Franklin Grand Isle Bar Association

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transmittal Email to House and Senate Members

Sent: Monday, March 5, 2018 1:47 PM To: David Ainsworth; Robert Bancroft; John Bartholomew; Fred Baser; Lynn Batchelor; Scott Beck; Paul Belaski; Steve Beyor; Clem Bissonnette; Thomas Bock; Bill Botzow; Patrick Brennan; Tim Briglin; Cynthia Browning; Jessica Brumsted; Susan Buckholz; Tom Burditt; Mollie Burke; William Canfield; Stephen Carr; Robin Chesnut-Tangerman; Annmarie Christensen; Kevin Christie; Brian Cina; Selene Colburn; Jim Condon; Peter Conlon; Daniel Connor; Chip Conquest; Sarah CopelandHanzas; Timothy Corcoran; Larry Cupoli; Maureen Dakin; David Deen; Dennis Devereux; Eileen Dickinson; Anne Donahue; Johannah Donovan; Betsy Dunn; Alyson Eastman; Alice Emmons; Peter Fagan; Rachael Fields; Robert Forguites; Robert Frenier; Douglas Gage; Marianna Gamache; John Gannon; Marcia Gardner; Dylan Giambatista; Diana Gonzalez; Maxine Grad; Rodney Graham; Adam Greshin; Sandy Haas; James Harrison; Mike Hebert; Robert Helm; Mark Higley; Matthew Hill; Mary Hooper; Jay Hooper; Lori Houghton; Mary Howard; Ronald Hubert; Kimberly Jessup; Ben Jickling; Mitzi Johnson; Ben Joseph; Bernie Juskiewicz; Brian Keefe; Kathleen Keenan; Charlie Kimbell; Warren Kitzmiller; Jill Krowinski; Rob LaClair; Martin LaLonde; Diane Lanpher; Richard Lawrence; Paul Lefebvre; Patti Lewis; William Lippert; Emily Long; Gabrielle Lucke; Terence Macaig; Michael Marcotte; Marcia Martel; Jim Masland; Christopher Mattos; Curt McCormack; Patricia McCoy; Francis McFaun; Alice Miller; Kiah Morris; Mary Morrissey; Mike Mrowicki; Barbara Murphy; Linda Myers; Gary Nolan; Terry -

Forum: a Child of an Era of Fear

Sent: Tuesday, March 20, 2018 11:20 AM To: Maxine Grad Subject: Bob Williamson shares Hailey Napier's powerful letter from the VALLEY NEWS Dear Chair Maxine Grad, Below is Hailey Napier’s letter from the VALLEY NEWS. Hailey eloquently expresses how today’s youngsters feel when mass shootings occur and lawmakers do little to address the lethal problem. Best, Bob Williamson…And here’s the letter: http://www.vnews.com/ Forum: A Child of an Era of Fear When I was 12 years old, I began scanning for exits at every movie theater I went to and carefully thought through escape scenarios as the previews played. I assessed the space between the seats and the floor. Would I be able to crawl between the armrest and the wall unseen? That was the year of the Aurora shooting. If you don’t remember the details, 12 people were murdered in a Century 16 theater in Aurora, Colo.. They were watching The Dark Knight Rises. I had begged to see the movie myself, and as I read the headlines online, I realized that innocent people had died, and that I could easily have been one of them. I am a child of an era of fear. Born almost exactly a year after Columbine, I grew up with the pitch black, unspoken terror of lockdown drills. Hiding in corners and closets and behind desks, as if turning the lights off will convince a killer that school’s been canceled on a Tuesday in May; as if a bookshelf will protect me from the rain of bullets driven by some arbitrary vendetta against society. -

