Investor Presentation FY2015 Results Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report Download (PDF)

Supplement to Quarterly Report for the quarter ended March 31, 2014 Play Holdings 2 S.á r.l. July 29, 2014 Play Holdings 2 S.á r.l. 5, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg INTRODUCTION This is the Report of Play Holdings 2 S.à r.l. (the “Parent”), 5, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg, the parent company of, P4 Sp. z o.o. (“Play”). The Parent is a guarantor of the following notes: 1 (a) €600,000,000 5 /4% Senior Secured Notes due 2019 and PLN 130,000,000 Floating Rate Senior Secured Notes due 2019 issued by Play Finance 2 S.A. (the “Senior Secured Notes”); and 1 (b) €270,000,000 6 /2% Senior Notes due 2019 issued by Play Finance 1 S.A (the “Senior Notes”). This Report is supplementary to the Quarterly Report for the quarter ended March 31, 2014. RECENT DEVELOPMENTS New financing transaction On July 29, 2014, a future indirect holding company of the Parent, Play Topco S.A. (“Topco,”) announced an offering of €415 million aggregate principal amount of senior PIK toggle notes due 2020 (the “Notes”). Release of Senior Notes proceeds from escrow and expected use of certain proceeds from the Offering On July 8, 2014, the €170 million of proceeds of the Senior Notes that were deposited in an escrow account on the issue date of the Senior Notes were released in connection with an M&A transaction and were distributed to the shareholders of Play. Following the distribution to the shareholders of Play and the use of the proceeds by Novator, 100% of the shares in Novator were thereafter controlled by an irrevocable discretionary trust of which the settlor is Björgólfur Thor Björgólfsson and the beneficiaries are Mr. -

Investor Presentation June 2017 Table of Contents 2

Investor Presentation June 2017 Table of Contents 2 Page Section 1: Group overview 3 Section 2: Portfolio companies 18 Attica Group 26 Vivartia 36 Hygeia Group 48 SingularLogic 59 Hilton Cyprus 66 RKB 68 Section 3: Financial Statement information 71 Appendix: Management biographies 84 Section 1 Group Overview MIG at a snapshot 4 High-quality portfolio of leading companies across key defensive sectors Net Asset Value (NAV) (2016) €666m Group Assets (2016) €2,715m NAV per share (2016) €0.71 Group Net Fixed Assets (2016) €1,134m Group Revenues (2016) €1,104 EBITDA Business Operations (1) (2016) €172m Group Gross Debt (€m) (2016) €1,674m EBITDA Consolidated (2016) €134m Tourism & Transportation Food & Dairy Healthcare Real Estate IT (32% of GAV) (32% of GAV) (15% of GAV) (15% of GAV) Leisure (2% of GAV) (4% of GAV) March 2017: MIG announced the sale of its entire stake in Sunce Koncern d.d. (1) EBITDA Business Operations = Group EBITDA excl. holding companies, provisions beyond normal course of business (€15m impairment of trade receivables from Marinopoulos group), gains/losses from the sale of investment property, fixed & intangible assets & revaluation of investment property Highly diversified operations across attractive sectors 5 Revenue breakdown (2016 data) EBITDA breakdown (2016 data) Gross Asset Value breakdown (2016 data) 4% 11% 19% 3% 27% 21% 32% 2% 18% 51% 15% 24% 41% 32% Food & Dairy Transportation Healthcare IT Other (Real Estate, Leisure) 2014 2015 2016 (in €m) 2014 2015 2016 2014 2015 2016 Group Sales (€m) 1,117 1,143 1,104 EBITDA Business Ops 1 89 163 172 Gross Asset Value (€m) 1,534 1,480 1,381 % margin 8.0% 14.2% 15.6% y-o-y chg (%) +4% +2% -3% GroupGross Debt (€m) 1,752 1,693 1,674 EBITDA Consolidated 66 125 134 3 NAV (€m) 923 783 666 Greek GDP 2 0.4% -0.3% -0.1% y-o-y chg (%) % margin 5.9% 10.9% 12.1% NAV pershare (€) 0.98 0.83 0.71 (1) EBITDA Business Operations = Group EBITDA excl. -

