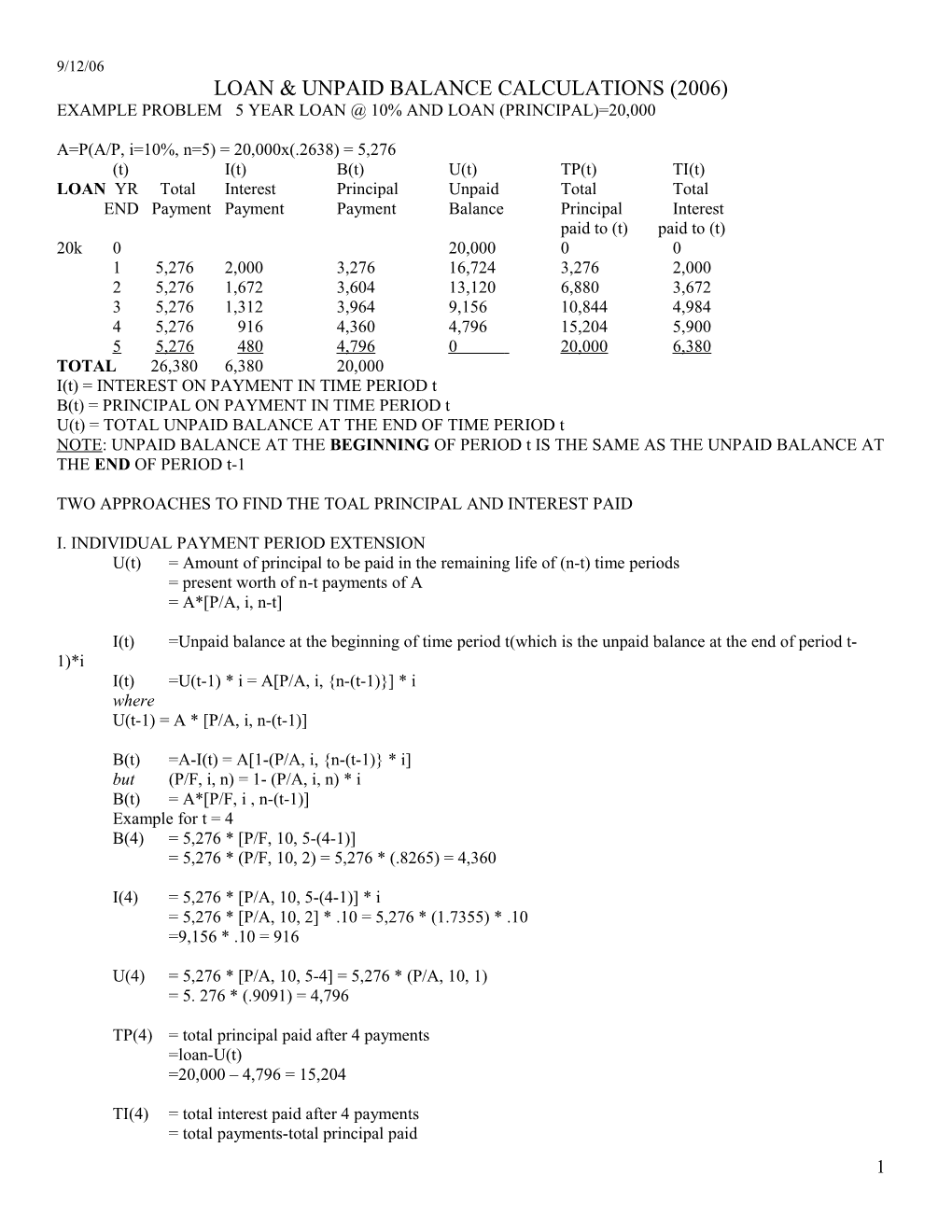

9/12/06 LOAN & UNPAID BALANCE CALCULATIONS (2006) EXAMPLE PROBLEM 5 YEAR LOAN @ 10% AND LOAN (PRINCIPAL)=20,000

A=P(A/P, i=10%, n=5) = 20,000x(.2638) = 5,276 (t) I(t) B(t) U(t) TP(t) TI(t) LOAN YR Total Interest Principal Unpaid Total Total END Payment Payment Payment Balance Principal Interest paid to (t) paid to (t) 20k 0 20,000 0 0 1 5,276 2,000 3,276 16,724 3,276 2,000 2 5,276 1,672 3,604 13,120 6,880 3,672 3 5,276 1,312 3,964 9,156 10,844 4,984 4 5,276 916 4,360 4,796 15,204 5,900 5 5,276 480 4,796 0 20,000 6,380 TOTAL 26,380 6,380 20,000 I(t) = INTEREST ON PAYMENT IN TIME PERIOD t B(t) = PRINCIPAL ON PAYMENT IN TIME PERIOD t U(t) = TOTAL UNPAID BALANCE AT THE END OF TIME PERIOD t NOTE: UNPAID BALANCE AT THE BEGINNING OF PERIOD t IS THE SAME AS THE UNPAID BALANCE AT THE END OF PERIOD t-1

