Course: PCI Compliance Essentials - lchr_01_a54_lc_enus

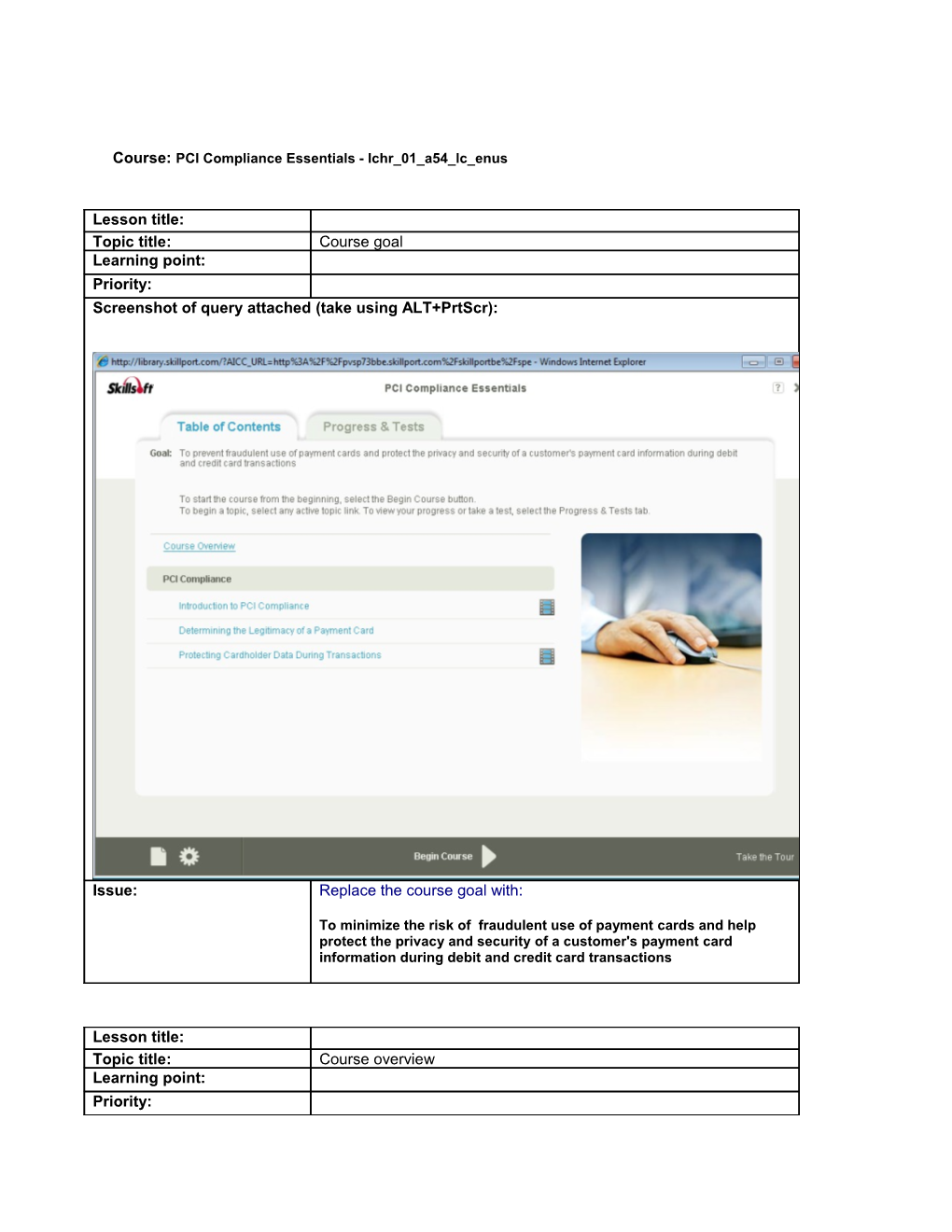

Lesson title: Topic title: Course goal Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr):

Issue: Replace the course goal with:

To minimize the risk of fraudulent use of payment cards and help protect the privacy and security of a customer's payment card information during debit and credit card transactions

Lesson title: Topic title: Course overview Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr):

Issue: Replace the table above with:

Card brand Number Purchase issued volume American 102.2 $588.17 Express million billion MasterCard 1,157.4 $982.29 million billion Visa 2,499.2 $2,085.42 million billion Discover 61.5 $122.27 million billion

Statistics as of year-end 2012

Caption item 1 – [no change]

Caption item 1 Alt text – A table lists the numbers of payment cards issued by various providers, as of year-end 2012. American Express has issued 102.2 million payment cards. MasterCard has issued 1,157.4 million payment cards. Visa has issued 2,499.2 million payment cards. Discover has issued 61.5 million payment cards

Caption item 2 – [no change]

Caption item 2 Alt text – American Express payment cards have a purchase volume of $588.17 billion, MasterCard payment cards have a purchase volume of $982.29 billion, Visa payment cards have a purchase volume of $2,085.42 billion, and Discover cards have a purchase volume of $122.27 billion.

Caption item 3 – [remove]

Caption item 3 Alt text – [remove]

Lesson title: Topic title: Introduction to PCI Compliance Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr): Issue: Replace the text associated with “Primary account number (PAN)”; with -

A primary account number, or PAN, usually consists of 16 digits, although it can be as many as 19 or as few as 13 digits. It's typically embossed on the front of a payment card although it is sometimes just printed. The PAN may also be printed on the back of the payment card where the signature is located.

Insert the text highlighted below within the text associated with “Expiration date “with -

A date of issue or “member since” date, if applicable,…..

Lesson title: Topic title: Introduction to PCI Compliance Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr): Issue: Replace the feedback with:

This option is incorrect. Although this information may be sensitive, a history of shopping habits isn't considered personally identifiable information unless it includes a cardholder's name or other information that could be used to personally identify the cardholder.

Lesson title: Topic title: Determining the Legitimacy of a Payment Card Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr): Issue: Insert the highlighted text below:

The back of each payment card also has security features, including a card security number, a magnetic stripe, a holographic stripe, and the cardholder's signature. All brand types have a signature panel that is some variation of a white stripe on the back of the card. Some brands repeat the brand name within the stripe or may have some other pattern watermarked on it. As mentioned before, you may also find the hologram here.

Lesson title: Topic title: Determining the Legitimacy of a Payment Card Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr): Issue: Replace caption 2 with (text highlighted in yellow):

You may also notice that the customer's signature doesn't match that on the back of the card. If this occurs, you should again call your supervisor rather than simply rejecting the card. Know whether your employer or state law permits you to ask for ID, such as a driver's license, or take other steps to help confirm the customer's identity when a signature is inconclusive

Lesson title: Topic title: Protecting Cardholder Data During Transactions Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr): Issue: Replace text in caption 1 with:

If orders are accepted via fax, your company may have a policy of asking customers to transmit a copy of both sides of the credit card with their orders. Your company may also require a faxed copy of a driver's license or other type of state-issued identification to further verify that the person making the order is the person named on the card. Your company may have a policy on disposing of paper records and fax documents (including handwritten notes containing credit card numbers) after transactions are completed. Be sure to familiarize yourself with your company's policy and follow it carefully.

Lesson title: Topic title: Protecting Cardholder Data During Transactions Learning point: Priority: Screenshot of query attached (take using ALT+PrtScr): Issue: Replace the text associated with “insist on a rush order”

With this: While not always a red flag, a request for unusually quick delivery may suggest fraud. Rush orders are common in fraud schemes that involve obtaining merchandise for quick resale using stolen or fraudulent credit cards. This is particularly true for high dollar value transactions.