NYSE Common Customer Gateway (CCG) FIX Specification and API

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

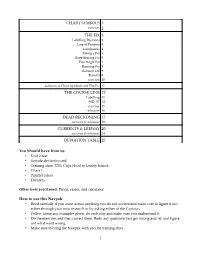

Chart Symbols 2 2 the Fix 3 the Course Line 12 Dead

CHART SYMBOLS 2 exercises 2 THE FIX 3 Labelling Positions 3 Line of Position 4 Landmarks 4 Taking a Fix 5 Three Bearing Fix 5 Two Angle Fix 7 Running Fix 8 Distance Off 9 Transits 9 exercises 10 solutions to Chart Symbols and The Fix 11 THE COURSE LINE 12 Labelling 12 60D=ST 14 exercises 15 solutions 16 DEAD RECKONING 17 exercises & solutions 19 CURRENTS & LEEWAY 20 exercises & solutions 24 DEVIATION TABLE 25 You Should have from us: • Unit 2 text. • Sample deviation card. • Training chart 2235, Cape Hurd to Lonely Island. • Chart 1. • Parallel rulers. • Dividers. Other tools you'll need: Pencil, eraser, and calculator. How to use this Navpak: • Read carefully if you come across anything you do not understand make sure to figure it out either through your own research or by asking either of the Captains. • Follow along any examples given, do each step and make sure you understand it. • Do the exercises and then correct them. Redo any questions you got wrong and try and figure out what went wrong. • Make sure to bring the Navpak with you for training days. 1 CHART SYMBOLS It is important to be able to understand what is on the chart. This is where Chart 1 comes in. It shows you all the symbols used on charts. Before you continue with this NavPack I would like you to pull out the copy of Chart 1 you have and read the introduction and look at explanation of the layout, they are both at the front of the book. -

Thearena INDUSTRY NEWS MARKET NEWS REGULATORY NEWS

theArena INDUSTRY NEWS MARKET NEWS REGULATORY NEWS Patience, but Potential, believing a top-of-the-ticket loss by the Like the presidential race, the in Cuba Market AFFORDABLE CARE ACT > SCOTT SINDER GOP to be inevitable either way, feel impact of a Republican victory on it’s more important to retain the soul the future of Obamacare is more While progress may be slow, there is of the party, even if it means Trump than a little unsettled. Trump movement in normalizing and developing U.S.- The Fix and his acolytes run a third-party has decreed the law a failure and Cuba relations, and companies with future business interest in the country would do Whoever our next president is, campaign. Some pollsters are starting promised to repeal it, but he’s well to engage now and be part of developing the ACA will be up for reform. to project a Trump ticket would cost offered no hint of what would strategic relationships in Havana. The Council What do we want? Here’s my Republicans the Senate and jeopardize replace it, other than the assurance the House majority. If those projections that it will be “great.” itself has joined Engage Cuba, a nonprofit wish list. dedicated to ending the travel and trade become more widespread, I think the Other Republican victors likely embargo on Cuba and facilitating relationships movement to oust Trump will begin to would pick up the House’s “repeal- between U.S. businesses and Cuba. We are at an interesting moment in echo more loudly. and-replace” mantra (I have lost P-C specialists take note: hurricanes, the presidential campaign cycle. -

