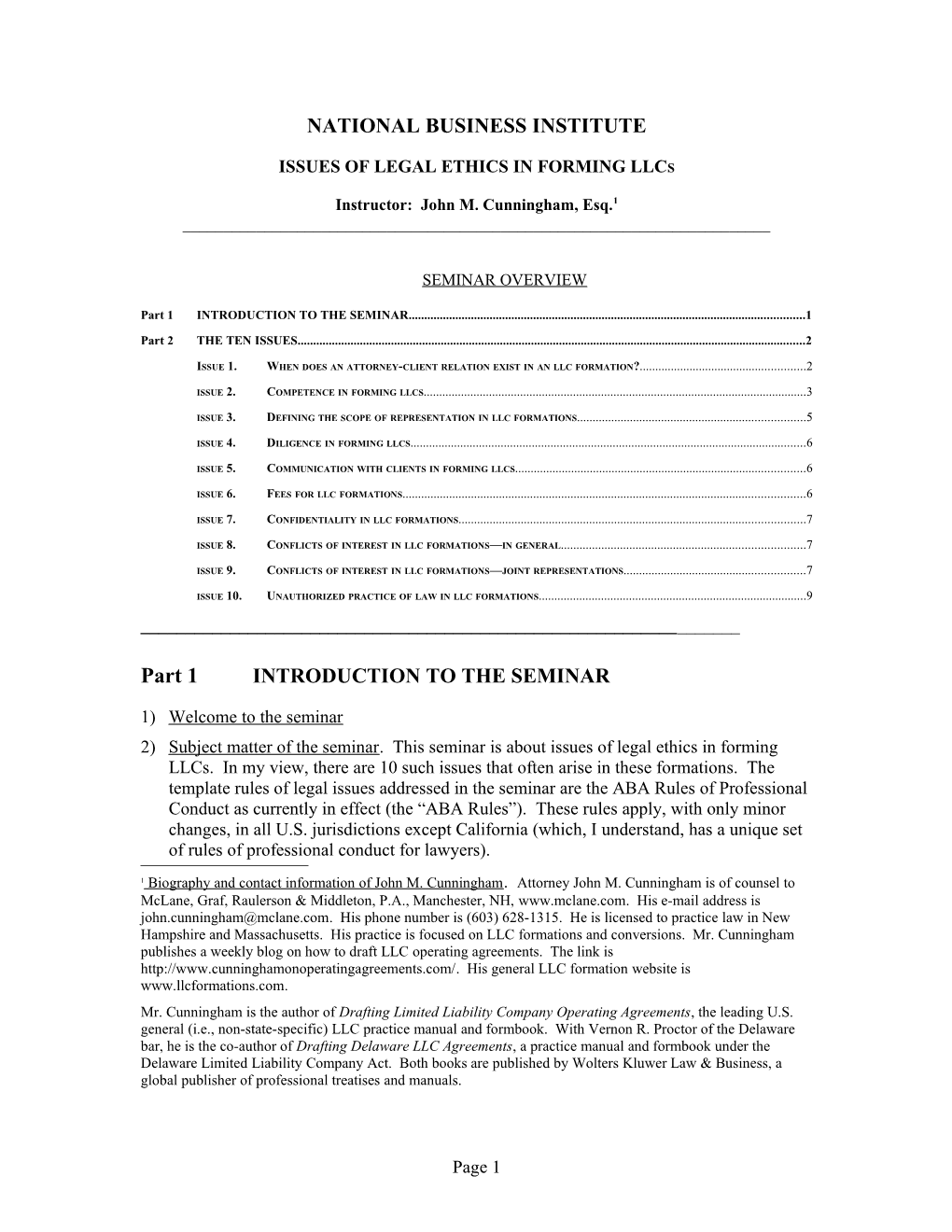

NATIONAL BUSINESS INSTITUTE

ISSUES OF LEGAL ETHICS IN FORMING LLCS

Instructor: John M. Cunningham, Esq.1 ______

SEMINAR OVERVIEW

Part 1 INTRODUCTION TO THE SEMINAR...... 1

Part 2 THE TEN ISSUES...... 2

ISSUE 1. WHEN DOES AN ATTORNEY-CLIENT RELATION EXIST IN AN LLC FORMATION?...... 2

ISSUE 2. COMPETENCE IN FORMING LLCS...... 3

ISSUE 3. DEFINING THE SCOPE OF REPRESENTATION IN LLC FORMATIONS...... 5

ISSUE 4. DILIGENCE IN FORMING LLCS...... 6

ISSUE 5. COMMUNICATION WITH CLIENTS IN FORMING LLCS...... 6

ISSUE 6. FEES FOR LLC FORMATIONS...... 6

ISSUE 7. CONFIDENTIALITY IN LLC FORMATIONS...... 7

ISSUE 8. CONFLICTS OF INTEREST IN LLC FORMATIONS—IN GENERAL...... 7

ISSUE 9. CONFLICTS OF INTEREST IN LLC FORMATIONS—JOINT REPRESENTATIONS...... 7

ISSUE 10. UNAUTHORIZED PRACTICE OF LAW IN LLC FORMATIONS...... 9 ______

Part 1 INTRODUCTION TO THE SEMINAR

1) Welcome to the seminar 2) Subject matter of the seminar. This seminar is about issues of legal ethics in forming LLCs. In my view, there are 10 such issues that often arise in these formations. The template rules of legal issues addressed in the seminar are the ABA Rules of Professional Conduct as currently in effect (the “ABA Rules”). These rules apply, with only minor changes, in all U.S. jurisdictions except California (which, I understand, has a unique set of rules of professional conduct for lawyers).

1 Biography and contact information of John M. Cunningham. Attorney John M. Cunningham is of counsel to McLane, Graf, Raulerson & Middleton, P.A., Manchester, NH, www.mclane.com. His e-mail address is [email protected]. His phone number is (603) 628-1315. He is licensed to practice law in New Hampshire and Massachusetts. His practice is focused on LLC formations and conversions. Mr. Cunningham publishes a weekly blog on how to draft LLC operating agreements. The link is http://www.cunninghamonoperatingagreements.com/. His general LLC formation website is www.llcformations.com. Mr. Cunningham is the author of Drafting Limited Liability Company Operating Agreements, the leading U.S. general (i.e., non-state-specific) LLC practice manual and formbook. With Vernon R. Proctor of the Delaware bar, he is the co-author of Drafting Delaware LLC Agreements, a practice manual and formbook under the Delaware Limited Liability Company Act. Both books are published by Wolters Kluwer Law & Business, a global publisher of professional treatises and manuals.