Microsoft Visual Basic

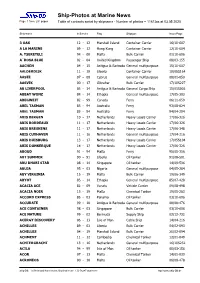

Schiffs-Fotos in Marine News Seite 1 von 291 Seiten Inhalt sortiert nach Schiffsname - Anzahl der Fotos = 11612 Stand 03.05.2020 Schiffsname Indienst Flagge Schiffstyp Ausgabe 3 OAK 12 - 12 Marshall Inseln Container-Frachter 16/10-607 A LA MARINE 09 - 12 Hong Kong Container-Frachter 12/10-604 A. TSERETELI 94 - 00 Malta Bulkfrachter 01/10-606 A´ROSA BLUE 02 - 04 Großbritannien Passagierschiff 08/03-155 AACHEN 04 - 15 Antigua & Barbuda Mehrzweck-Frachtschiff 15/10-607 AALDERDIJK 11 - 19 Liberia Container-Frachter 19/05S164 AASEE 07 - 08 Zypern Mehrzweck-Frachtschiff 08/01-050 AASVIK 00 - 17 Gibraltar Bulkfrachter 17/10S227 AB LIVERPOOL 03 - 14 Antigua & Barbuda Frachtschiff 15/01S002 ABBAY WONZ 84 - 14 Äthiopien Mehrzweck-Frachtschiff 17/05-303 ABEGWEIT 82 - 99 Kanada Fährschiff 06/11-659 ABEL TASMAN 85 - 94 Australien Fährschiff 93/08-024 ABEL TASMAN 85 - 94 Australien Fährschiff 94/04-204 ABIS BERGEN 10 - 17 Niederlande Schwergutfrachter 17/06-326 ABIS BORDEAUX 11 - 17 Niederlande Schwergutfrachter 17/06-326 ABIS BRESKENS 11 - 17 Niederlande Schwergutfrachter 17/06-348 ABIS CUXHAVEN 11 - 16 Niederlande Mehrzweck-Frachtschiff 17/04-216 ABIS DUISBURG 13 - 17 Niederlande Schwergutfrachter 17/05S104 ABIS DUNKERQUE 14 - 17 Niederlande Schwergutfrachter 17/06-326 ABOUD 91 - 94 Malta Fährschiff 95/05-356 ABT SUMMER 90 - 91 Liberia Tankschiff 91/08-501 ABU DHABI STAR 08 - 14 Singapur Tankschiff 14/09-536 ABUJA 95 - 03 Nigeria Mehrzweck-Frachtschiff 04/05-284 ABY VIRGINIA 15 - 19 Malta Bulkfrachter 19/06-349 ABYOT 85 - 14 Äthiopien Mehrzweck-Frachtschiff -

Corporate Responsibility Report 2014

Albania Mobile Communications SA (AMC) Corporate Responsibility Report 2014 AMC Corporate Responsibility Report 2014 Table of Contents 1 About this report............................................................................................................. 1 2 About AMC ..................................................................................................................... 1 2.1 AMC Shareholders Structure ................................................................................................................................. 1 2.2 AMC Organizational Structure .............................................................................................................................. 2 2.3 Main Products and Services ................................................................................................................................... 2 2.4 AMC Business Performance Review ................................................................................................................... 3 2.5 AMC Financial Performance ................................................................................................................................... 4 2.6 Significant Developments/Changes in 2014 ................................................................................................... 4 3 CR Strategy and Management ......................................................................................... 5 3.1 CR Management Approach .................................................................................................................................... -