High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses Ian Poirier

Hastings Business Law Journal Volume 8 Article 5 Number 2 Summer 2012 Summer 1-1-2012 High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses Ian Poirier Follow this and additional works at: https://repository.uchastings.edu/ hastings_business_law_journal Part of the Business Organizations Law Commons Recommended Citation Ian Poirier, High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses, 8 Hastings Bus. L.J. 445 (2012). Available at: https://repository.uchastings.edu/hastings_business_law_journal/vol8/iss2/5 This Note is brought to you for free and open access by the Law Journals at UC Hastings Scholarship Repository. It has been accepted for inclusion in Hastings Business Law Journal by an authorized editor of UC Hastings Scholarship Repository. For more information, please contact [email protected]. High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses Ian Poirier* I. INTRODUCTION On May 6th, 2010, a single trader in Kansas City was either lazy or sloppy in executing a large trade on the E-Mini futures market.1 Twenty minutes later, the broad U.S. securities markets were down almost a trillion dollars, losing at their lowest point more than nine percent of their value.2 Certain stocks lost nearly all of their value from just minutes before.3 Faced with the blistering pace of the decline, many market participants opted to cease trading entirely, including both human traders and High Frequency Trading (“HFT”) programs.4 This withdrawal of liquidity5 accelerated the crash, as fewer buyers were able to absorb the rapid-fire selling pressure of the HFT programs.6 Within two hours, prices were back * J.D. -

Waveyard Developers Seek More Time• A3 a Tribune Investigation Into

Waveyard developers seek more time A3 Mesa • WHERE LOCAL NEWS IS FIRST Winner of the Pulitzer Prize for Local Reporting EastValleyTribune.com >> Online every day. In print Wednesday, Friday and Sunday for FREE! INSIDE TODAY’S A Tribune investigation into Arizona’s Private RIGGED Schools Tax Credit Program PRIVILEGE SPORTS Fitzgerald pushes himself to keep improving, AA4 ENTERTAINMENT Museum showcases legacy of Chicano THOMAS BOGGAN, TRIBUNE creativity, AA8 The offi ce of the Arizona Scholarship Fund in Mesa. Today’s Tomorrow’s weather: weather: High 110, High 110, INSIDE TODAY’S TRIBUNE, A4-A10 WEDNESDAY, AUG. 5 FRIDAY, AUG. 7 Low 81 Low 81 THE FIX: The tuition tax credits law was supposed to HOW-TO GUIDE: Many private PERKS: Executives at two of Sunny Sunny revolutionize school choice for disadvantaged children. Instead schools teach parents how to skirt Arizona’s largest scholarship it fostered a rigged system that keeps private education a the law by lining up donors for charities are using income tax INSIDE TODAY’S TRIBUNE privilege for the already privileged. PAGE A4 their children. donations to enrich themselves. This section Take 2 NO OVERSIGHT: The state has no way of ensuring that PLOT TWIST: The tale of Maricopa ALTERED VISION: Twelve years Today’s quick take, A2 Sports, AA2 Local news, A3-27 Entertainment, AA8 $55 million a year in tax credits really goes toward scholarships County Schoolhouse Foundation ago, Trent Franks envisioned a Bulletin Board, A17 Theater, AA10 for private school students as the law intended. PAGE A10 begins with criminal indictments statewide system to enable poor Wall Street Journal, A28 Television, AA11 and fraud but ends as an example kids to go to private schools. -

Fix NICS Act of 2017, to Strengthen an Individual

NSSF FAST FACTS NSSF’S FIXNICS® CAMPAIGN Federally licensed retailers are law. After securing FixNICS® reforms (R-Texas). required to run a background check in 16 states to date, the number of In the Senate, Sen. John Cornyn through the FBI’s National Instant disqualifying mental health records (R-Texas) had introduced NSSF- Criminal Background Check System submitted to NICS increased by 270 supported bipartisan S. 2135, the (NICS) when transferring a firearm to percent to about 6.07 million as of Fix NICS Act of 2017, to strengthen an individual. Firearm retailers rely on December 31, 2020, from about 1.7 NICS by requiring federal agencies to NICS to ensure the lawful transfer of million in December 2012. enter all disqualifying records under firearms to law-abiding citizens. Over However, gaps remain in the current law. Sen. Cornyn’s legislation 391 million NICS background checks efforts to ensure all relevant records also allowed a federal grant for states have been conducted from November are submitted to NICS. Several to help upload these records. 30, 1998 through May 31, 2021; about states, and as tragically learned These legislative efforts 19 million have been conducted through recent events, some through May 2021 alone. federal agencies, still are not fully However, a background check participating in submitting records to is only as good as the records in the keep firearms from those prohibited database. That is why the firearm from purchasing them. industry supports improving the current NICS system by increasing NSSF APPLAUDS FEDERAL ACTION the number of prohibiting records A December 2017 report by the states and federal agencies submit to Defense Department’s Inspector the FBI databases, helping to prevent General found that the military illegal transfers of firearms to those services failed to consistently submit who are prohibited from owning records to NICS. -

