.

Note: While I realize you have access to resources for this deliverable, you should be able to complete this deliverable with only one source, the financial ratios sheet. That is, to obtain a better feel for how you will do on the final exam, you should be able to complete this deliverable using just the financial ratios sheet. You should be able to complete the 40 point problem with no additional resources. Likewise, you should be able to work through the time value deliverable with only one resource, your calculator.

Part I

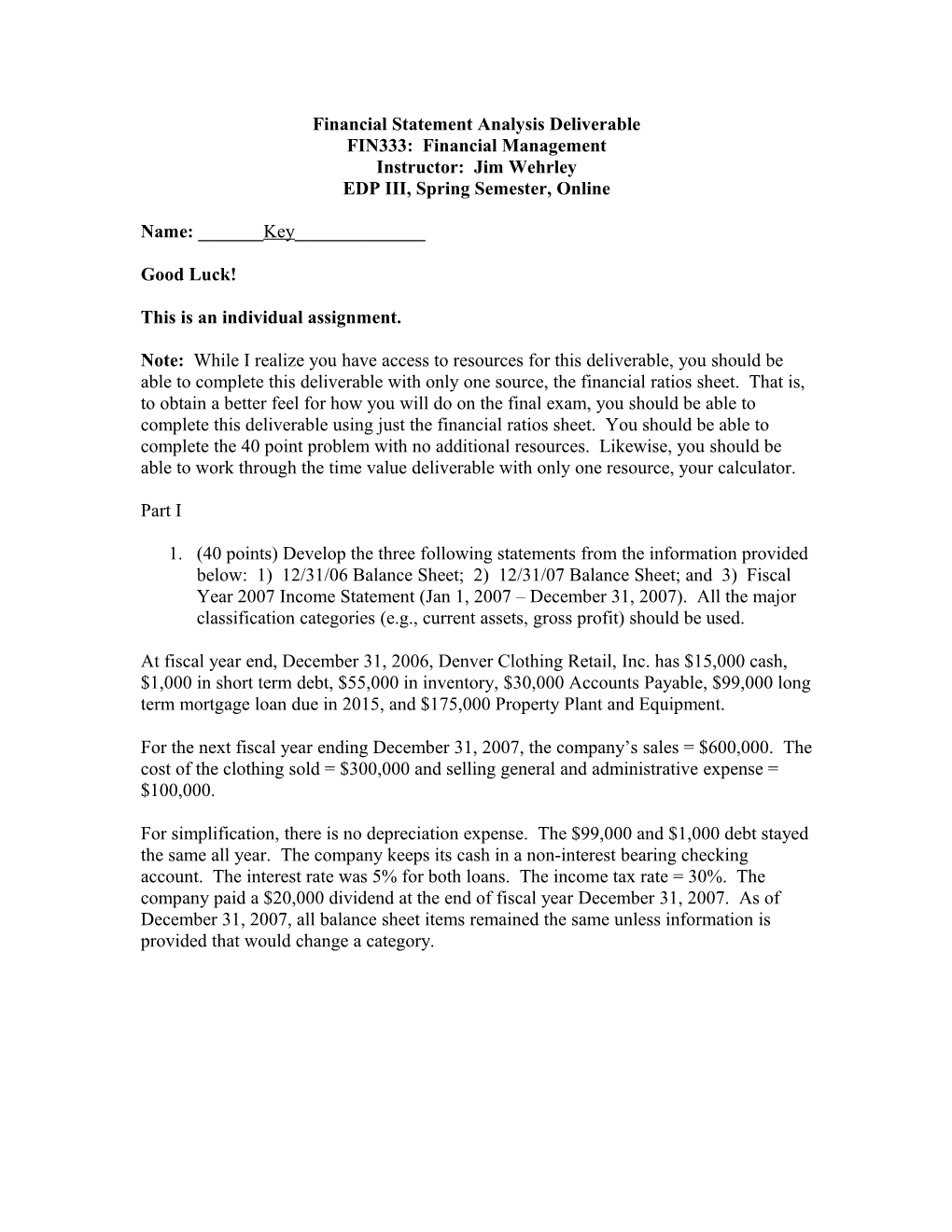

1. (40 points) Develop the three following statements from the information provided below: 1) 12/31/06 Balance Sheet; 2) 12/31/07 Balance Sheet; and 3) Fiscal Year 2007 Income Statement (Jan 1, 2007 – December 31, 2007). All the major classification categories (e.g., current assets, gross profit) should be used.

At fiscal year end, December 31, 2006, Denver Clothing Retail, Inc. has $15,000 cash, $1,000 in short term debt, $55,000 in inventory, $30,000 Accounts Payable, $99,000 long term mortgage loan due in 2015, and $175,000 Property Plant and Equipment.

For the next fiscal year ending December 31, 2007, the company’s sales = $600,000. The cost of the clothing sold = $300,000 and selling general and administrative expense = $100,000.

