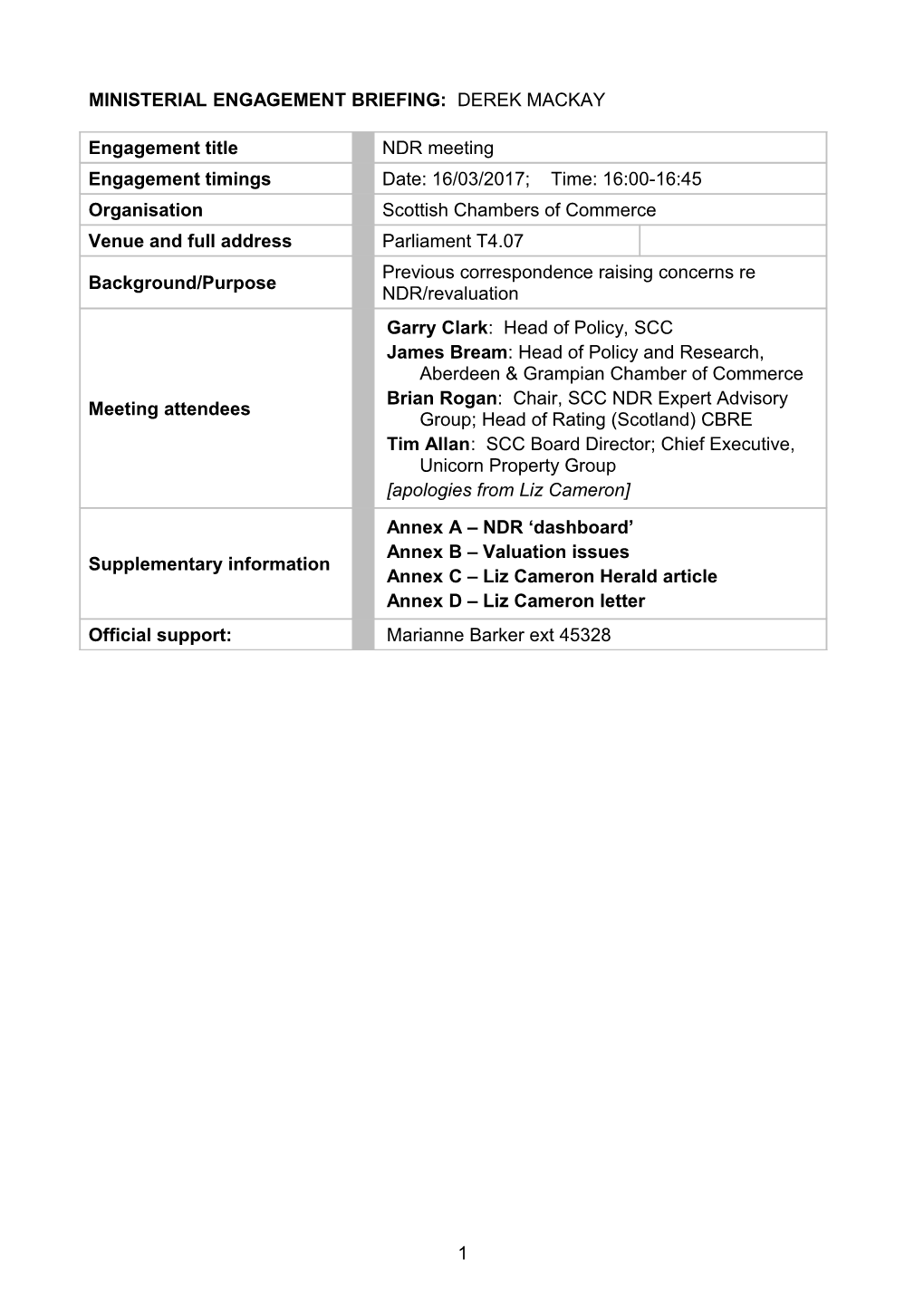

MINISTERIAL ENGAGEMENT BRIEFING: DEREK MACKAY

Engagement title NDR meeting Engagement timings Date: 16/03/2017; Time: 16:00-16:45 Organisation Scottish Chambers of Commerce Venue and full address Parliament T4.07 Previous correspondence raising concerns re Background/Purpose NDR/revaluation Garry Clark: Head of Policy, SCC James Bream: Head of Policy and Research, Aberdeen & Grampian Chamber of Commerce Brian Rogan: Chair, SCC NDR Expert Advisory Meeting attendees Group; Head of Rating (Scotland) CBRE Tim Allan: SCC Board Director; Chief Executive, Unicorn Property Group [apologies from Liz Cameron] Annex A – NDR ‘dashboard’ Annex B – Valuation issues Supplementary information Annex C – Liz Cameron Herald article Annex D – Liz Cameron letter Official support: Marianne Barker ext 45328

1 Annex A NDR ‘DASHBOARD’

Business Rates UK Budget Announcement on Business Rates Three headline measures from UK Budget; package announced as £435m, but over 3 years. o Mitigating Impact of Dropping out of SBBR o LA Discretionary Relief Fund o Support for Pubs (£1,000 per property with rateable value up to £100k) Rates relief for small business in Scotland still more competitive than England. Scottish package of reliefs announced on 21 Feb amounts to £44.6 in 2017-18 alone and offers proportionately double the total support announced today in England. No additional funding directly earmarked in Scotland for discretionary releif but it would be open to councils to decide to deploy some of the additional funding (£130m) Mr Mackay confirmed on 2 Feb at Stage 1 Budget Bill debate to support local businesses by utilising their powers to grant local reliefs under the Community Empowerment (Scotland) Act.