UAAC Conference.Pdf

Friday Session 1 : Room uaac-aauc1 : KC 103 2017 Conference of the Universities Art Association of Canada Congrès 2017 de l’Association d’art des universités du Canada October 12–15 octobre, 2017 Banff Centre for Arts and Creativity uaac-aauc.com UAAC - AAUC Conference 2017 October 12-15, 2017 Banff Centre for Arts and Creativity 1 Welcome to the conference The experience of conference-going is one of being in the moment: for a few days, we forget the quotidian pressures that crowd our lives, giving ourselves over to the thrill of being with people who share our passions and vocations. And having Banff as the setting just heightens the delight: in the most astonishingly picturesque way possible, it makes the separation from everyday life both figurative and literal. Incredibly, the members of the Universities Art Association of Canada have been getting together like this for five decades—2017 is the fifteenth anniversary of the first UAAC conference, held at Queen’s University and organized around the theme of “The Arts and the University.” So it’s fitting that we should reflect on what’s happened in that time: to the arts, to universities, to our geographical, political and cultural contexts. Certainly David Garneau’s keynote presentation, “Indian Agents: Indigenous Artists as Non-State Actors,” will provide a crucial opportunity for that, but there will be other occasions as well and I hope you will find the experience productive and invigorating. I want to thank the organizers for their hard work in bringing this conference together. Thanks also to the programming committee for their great work with the difficult task of reviewing session proposals. -

Congress Balks at $200M Price

16 POLITICO THURSDAY, JULY 1, 2010 THURSDAY, JULY 1, 2010 POLITICO 17 Congress Statue of Freedom Refurbishment Dome Skirt Rehabilitation $3.99 million $19.9 million Water is leaking through pin holes in the “Statue of Free- The skirt area inside the dome needs repair. Balks at dom,” at the pinnacle of the Capitol dome. Fine iron filings Lead-based paint is flaking off the interior face caused by corrosion are staining the trusses of the dome. of the dome skirt, allowing moisture to penetrate Spider mites are crawling on the exterior surfaces. Interior the sandstone. Visitors who get Capitol dome finishes at the first visitor’s gallery and the inner dome are tours have a less pleasant experience. $200M degrading. The fix: Requirements for this project would in- The fix: Overhaul construction design documents from clude repairing and preserving the dome’s cast- 2001, which will detail a full rehabilitation of the Capitol iron structure within the skirt area, as well as Price Tag dome exterior and Rotunda interior that is up to code. Re- removing the lead-based paint, making a series place, repair and recast the broken or missing pieces on of roof repairs and repainting all surfaces of the skirt, grand stair and Rotunda walls. From DISREPAIR on Page 1 the exterior shell of the dome. Perform an extensive lead- abatement project on the entire exterior of the dome. The risk: The dome will continue to degrade. The risk: Staining will worsen, iron plates will continue to Lead paint chips will continue to fall on the dome “I have no doubt that many of them corrode, and the total cost of rehabilitation will increase tour route, creating a health risk for maintenance are good and legitimate requests,” said because of rapidly deteriorating conditions. -