Draft House Human Services Letter to Dept Of

115 STATE STREET REP. ANN PUGH, CHAIR MONTPELIER, VT 05633 REP. SANDY HAAS, VICE CHAIR TEL: (802) 828-2228 REP. FRANCIS MCFAUN, RANKING MEMBER FAX: (802) 828-2424 REP. THERESA WOOD, CLERK REP. JESSICA BRUMSTED REP. JAMES GREGOIRE REP. LOGAN NICOLL REP. DANIEL NOYES REP. KELLY PAJALA REP. MARYBETH REDMOND STATE OF VERMONT REP. CARL ROSENQUIST GENERAL ASSEMBLY HOUSE COMMITTEE ON HUMAN SERVICES April 20, 2020 Ken Schatz, Commissioner Department for Children and Families 280 State Drive, HC 1 North Waterbury, VT 05671-1080 Dear Commissioner Schatz, As you know, the House Committee on Human Services has spent considerable time in the last few weeks taking testimony and engaging in discussions regarding compliance with parent-child contact orders regarding children in need of care or supervision during the current declared state of emergency. The Committee understands the tremendous pressure you and your staff are under and the extraordinary steps you are taking to see that children who are in the custody of DCF are safe and well- cared for during the COVID-19 outbreak. While our committee believes that the safest approach for everyone during the state of emergency is to replace in-person contact with remote or virtual visits as recommended by Vermont Department of Health Commissioner Levine on March 25, 2020, we understand there may be some instances, taken on a case-by-case basis, where in-person contact may critical to staying on the path to family reunification and can be effectuated in a safe manner. To this end, we ask that DCF use the Vermont Department of Health’s most recent guidance regarding COVID-19 best practices to develop specific written guidance for DCF staff, foster parents, natural parents, and others who may participate in or facilitate in-person parent-child contact during the declared state of emergency. -

Citizen Initiatives Teacher Training Gas Taxes

DEFENDING AGAINST SECURITY BREACHES PAGE 5 March 2015 Citizen Initiatives Teacher Training Gas Taxes AmericA’s innovAtors believe in nuclear energy’s future. DR. LESLIE DEWAN technology innovAtor Forbes 30 under 30 I’m developing innovative technology that takes used nuclear fuel and generates electricity to power our future and protect the environment. America’s innovators are discovering advanced nuclear energy supplies nearly one-fifth nuclear energy technologies to smartly and of our electricity. in a recent poll, 85% of safely meet our growing electricity needs Americans believe nuclear energy should play while preventing greenhouse gases. the same or greater future role. bill gates and Jose reyes are also advancing nuclear energy options that are scalable and incorporate new safety approaches. these designs will power future generations and solve global challenges, such as water desalination. Get the facts at nei.org/future #futureofenergy CLIENT: NEI (Nuclear Energy Institute) PUB: State Legislatures Magazine RUN DATE: February SIZE: 7.5” x 9.875” Full Page VER.: Future/Leslie - Full Page Ad 4CP: Executive Director MARCH 2015 VOL. 41 NO. 3 | CONTENTS William T. Pound Director of Communications Karen Hansen Editor Julie Lays STATE LEGISLATURES Contributing Editors Jane Carroll Andrade Mary Winter NCSL’s national magazine of policy and politics Web Editors Edward P. Smith Mark Wolf Copy Editor Leann Stelzer Advertising Sales FEATURES DEPARTMENTS Manager LeAnn Hoff (303) 364-7700 Contributors 14 A LACK OF INITIATIVE 4 SHORT TAKES ON -

Refer to This List for Area Legislators and Candidates

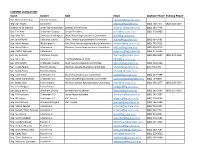

CURRENT LEGISLATORS Name District Role Email Daytime Phone Evening Phone Sen. Richard Westman Lamoille County [email protected] Rep. Dan Noyes Lamoille-2 [email protected] (802) 730-7171 (802) 644-2297 Speaker Mitzi Johnson Grand Isle-Chittenden Speaker of the House [email protected] (802) 363-4448 Sen. Tim Ashe Chittenden County Senate President [email protected] (802) 318-0903 Rep. Kitty Toll Caledona-Washington Chair, House Appropriations Committee [email protected] Sen. Jane Kitchel Caledonia County Chair, Senate Appropriations Committee [email protected] (802) 684-3482 Rep. Mary Hooper Washington-4 Vice Chair, House Appropriations Committee [email protected] (802) 793-9512 Rep. Marty Feltus Caledonia-4 Member, House Appropriations Committee [email protected] (802) 626-9516 Rep. Patrick Seymour Caledonia-4 [email protected] (802) 274-5000 Sen. Joe Benning Caledonia County [email protected] (802) 626-3600 (802) 274-1346 Rep. Matt Hill Lamoille 2 *NOT RUNNING IN 2020 [email protected] Sen. Phil Baruth Chittenden County Chair, Senate Education Committee [email protected] (802) 503-5266 Sen. Corey Parent Franklin County Member, Senate Education Committee [email protected] 802-370-0494 Sen. Randy Brock Franklin County [email protected] Rep. Kate Webb Chittenden 5-1 Chair, House Education Committee [email protected] (802) 233-7798 Rep. Dylan Giambatista Chittenden 8-2 House Leadership/Education Committee [email protected] (802) 734-8841 Sen. Bobby Starr Essex-Orleans Member, Senate Appropriations Committee [email protected] (802) 988-2877 (802) 309-3354 Sen. -

