Investigation Section

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Rules of Evidence: 801-03, 901

FEDERAL RULES OF EVIDENCE: 801-03, 901 Rule 801. Definitions The following definitions apply under this article: (a) Statement. A "statement" is (1) an oral or written assertion or (2) nonverbal conduct of a person, if it is intended by the person as an assertion. (b) Declarant. A "declarant" is a person who makes a statement. (c) Hearsay. "Hearsay" is a statement, other than one made by the declarant while testifying at the trial or hearing, offered in evidence to prove the truth of the matter asserted. (d) Statements which are not hearsay. A statement is not hearsay if-- (1) Prior statement by witness. The declarant testifies at the trial or hearing and is subject to cross- examination concerning the statement, and the statement is (A) inconsistent with the declarant's testimony, and was given under oath subject to the penalty of perjury at a trial, hearing, or other proceeding, or in a deposition, or (B) consistent with the declarant's testimony and is offered to rebut an express or implied charge against the declarant of recent fabrication or improper influence or motive, or (C) one of identification of a person made after perceiving the person; or (2) Admission by party-opponent. The statement is offered against a party and is (A) the party's own statement, in either an individual or a representative capacity or (B) a statement of which the party has manifested an adoption or belief in its truth, or (C) a statement by a person authorized by the party to make a statement concerning the subject, or (D) a statement by the party's agent or servant concerning a matter within the scope of the agency or employment, made during the existence of the relationship, or (E) a statement by a coconspirator of a party during the course and in furtherance of the conspiracy. -

Rule 609: Impeachment by Evidence of Conviction of a Crime

RULE 609: IMPEACHMENT BY EVIDENCE OF CONVICTION OF A CRIME Jessica Smith, UNC School of Government (Feb. 2013). Contents I. Generally .........................................................................................................................1 II. For Impeachment Only. ...................................................................................................2 III. Relevant Prior Convictions. .............................................................................................2 A. Rule Only Applies to Certain Classes of Convictions .............................................2 B. Out-of-State Convictions ........................................................................................3 C. Prayer for Judgment Continued (PJC) ...................................................................3 D. No Contest Pleas ...................................................................................................3 E. Charges Absent Convictions ..................................................................................3 F. Effect of Appeal .....................................................................................................3 G. Reversed Convictions ............................................................................................3 H. Pardoned Offenses ................................................................................................3 I. Juvenile Adjudications ...........................................................................................3 J. Age -

Video Evidence a Primer for Prosecutors

Global Justice Information Sharing Initiative Video Evidence A Primer for Prosecutors Even ten years ago, it was rare for a court case to feature video evidence, besides a defendant’s statement. Today, with the increasing use of security cameras by businesses and homeowners, patrol-car dashboard and body-worn cameras by law enforcement, and smartphones and tablet cameras by the general public, it is becoming unusual to see a court case that does not include video evidence. In fact, some estimate that video evidence is involved in about 80 percent of crimes.1 Not surprisingly, this staggering abundance of video brings with it both opportunities and challenges. Two such challenges are dealing with the wide variety of video formats, each with its own proprietary characteristics and requirements, and handling the large file sizes of video evidence. Given these obstacles, the transfer, storage, redaction, disclosure, and preparation of video evidence for evidentiary purposes can stretch the personnel and equipment resources of even the best-funded prosecutor’s office. This primer provides guidance for managing video evidence in the office and suggests steps to take to ensure that this evidence is admissible in court. Global Justice Information Sharing Initiative October 2016 Introduction The opportunities inherent in video evidence cannot be overlooked. It is prosecutors who are charged with presenting evidence to a jury. Today, juries expect video to be presented to them in every case, whether it exists or not.2 As a result, prosecutors must have the resources and technological skill to seamlessly present it in court. Ideally, prosecutors’ offices could form specially trained litigation support units, which manage all video evidence from the beginning of the criminal process through trial preparation and the appellate process. -

The Admission of Government Agency Reports Under Federal Rule of Evidence 803(8)(C) by John D