TWO APPROACHES TO FIND THE TOAL PRINCIPAL AND INTEREST PAID

I. INDIVIDUAL PAYMENT PERIOD EXTENSION U(t) = Amount of principal to be paid in the remaining life of (n-t) time periods = present worth of n-t payments of A = A*[P/A, i, n-t]

I(t) =Unpaid balance at the beginning of time period t(which is the unpaid balance at the end of period t- 1)*i I(t) =U(t-1) * i = A[P/A, i, {n-(t-1)}] * i where U(t-1) = A * [P/A, i, n-(t-1)]

B(t) =A-I(t) = A[1-(P/A, i, {n-(t-1)} * i] but (P/F, i, n) = 1- (P/A, i, n) * i B(t) = A*[P/F, i , n-(t-1)] Example for t = 4 B(4) = 5,276 * [P/F, 10, 5-(4-1)] = 5,276 * (P/F, 10, 2) = 5,276 * (.8265) = 4,360

I(4) = 5,276 * [P/A, 10, 5-(4-1)] * i = 5,276 * [P/A, 10, 2] * .10 = 5,276 * (1.7355) * .10 =9,156 * .10 = 916

U(4) = 5,276 * [P/A, 10, 5-4] = 5,276 * (P/A, 10, 1) = 5. 276 * (.9091) = 4,796

TP(4) = total principal paid after 4 payments =loan-U(t) =20,000 – 4,796 = 15,204

TI(4) = total interest paid after 4 payments = total payments-total principal paid 1 9/12/06 = 4 * 5, 276 – 15, 204 = 5,900

(t) I(t) B(t) U(t) TP(t) TI(t) LOAN YR Total Interest Principal Unpaid Total Total END Payment Payment Payment Balance Principal Interest paid to (t) paid to (t) 20k 0 20,000 0 0 1 5,276 2,000 3,276 16,724 3,276 2,000 2 5,276 1,672 3,604 13,120 6,880 3,672 3 5,276 1,312 3,964 9,156 10,844 4,984 4 5,276 916 4,360 4,796 15,204 5,900 5 5,276 480 4,796 0 20,000 6,380 TOTAL 26,380 6,380 20,000

II. FUTURE AMOUNG APPROACH U(t) = Equivalent Amount of loan at time (t) - Equivalent Amount repaid = P(F/P, i, t) - A(F/A, i, t) = P[i(F/A, i, t) + 1] - A(F/A, i, t) = (F/A, i, t) (iP – A) + P = P - (A-iP) * (F/A, i, t) = loan – (principal in 1st year) * (future worth of (t) payments) = loan – total principal paid

U(4) = 20,000 – (5, 276 - .10 * 20,000) * (F/A, 10, 4) = 20,000 – (5,276 – 2,000) * (4.641) = 20,000 – (3,276) * (4.641) = 20,000 – 15, 204 = 4,796

U(t) = loan – (principal paid in 1st year) * (Future Worth of (t) payments)

U(3) = 20,000 – 3,276 * (F/A, i, n=3) = 20,000- 3, 276 * (3.310) =9,156

TP(t) = Total Principal Paid in (t) payments TP(t) = loan – U(t) = 20,000 – 9,156 = 10,844 or TP(t) = (A-iP) * (F/A, i, t) TP(3) = (5, 276 - .10 * 20,000) * (F/A, 10, 3) = 3,276 * (3.310) = 10,844

TI(t) = Total Interest paid through time (t) = Total Payments – Total Principal Paid = t * A – (A-iP) * (F/A, i, t) TI(3) = 3 * 5.276 – (5, 276 – 0.10 * 20,000) * (F/A, i, n=3) = 15,828 – 3, 276 * (3.310) =15,828 – 10,844 = 4,984 CHECK TP(3) + TI(3) = 10,844 + 4,984 = t*A = 3 * 5,276

2 9/12/06 = 15,828 = 15,828

3