HOUSE COMMITTEES 2019 - 2020 Legislative Session

HOUSE COMMITTEES 2019 - 2020 Legislative Session Agriculture & Forestry Education Health Care Rep. Carolyn W. Partridge, Chair Rep. Kathryn Webb, Chair Rep. William J. Lippert Jr., Chair Rep. Rodney Graham, Vice Chair Rep. Lawrence Cupoli, Vice Chair Rep. Anne B. Donahue, Vice Chair Rep. John L. Bartholomew, Ranking Mbr Rep. Peter Conlon, Ranking Member Rep. Lori Houghton, Ranking Member Rep. Thomas Bock Rep. Sarita Austin Rep. Annmarie Christensen Rep. Charen Fegard Rep. Lynn Batchelor Rep. Brian Cina Rep. Terry Norris Rep. Caleb Elder Rep. Mari Cordes Rep. John O'Brien Rep. Dylan Giambatista Rep. David Durfee Rep. Vicki Strong Rep. Kathleen James Rep. Benjamin Jickling Rep. Philip Jay Hooper Rep. Woodman Page Appropriations Rep. Christopher Mattos Rep. Lucy Rogers Rep. Catherine Toll, Chair Rep. Casey Toof Rep. Brian Smith Rep. Mary S. Hooper, Vice Chair Rep. Peter J. Fagan, Ranking Member Energy & Technology Human Services Rep. Charles Conquest Rep. Timothy Briglin, Chair Rep. Ann Pugh, Chair Rep. Martha Feltus Rep. Laura Sibilia, Vice Chair Rep. Sandy Haas, Vice Chair Rep. Robert Helm Rep. Robin Chesnut-Tangerman, Rep. Francis McFaun, Ranking Member Rep. Diane Lanpher Ranking Member Rep. Jessica Brumsted Rep. Linda K. Myers Rep. R. Scott Campbell Rep. James Gregoire Rep. Maida Townsend Rep. Seth Chase Rep. Logan Nicoll Rep. Matthew Trieber Rep. Mark Higley Rep. Daniel Noyes Rep. David Yacovone Rep. Avram Patt Rep. Kelly Pajala Rep. Heidi E. Scheuermann Rep. Marybeth Redmond Commerce & Rep. Michael Yantachka Rep. Carl Rosenquist Rep. Theresa Wood Economic Development General, Housing, & Military Affairs Rep. Michael Marcotte, Chair Judiciary Rep. Thomas Stevens, Chair Rep. Jean O'Sullivan, Vice Chair Rep. -

Vermont Council of Developmental and Mental Health Services Legislative Update for January 13, 2015

Vermont Council of Developmental and Mental Health Services Legislative Update for January 13, 2015 House Human Services Committee Hears Overview from the Department of Mental Health On Thursday January 8 th the House Human Services received an overview of the Department of Mental Health from Commissioner Paul Dupre, Deputy Commissioner Frank Reed, Medical Director Jaskanwar Batra, and Adult Mental Health Director Susan Onderwyser. Ann Pugh pointed out that other than VPCH and the secure residential, all the work is contracted out to non-profit organizations. Jascanwar Batra and Frank Reed described the designated agencies and our programs. A particularly important fact shared was that crisis calls have risen to 30,000 per year compared to previous years when there were 13,000 – 17,000 calls. To view the full presentation please go to: http://legislature.vermont.gov/assets/Documents/2016/WorkGroups/House%20Human%20Services/De partment%20of%20Mental%20Health/W~Paul%20Dupre~Department%20of%20Mental%20Health%20 Overview~1-8-2015.pdf House Appropriations Receives Governor Shumlin’s Proposal for Budget Adjustment On January 12 th the House Appropriations Committee received the Governor’s proposal for a $12 million general fund reduction in the fiscal year 2015 budget adjustment act. During this week Administration officials will provide more specific information to the Committee. The following numbers are in global commitment dollars which is both state general fund and federal Medicaid match. Department of Disability Aging and Independent Living: Severely Functional Impairment Caseload Savings (-$200K); Integrated Family Services Family managed respite (-$1.2M); Developmental Services Caseload and utilization savings (-$646.5K). -