General On top of our business rates package at Draft Budget, which will deliver an overall tax cut of £155 million next year, we have listened to business and are now providing further targeted support worth £44.6m for particular sectors and specifically for Aberdeen and Aberdeenshire where it is most needed. The total rates relief package is now worth over £660 million, and councils are empowered to apply further reductions to address any local issues as they see fit. Expanded renewables relief as committed to in the Draft Budget Updating the profiles of the Scottish Government’s contribution required to bring the NDR pool into balance has provided the flexibility to meet the additional cost of these measures. The capping measures will apply for 2017-18 and we will consider what further future support is required in light of the Barclay review when it reports this summer. We have freed councils to use their powers to introduce local rates relief schemes to address any other local issues. Over 70% of Scottish properties will pay the same or less in 2017-18 than they do currently. We are cutting the poundage by 3.7%, extending the Small Business Bonus Scheme (saved business over £1.2 billion cumulatively since 2008), and focusing the Large Business Supplement only on the very biggest businesses. More than half of rateable properties will pay nothing for 2017-18 [due to the Small Business Bonus and other reliefs]. An external review (led by Ken Barclay) is exploring how business rates can better reflect economic conditions and support growth. We will respond quickly when it concludes in the summer. In 2017 all commercial premises will have their property value reassessed by the independent Assessor. The Scottish Government has no locus to intervene in this process. The Scottish Government will publish an analytical report on the impact of revaluation in due course.

2 All ratepayers have a right of appeal against the independent Assessors determination of rateable value. This is free to do in Scotland, unlike in England where charges are proposed from 2017-18. The Small Business Bonus eligibility threshold for 100% rates relief will increase to a rateable value of £15,000, lifting 100,000 properties out of rates altogether. The Small Business Bonus will provide maximum support of £6,990 per business

Annex B VALUATION ISSUES

Issue: Liz Cameron’s letter “asking the Scottish Government to convene an urgent expert investigation into the basis of valuation for properties in the hospitality, motor trade and energy sectors, led by independent private sector valuation professionals”.

Analysis: this would be problematic as it would invite the Assessors’ methodologies to be critiqued, facilitated by SG, the outputs of which could be cited in valuation appeal cases. Also, “private sector valuation professionals” often have vested interests, and it could be difficult to ensure objectivity, or indeed a group of people that agreed with each other.

Options

Rather than undermine our stance that valuations are a matter for independent Assessors and open the door for others who view their valuation method as unfair to request similar reviews (petrol filling stations, nurseries, airports)-

we could instead offer to host a round table with 2 aims - to discuss current methodology and explain to the sectors that the need to submit information will mean their valuations are more accurate

Barclay remit: (NB. Nora Senior, current SCC Chair, is on the Barclay review group). To explore ideas and options to improve the business rates system in Scotland to better support business growth that : consider how the system can respond to wider economic conditions and changing marketplaces; support long-term growth and investment; are based on overall revenue neutrality and on maintaining the overall level of funding for local government. Assessors’ valuation methodology Valuation methodology is not set out in legislation, although Ministers have some powers to intervene by regulations (very rarely used). Valuation is for independent Assessors, subject to appeal in the courts. The Assessors are broadly harmonised with counterparts in rest of UK. Rateable value is broadly rental value. There are three main methodologies: o comparative: comparing rents, e.g. referencing floor-space or turnover;

3 o contractors: estimate replacement capital cost and applying decapitalisation rate; o receipts & expenditure: related to company accounts. Licensed trade Hotels and pubs are generally valued on (hypothetical turnover), using conversion factors based on rental evidence. The method has been upheld in court. Barclay has been made aware of the issues raised by the hospitality trade and are actively engaging with the sector. At a recent meeting with Barclay, the hospitality trade bodies indicated that they now better understood the need to use turnover (they had discussed further with Assessors) and acknowledged that they also needed to provide better information, but are still unhappy with the system. Material change of circumstance (MCC) Chambers have been vocal about the limits of MCC appeals following the two Schuh cases and the Mercat/Overgate cases at the Court of Session (Lands Valuation Appeal Court). They say the scope of MCC appeal is narrower in Scotland than in England. That, however, is their judgment based on looking at legal judgments. The current scope is as follows: “ Material change of circumstances means in relation to any lands and heritages a change of circumstances affecting their value and, without prejudice to the foregoing generality, includes any alteration in such lands and heritages, any relevant decision of the Lands Valuation Appeal Court or a valuation appeal committee the members of which are drawn from the valuation appeal panel serving the valuation area in which the lands and heritages are situated or the Lands Tribunal for Scotland under s.1(3A) of the Lands Tribunal Act 1949, and any decision of that Court, committee or Tribunal which alters net annual value or rateable value of any comparable lands and heritages.” Primary legislation would be required to change this. We would not advise considering this until after Barclay reports. SG consulted on valuation appeals in 2015, responded in autumn 2016, and the associated SSI is being laid on 16 March 2017. Valuation appeal case in Aberdeen in January the Valuation Appeal Committee for Grampian upheld MCC appeals for several large offices in Aberdeen in respect of the current (2010) valuation roll, linked to the oil downturn. James Bream & Brian Rogan (attending this meeting) were involved for the appellants. Grampian Assessor can appeal the Committee’s decision to the Court of Session.