Mykonos, Chios,Tinos, Chania Ογραφίες

Κρήτη της καρδιάς μας... μέσα από πεντακόσιες φωτογραφίες Διανέμεται Δωρεάν Free Copy Crete of our Hearts... in 500 photographs Άνοιξη 2018 Spring 2018 Άνοιξη 2018 Διανέμεται Δωρεάν / Spring 2018 Free Copy Διανέμεται 2018 Άνοιξη H ιστορία της Κρήτης, από τη Μινωική The history of Crete from the Minoan εποχή μέχρι σήμερα, μαζί με τις αντιθέσεις era until today, along with its unrivalled TRAVEL: και τις ομορφιές της –από τα ενετικά κάστρα beauties –from the Venetian castles and the και τις παραδεισένιες παραλίες μέχρι τα paradisiac beaches all the way through υπέροχα μοναστήρια και τα άγρια φαράγγια– the magnificent monasteries and the wild Mykonos, παρουσιάζονται στο φωτογραφικό λεύκωμα gorges– is presented in the photographic «Κρήτη της Καρδιάς μας...». album ‘Crete of Our Hearts...’. Chios, Tinos, Chania Για παραγγελίες & πληροφορίες: Θεομήτορος 62Β, 173 42, Άγιος Δημήτριος Τηλ. (+30) 210 - 3211170 · www.militos.gr · [email protected] Editorial Σπύρος Πασχάλης Αγαπητοί επιβάτες, Διευθύνων Σύμβουλος Αφήσαμε πίσω μας και αυτόν τον χειμώνα και μπήκαμε στην άνοιξη. Η νησιώτικη Ελλάδα προετοιμάζεται για τις γιορτές του Πάσχα και την νέα τουριστική σεζόν. Η Blue Star Ferries είναι και πάλι προετοιμασμένη στο ακέραιο, ώστε να εξυπηρετήσει τους επιβάτες που ταξιδεύουν στα νησιά μας και ταυτόχρονα να καλύψει τις σταδιακά αυξανόμενες ανάγκες των τοπικών κοινωνιών έως την έναρξη και κατά την διάρκεια της νέας τουριστικής περιόδου. Η Εταιρεία μας δεν αντιλαμβάνεται αυτή την προετοιμασία εποχικά και είναι στρατηγική επιλογή να προσφέρει απρόσκοπτη και διαχρονική σύνδεση των προορισμών που εξυπηρετεί με την ηπειρωτική Ελλάδα όλο τον χρόνο, όλες τις εποχές. Η Blue Star Ferries λειτουργώντας με αίσθημα ευθύνης, αντιλαμβάνεται πλήρως την αναγκαιότητα για την ανάπτυξη των τοπικών κοινωνιών με σεβασμό στον άνθρωπο και στο περιβάλλον, καθώς αποτελεί το κλειδί για την περαιτέρω βελτίωση της ελκυστι- κότητας και αειφορίας των νησιών μας. -

Russell Priest Ship Catalog

Russell Priest Catalogue Name Type Company Flag YOB Tonnage Desc. Colour B/W 1ST LT BALDOMERO LOPEZ US URR USN USA 1985 40846 GRT 50 LET SSSR GRF 1973 13518 GRT A,S,MAYNE DRG MELBOUR AUS A.D.GEOPOTES DSH VOLKER D GBR 1972 4122 GRT A.D.McKENZIE DBD MELBOUR AUS GRT A.HAZER BBU 1978 25635 GRT A.M.VELLA DCH PORT OF AUS 1972 4122 GRT A.P.MOLLER TTA A.P.MOLL DIS 1984 28010 GRT A.P.MOLLER TTA A.P.MOLL DNK 1966 52673 GRT AAGTEKERK GGC UNITED N NLD 1943 8149 GRT AALSMEERGRACHT GGC SPLIETHO NLD 1992 7949 GRT AALTJE-JACOBA GGC WAGENBO 1995 1576 GRT AARO GGC ELLERMA GBR 1960 2468 GRT AASFJORD BBU TORKELSE NIS 1978 3086 GRT ABADESA TTA HOULDER GBR 1962 13571 GRT ABAKAN TTA 1971 14106 GRT ABBEKERK GGC UNITED N NLD 1946 8336 GRT ABBEYDALE TTA RFA GBR 1937 8299 GRT ABDALLAH BNOU YASSINE GRF SOCIETE MAR 1978 3086 GRT ABDOUN DISCOVERY TTA 1977 45587 GRT ABEL TASMAN GGC H.C.SLEIG AUS 1957 2681 GRT ABEL TASMAN MPR TT LINE AUS 1975 19212 GRT ABEL TASMAN GGC H.C.SLEIG AUS 1916 2053 GRT ABERDEEN TTA CHEVRON BHS 1996 47274 GRT ABERDEEN MPR G.THOMPS GBR 1881 3684 GRT ABERSEA GGC JONES BR AUS 1913 818 GRT ABIDA TTA SHELL TA NLD 1958 12226 GRT ABILITY GGC EVERARD GBR 1943 881 GRT ABINSI MPR ELDER DE GBR 1908 6327 GRT ABITIBI CLAIBORNE GGC 1986 7580 GRT ABITIBI ORINOCO GGC 1986 7580 GRT ABLE GENERAL GGC 1985 4337 GRT ABLE REEFER GRF SNG 1961 2683 GRT ABOSSO MPR ELDER DE GBR 1935 11329 GRT ABRAHAM LINCOLN GGC US GOVER USA 1919 7660 GRT ABRAHAM LINCOLN USS (CVN7 CVN USN USA 1989 102000 DISP ABRAM SCHULTE TTA SCHULTE CYP 2004 41503 GRT ABSIRTO GGC ITA 1943 7176 GRT ABU DHABI UCC 1998 48154 GRT ABU EGILA GGC EGY 1984 10022 GRT ABU ZEMNIA URR 1983 10022 GRT ABUJA GGC 1995 5999 GRT Thursday, 31 January 2013 Page 1 of 449 Name Type Company Flag YOB Tonnage Desc. -

