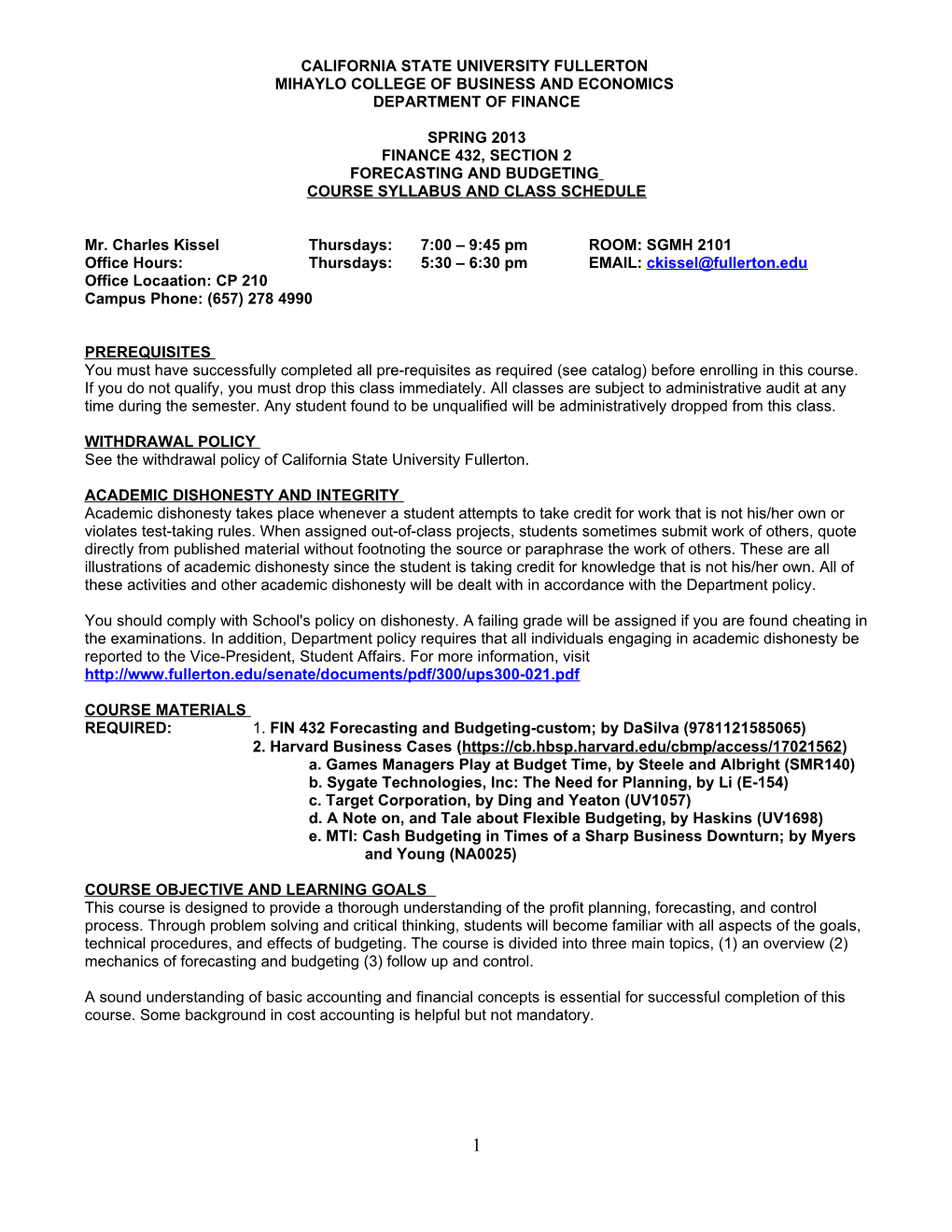

CALIFORNIA STATE UNIVERSITY FULLERTON MIHAYLO COLLEGE OF BUSINESS AND ECONOMICS DEPARTMENT OF FINANCE

SPRING 2013 FINANCE 432, SECTION 2 FORECASTING AND BUDGETING COURSE SYLLABUS AND CLASS SCHEDULE

Mr. Charles Kissel Thursdays: 7:00 – 9:45 pm ROOM: SGMH 2101 Office Hours: Thursdays: 5:30 – 6:30 pm EMAIL: [email protected] Office Locaation: CP 210 Campus Phone: (657) 278 4990

PREREQUISITES You must have successfully completed all pre-requisites as required (see catalog) before enrolling in this course. If you do not qualify, you must drop this class immediately. All classes are subject to administrative audit at any time during the semester. Any student found to be unqualified will be administratively dropped from this class.