The Admission of Government Agency Reports under Federal Rule of Evidence 803(8)(c) By John D. Winter and Adam P. Blumenkrantz or (B) matters observed pursuant having hearsay evidence admitted under to duty imposed by law as to which Rule 803(8)(c) follow from the justifica- matters there was a duty to report, tions for adopting the rule in the first excluding, however, in criminal cases place. The hearsay exception is premised matters observed by police officers on several conditions. First, the rule as- and other law enforcement person- sumes that government employees will nel, or (C) in civil actions . factual carry out their official duties in an honest 2 John D. Winter Adam P. Blumenkrantz findings resulting from an investiga- and thorough manner. This assump- tion made pursuant to authority tion results in the rule’s presumption of n product liability and other tort ac- granted by law, unless the sources of reliability. Second, the rule is based on the tions, plaintiffs may seek to introduce information or other circumstances government’s ability to investigate and re- Igovernment records or documents, indicate lack of trustworthiness. port on complex issues raised in many cas- federal and nonfederal alike, to establish es, from product liability claims to section one or more elements of their claims. In This article focuses specifically on 1983 actions against government officials. this regard, plaintiffs attempt to rely on the third prong of the rule: the use of Government agencies generally possess reports or letters written by government agency records in civil actions that result levels of expertise, resources, and experi- agencies responsible for overseeing the from an agency investigation made ence, including access to information that health, safety, and consumer aspects pursuant to authority granted by law. -

Criminal Procedure Code of the Republic of Armenia

(not official copy) CRIMINAL PROCEDURE CODE OF THE REPUBLIC OF ARMENIA GENERAL PART Section One : GENERAL PROVISIONS CHAPTER 1. LEGISLATION ON CRIMINAL PROCEDURE Article 1. Legislation Governing Criminal Proceedings Article 2. Objectives of the Criminal-Procedure Legislation Article 3. Territory of Effect of the Criminal-procedure Law Article 4. Effect of the Criminal-Procedure Law in the Course of Time Article 5. Peculiarities in the Effect of the Criminal-Procedure Law Article 6. Definitions of the Basic Notions Used in the Criminal-procedure Code CHAPTER 2. PRINCIPLES OF CRIMINAL PROCEEDINGS Article 7. Legitimacy Article 8. Equality of All Before the Law Article 9. Respect for the Rights, Freedoms and Dignity of an Individual Article 10. Ensuring the Right to Legal Assistance Article 11. Immunity of Person Article 12. Immunity of Residence Article 13. Security of Property Article 14. Confidentiality of Correspondence, Telephone Conversations, Mail, Telegraph and Other Communications Article 15. Language of Criminal Proceedings Article 16. Public Trial Article 17. Fair Trial Article 18. Presumption of Innocence Article 19. The Right to Defense of the Suspect and the Accused and Guarantees for this Right Article 20. Privilege Against Self-Incrimination (not official copy) Article 21. Inadmissibility of Repeated Conviction and Criminal Prosecution for the Same Crime Article 22. Rehabilitation of the Rights of the Persons who suffered from Judicial Mistakes Article 23. Adversarial System of Criminal Proceedings Article 24. Administration of Justice Exclusively by the Court Article 25. Independent Assessment of Evidence CHAPTER 3. CONDUCT OF CRIMINAL CASE Article 26. Conduct of Criminal Case Article 27. The Obligation to institute a criminal case and resolution of the crime Article 28. -

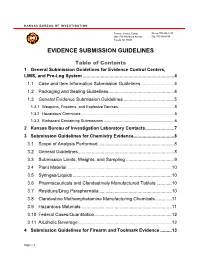

1 General Submission Guidelines for Evidence Control Centers, LIMS, and Pre-Log System

KANSAS BUREAU OF INVESTIGATION Forensic Science Center Phone: 785-296-1137 2001 SW Washburn Avenue Fax: 785-368-6564 Topeka, KS 66604 EVIDENCE SUBMISSION GUIDELINES Table of Contents 1 General Submission Guidelines for Evidence Control Centers, LIMS, and Pre-Log System ........................................................................4 1.1 Case and Item Information Submission Guidelines ..........................4 1.2 Packaging and Sealing Guidelines....................................................4 1.3 General Evidence Submission Guidelines ........................................5 1.3.1 Weapons, Firearms, and Explosive Devices....................................................5 1.3.2 Hazardous Chemicals ......................................................................................5 1.3.3 Biohazard Containing Submissions .................................................................6 2 Kansas Bureau of Investigation Laboratory Contacts.......................7 3 Submission Guidelines for Chemistry Evidence................................8 3.1 Scope of Analysis Performed............................................................8 3.2 General Guidelines............................................................................8 3.3 Submission Limits, Weights, and Sampling ......................................9 3.4 Plant Material ..................................................................................10 3.5 Syringes/Liquids..............................................................................10 3.6 -