Page 1 3) My background as relevant to the seminar a) The McLane firm. I am of counsel to McLane, Graf, Raulerson & Middleton, P.A., a New England law firm based in Manchester, NH. I am licensed to practice law in New Hampshire and Massachusetts. b) My practice. My law practice is focused on forming LLCs and converting corporations and other non-LLC entities to LLCs. Ethical issues are central in my practice. c) My writings and seminars about legal ethics i) I am the author of the leading “general” (i.e., non-state-specific) LLC formbook and practice manual, and, with Vernon R. Proctor of the Delaware bar, I am the co-author of an LLC formbook and practice manual under the Delaware Limited Liability Company Act (the “DLLC Act”). ii) In both books, I write extensively about issues of legal ethics in forming LLCs. iii) I have taught scores of LLC seminars nationwide to bar associations, CPA societies, law firms and CPA firms. In all of these seminars, I give substantial attention to issues of legal ethics in forming LLCs. 4) Seminar format; questions a) I will follow the revised outline. In this seminar, I will follow this outline closely. b) Questions. If, during the seminar, you have questions relating to the subject matter of the seminar, you can submit them by e-mail at any time if you have registered for the seminar via Westlaw or, at the end of the seminar, you can submit them by phone if you have registered via NBI. c) Post-seminar contacts. After the seminar, please feel free to call me or e-mail me with questions relating to the seminar. I do not charge for brief consultations. My contact information is in footnote 1 of this outline. 5) This outline does not provide legal advice. The ideas in this outline represent only my personal views. They are not intended as legal opinions, and they may possibly conflict with ethical rules in one or more jurisdictions.