WITHDRAWAL POLICY See the withdrawal policy of California State University Fullerton.

ACADEMIC DISHONESTY AND INTEGRITY Academic dishonesty takes place whenever a student attempts to take credit for work that is not his/her own or violates test-taking rules. When assigned out-of-class projects, students sometimes submit work of others, quote directly from published material without footnoting the source or paraphrase the work of others. These are all illustrations of academic dishonesty since the student is taking credit for knowledge that is not his/her own. All of these activities and other academic dishonesty will be dealt with in accordance with the Department policy.

You should comply with School's policy on dishonesty. A failing grade will be assigned if you are found cheating in the examinations. In addition, Department policy requires that all individuals engaging in academic dishonesty be reported to the Vice-President, Student Affairs. For more information, visit http://www.fullerton.edu/senate/documents/pdf/300/ups300-021.pdf

COURSE MATERIALS REQUIRED: 1. FIN 432 Forecasting and Budgeting-custom; by DaSilva (9781121585065) 2. Harvard Business Cases (https://cb.hbsp.harvard.edu/cbmp/access/17021562) a. Games Managers Play at Budget Time, by Steele and Albright (SMR140) b. Sygate Technologies, Inc: The Need for Planning, by Li (E-154) c. Target Corporation, by Ding and Yeaton (UV1057) d. A Note on, and Tale about Flexible Budgeting, by Haskins (UV1698) e. MTI: Cash Budgeting in Times of a Sharp Business Downturn; by Myers and Young (NA0025)

COURSE OBJECTIVE AND LEARNING GOALS This course is designed to provide a thorough understanding of the profit planning, forecasting, and control process. Through problem solving and critical thinking, students will become familiar with all aspects of the goals, technical procedures, and effects of budgeting. The course is divided into three main topics, (1) an overview (2) mechanics of forecasting and budgeting (3) follow up and control.

A sound understanding of basic accounting and financial concepts is essential for successful completion of this course. Some background in cost accounting is helpful but not mandatory.

1 COURSE MANAGEMENT PROCEDURES This course consists of discussions, lectures, cases and problem solving. The lectures expand, on the concepts and mechanics of budgeting introduced in the text and supplementary materials. The students are expected to follow the syllabus and class schedule and review the assigned chapters and problems prior to each class meeting. The course material is cumulative and students cannot afford to miss any lectures or skip any assignments. ATTENDANCE IS IMPORTANT in that the text is supplemented by additional in-class materials. Basic knowledge and ability to use Excel is essential in developing a budgeting worksheet using the course material as a guideline. Quizzes and exams will be taken within Excel workbooks on classroom computers. This is an upper division course and students are expected to do a significant amount of learning on their own.

To successfully complete this course, it is important to 1, Attend classes regularly 2. Complete all reading assignments and projects 3. Actively participate in class and case discussions 4. Complete all quizzes and tests on the scheduled dates 5. Visit Titanium (student portal) on a weekly basis for course communication and materials

INDIVIDUAL PROJECT Each student will work independently. A public company is to be selected by each student and (taking the role of the CFO) will forecast 3 years of Income (Profit/Loss), Balance Sheet, and Cash Statement including an executive summary (in Excel) of the derived forecast (directed to the CEO of the company) providing analysis, insights, concerns, and recommendations.

GROUP CASE The students will be divided into groups. Each group consists of three or four students. A Harvard Business Case related to this course is introduced in the class. Each group is required to discuss, analyze and prepare solutions using an Excel model for the assigned case for grading. Peer reviews from group members will be included in determining overall group project grade.

After the cases are submitted, the case will be discussed in a round table setting. All students are to be prepared to discuss and defend by referencing facts from the case. Students are required to actively participate in analyzing these problems and discuss the case.

GRADING STANDARDS AND POLICIES Students are tested on their ability of understanding the course material. The final letter grade is based on the total points accumulated over the entire semester. The Department of Finance desires to maintain high academic standards.