Globalmarketing2006 Q.Qxp

20th Annual GLOBAL MARKETERS Published November 20, 2006 This document, and information contained therein, is the copyrighted property of Crain Communications Inc. and The Ad Age Group (© Copyright 2006) and is for your personal, non-commercial use only. You may not reproduce, display on a website, distribute, sell or republish this document, or the information contained therein, without prior written consent of The Ad Age Group. Additional copies of this report are available for download on AdAge.com in the DataCenter. GLOBAL MARKETERS November 20, 2006 | Advertising Age | 2 Top 100’s measured media outlay hits $98 billion globally Where the do you begin? P&G leads all marketers; have ad spending on three continents, and in this report, reach a spending level of China pushes up Asia gains; $274.1 million, the amount recorded by personal care category No. 100 Joh. A. Benckiser (Coty). P&G set the spending tone for the increases 7.8% group by applying the skids to its media budget, paring it to 2.6% growth from By R. CRAIG ENDICOTT [email protected] 17.6% in 2004, the latter representing a first-year fusion of ad spending from P&G the world’s Top 100 marketers generat- and its acquisition Gillette Co. Advertising ed a collective $98.27 billion in global in the second year of such mergers typical- media in 2005, capturing a quarter of the ly cools off as non-core brands are sold and world’s media pie as the group’s expendi- economies of scale achieved. tures hit a modest 4.5% growth, accord- Overall, the Top 100’s pace dipped dra- Available in book and online March 12 • Closes January 19 th ing to the 20 annual Global Marketers matically from the set’s 2004 growth Advertising Age’s CHINA Fact Pack will provide information to help marketers report. -

Leading the Way

Investor Information Attica Group in figures *In the course of 2006, the Group sold 4 vessels and as at 31st December, 2006 owned 15 vessels. Attica Group operates modern, fast, cruise-class, car-passenger ferries providing year-round Tickers transportation services for passengers, private vehicles and freight, in the Adriatic Sea, Certified Auditors the North Sea and the Greek domestic market. Attica Group: Reuters: EPA.AT DRM STYLIANOU S.A. Bloomberg: ATTICA GA A member of RSM International 2002 2003 2004 2005 2006 ATHEX: ATTICA Kifissias Avenue & 84, Ethn. Antistasseos Street Sailings 8,113 9,855 8,988 7,568 6,228 Tenfore : ATTICA.at 15231 Athens, Greece Tel.: +30 210 674 78190 Passengers 3,919,946 5,041,332 4,741,660 4,366,945 4,027,896 Blue Star Group: Fax: +30 210 672 6099 Freight units 301,811 346,644 332,930 339,381 298,090 Reuters: STR.AT e-mail: [email protected] Bloomberg: BSTAR GA Private vehicles 650,538 791,573 733,874 635,976 579,881 ATHEX: BSTAR Leading the way Tenfore : BSTAR.at Annual General Meetings Ships 23 21 16 18 19 Attica Holdings S.A.: 14th June, 2007 Average Fleet age 10 9 8 7 10 Investor Enquiries Blue Star Maritime S.A.: 14th June, 2007 Ports Served 31 33 27 30 30 Yannis Criticos ATTICA GROUP 157, C. Karamanli Avenue (in million Euro) 2002 2003 2004 2005 2006 16673 Voula, Athens Revenue 318.61 385.87 371.25 385.12 326.60 Greece Tel.: +30 210 891 9500 ΕΒΙΤDΑ 60.99 100.83 104.72 99.10 71.53 Fax: +30 210 891 9509 Depreciation 32.98 40.12 37.98 37.39 29.93 e-mail: [email protected] Net Interest Expense -38.57 -