Physical Evidence Manual

If you have issues viewing or accessing this file contact us at NCJRS.gov. City of Phoenix Physical Evidence Manual 142520 U.S. Department of Justice National Institute of Justice This document has been reproduced exactly as received from the person or organization originating it. Points of view or opinions stated in this document are those of the authors and do not necessarily represent the official position or policies of the National Institute of Justice. Permission to reproduce this copyrighted material has been granJ;l}\8'enix Police Department (AZ) to the National Criminal Justice Reference Service (NCJRS). Further reproduction outside of the NCJRS system requires permission of the copyright owner. Phoenix Police Department Crime Detection Laboratory d 5 CITY OF PHOENIX POLICE DEPARTMENT Crime Detection Laboratory WILLIAM J. COLLIER Director Edited by Raymond Gieszl 1990 -------------_._---------------------' CONTENTS I. Introduction ---------------------------------- 3-4 II. Laboratory ------------------------------------- 5 III. Function and Services ------------------------- 6-7 IV. General Instruction for Collection and -------- 8-10 Preservation of Physical Evidence V. Crime Scene Processing and Reconstruction ----- 11-15 VI. Marijuana, Narcotics and Dangerous Drugs ------ 16-18 VII. Prescription Only Drugs ------------------------ 19-20 VIII. Toxicology ------------------------------------ 21-22 IX. Blood stains ---------------------------------- 23-29 X. Hair ------------------------------------------- 30-32 XI. Seminal -

The Role and Impact of Forensic Evidence in the Criminal Justice System, Final Report

The author(s) shown below used Federal funds provided by the U.S. Department of Justice and prepared the following final report: Document Title: The Role and Impact of Forensic Evidence in the Criminal Justice System, Final Report Author: Tom McEwen, Ph.D. Document No.: 236474 Date Received: November 2011 Award Number: 2006-DN-BX-0095 This report has not been published by the U.S. Department of Justice. To provide better customer service, NCJRS has made this Federally- funded grant final report available electronically in addition to traditional paper copies. Opinions or points of view expressed are those of the author(s) and do not necessarily reflect the official position or policies of the U.S. Department of Justice. This document is a research report submitted to the U.S. Department of Justice. This report has not been published by the Department. Opinions or points of view expressed are those of the author(s) and do not necessarily reflect the official position or policies of the U.S. Department of Justice. Institute for Law and Justice, Inc. 1219 Prince Street, Suite 2 Alexandria, Virginia Phone: 703-684-5300 The Role and Impact of Forensic Evidence in the Criminal Justice System Final Report December 13, 2010 Prepared by Tom McEwen, PhD Prepared for National Institute of Justice Office of Justice Programs U.S. Department of Justice This document is a research report submitted to the U.S. Department of Justice. This report has not been published by the Department. Opinions or points of view expressed are those of the author(s) and do not necessarily reflect the official position or policies of the U.S. -

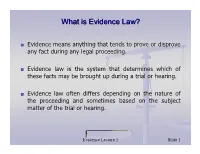

What Is Evidence Law?

WWhhaat t isis Ev Evidideennccee LLaaww?? n Evidence means anything that tends to prove or disprove any fact during any legal proceeding. n Evidence law is the system that determines which of these facts may be brought up during a trial or hearing. n Evidence law often differs depending on the nature of the proceeding and sometimes based on the subject matter of the trial or hearing. Evidence Lecture 1 Slide 1 WWhhyy H Haavvee E Evvidideennccee LLaaww?? n A fundamental question concerning evidence law is why have it at all? If a trial is supposed to be about the search for the truth, why not just let everything in and let the trier of fact sort it out? n Some answers: n Avoid confusing and diverting the attention of the trier of fact; n Efficiency of the trial process, in terms of time and expense; n Minimize the risk of unfair prejudice; n To the extent possible, avoid admitting false evidence; n Protect other important interests such as privileges.s. Evidence Lecture 1 Slide 2 TThhee R Roolleess oof f tthhee Judg Judgee aanndd JJuurryy n In general, there are roles a court must fill in each case: n Trier of fact (decide, based on the evidence, what happened; and n Trier of Law (apply the rules of evidence and decide other necessary administrative questions). n Where there is a jury, the jury is the trier of fact and the judge is the trier of law n Therefore, it is the judge who makes virtually all decisions on the admissibility of evidence. -

CHARACTER EVIDENCE QUICK REFERENCE Reputation – Opinion – Specific Instances of Conduct - Habit