Final grades will be based on the following weighted factors:

A 93 – 100 A- 90 – 92 B+ 87 - 89 B 83– 86 B- 80 – 82 C+ 77 – 79 C 73– 76 C- 70 – 72 D 69 or below

The following weights are allocated to the areas of work: PERCENT Quizzes (6)* 10 Individuals Project Write-up (1) 10 Group Project (1) ` 20 Mid Term Exam 1 15 Mid Term Exam 2 15 Final Examination 25 Participation 5

Total 100

*The lowest quiz score will be dropped. There are no make-ups for quizzes.

2 STUDENTS RIGHTS FOR SPECIAL NEEDS On the CSUF campus, the Office of Disabled Student Services has been delegated the authority to certify disabilities and to prescribe specific accommodations for students with documented disabilities. DSS provides support services for students with mobility limitations, learning disabilities, hearing or visual impairments, and other disabilities. Counselors are available to help students plan a CSUF experience to meet their individual needs. For more information, visit http://www.fullerton.edu/DSS/handbook/DSSGenInfo.htm

MIHAYLO COLLEGE OF BUSINESS AND ECONOMICS ASSESSMENT STATEMENT The programs offered in Mihaylo College of Business and Economics (MCBE) at Cal State Fullerton are designed to provide every student with the knowledge and skills essential for a successful career in business. Since assessment plays a vital role in Mihaylo College’s drive to offer the best, several assessment tools are implemented to constantly evaluate our program as well as our students’ progress. Students, faculty, and staff should expect to participate in MCBE assessment activities. In doing so, Mihaylo College is able to measure its strengths and weaknesses, and continue to cultivate a climate of excellence in its students and programs.

EMERGENCY INFORMATION At the sound of an alarm: Stop whatever you are doing. Turn off, or close the container of anything potentially hazardous, if you can. Grab your personal possessions quickly. Do not take time to gather more things than you can quickly find. DO NOT WAIT! Walk to the nearest exit and proceed to the right and down the exterior stairs. Proceed 50 feet away from the building in the direction of Parking Lot E. If your nearest exit is blocked, move immediately to another exit. For more information, visit http://prepare.fullerton.edu/

3 CLASS SCHEDULE AND ASSIGNMENTS SPRING 2013 FINANCE 432, SECTION 2 THURSDAY 7:00 – 9:45 PM

WEEK THURSDAY TOPICS ASSIGNMENTS PAGES 1 1/31 Course Introduction and Syllabus Overview Budget Fundamentals Chapter 1 77-90

2 2/7 Financial Statements, COGS Pre-Chapter 2 2-45 Budget Dynamics Games Managers Play HBC

3 2/14 Quiz 1 Groups (4-5) Finalized Cost –Volume-Profit Analysis Pre-Chapter 3 46-76

4 2/21 No class – Budget Planning Sygate Technologies HBC

5 2/28 Quiz 2 Forecasting; Sales and Revenue Budgets Chapter 2 91-112

Linear Regression Analysis Manufacturing and Retail Budgets

6 3/7 Operating and Expense Budgets Chapter 3 113-138 Capital Budgeting (IRR, NPV, and LR) Target Corporation HBC Study Guide for Exam

7. 3/14 MID TERM # 1 Chapters 1-2, Pre-Chapters 2-3

8 3/21 Mid Term #1 Review Cash Budgets Chapter 4 139-186

9 3/28 Quiz 3 Budgeted Financial Statements Chapter 5 187-222 Forecasting Balance Sheet and Cash Flow

10 4/4 Spring Break – no class

11 4/11 Quiz 4 Master Budgets Chapter 6 223-256 INDIVIDUAL PROJECT DUE

12 4/18 Quiz 5 Flexible Budgets Chapter 7 257-273 Study Guide for Exam

13 4/25 MID TERM # 2 Chapters 3-6

14 5/2 Mid Term #2 Review Variance Analysis Chapter 16 274-318 Flexible Budgeting and Variance Analysis A Note On HBC

15 5/9 Quiz 6 Performance Reports Chapter 8 319-338 Study Guide for Final

4 16 5/16 GROUP CASE IS DUE Class Discussion of Case

17 5/23 7:30 pm FINAL EXAM - Comprehensive

5