Telekom Albania SHA Corporate Responsibility Report 2015

Telekom Albania SHA Corporate Responsibility Report 2015 September 2016 TELEKOM Albania Corporate Responsibility Report 2015 Table of Contents 1 About the Report ...................................................................................................................... 3 2 Telekom Albania ...................................................................................................................... 5 2.1 Shareholders Structure ................................................................................................................ 5 2.2 Organizational Structure ............................................................................................................. 6 2.3 Main Products and Services ........................................................................................................ 6 2.4 Business Performance Review................................................................................................... 7 2.5 Memberships and Acknowledgements ................................................................................... 8 2.6 Significant Developments/Changes in 2015 ......................................................................... 8 3 Corporate Responsibility Strategy and Governance ................................................... 9 3.1 Values and Guiding Principles ................................................................................................... 9 3.2 CR Strategy ..................................................................................................................................... -

Cruise Ship Roaming CDMA* $2.50 Per Minute

Cruise Ship Roaming CDMA* Rates are subgject to change $2.50 per minute / $.50 per text (sent or received) As of 8/11/14 Shipping Company Name of the Ship All Leisure Group Discovery All Leisure Group Voyager Azamara Club Cruises Journey Azamara Club Cruises Quest Carnival Cruise Lines Carnival Breeze Carnival Cruise Lines Carnival Conquest Carnival Cruise Lines Carnival Dream Carnival Cruise Lines Carnival Ecstasy Carnival Cruise Lines Carnival Elation Carnival Cruise Lines Carnival Fantasy Carnival Cruise Lines Carnival Fascination Carnival Cruise Lines Carnival Freedom Carnival Cruise Lines Carnival Glory Carnival Cruise Lines Carnival Imagination Carnival Cruise Lines Carnival Inspiration Carnival Cruise Lines Carnival Legend Carnival Cruise Lines Carnival Liberty Carnival Cruise Lines Carnival Magic Carnival Cruise Lines Carnival Miracle Carnival Cruise Lines Carnival Paradise Carnival Cruise Lines Carnival Pride Carnival Cruise Lines Carnival Sensation Carnival Cruise Lines Carnival Spirit Carnival Cruise Lines Carnival Splendor Carnival Cruise Lines Carnival Sunshine Carnival Cruise Lines Carnival Triumph Carnival Cruise Lines Carnival Valor Carnival Cruise Lines Carnival Victory Celebrity Cruise Lines Celebrity Centruy Celebrity Cruise Lines Celebrity Constellation Celebrity Cruise Lines Celebrity Eclipse Celebrity Cruise Lines Celebrity Equinox Celebrity Cruise Lines Celebrity Infinity Celebrity Cruise Lines Celebrity Millennium Celebrity Cruise Lines Celebrity Silhouette Celebrity Cruise Lines Celebrity Solstive Crystal Cruises -