For simplification, there is no depreciation expense. The $99,000 and $1,000 debt stayed the same all year. The company keeps its cash in a non-interest bearing checking account. The interest rate was 5% for both loans. The income tax rate = 30%. The company paid a $20,000 dividend at the end of fiscal year December 31, 2007. As of December 31, 2007, all balance sheet items remained the same unless information is provided that would change a category. Bal. Sheet 12/31/06 12/31/07

Cash $15,000 $136,500 -$20,000 $131,500 Inventory $55,000 $ 55,000 Total Current Assets $70,000 $186,500 PP&E $175,000 $175,000 Total Assets $245,000 $361,500

Short Term Debt $1,000 $1,000 Accounts Payable $30,000 $30,000 Total Current Liab. $31,000 $31,000

LT Debt $99,000 $99,000 Total Liabilities $130,000 $130,000

Equity $115,000 $136,500 -$20,000 $231,500 NI Dividend

Income Statement- 12 months ended 12/31/07

Sales $600,000 COGS $300,000 Gross Profit $300,000 Op. Expenses $100,000 Op. Profit $200,000 Interest Expense $ 5,000 Earnings Before Taxes$195,000 Income Taxes $ 58,500 Net Income $136,500

Note: Your terminology may be slightly different Part II Each question = 5 points

Fiscal Year End Transaction: 12/31/06 11:59 p.m. 2006— Obtain a $2,000 long term loan 12/31/06 at and buy back $1,000 of stock at 11:58 p.m. $10 per share

Total Assets $10,000 $2,000 and $1,000 = $11,000 Total Liabilities $6,000 $8,000 Equity $4,000 $3,000 Sales $5,000 $5,000 Net Income $1,000 $1,000 Shares 600 500 Note: Above boxes will not be part of the grade; however, filling in the boxes may help you develop your answers.

Use the table above to answer questions 1 through 5.

1. Using the current ratio as a measure of liquidity, will the transaction improve liquidity? Explain.

Yes, probably—Cash, a current asset, goes up. Current Liabilities do not change unless you assume some of the LT loan is due in the next 12 months. So, given the current ratio = current assets/current liabilities, liquidity should strengthen using the current ratio as a measure.

Current Assets: unknown but increased by $1,000 Current Liabilities: no change in all likelihood

2. Using the Return on Assets (ROA) ratio as a measure of performance, will the transaction improve the company’s performance? Explain.

No, in the short run, net income will not change, but total assets increases. Therefore, ROA (NI/TA) will decrease. That is, the performance will decrease using ROA as a measure.

ROA= $1,000/$10,000 to $1,000/$11,000—ROA decreases

3. Using the Return on Equity (ROE) ratio as a measure of performance, will the transaction improve the company’s performance? Explain.

Yes, equity will decrease and drive the ROE higher—NI/equity. NI doesn’t change.

ROE = $1,000/$4,000 to $1,000/$3,000-- ROE would increase 4. Using the Earnings Per Share (EPS) ratio as a measure of performance, will the transaction improve the company’s performance? Explain.

Yes, NI does not change and shares decrease; therefore, EPS goes up.

EPS= $1,000/600 to $1,000/500, EPS would increase

5. Using the debt ratio as a measure of risk, will the transaction make the company more or less risky? Explain.

More risky—the debt ratio (TL/TA) increases meaning that the company is financed more with debt and less with equity.

60% of assets are financed with debt to 72.73% ($8,000/$11,000) of assets financed with debt

6. The goal is for your company to earn a net income of $400,000. You expect your net profit margin to equal 5 percent. Revenue must equal how much to reach your goal? Show your work!

NPM = NI/Sales

.05 = $400,000/Sales

$8,000,000

7. The goal is for your company’s annual EPS (Earnings Per Share) to equal $5.00. There are 1,000 shares outstanding. Sales are expected to reach $200,000 per year. What does your net profit margin have to equal to reach your goal? Show your work!

EPS = NI/shares outstanding 5 = X/1,000--- NI must equal $5,000

NPM = NI/Sales X = $5,000/$200,000 OR 2.5%

8. Q1: Sales = $1,000, COGS = $400 Q2: Gross Profit = $600 The gross profit margin . . . 1) increased, 2) decreased, 3) stayed the same; or 4) not enough information—EXPLAIN YOUR ANSWER

Not enough information. We need to know Sales or gross profit to determine the gross profit margin for Q2. 9. Qualcomm’s Gross Profit Margin (GPM) = 30.2% on Sales of $9 billion. If Qualcomm’s GPM was 30.3% due to increased efficiency, gross profit would increase by $______. Explain or show your work!

.001 x $9,000,000,000 = $9 million

10. ROA and ROE are the same. What does this imply or mean regarding how the company is financed?

Company is financed 100% with equity or no debt

TA = TL + E

Example

ROA = NI/Total Assets ROE = NI/Equity

So, Total Assets and Equity must be the same. Therefore. TL must equal $0 ProForma for Q2 Q1 Actual Scenario A Scenario B Scenario C Sales $200 $400 $400 $400 Units Sold 20 40 20 40 COGS $80 $160 $80 $120 Q1: $200 in Sales: $10 per unit X 20 units = $200; Per unit COGS: $4 per unit: $80/20

Show your work below for questions 11 and 12

Actual A B C $10 $10 $20 $10 Sale price per unit $4 $4 $4 $3 Cost per unit

Sales $200 $400 $400 $400 COGS $80 $160 $80 $120 Gr. Pr. $120 $240 $320 $280 60% GPM 60% 80% 70%

Use the table above to answer questions 11 and 12

11. Which scenario, if any, increases the gross profit margin by increasing the (average) price per unit? If applicable, what does the gross profit margin equal for this scenario?

B—GPM = 80%

12. Which Scenario, if any, increases the gross profit margin by cutting the (average) cost per unit? If applicable, what does the gross profit margin equal for this scenario?

C—GPM = 70%