Bi-State Primary Care Association, January 2020

Vermont 2020January 2020 Primary Care Sourcebook Bi-State Primary Care Association 61 Elm Street, Montpelier, Vermont 05602 (802) 229-0002 www.bistatepca.org TABLE OF CONTENTS Introduction to Bi-State Page 3 Overcoming Transpiration Barriers Page 18 Bi-State PCA Vermont Members Page 4 Helping Patients Experiencing Homelessness Page 19 Key Elements of Bi-State’s Work Page 5 Accessing Nutritious Food Page 19 FQHC’s, AHEC, PPNNE, and VCCU Page 7 Reducing Isolation for Farmworkers Page 20 Member Map Page 8 Other Elements of Comprehensive Care Page 21 Payer Mix Page 9 Vermont Rural Health Alliance (VRHA) Page 24 Bi-States 2019-2020 Vermont Public Policy 1 in 3 Vermonters in over 88 Sites Page 10 Page 27 Principles Investing in Primary Care Page 11 FQHC Funding Page 28 Workforce Development Supports Primary Care Page 13 FQHC and ACO Participation Page 28 Bi-State Workforce Recruitment Center Page 14 FQHC Federal Requirements Page 29 Workforce & Area Health Education Centers (AHEC) Page 15 Member Sites by Organization Page 30 Addressing All the Factors of Wellness Page 17 Member Sites by County Page 31 Legislative Representation List Biennium 2019 – Tracking Social Determinants of Health Page 18 Page 33 2020 2 What is a Primary Care Association? Each of the 50 states (or in Bi-State’s case, a pair of states) has one nonprofit Primary Care Association (PCA) to serve as the voice for Community Health Centers. These health centers were born out of the civil rights and social justice movements of the 1960’s with a clear mission that prevails today: to provide health care to communities with a scarcity of providers and services. -

Champlain Housing Trust Annual Report 2018

ANNUAL REPORT FISCAL YEAR 2018 OUR MISSION DEAR MEMBERS, The Champlain Housing Trust is a Community As I look back over 2018, I have no doubt that this year will always stand Land Trust that supports the people of out in our history as a milestone in our organizational progress–a year Northwest Vermont and strengthens their in which we achieved long-standing goals on a scale that redefined our communities through the development and capacity and potential for the future. stewardship of permanently affordable homes. For many years, we have sought to secure new kinds affordable capital to expand our reach and impact. With the purchase this year of Dorset Commons, we put such resources to work to ensure that 105 families renting in the market could count on affordable rents and housing security for the long term. Social impact investments and enterprise capital were added to our usual grant sources to realize the new neighborhood of Cambrian Rise, with Laurentide Apartments under construction, and to fund our first phase of affordable homes for sale that will soon follow. In addition to these 76 apartments are 60 more being built now in South Burlington’s new City Center. This is truly a milestone: the largest number of homes that we have ever had in production at once. This scale is possible also due to the state’s affordable housing bond, another new source that we worked hard to bring about with the Building Homes Together campaign. We are delighted to welcome new homeowners in Essex at our largest Green Mountain Habitat for Humanity collaboration to date, certainly a homeownership milestone and at a scale that we plan to replicate as we continue to grow this outstanding partnership. -