Part 2 THE TEN ISSUES

ISSUE 1. WHEN DOES AN ATTORNEY-CLIENT RELATION EXIST IN AN LLC FORMATION?

1) The importance of the issue as to whether an attorney-client relation exists. Obviously, if there is no attorney-client relation between you as an attorney and a particular participant in an LLC formation, you are not subject to any rules of professional conduct with regard to that person. Thus, the first issue you must ask in order to ensure that you are complying with these rules is whether such a relation exists. 2) When does an attorney-client relation exist? In general, a person has an attorney-client relation with an attorney if the person seeks and receives legal advice or legal services from the attorney.

Page 2 3) Ethical duties. If you are forming an LLC, you will have many different ethical duties toward any persons who are your clients with respect to that formation. 4) Malpractice. In addition, if you are negligent in forming an LLC, you may be liable to your clients in a malpractice suit. 5) What factors determine whether an attorney-client relation exists? In general, whether a person is your client in an LLC formation is a question of fact that depends on the subjective perception of the relevant purported clients. 6) Determining whether an attorney-client relationship exists; disclaimers to non-clients. Thus, it is critical that, before you begin forming an LLC for parties to an LLC formation: a) You determine in advance in your own mind whether an attorney-client relation exists between you and one or more of the parties; and b) You make expressly clear to the parties which of them is and which is not your client. The best way to do this is, of course, in an engagement letter. 7) Examples a) IRS filing statistics suggest that about one-third of all LLC formations are formations of single-member LLCs whose members are individuals. I generally advise individuals for whom I am forming single-member LLCs to appoint non-member assistant managers in their operating agreements in order to provide their LLCs with continuity of management if, by reason of death, illness or otherwise, the members are unable to manage the LLC. If you follow this practice, you should consider expressly mentioning to the member and the person whom the member wants to appoint as the assistant manager that the latter person is not your client. b) It is even possible (I’ve seen it happen) that a bank or other entity that has referred its customer or another person to you for an LLC formation may believe that it is one of your clients in the formation. If this is the case, you must talk with representatives of the entity and dispel this belief. 8) Other situations. There may be many other situations in which a person who you believe is not your client thinks himself or herself to be your client.

ISSUE 2. COMPETENCE IN FORMING LLCS

A. Introduction 1) Rule 1.1; the four components of competence. Rule 1.1 of the ABA rules provides that in handling legal matters for clients, lawyers must be competent. The rule provides that to be competent in a matter, a lawyer must have the necessary knowledge, skill, diligence and thoroughness. Knowledge means substantive knowledge—i.e., knowledge of the statutes and cases relevant to the matter in question. Skill means know-how—i.e., knowledge of how to perform the tasks necessary in handling the matter. Diligence means, among other things, due preparation. Preparation means two things —it means (i) general study of the law relevant to the matter; and (ii) study of the law