4 This might raise expectations of MCC appeals linked to the oil downturn in respect of the 2017 roll.

5 Annex C HERALD ARTICLE, LIZ CAMERON, 14 MARCH

The recognition by the Scottish Government of the devastating impact that sharp business rates increases could have in the hospitality and energy sectors and on the economy of the north east of Scotland is welcome, and its decision to mitigate the worst of the excesses of the rates revaluation on these sectors and regions demonstrates that it, in this case at least, it understands the legitimate concerns of business. However, applying a temporary fix for the coming year does not get to the root of the problem. In the hospitality sector for example, where a business’s turnover is often used as an indicator of a property’s rental value, some valuations have increased even when a business’s actual turnover has not. Moreover, when a few business sectors in isolation are hit with a massive rates increase, whilst others are left relatively untouched, it raises question marks over the accuracy and reliability of methodology being used by regional assessors for valuations. The Scottish Government claims to have “no powers to direct [assessors] or locus to comment on their methodology used to determine rateable values” (answer to question S5W-06882, given by Derek Mackay MSP on 20 February 2017). If this is indeed the case, then it begs the question: how on earth is the issue which has caused this latest business rates outcry going to be addressed? All of this serves to underline the absolute necessity that the business rates system in Scotland is fundamentally reformed from the ground up. Yes, the independent Barclay Review will report in July and, having spent the best part of a year gathering evidence from across Scotland and looking at international comparators, our hope is that this will deliver a solid basis for reshaping business rates. However, any reform will be incomplete without a comprehensive review of the valuation framework and methodologies used by assessors for each and every non-domestic property in Scotland. Businesses need to know when they receive their valuation that it has been fairly assessed and is demonstrably correct. Trust needs to be restored in Scotland’s biggest business tax, which raises over £2.6 billion per year. If the Scottish Government cannot do this alone, then it needs to work with local government, with the assessors themselves and with the private sector to find out what has gone wrong and to find and implement a solution that will deliver for business in the long term. ENDS

6 Annex D LIZ CAMERON LETTER, 21 FEBRUARY

Over the past few weeks, the Scottish Chambers of Commerce network has been building a picture of the impact of the 2017 business rates revaluation. We know that there are a number of geographical areas and industry sectors that seem to be subject to higher increases in valuations than others. It would greatly help business understanding of the context of their own valuation within the wider revaluation if the Scottish Government was to publish its analysis of the impacts of the revaluation. This was a request made by ourselves and other business organisations at the January meeting of the Scottish Ratepayers’ Forum and we would be grateful if this could be done as quickly as possible. Whilst we are aware of impacts on particular sectors, being able to measure the picture across the totality of non-domestic properties in Scotland would help to contextualise the reports we are receiving from member businesses. I have already written to you on the subject of the impact of the revaluation in the Grampian region and I know that discussions involving the local authorities are ongoing in this regard. We look forward to a solution being reached that recognises the particular circumstances of this region, where current rental values have been significantly over- estimated as a result of the timing of the tone date. The other anomaly arising from the revaluation appears to be sectoral in nature. In particular, we are aware of three sectoral issues which are resulting in high levels of business rates increases this year; these are in the hospitality sector, motor trade and energy infrastructure, and each appears to be affecting properties across the length and breadth of Scotland. Given the sectoral nature of these cases, it appears to us that further investigation of the reasons behind these increases is required. In the case of the hospitality sector, for example, the basis for calculating rateable values of various types of premises is not well understood and may be resulting in an overestimation of valuations on a wide scale. Though this could be put to the test through the valuation appeals system, the fact remains that businesses would remain liable for rates based upon their new valuation until such time as the appeal was resolved. Given that many businesses have indicated that jobs and, indeed, the very future of their business may be at stake, this is not a route that we believe should be taken. Instead, we are asking the Scottish Government to convene an urgent expert investigation into the basis of valuation for properties in the hospitality, motor trade and energy sectors, led by independent private sector valuation professionals. Such a study would be tasked with ensuing that rateable values are set at a correct level for the circumstances of these properties. In the meantime, businesses whose rateable values were due to increase should be limited to a rise of no more than the CPI rate of inflation for 2017-18, until such time as the review is complete. We believe that these measures would go some way to restoring confidence in the Scottish rating system until such time as the Barclay Review can report, and we would urge you to respond positively to this constructive proposition.

7