Instructions for Use —Type 1 Fix Type 1 Button-Fix Warnings

Instructions for use —Type 1 Fix Type 1 button-fix Warnings The Button-fix concept is simple: of the Type 1 Button-fix in use. You can also —Button-fix is intended for furniture obtain a new copy of these instructions from construction and interior fittings and is not the Fixes are attached to the the website in the event of loss or in the event intended, nor should it be used, for any other back of one panel and the mating that Buttonfix modifies the instructions. purpose. Buttonfix Limited retains the right to modify —WARNING: Serious damage to property Buttons are attached to the other. the instructions as it deems appropriate and and severe bodily injury can result from Bring the panels together and slide the consumer is responsible for checking the (1) improper use, application or installation of website for the latest information. the Button-fix or (2) use as part of improperly until the Button-fixes ‘click’. designed or constructed assemblies or The Type 1 Button-fix is moulded in durable, materials. glass-filled nylon. It connects parallel panels —Provided that the screws and substrate are and its strength has been verified by an properly matched, and all other instructions independent test house. It can be configured complied with, independent tests showed that in many different ways to best suit your a vertical panel fixed with four Type 1 Fixes application, either surface-mounted can support loads weighing up to a maximum or rebated into the panel, of 200kg (440lbs). For critical applications it is and orientated for vertical or essential to perform your own tests. -

NYSE Changing Hands: Antitrust and Attempted Acquisitions of an Erstwhile Monopoly

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Jeitschko, Thomas D. Working Paper NYSE changing hands: Antitrust and attempted acquisitions of an erstwhile monopoly DICE Discussion Paper, No. 105 Provided in Cooperation with: Düsseldorf Institute for Competition Economics (DICE) Suggested Citation: Jeitschko, Thomas D. (2013) : NYSE changing hands: Antitrust and attempted acquisitions of an erstwhile monopoly, DICE Discussion Paper, No. 105, ISBN 978-386-30410-4-5, Heinrich Heine University Düsseldorf, Düsseldorf Institute for Competition Economics (DICE), Düsseldorf This Version is available at: http://hdl.handle.net/10419/80726 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu No 105 NYSE Changing Hands: Antitrust and Attempted Acquisitions of an Erstwhile Monopoly Thomas D. -

Grantsville, Carlisle Syntech in Third District Court by Judge Mark Tion “To Steal Employees from Anoth- the Utah Industrial Depot, and the Kouris

www.tooeletranscript.com TUESDAY Service dogs help those in need See B1 TOOELETRANSCRIPT BULLETIN January 9, 2007 SERVING TOOELE COUNTY SINCE 1894 VOL. 113 NO. 66 50¢ Baird sentenced to mental evaluation No end in sight for for having sex with THS student hot local job market by Alleen Lang Family Creamery in Tooele. The ice cream parlor and restaurant by Mary Ruth Hammond CORRESPONDENT Tooele County’s employment employs 35 to 40 employees. Sweat If this was a male defendant standing before me for this STAFF WRITER outlook is predicted to match or said the work environment he A Tooele High School teacher crime, there would be a bus with its engine idling in the exceed the bullish pace of the state works to create helps him keep the was sentenced today to undergo a in 2007, according to local employ- business staffed with young people parking lot to transport him to Utah State Prison. 90-day psychological evaluation at ment officials. who find “it’s a fun place to work.” Utah State Prison after pleading JUDGE MARK KOURIS The county’s unemployment rate While he has high expectations of guilt to sexually abusing one of her THIRD DISTRICT COURT is currently 2.6 percent, even lower his staff, he said the family atmo- students last year. than a statewide unemployment sphere of the restaurant, as well as Leslie Baird, 42, who worked at rate of 3.3 percent. And with less his practice of giving staff owner- THS for six years — most recently than 700 people looking for jobs ship of their jobs, has helped keep as a computer lab coordinator — countywide, competition for good turnover low. -