Page 3 and facts specifically relevant to the matter. Thoroughness means (i) identifying all of the tasks relevant to the matter and (ii) performing each of these tasks diligently. B. The Tasks You Must Perform in Forming LLCs; the Knowledge You Need in order to Perform These Tasks 1) Non-tax choice of entity. You should be able to perform non-tax choice of entity analyses for your business start-up clients; that is, you should know how to determine for your client which of the various types of business organizations available to them under the law of the relevant state will be best for their business on business organization law grounds and other relevant non-tax grounds. a) Types of business organizations. Under Delaware law and the law of most other states, there are seven principal types of business organizations—namely, sole proprietorships, divisions (i.e., administrative units of entities), business corporations, general partnerships, limited partnerships, business trusts and LLCs. LLCs under most LLC acts have 11 or 12 chief statutory features. In order to determine competently whether an LLC is the best type of business organization for a business start-up client from a business organization law viewpoint, it will be useful to you: To know all of these features in reasonable detail; To know the chief business organization law features of the other principal types of business organizations in the relevant jurisdiction; and To you to know how to compare the various business organization law features of each of the above seven types of business organizations with those of each other type. 2) Choosing between your state act and other LLC acts. You need to know how to choose which of the various LLC acts potentially useful to the parties to the LLC formation in question will be best for your client. In order to make this choice competently, it will be useful to you to have a detailed comparative knowledge of the chief statutory features of each of the relevant LLC acts and of the case law interpreting them. However, in the remainder of this article, I will assume that the correct choice is the Delaware LLC Act. 2 3) Planning, negotiation and drafting LLC operating agreements. The key constitutive documents of LLCs are their operating agreements. Thus, you need to know how to plan, negotiate and draft these agreements for your clients’ LLCs. There are five main types of business organization law knowledge that are likely to be useful to you in order to perform these tasks competently: i) Knowledge of the provisions of the governing LLC act relevant to LLC formation practice. It will be useful to you to know the provisions of the governing LLC Act that are relevant to LLC formation practice in your jurisdiction. This means: Identifying and understanding each of these provisions;

2 I have recently published in the Massachusetts Lawyers Journal a brief article on how to decide whether to form an LLC for Massachusetts LLC formation clients under the Delaware Limited Liability Company Act or the Massachusetts LLC Act. See John M. Cunningham, Choosing the Right LLC act: Massachusetts vs. Delaware, MASS. LAW. J. 10 (Aug. 2010).

Page 4 Accurately characterizing each as definitional, mandatory, default, non-self- enabling permissive or self-enabling permissive; and Knowing the tactical significance of each of these characterizations for your clients in the LLC formation in question. ii) Knowledge of the case law relevant to LLC formations. It will be useful to you to know the case law relevant to the LLC formation in question. iii) Knowledge of the gap issues in LLC statutory and case law. It will be useful to you to know the “gap issues” in the governing LLC law—that is, the business organization law issues potentially significant in LLC formations on which the governing act and the relevant case law are either silent or ambiguous. iv) Knowledge of the principal business organization law issues relevant to your client’s LLC. It will be useful to you to know: The principal business organization law issues relevant to the type of LLC you are forming for your client; The various alternative ways of resolving these issues; and Which of these resolutions will be best for your LLC formation client. v) Knowledge of the impact of the governing LLC act law on “informal” LLCs. In order to explain to your LLC formation clients why they need a comprehensive written operating agreement for their LLC and to draft this agreement properly: It will be useful to you to know the LLC law that governs LLCs that have filed valid certificates of formation (or similar required documents) but that lack oral or written operating agreements (referred to in this article as “informal” LLCs); and On the basis of your knowledge of the specific needs and interests of your LLC formation clients with respect to the LLC in question, it will be useful to you to know how to point out to your clients, on the basis of the above “informal LLC” law, the specific adverse impacts of this law on their LLC and on them as its members.

ISSUE 3. DEFINING THE SCOPE OF REPRESENTATION IN LLC FORMATIONS

1) Rule 1.2. Rule 1.2 of the ABA Rules requires that, in handling legal matters for their clients, lawyers define the scope of their representation. 2) Tax disclaimer. For business lawyers who are competent in LLC business organization law but who lack LLC tax expertise, this means disclaiming any responsibility as to the tax issues of their LLC formation clients and any responsibility for the tax provisions in the LLC’s operating agreement. 3) Other disclaimers. LLC formations often raise issues in fields of law other than LLC business organization law and LLC tax. You should do your best to identify these other issues and, if you lack competence in them, to disclaim that you are handling them.

ISSUE 4. DILIGENCE IN FORMING LLCS

Page 5 1) Rule 1.3. ABA Rule 1.3 requires that in handling legal matters for clients, lawyers must be diligent. The duty of diligence is also imposed by Rule 1.1, and is briefly discussed above. 2) Commitment, etc. Diligence means, among other things, that a lawyer “must act with commitment and dedication to the interests of the [client] and with zeal in advocacy upon the [client’s] behalf.” Rule 1.3, Model Code Comments.