Vermont Directory of Municipal Officials

2015 Vermont Directory of Municipal Officials Vermont Local Roads Program VTrans Training Center 1716 US Route 302 Berlin, VT 05633-5002 802-828-3537 802-828-1932 (fax) http://ww.vermontlocalroads.org Updated June 2015 DIRECTORY OF TOWN OFFICIALS Table of Contents Municipal Index (alphabetical) - 3 VT Highway District Map - 9 District Transportation Administrators - 10 VT Regional Planning Commissions - 11 Vermont State Highway Mileage 2015 - 15 Directory of Town Officials Addison County - 30 Bennington County - 36 Caledonia County - 41 Chittenden County - 46 Essex County - 52 Franklin County - 56 Grand Isle County - 61 Lamoille County - 63 Orange County - 67 Orleans County - 72 Rutland County - 77 Washington County - 84 Windham County - 90 Windsor County - 96 About Vermont Local Roads - 103 _________________________________________________________ Municipalities are listed alphabetically within counties. Municipality type is designated by the letter following the municipality's name: (T) Town (C) City (V) Village (UTG) Unified Towns and Gores Please notify the Vermont Local Roads Program of corrections: Phone: 802-828-3537 Fax: 802-828-1932 E-Mail: [email protected] 2 Municipality County City/Town/Village Highway District Addison Addison T 5 Albany Orleans T 9 Alburgh Grand Isle T 8 Andover Windsor T 2 Arlington Bennington T 1 Athens Windham T 2 Bakersfield Franklin T 8 Baltimore Windsor T 2 Barnard Windsor T 4 Barnet Caledonia T 7 Barre Washington C 6 Barre Washington T 6 Barton Orleans T 9 Barton Orleans V 9 Bellows Falls Windham -

Legislative Update for February 20, 2019

Supporting Vermonters to lead healthy and satisfying lives community by community Legislative Update for February 20, 2019 Community-Based Public Hearings on the Governor’s Recommended FY2020 State Budget. Here’s your chance to have your voice heard. Share your life experiences; the values of developmental disability, mental health and substance use disorder services; or how it feels to work in this system of care. What are the challenges and opportunities and what resources are required to serve Vermonters. Vermont Care Partners is requesting a two-pronged multi-year investment to address an under- resourced system of care beginning with a 4% increase for FY2020. Specifically we are requesting: • Invest in the DA/SSAs’ workforce to recruit and retain qualified experienced staff • Invest in the DA/SSAs’ to develop community services that reduce emergency room and Inpatient bed need. The Vermont House and Senate Committees on Appropriations are seeking public input on the Governor’s Recommended FY2020 State Budget and will hold community-based public hearings on Monday, February 25, 2019, 6:00 – 7:00 p.m. at the following 5 locations. An additional location in Springfield will be held from 5:30 – 6:30 p.m. Morrisville – People’s Academy High School, Auditorium, top of Copley Avenue Rutland City – Rutland Public Schools, Longfellow School Building, Board Room St. Johnsbury – St. Johnsbury House, Main dining room, 1207 Main Street St. Albans City – St. Albans City School, Library, 29 Bellows Street Winooski – Community College of Vermont, Room 108, 1 Abenaki Way Springfield – Springfield Town Hall, 96 Main Street, 3rd Floor Conference Room (Selectmen’s Hall) 5:30-6:30 p.m. -

Weekly Legislative Report No. 2 January 6, 2017 Page 1

Governor Scott Takes Office ........................................ 1 Vermont House Committee Members ....................... 4 Governor Shumlin Says Good-bye .............................. 2 Summary of New Bills ................................................... 6 House Committees Makeover ....................................... 2 Advocacy Webinars ........................................................ 6 Governor Scott Takes Office Inauguration Day in Vermont is always an occasion to celebrate and showcase our state’s history and the pomp and circumstance that recall it. From the procession of four former governors and numerous dignitaries who were escorted by members of the armed services in Vermont to the singing of “America the Beautiful” by Colchester Police Chief Jennifer Morrison, it was an opportunity for the overflow crowd of Vermonters crammed in the House Chamber to witness their state’s peaceful transfer of power. After Governor Philip Scott took the oath of office, he used his inauguration speech to focus on themes that he had emphasized throughout his campaign for office. He assured Vermonters that he heard their concerns about “struggles to make ends meet as costs and taxes rise and good paying jobs are fewer and fewer.” He committed his administration to strengthening the economy, making living and doing business in Vermont more affordable, and protecting the most vulnerable. He announced that he would sign an executive order that very day directing every state agency to focus on those issues. His purpose in so doing,