Chapter 420 Navigation Systems Equipment and Aids

S9086-NZ-STM-010/CH-420R1 REVISION 1 NAVAL SHIPS’ TECHNICAL MANUAL CHAPTER 420 NAVIGATION SYSTEMS, EQUIPMENT AND AIDS THIS CHAPTER SUPERSEDES CHAPTER 420 DATED 1 JUNE 1994 DISTRIBUTION STATEMENT A: APPROVED FOR PUBLIC RELEASE, DISTRIBUTION IS UNLIMITED. PUBLISHED BY DIRECTION OF COMMANDER, NAVAL SEA SYSTEMS COMMAND. 1 SEP 1999 TITLE-1 @@FIpgtype@@TITLE@@!FIpgtype@@ S9086-NZ-STM-010/CH-420R1 Certification Sheet TITLE-2 S9086-NZ-STM-010/CH-420R1 TABLE OF CONTENTS Chapter/Paragraph Page 420 NAVIGATION SYSTEMS, EQUIPMENT AND AIDS ................ 420-1 SECTION 1. NAVIGATION SYSTEM, GENERAL REQUIREMENTS ............. 420-1 420-1.1 ORGANIZATION ..................................... 420-1 420-1.1.1 CHAPTER ORGANIZATION. .......................... 420-1 420-1.1.2 ESWBS SECTIONS. ............................... 420-1 420-1.1.3 REFERENCES. .................................. 420-1 420-1.1.3.1 Naval Ships’ Technical Manuals (NSTM). ............ 420-1 420-1.1.4 BULLETINS. ................................... 420-1 420-1.2 ADMINISTRATION INFORMATION .......................... 420-2 420-1.2.1 INTENT. ...................................... 420-2 420-1.2.2 RESPONSIBILITY ASSIGNMENTS. ...................... 420-2 420-1.2.3 TRAINING. .................................... 420-2 420-1.2.4 QUALIFIED REPAIR PERSONNEL. ...................... 420-2 420-1.2.4.1 Maintenance Responsibility. .................... 420-2 420-1.2.5 TEST AND REPAIR ACTIVITIES. ....................... 420-2 420-1.2.6 PARTS. ....................................... 420-2 420-1.2.6.1 Coordinated Shipboard Allowance List (COSAL). ........ 420-2 420-1.2.6.2 Equipment Selection. ........................ 420-3 420-1.2.7 EQUIPMENT INSTALLATION. ......................... 420-3 420-1.2.8 RECORDS AND REPORTS. ........................... 420-3 420-1.2.9 PREVENTIVE MAINTENANCE. ........................ 420-3 420-1.2.9.1 Routine Maintenance. ........................ 420-3 420-1.2.9.2 Safety Precautions. -

Understanding the Market for U.S. Equity Market Data

Understanding the Market for U.S. Equity Market Data Charles M. Jones1 August 31, 2018 1 Robert W. Lear Professor of Finance and Economics, Columbia Business School. I am solely responsible for the contents of this paper. I thank Larry Glosten, Frank Hatheway, Terry Hendershott, Stewart Mayhew, Jonathan Sokobin, and Chester Spatt for helpful discussions on these topics. I currently serve on FINRA’s Economic Advisory Committee and on Nasdaq’s Quality of Markets Committee, and I served as Visiting Economist at the New York Stock Exchange (“NYSE”) in 2002–2003. The NYSE provided financial support for this research. I. Executive Summary A stock exchange facilitates share trading, in large part by developing computer systems, rules, and processes that allow buyers and sellers to submit orders, trade with each other, and determine a market price for shares listed on those exchanges. In the current market environment, this results in a vast amount of data, which market participants of all types rely on to make investment and trading decisions. Exchanges provide some of this market data to market participants at prices that vary depending on the type of data as well as how the data is used. This paper provides an analysis of the market for equity market data in the United States. Unlike other data sources, U.S. equity market data is highly regulated by the Securities and Exchange Commission (“SEC”), and recently the SEC has been lobbied by entities arguing that exchanges charge too much. These entities have written comment letters and filed a number of proceedings with the SEC in an effort to reduce the prices of equity market data.