ISSUE 5. COMMUNICATION WITH CLIENTS IN FORMING LLCS

1) Rule 1.4. ABA Rule 1.4 provides that, in order to meet professional conduct standards for effective communication with clients in handling an LLC formation, you must: a) Keep your clients reasonably informed about the status of the formation; b) Promptly respond to their requests for information about it; and c) Explain all relevant issues to the extent necessary to enable them to make informed decisions regarding them. 2) Planning memos a) In my experience, few clients are willing or able to meaningfully review draft operating agreements. For this reason, I usually recommend to clients that, before drafting an operating agreement for them, I provide them with a plain-English planning memo (i) identifying the issues in the agreement, (ii) summarizing the alternatives available to them in addressing these issues, and (ii) advising them as to which alternative will be best for them. b) Needless to say, I advise them that I will charge them for the time it takes me to prepare this memo—usually about two hours. Despite the additional cost, a majority of them request that I prepare this memo.

ISSUE 6. FEES FOR LLC FORMATIONS

1) Rule 1.5. ABA Rule 1.5 provides that in order to meet professional conduct requirements concerning fees in handling LLC formations, you must charge your clients fees that are “not unreasonable.” 2) Fees for LLC formations vary widely from state to state. a) In case it’s useful by way of example: Legal fees in Manchester, New Hampshire, where I practice, tend to be substantially lower than in larger cities, such as Boston and New York. My hourly rate is $350. I generally charge about $750 for the formation of a single-member LLC (including a planning memo) and about $1,600 for the formation of a multi-member LLC. b) However, for forming larger LLCs, I’ve charged many tens of thousands of dollars. 3) Forming a Delaware single-member LLC. I know of a case in which a major U.S. law firm charged a foreign client $10,000 for forming a simple Delaware LLC. In my view, this fee was grossly “unreasonable” under Rule 1.5. (Furthermore, the LLC agreement for this LLC was incompetent.)

ISSUE 7. CONFIDENTIALITY IN LLC FORMATIONS

Page 6 1) Rule 1.6. Under ABA Rule 1.6, you must maintain the confidentiality of confidential information of which you become aware in an LLC formation. 2) Joint representations. As discussed further below, complying with Rule 1.6 can be tricky in a joint representation, since in such a representation, it may be argued that you are required to disclose to each of your clients any information disclosed to you by any of your clients. You need to advise your joint representations clients about this duty clearly and in advance of your work for them.

ISSUE 8. CONFLICTS OF INTEREST IN LLC FORMATIONS—IN GENERAL

1) Conflicts of interest. In order to comply with professional conduct requirements concerning conflicts of interest in LLC formations, you must comply with the rule in your state corresponding to ABA Rule 1.7. This rule provides in general that you may not undertake a representation: a) Without full disclosure to the relevant parties concerning any conflicts potentially relevant to the representation and concerning the risks that these conflicts may involve for them; and b) Without a written consent by these parties to waive the conflict. 2) Joint representations. As noted above, a key conflict-of-interest issue in many LLC formations involving two or more parties is to identify which, if any, of these clients are your clients in the formation and which are not.

ISSUE 9. CONFLICTS OF INTEREST IN LLC FORMATIONS—JOINT REPRESENTATIONS

1) The statistics. IRS filing statistics suggest that about two thirds of all LLC formations involve two or more prospective members. In my experience, these members usually want you to represent all of them jointly in the formation. 2) Why parties to formations of multi-member LLCs want joint representations. There are three main reasons why parties to LLC formations often want the same lawyer to represent all of them in the formation. a) Joint representations save the parties legal fees. b) The parties believe that their interests are “substantially aligned” and that they don’t need individual representation. c) They believe that if two or more lawyers are involved in the representation, there will be needless complexity and disharmony. 3) Rule 1.7. ABA Rule 1.7 provides, in essence, that in order to conduct a joint representation, lawyers must obtain the written and signed informed consent of all relevant clients. 4) Disclosures. In my view, it is unclear what disclosures lawyers must make to potential clients before handling joint representations in order to meet the above “informed consent” requirement. I suggest that these disclosures include at least the following:

Page 7 a) No duty of loyalty. The lawyer will have no duty of loyalty toward any of the clients. Rather, the lawyer’s task will be to reach accommodation among them about potentially contentious issues. b) Duty to disclose to all clients information obtained from any client. As indicated above, the lawyer will have to disclose to all clients any information disclosed to the lawyer about the formation by any of the clients. c) No attorney-client privilege. None of the clients will have an attorney-client privilege in any claims they may make against other clients after the formation. Rather, the lawyer may be called upon to disclose in testimony in any such claim all information relevant to the claim possessed by the lawyer. d) Attorney withdrawal. If conflicts arise among the clients in the course of the representation, the lawyer must withdraw (but the clients must pay the lawyer fees accrued to the date of the withdrawal). 5) “Substantial alignment”—doing mini-formations. In my view, lawyers cannot represent multiple clients in an LLC formation unless they first ascertain whether the interests of the potential clients are substantially aligned. This means doing a mini-formation in which you determine the views of the parties about all matters that may be contentious among them, including: a) Issues concerning contributions, allocations and distributions; b) Issues concerning member voting rights; c) Fiduciary issues; and d) Issues concerning the LLC’s method of dispute resolution (generally, an issue of arbitration vs. litigation). 6) My practice of avoiding joint representations. a) Because of (i) the difficulty and complexity of the process of obtaining written informed consents from clients in a joint representation and (ii) the risk of post- formation malpractice claims by irate clients (which may come years after the formation), I generally try to avoid these representations. b) Instead, I prefer to have only one client in the representation and to advise the other parties to the formation that they are not my clients. However, my client generally wants me to structure the LLC so as to accommodate all of the parties to the formation. 7) Representing the “entity in formation.” In my view, it is not valid for lawyers to the parties to the formation of a multi-member LLC to advise the parties that in the formation, the lawyer is representing only the “entity in formation” and not any of the parties. a) For one thing, an entity in formation does not exist. b) For another, what does it mean to represent the “entity in formation”? I think it means to do a joint representation. c) Well-reasoned recent law journal articles support my view, but many experienced and thoughtful lawyers disagree with it.

Page 8 ISSUE 10. UNAUTHORIZED PRACTICE OF LAW IN LLC FORMATIONS

1) Unauthorized practice of law. The rules concerning unauthorized practice of law are set forth in ABA Rule 5.5. In general, a lawyer not admitted to practice in a particular state will be treated by the relevant state regulatory board under Rule 5.5 as engaging in the unauthorized practice of law in that state only if: a) The lawyer establishes an office or other systematic and continuous presence in that state for the practice of law; or b) The lawyer holds out to the public that he or she is admitted to practice in that state. 2) Advising clients about LLC law in a state in which you are not licensed. However, merely advising clients about the law of a particular state in which you are not licensed or causing documents to be filed for clients with the secretary of state of that state will not generally constitute the unauthorized practice of law by lawyers not licensed in that state. See ABA Rules 5.5(b)(1) and (2). The issue here is one of competence, not licensure. 3) Sample v. Morgan. a) Lawyers not licensed to practice law in Delaware should be aware that in certain circumstances, they may be subject to the long-arm jurisdiction of the Delaware courts in malpractice suits, “aiding and abetting” suits and other suits on the basis of their advising their clients on Delaware legal matters and retaining agents in Delaware to file documents relating to those matters, even those these lawyers have never set foot in Delaware. See generally, Sample v. Morgan, 935 A.2d 1046 (Del. Ch. 2007). b) However, this case should probably be read to provide that lawyers will be subject to long-arm Delaware jurisdiction only if the documents they file through Delaware agents are elements of the alleged misconduct. It seems doubtful that merely filing a Delaware certificate of formation can constitute an element of malpractice in forming a Delaware LLC.

D:\Docs\2017-11-28\0250716fa026fb8315e744faf41958f0.doc

Page 9