Microsoft Visual Basic

Ship-Photos at Marine News Page 1 from 291 pages Table of contents sortet by shipname - Number of photos = 11612as at 03.05.2020 Ship-name in Service Flag Shiptype Issue/Page 3 OAK 12 - 12 Marshall Island Container Carrier 16/10-607 A LA MARINE 09 - 12 Hong Kong Container Carrier 12/10-604 A. TSERETELI 94 - 00 Malta Bulk Carrier 01/10-606 A´ROSA BLUE 02 - 04 United Kingdom Passenger Ship 08/03-155 AACHEN 04 - 15 Antigua & Barbuda General multipurpose 15/10-607 AALDERDIJK 11 - 19 Liberia Container Carrier 19/05S164 AASEE 07 - 08 Cyprus General multipurpose 08/01-050 AASVIK 00 - 17 Gibraltar Bulk Carrier 17/10S227 AB LIVERPOOL 03 - 14 Antigua & Barbuda General Cargo Ship 15/01S002 ABBAY WONZ 84 - 14 Ethopia General multipurpose 17/05-303 ABEGWEIT 82 - 99 Canada Ferry 06/11-659 ABEL TASMAN 85 - 94 Australia Ferry 93/08-024 ABEL TASMAN 85 - 94 Australia Ferry 94/04-204 ABIS BERGEN 10 - 17 Netherlands Heavy Loads Carrier 17/06-326 ABIS BORDEAUX 11 - 17 Netherlands Heavy Loads Carrier 17/06-326 ABIS BRESKENS 11 - 17 Netherlands Heavy Loads Carrier 17/06-348 ABIS CUXHAVEN 11 - 16 Netherlands General multipurpose 17/04-216 ABIS DUISBURG 13 - 17 Netherlands Heavy Loads Carrier 17/05S104 ABIS DUNKERQUE 14 - 17 Netherlands Heavy Loads Carrier 17/06-326 ABOUD 91 - 94 Malta Ferry 95/05-356 ABT SUMMER 90 - 91 Liberia Oil tanker 91/08-501 ABU DHABI STAR 08 - 14 Singapore Oil tanker 14/09-536 ABUJA 95 - 03 Nigeria General multipurpose 04/05-284 ABY VIRGINIA 15 - 19 Malta Bulk Carrier 19/06-349 ABYOT 85 - 14 Ethopia General multipurpose 85/07-428 ACACIA -

AT a GLANCE INFORMATION for INVESTORS GERMANOS GROUP of COMPANIES: REVENUE BREAKDOWN by COUNTRY on the TOP of the GREEK MARKET 1St Half 2005 CYPRUS 2.7 Mil

AT A GLANCE INFORMATION FOR INVESTORS GERMANOS GROUP OF COMPANIES: REVENUE BREAKDOWN BY COUNTRY ON THE TOP OF THE GREEK MARKET 1st Half 2005 CYPRUS 2.7 mil. € Going through the 25th year of its operations, the Germanos Group of Companies incorporates one of FYROM BULGARIA 5.3 mi.l € the biggest Product Networks and 21.1 mil. € Telecommunication Services as well as one of the POLAND most important battery production factories in 46 mil. € ROMANIA Europe. Founded in 1980, GERMANOS employs 39.1 mil. € today more than 4,800 people in more than 7 countries. GERMANOS is listed on Athens Stock UKRAINE Exchange (ASE – FTSE20) and participates in the GREECE 1.5 mil. € 334.4 mil. € MSCI Standard Index. BUSINESS OVERVIEW The Group’s corporate mission is to consolidate its TOTAL REVENUE leading position in the provision of integrated In mil € / percent change since previous year solutions in two sectors : • Specialized Chain of Stores for Telecommunication Goods and Services. • Production and Distribution of Integrated Energy Systems and Batteries for Specialized Applications. COUNTRIES OF OPERATION GREECE, POLAND, BULGARIA, ROMANIA, FYROM, CYPRUS, UKRAINE, UZBEKISTAN GERMANOS CHAIN OF STORES No of stores SHAREHOLDER STRUCTURE Foreign Panos Germanos Institutional 34.45% Investors 37% Retail 13.55% Greek Institutional Investors 15% 2005 TARGETS GERMANOS BOARD OF DIRECTORS Our main focus for 2005 are the operations Panos Germanos outside Greece. We aim to obtain leading market position in Poland, Romania and Ukraine and at the President and executive member same time we are investigating new countries that Christos Germanos match with our expansion criteria. Vice President and executive member John Karagiannis Managing Director and executive member Loukas Petkidis GERMANOS SHARE PERFORMANCE Executive member Germanos has shown stable performance pattern.