CHARACTER EVIDENCE QUICK REFERENCE reputation – opinion – specific instances of conduct - habit Character of the Defendant – 404(a)(1) (pages 14-29) (pages 4-8) * Test: Proper Purpose + Relevance + Time * Test: Relevance (to the crime charged) + Similarity + 403 balancing; rule of inclusion + 403 balancing; rule of exclusion * Put basis for ruling in record (including * Defendant gets to go first w/ "good 403 balancing analysis) character" evidence – reputation or opinion only (see rule 405) * D has burden to keep 404(b) evidence out ^ State can cross-examine as to specific instances of bad character * proper purposes: motive, opportunity, knowledge/intent, preparation/m.o., common * Law-abidingness ALWAYS relevant scheme/plan, identity, absence of mistake/ accident/entrapment, res gestae (anything * General good character not relevant but propensity) * Defendant's character is substantive ^ Credibility is never proper – 608(b), not 404(b) evidence of innocence – entitled to instruction if requested * time: remoteness is less significant when used to show intent, motive, m.o., * D's evidence of self-defense does not knowledge, or lack of mistake/accident - automatically put character at issue * remoteness more significant when common scheme or plan (seven year rule) ^ unless continuous course of conduct, or D is gone * similarity: particularized, but not Character of the victim – 404(a)(2) (pages 8-11) necessarily bizarre ^ the more similar acts are, the less problematic time is * Test: Relevance (to the crime charged) + 403 balancing; -

Principles of Fraud Examination

Building a Culture of Fraud Prevention and Detection Responding to Discovered Fraud © 2014 Association of Certified Fraud Examiners, Inc. Discussion Questions 1. Does your organization have formal procedures for responding to discovered frauds? Who is responsible for investigating such frauds? Are identified instances of fraud within your organization always reported to the authorities? © 2014 Association of Certified Fraud Examiners, Inc. 2 of 25 Discussion Questions 2. You are an internal auditor who has just uncovered significant evidence that an employee in the accounting department has been embezzling money from the company. What steps do you take in response to this discovery? © 2014 Association of Certified Fraud Examiners, Inc. 3 of 25 Learning Objectives . Understand what to do when an organization receives fraud allegations and how to determine whether to undertake an investigation. Know how to develop a fraud investigation plan and form a fraud investigation team. Understand the steps and techniques involved in conducting a fraud examination. © 2014 Association of Certified Fraud Examiners, Inc. 4 of 25 Learning Objectives . Consider the risks that arise during a fraud examination and how best to manage those risks. Determine how and to whom to report the results of a fraud examination. Consider necessary follow-up steps after the conclusion of a fraud examination. © 2014 Association of Certified Fraud Examiners, Inc. 5 of 25 Introduction . An effective anti-fraud program includes formal and consistent procedures for: • Receiving and handling reports of fraud allegations • Thoroughly investigating identified instances of fraud • Swiftly and appropriately punishing perpetrators • Remediating weaknesses that allowed fraud to occur © 2014 Association of Certified Fraud Examiners, Inc. -

Mccormick on Evidence and the Concept of Hearsay: a Critical Analysis Followed by Suggestions to Law Teachers Roger C

University of California, Hastings College of the Law UC Hastings Scholarship Repository Faculty Scholarship 1981 McCormick on Evidence and the Concept of Hearsay: A Critical Analysis Followed by Suggestions to Law Teachers Roger C. Park UC Hastings College of the Law, [email protected] Follow this and additional works at: http://repository.uchastings.edu/faculty_scholarship Part of the Evidence Commons Recommended Citation Roger C. Park, McCormick on Evidence and the Concept of Hearsay: A Critical Analysis Followed by Suggestions to Law Teachers, 65 Minn. L. Rev. 423 (1981). Available at: http://repository.uchastings.edu/faculty_scholarship/598 This Article is brought to you for free and open access by UC Hastings Scholarship Repository. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of UC Hastings Scholarship Repository. For more information, please contact [email protected]. Faculty Publications UC Hastings College of the Law Library Park Roger Author: Roger C. Park Source: Minnesota Law Review Citation: 65 Minn. L. Rev. 423 (1981). Title: McCormick on Evidence and the Concept of Hearsay: A Critical Analysis Followed by Suggestions to Law Teachers Originally published in MINNESOTA LAW REVIEW. This article is reprinted with permission from MINNESOTA LAW REVIEW and University of Minnesota Law School. McCormick on Evidence and the Concept of Hearsay: A Critical Analysis Followed by Suggestions to Law Teachers Roger C. Park* Few modern one volume treatises are as widely used or as influential as McCormick's Handbook of the Law of Evidence.1 The book has been employed by teachers as a casebook substi- tute in law school evidence courses,2 used by attorneys in the practice of law, and cited extensively by the Advisory Commit- tee on the Federal Rules of Evidence.3 McCormick deserves the popularity that it has achieved as a teaching tool and a ref- erence work.